Global Car Rental Market Trend, Share, Growth, Size, Analysis and Forecast 2034

Car Rental Market By Rental Length (Long Term and Short Term), By Booking Type (Online Booking and Offline Booking), By Application (Commercial and Leisure), By Vehicle Type (Multi Utility Vehicle (MUV), Sports Utility Vehicle (SUV), Economical Car, Executive Car, and Luxury Car), By End-User (Chauffeur-Driven and Self-Driven), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 107.76 Billion | USD 216.58 Billion | 7.23% | 2024 |

Car Rental Market Size & Industry Analysis

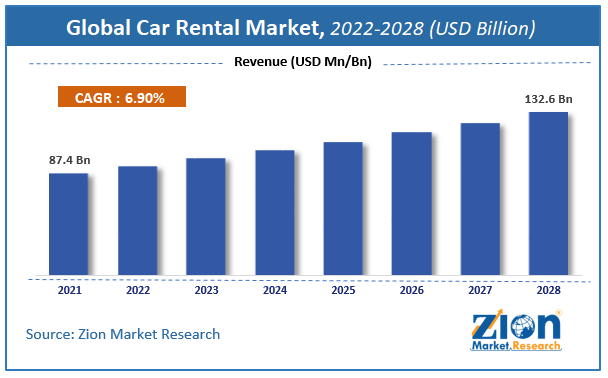

The global car rental market was worth around USD 107.76 billion in 2024 and is estimated to grow to about USD 216.58 billion by 2034, with a compound annual growth rate (CAGR) of approximately 7.23% between 2025 and 2034.

The report analyzes the car rental market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the car rental market.

Car Rental Market: Overview

Car rental or vehicle hiring firms are businesses that rent cars for a set amount of time at a set price. This service is frequently arranged with several local branches, which are usually located around airports or major sections of the city and are supplemented with a website that allows for online bookings. The automobile rental sector has seen a significant transition in recent years as a result of rising pollution levels and population, becoming one of the most prominent industries in fleet transportation.

Car or vehicle rental service is relatively developed in the industrialized economies. A car rental, hire car, or car hire company provides vehicles on rent for short periods of time, generally ranging from a few hours to a few weeks. Car rental providers have a number of local branches and offices near airports, bus stops, railway station, and busy city areas. The key vendors that provide vehicle rental services mainly focus on customer's requirements, growth, innovation, and offers that attract customers and efficiency.

COVID-19 Impact:

COVID-19's quick expansion had a huge influence on the broader tourist sector in 2020, affecting the car rental business as a result. Furthermore, a drop in global air traffic has led to a drop in demand for automobile rentals at airports. Furthermore, decreased demand for inter and intracity transport also decreased the demand for car rental services. However, with the occurrence of pre-pandemic conditions number of tourist activities is expected to increase which will ultimately support the growth of the global car rental market.

Car Rental Market: Growth Drivers

The convenience and flexibility offered by rental cars may boost the overall market growth.

The car rental market is primarily driven by rising tourism industry. Healthy economic growth and rising disposable income in developing countries are expected to propel the market growth during the year to come. Furthermore, high demand of the internet and smart technology helps to drive this market at the fast pace. However, some restraints like the rise in crude oil prices and lack of proper marketing may hinder the growth of the market. Moreover, use of the green vehicle is the most cost-effective way to improve energy efficiency and reduce carbon emissions is likely to open up new opportunities in evolving consumer preference.

Renting a car in another country does not only save time but also helps to discover more places, helps to carry more luggage, feels local, and reduces waiting time. Besides rental cars offer more convenience where a network of public transport is not well developed. Such factors significantly fuel the growth of the global car rental market. Moreover, services such as Flexi hire offered by many car rental service providers are getting more traction. Flexi hire ensures that passengers can always satisfy their travel requirements. The cars that passengers have on contract may be suitable for day-to-day business, but something else is required for a particular event, such as a conference or exhibition. It's also possible that passengers planning a vacation overseas don't have an appropriate mode of transportation. With such flexible options adoption of rental cars is expected to increase over the forecast period.

Car Rental Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Car Rental Market |

| Market Size in 2024 | USD 107.76 billion |

| Market Forecast in 2034 | USD 216.58 billion |

| Growth Rate | CAGR of 7.23% |

| Number of Pages | 195 |

| Key Companies Covered | Uber Technologies, Inc., Localiza, Hertz System, Inc., Enterprise Holdings Inc, Europcar, Avis Budget Group, Eco Rent a Car, ANI Technologies Pvt. Ltd. (OLA TAXI’S), Carzonrent India Pvt Ltd., and SIXT amongst others. |

| Segments Covered | By Rental Length, By Booking Type, By Application, By Vehicle Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Car Rental Market: Restraints

Higher prices of car rentals compared to public transport may hamper the market growth.

In middle-and low-income countries, most passenger uses public transport due to its wide network and low fares. In fact, preferences for public transport are still more in emerging countries due to convenience. Furthermore, in several parts of the world, the car rental sector is dominated by few players due to such a monopoly the fares are far more compared to public transport. Most of the population travel on daily basis for work and other activities and hiring a rented car over public transport can add extra load on the daily expenses. All such factors can contribute to the slow growth of the market.

Car Rental Market: Opportunities

Technological advancements may have numerous opportunities for market growth

Many key players are implementing novel automated technologies especially to improve operations. Thus, there is an increase in the adoption of car rental management software which is likely to boost the market. Also, the introduction of robotaxis and penetration of car rentals in electric vehicle sectors are also some of the factors that may boost the global car rental market during the forecast period.

Car Rental Market: Challenges

Driving challenges with international travelers

The largest issue for many car rental firms, especially in large and famous cities, is dealing with international consumers. These travelers are more likely to be in danger or have an accident. Many visitors are unfamiliar with the country's traffic laws, and others are accustomed to driving on the opposite side of the road. Some of them had never driven on a winding route with abrupt twists before. To overcome these points car rental services have to invest more amount and time to provide training for overseas travelers. As a result, it is a major burden for rental firms to give special attention to these clients.

Car Rental Market: Segmentation

The global car rental market is categorized based on rental length, booking type, application, vehicle type, end-user, and region.

By rental length, the market is segregated into long-term and short-term. The booking type segment of the market is bifurcated into online booking and offline booking. The application segment includes commercial and leisure. Multi-utility vehicle (MUV), sports utility vehicles (SUVs), economical cars, executive cars, and luxury cars are the vehicle types covered in the report.

In terms of car type, global car rental market is segmented intoMUV cars, SUV cars, economy cars, executive cars, luxury cars. Economy cars dominated the car rental market and accounted for significant share of the market. Economy cars are expected have a faster growth in the future due to the emergence of new companies in the market.

Based on end-users, the car rental market has been segmented into local usage, airport transport, outstation and others. Car rental for airport transport was leading end-user segment in car rental market and accounted for the largest market share in 2020. Growing demand for car rental due to green initiatives was taken by Government and increasing awareness about pollution is expected to drive the car rental market over the forecast period. One of the leading vendors in car rental market i.e. ‘Hertz’ New Zealand offers its customers a carbon calculator to allow potential renters to determine their carbon footprint for various car models.

Recent Developments

- In February 2022, Hertz announced its investment in Ufodrive, European mobility and self-service electric car rental service provider.

- In February 2022, Sixt, a car rental company, has partnered with Accor, a French hospitality corporation. The agreement will deliver extra appealing perks to Accor guests and staff — internationally and at no cost.

- In September 2021, Sixt announced the introduction of robotaxis in Munich in collaboration with Intel. The partnership among both Intel subsidiaries Mobileye and Sixt aim to expand autonomous ride-sharing services all over Europe by the end of the decade.

Car Rental Market: Regional Landscape

North America is expected to lead the global car rental market with over 36 percent of the share. One of the major reasons supporting the expansion of the regional market is the increasing number of leisure and business journeys across the area, both domestically and globally. Furthermore, a steady movement in consumer preferences toward rental services, as well as the presence of major service providers in the region, including Enterprise Rent-a-Car and Avis Budget Group are likely to boost revenue-generating opportunities. In the projection period, North America is predicted to be the biggest car rental market in the world, as the United States continues to be the largest country for vehicle rental services. The use of these services has recently expanded in various cities, owing to increasing service provider activities. Uber Technology Inc., for example, used mobile technologies and other devices more efficiently to satisfy travelers' transport demands. Also, increased use of automobile rental services in the United States with expanding use of electric cars and growing concern & knowledge of fewer emissions among customers in the region are all contributing to this increase in revenue share.

Car Rental Market: Competitive Landscape

The predominant players functioning in the global car rental market include

- Uber Technologies, Inc.

- Localiza

- Hertz System, Inc.

- Enterprise Holdings Inc

- Europcar

- Avis Budget Group

- Eco Rent a Car

- ANI Technologies Pvt. Ltd. (OLA TAXI’S)

- Carzonrent India Pvt Ltd.

- and SIXT amongst others.

The global car rental market is segmented as follows:

By Rental Length

- Long Term

- Short Term

By Booking Type

- Online Booking

- Offline Booking

By Application

- Commercial

- Leisure

By Vehicle Type

- Multi Utility Vehicle (MUV)

- Sports Utility Vehicle (SUV)

- Economical Car

- Executive Car

- Luxury Car

By End User

- Chauffeur-Driven

- Self-Driven

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed