Automotive Rental And Leasing Market Size, Share Report 2034

Automotive Rental And Leasing Market By Type (Truck & Utility Trailer, Passenger Car Rental, Passenger Car Leasing, and Recreational Vehicle Rental & Leasing), By Mode (Online and Offline), By Lease Type (Close and Open), By End-User (Travel & Tourism, Government, Fleet Operators, Corporate, Individual, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

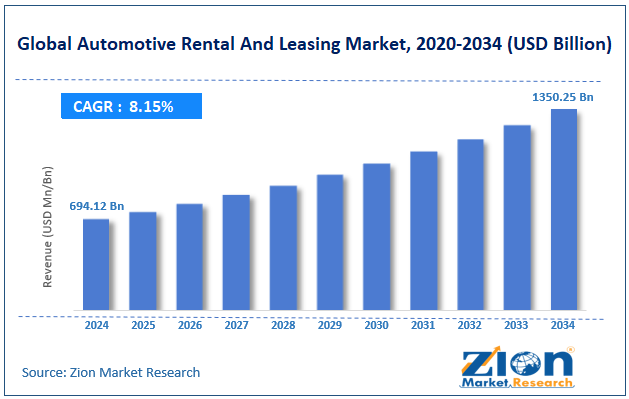

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 694.12 Billion | USD 1350.25 Billion | 8.15% | 2024 |

Automotive Rental And Leasing Industry Perspective:

What will be the global automotive rental and leasing market size during the forecast period?

The global automotive rental and leasing market size was worth around USD 694.12 billion in 2024 and is predicted to grow to around USD 1350.25 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.15% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive rental and leasing market is estimated to grow annually at a CAGR of around 8.15% over the forecast period (2025-2034)

- In terms of revenue, the global automotive rental and leasing market size was valued at around USD 694.12 billion in 2024 and is projected to reach USD 1350.25 billion by 2034.

- The automotive rental and leasing market is projected to grow at a significant rate due to the rising tourism rate across the globe

- Based on type, the passenger car rental segment is growing at a high rate and will continue to dominate the global market, as per industry projections

- Based on lease type, the close ending segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Automotive Rental And Leasing Market: Overview

Automotive rental and leasing are innovative solutions that allow customers to use a vehicle for a short or longer time without paying the full price of the vehicle. Automotive rental refers to the process of renting a vehicle for a shorter time, such as a few hours or a week, for a one-time fee. On the other hand, leasing is undertaken for a longer time, ranging from a year to more. This allows users to obtain the full benefits of a vehicle at a reasonable price while the leasing company remains the primary owner of the vehicle. Automotive rental and leasing solution providers have witnessed increased growth over the last few years.

For instance, demand for automotive rental services has increased as more travelers worldwide require vehicles for a temporary period. In addition, the growing adoption of digital solutions in the leasing segment has simplified the leasing process. During the forecast period, the automotive rental and leasing market is expected to witness steady growth while encountering challenges such as fluctuating demand among end-consumers and the high cost of initial investment.

Automotive Rental And Leasing Market: Dynamics

Growth Drivers

How will increased worldwide tourism influence the growth of the automotive rental and leasing market?

The global automotive rental and leasing market is expected to be driven by the rising tourism rate across the globe. Vehicle rental services are generally leveraged by global tourists who do not have access to their personal cars. Automotive rental services allow them to rent a vehicle of their own choice and use it for as many days as they desire. The service seekers are required to pay the rental fees without worrying about additional aspects of driving a vehicle in a foreign territory.

For instance, as per UN Tourism, Europe registered more than 747 million international arrivals in 2024. Similar growth trends in the tourism sector have been witnessed in other parts of the world, including Asian countries and Middle Eastern nations. In February 2025, Al Dhile Rent A Car announced the launch of its premium car rental services in Dubai, UAE. The brand offers a wide range of fleet meeting dynamic car rental demands in the region.

Changes in consumer lifestyle and buying patterns are expected to impact market revenue in the long run

The rapid expansion of urban lifestyles is one of the most significant growth propellers for increased demand for renting or leasing a vehicle. Owning a car in an urban city with a high cost of living can be expensive. In addition, the younger generation prefers to have access to flexible means of travel. The rising traffic congestion in urban areas has further discouraged people from owning a vehicle. These factors have worked in tandem to create significant demand for rental and leasing services. It offers greater flexibility for vehicle users, as they do not have to spend on vehicle maintenance but can still enjoy driving benefits at reasonable costs.

As per industry research, more than 25% of new vehicle transactions in the US were related to car leasing. Such trends are likely to work in favor of the global automotive rental and leasing market leaders during the projection period.

Restraints

What will be the impact of dynamic demand on automotive rental and leasing market growth trends?

The global automotive rental and leasing industry is projected to be affected by fluctuating demand. Vehicle rental or leading market needs continue to change depending on several factors such as economic conditions and travel trends. In addition, the automotive industry is facing competition from rising sales of vehicles as more automotive enthusiasts are willing to own a vehicle. This is further encouraged by access to lucrative financial assistance and the introduction of affordable alternatives in the market.

Opportunities

Rising industry digitalization to create growth opportunities for the industry players

The global automotive rental and leasing market is expected to offer growth opportunities as digital solutions increasingly integrate into the industry. For instance, in October 2025, Renty.ae, a United Arab Emirates (UAE)-based luxury yacht and car rental company, announced the expansion of its services with the launch of a new fleet and a digital booking option. The company has launched a user-friendly application allowing customers to make bookings remotely. In the same month, another regional company, Thrifty Car Rental UAE, launched a self-service digital car rental kiosk, further strengthening the company’s technology-driven growth strategy. The kiosk was launched at Novotel and Ibis Deira Creekside Dubai. It will include features such as browsing vehicles, verifying identity, and completing secure payments.

How will the introduction of new concepts open new growth avenues for automotive rental and leasing market players

In the last few years, the introduction of new business models, such as Mobility-as-a-Service (MaaS) and lucrative subscription solutions, has helped industry players generate higher revenue. MaaS, for instance, deals with integrating automotive rentals with other innovative concepts such as ride-sharing. Additionally, growing use of Artificial Intelligence (AI) and other intelligent technologies for fleet management and price analysis will help the industry thrive during the projection period.

Challenges

High cost of investment and operations to challenge market revenue in the coming years

The global automotive rental and leasing industry is projected to be challenged by the high cost of investment associated with the market. Acquisition of a large fleet and its long-term maintenance demands significant investments. Additionally, market players must invest in innovative strategies to remain competitive, further increasing the financial burden on industry players. The growing prices of developing supportive digital infrastructure will further impact market expansion in the long run.

Automotive Rental And Leasing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Rental And Leasing Market |

| Market Size in 2024 | USD 694.12 Billion |

| Market Forecast in 2034 | USD 1350.25 Billion |

| Growth Rate | CAGR of 8.15% |

| Number of Pages | 212 |

| Key Companies Covered | Europcar Mobility Group, Enterprise Holdings, Avis Budget Group, Unidas, LeasePlan, Donlen, Hertz Global Holdings, Arval, Element Fleet Management, Sixt SE, ALD Automotive, Localiza, Toyota Rent a Car, Athlon, Wheels Inc., and others. |

| Segments Covered | By Type, By Mode, By Lease Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Rental And Leasing Market: Segmentation

The global automotive rental and leasing market is segmented based on type, mode, lease type, end-user, and region.

Why will the passenger car rental segment dominate the automotive rental and leasing market?

Based on type, the global market segments are truck & utility trailer, passenger car rental, passenger car leasing, and recreational vehicle rental & leasing. In 2024, the highest growth was listed in the passenger car rental segment, driven by rising demand for short-term access to vehicles among tourists and business travelers. The passenger car leasing will generate significant revenue for market players over the projection period.

Based on mode, the global automotive rental and leasing industry is segmented into online and offline.

Why will the close segment lead the automotive rental and leasing industry?

Based on lease type, the global market is divided into closed and open. In 2024, the highest revenue-generating segment was the close ending. According to industry research, closed-end deals offer reduced risk to the fleet owners as well as the customers. Rising demand for flexible transportation solutions among the urban population is helping fuel segmental demand, and similar trends are expected to emerge in the future.

Based on end-users, the global market is fragmented into travel & tourism, government, fleet operators, corporate, individual, and others.

Automotive Rental And Leasing Market: Regional Analysis

Why will North America continue to lead the automotive rental and leasing market during the forecast period?

The global automotive rental and leasing market is expected to be led by North America during the forecast period. The region will register a CAGR of over 6.5% in the coming years, driven by the presence of a mature vehicle leasing and renting industry. The Canadian and North American automotive industry is heavily dominated by the growing demand for car leasing services, as passenger-car demand remains high.

In December 2025, Enterprise Mobility, a global car rental and vehicle leasing service brand, announced the acquisition of Hogan. The latter is a provider of commercial vehicle rental and truck leasing services in the U.S. With this move, Enterprise Mobility has expanded its presence in the growing automotive rental and leasing industry.

Why will Asia Pacific emerge as the fastest-growing region in the automotive rental and leasing industry?

The Asia-Pacific region is expected to be the fastest-growing market, with a CAGR of 8.01% over the projection period. Growth in Asia-Pacific will be driven by changing consumer lifestyles and increased demand for flexible travel solutions, especially in regions registering increasing tourism.

Furthermore, increased digitalization of the regional automotive rental and leasing segment will further help the region thrive. In October 2025, Enterprise Mobility announced that it had signed an agreement with Taiwan-based Ho Ing Mobility Service Co., Ltd. Enterprise Mobility will add new franchise locations offering car rental options from brands such as Alamo, National Car Rental, and Enterprise Rent-A-Car.

Automotive Rental And Leasing Market: Competitive Analysis

The global automotive rental and leasing market is led by players like:

- Europcar Mobility Group

- Enterprise Holdings

- Avis Budget Group

- Unidas

- LeasePlan

- Donlen

- Hertz Global Holdings

- Arval

- Element Fleet Management

- Sixt SE

- ALD Automotive

- Localiza

- Toyota Rent a Car

- Athlon

- Wheels Inc.

What are the key trends in the Automotive Rental And Leasing Market?

Eco-friendly vehicles

A growing trend in the automotive rental and leasing industry is the rising use of electric, hybrid, or highly fuel-efficient vehicles as part of the expanding fleet. This allows service providers to comply with regulatory emission standards and meet evolving consumer expectations.

Entry into emerging markets

The ongoing penetration of vehicle rental and leasing service providers in new markets is expected to work in favor of the industry players. Emerging economies offer significant growth potential due to favorable government policies, rising disposable income, and evolving consumer preferences.

The global automotive rental and leasing market is segmented as follows:

By Type

- Truck & Utility Trailer

- Passenger Car Rental

- Passenger Car Leasing

- Recreational Vehicle Rental & Leasing

By Mode

- Online

- Offline

By Lease Type

- Close

- Open

By End-User

- Travel & Tourism

- Government

- Fleet Operators

- Corporate

- Individual

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed