Luxury Car Rental Market Size, Share, Trends, Growth and Forecast 2032

Luxury Car Rental Market By Rental Type (Business, and Leisure), By Distribution Channel (Online, and Offline), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

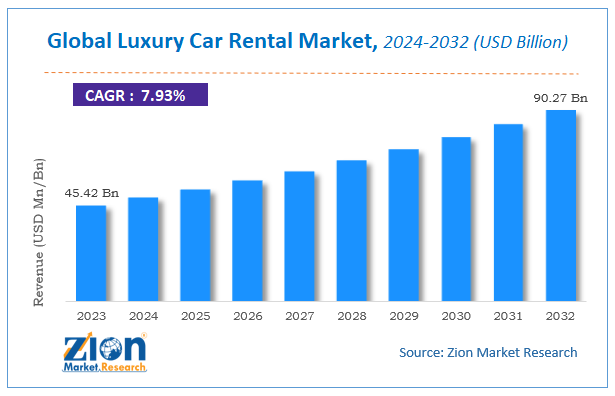

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 45.42 Billion | USD 90.27 Billion | 7.93% | 2023 |

Luxury Car Rental Market Insights

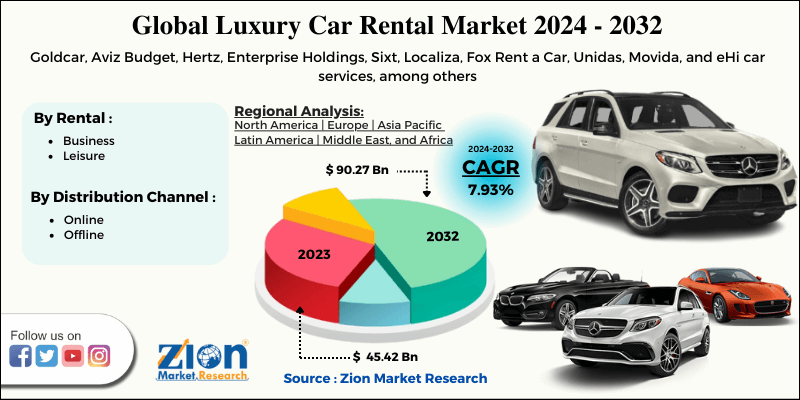

According to a report from Zion Market Research, the global Luxury Car Rental Market was valued at USD 45.42 Billion in 2023 and is projected to hit USD 90.27 Billion by 2032, with a compound annual growth rate (CAGR) of 7.93% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Luxury Car Rental Market industry over the next decade.

Luxury Car Rental Market: Overview

Vehicle rental services are relatively developed in the industrialized economies. A car rental, hire car, or car hire company gives automobiles on rent for short periods of time, generally ranging from a few hours to a few weeks. Car rental providers have a number of local branches and are primarily located near airports or busy city areas. The offices or branches of car rental allow a user to hire or return a vehicle to different branches for the user’s convenience. Car rental agencies also serve other services as per the industry needs, by renting vans or trucks, and in certain markets, other types of vehicles such as motorcycles or scooters may also be offered. Most of the time, car rental companies also provide value-added services such as insurance, entertainment systems, GPS navigation systems, etc.

A luxury car provides a high level of equipment, comfort, quality, performance, amenities, and status compared to regular cars for a higher price. Compact Luxury Cars, Full-size Luxury Cars, Mid-size Luxury Cars, Luxury SUVs, Luxury Crossovers & Minivans are the type of luxury cars.

COVID-19 Impact Analysis

COVID-19 harshly impacted demand for Luxury Car Rental Market. Lockdown in different countries has adversely affected Luxury Car Rental companies. The outbreak of the novel coronavirus affected on many aspects, like travel bans and flight cancellations which forced people to sit at home which means people cannot roam around for business or leisure. This has affected severely to the car rental services.

Luxury Car Rental Market: Growth Factors

Increasing tension with respect to traffic backed by the rising vehicles on roads is set to further improve the luxury car rental market growth globally. Likewise, the booming travel and tourism industry in different countries, as well as rising air pollution would stimulate growth. People nowadays are bending more towards luxury car rentals as an alternative to buying their own cars due to the increasing traffic problems & its harmful effects on our health.

One doesn’t have to take the effort to drive them to reach their destination, since, these cars are chauffeur driven. It has many benefits, such as enhanced traveling convenience, cost-effectiveness, low air pollution level, and reduction in traffic volume. At the same time, renting or hiring a car helps in decreasing various hidden costs that the buyer often has to bear while he/she owns a car.

Luxury Car Rental Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Luxury Car Rental Market |

| Market Size in 2023 | USD 45.42 Billion |

| Market Forecast in 2032 | USD 90.27 Billion |

| Growth Rate | CAGR of 7.93% |

| Number of Pages | 160 |

| Key Companies Covered | Goldcar, Aviz Budget, Hertz, Enterprise Holdings, Sixt, Localiza, Fox Rent a Car, Unidas, Movida, and eHi car services, among others |

| Segments Covered | By Rental Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Luxury Car Rental Market: Segment Analysis

By Rental Type Segment Analysis

The business segment held a share of over 60% in 2020. Business rental car services are mainly used by groups of people and individuals for traveling for conferences, meetings, seminars, workshops, and to their regular working spaces. Leisure rental car service is usually used for occasions, outings, weddings, road trips, parties, and others.

By Distribution Channel Segment Analysis

The online segment is projected to grow at a CAGR of around 2.7% from 2021 to 2028. A growing number of customers is a key factor driving the endorsement of online platforms for renting out a luxury car as they offer various benefits over an offline seller such as discounts and cashback to attract the customer, development in internet connectivity, one-click procedures, and it’s a time-saving method.

Moreover, market players are developing strategies, for instance, customization in the products according to the requirements and delivery at the doorstep is also helping in growing the market share.

Luxury Car Rental Market: Regional Analysis

North America accounted for a share of over 37% in 2020 and is expected to generate substantial growth in the luxury car rental service market while maintaining its leading position in the coming few years supported by the increasing technological advancements in the region. Also, the existence of different renowned luxury car rental service providers in the region would drive growth.

The Asia Pacific in the coming years is expected to remain in the second position owing to the rising craze of luxury cars in the region. Additionally, the increasing adoption of greater production of passenger cars and state-of-the-art technologies would augment growth in this region. The global market is made up of a large number of Small and Medium Enterprises (SMEs). SMEs are striving constantly to bolster their positions by taking over other local firms. Some of the firms are helping common people to list up their cars for rental and generate income.

Luxury Car Rental Market: Key Market Players & Competitive Landscape

Some of the key players in the Luxury Car Rental Market are-

- Goldcar

- Aviz Budget

- Hertz

- Enterprise Holdings

- Sixt

- Localiza

- Fox Rent a Car

- Unidas

- Movida

- eHi car services

- among others.

The industry players are focusing in joint ventures, new product development, and research, and development activities to create innovative and new products to stay ahead of the competition.

The Luxury Car Rental Market is segmented as follows:

By Rental Type

- Business

- Leisure

By Distribution Channel

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Increased traffic congestion brought on by an increase in the number of vehicles on the road is expected to boost the expansion of the luxury car rental industry globally. Similar to how the burgeoning travel and tourism sector in several nations, along with increased air pollution, will spur growth.

Luxury Car Rental Market size worth at USD 45.42 Billion in 2023 and projected to USD 90.27 Billion by 2032, with a CAGR of around 7.93% between 2024-2032.

a CAGR of around 7.93% between 2024-2032.

The market for luxury car rental services in North America, which had a share of over 37% in 2020, is predicted to expand significantly over the next few years while also holding onto the top spot because to the region's rapid technological development.

The Global Luxury Car Rental Market is led by players like Goldcar, Aviz Budget, Hertz, Enterprise Holdings, Sixt, Localiza, Fox Rent a Car, Unidas, Movida, eHi car services, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed