IoT Fleet Management Market Size, Share Report, Analysis, Trends, Growth 2032

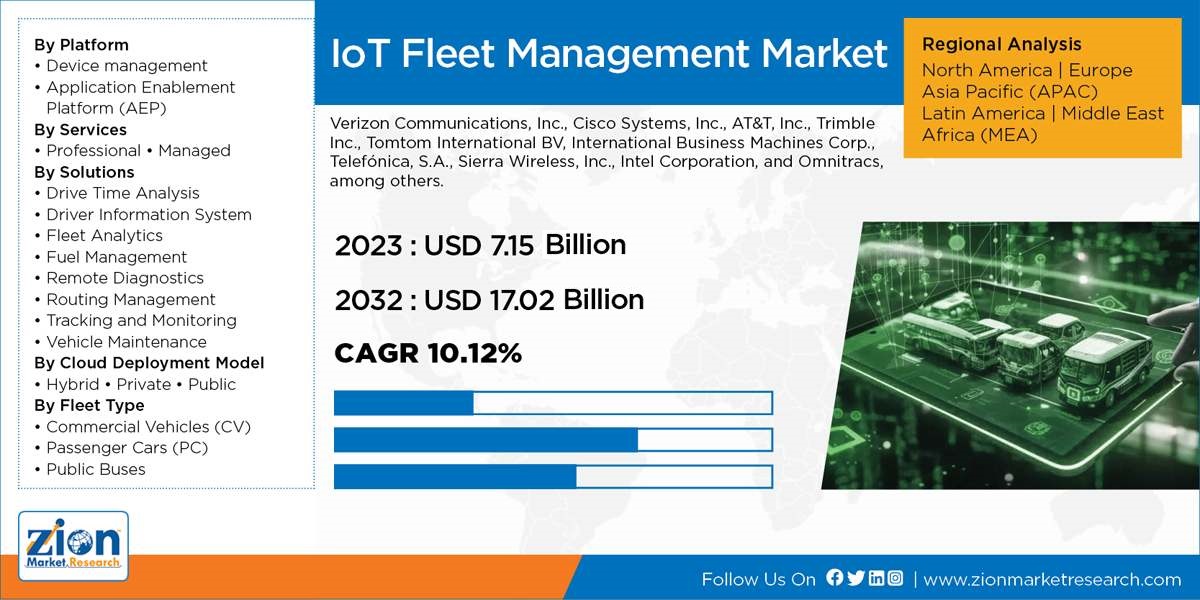

IoT Fleet Management Market By Platform (Device management and Application Enablement Platform (AEP)); by Services (Professional and Managed); by Solutions (Drive Time Analysis, Driver Information System, Fleet Analytics, Fuel Management, Remote Diagnostics, Routing Management, Tracking and Monitoring, and Vehicle Maintenance); by Cloud Deployment Model (Hybrid, Private, and Public); by Fleet Type (Commercial Vehicles (CV), Passenger Cars (PC), and Public Buses): Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2024-2032

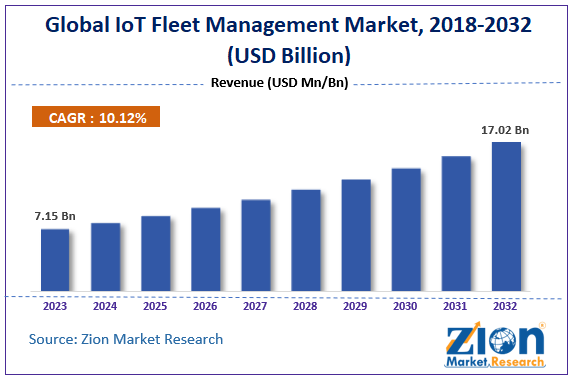

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.15 Billion | USD 17.02 Billion | 10.12% | 2023 |

IoT Fleet Management Industry Perspective:

The global IoT Fleet Management market size accrued earnings worth approximately USD 7.15 Billion in 2023 and is predicted to gain revenue of about USD 17.02 Billion by 2032, is set to record a CAGR of nearly 10.12% over the period from 2024 to 2032

Key Insights

- As per the analysis shared by our research analyst, the global IoT fleet management market is estimated to grow annually at a CAGR of around 10.12% over the forecast period (2024-2032).

- In terms of revenue, the global IoT fleet management market size was valued at around USD 7.15 Billion in 2023 and is projected to reach USD 17.02 Billion by 2032.

- The growth of the IoT fleet management market is being driven by the increasing need for real-time vehicle tracking, route optimization, and predictive maintenance.

- Based on platform, the device management segment is growing at a high rate and is projected to dominate the market.

- On the basis of services, the professional segment is projected to swipe the largest market share.

- In terms of solutions, the drive time analysis segment is expected to dominate the market.

- Based on cloud deployment model, the hybrid segment is expected to dominate the market.

- In terms of fleet type, the commercial vehicles (CV) segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

IoT Fleet Management Market: Overview

Fleet management is a function that helps companies involved in transportation business to minimize or remove the risk associated with productivity, improves efficiency, vehicle investment, and also provides compliance with government legislation. Fleet management also helps to reduce the cost associated with transportation by optimizing cost and efficiency in fleet operations.

The integration of the IoT in the fleet management system aims at improving the business opportunities. IoT solutions in the fleet management will enhance the supply-chain visibility, process-chain monitoring, and much more.

IoT Fleet Management Market: Growth Drivers and Restraints

The major factor driving the growth of IoT fleet management market is the integration of smart devices with vehicles. The introduction of the IoT has made possible the automobiles to perfectly connect with the smart devices, thus making possible real-time traffic alerts and emergency roadside assistance. The integration of IoT with fleet management helps in remote diagnostics, fuel management, fleet analytics, routing management, tracking and monitoring, vehicle maintenance, drive time analysis, cost- and time-saving, and also fulfills the needs of the client. The increasing adoption of the smart devices by transportation companies is expected to propel the growth of IoT fleet management market over the forecast period.

Moreover, the increasing involvement of government by incorporating regulations on fleet safety and security is expected to propel the growth of the IoT fleet management market.

However, lack of IoT infrastructure in developing countries may hamper the growth of IoT fleet management market. Moreover, poor internet connectivity and lack of technically knowledgeable personnel are other factors that may negatively affect the growth of the market over the forecast period

IoT Fleet Management Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | IoT Fleet Management Market |

| Market Size in 2023 | USD 7.15 Billion |

| Market Forecast in 2032 | USD 17.02 Billion |

| Growth Rate | CAGR of 10.12% |

| Number of Pages | 193 |

| Key Companies Covered | Verizon Communications, Inc., Cisco Systems, Inc., AT&T, Inc., Trimble Inc., Tomtom International BV, International Business Machines Corp., Telefónica, S.A., Sierra Wireless, Inc., Intel Corporation, and Omnitracs, among others. |

| Segments Covered | By Platform, By Services, By Solutions, By Cloud Deployment Model, By Fleet Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

IoT Fleet Management Market: Segmentation

The device management platform contributed the major share of 39.59% in the IoT fleet management market in 2017 and is expected to keep its dominance over the forecast period. The device management platform gives the facility of remote access, device confirmation, and offers security highlights against malware assaults and hacking.

The professional and managed services are the two major type of services included in the IoT fleet management market. The professional services are expected to register the highest CAGR growth during the forecast period owing to its ability to manage both the operational and service cost of the organization. The professional services help in understanding the company requirements, technical goals, challenges, and it also provides support for developing new products.

The routing management segment is estimated to register the highest CAGR of 23% between 2017 and 2024. Constant R&D activities for developing new products and the growing road freight traffic are factors that are contributing to the growth of the segment. The routing management solutions help the fleet providers in planning and monitoring their travel routes which help them in cost-saving owing to which its popularity is increasing in the global market.

The hybrid, private, and public are the three type of cloud deployment model for IoT fleet management. Among them, hybrid deployment model is estimated to contribute the major share in the global market by cloud deployment model type. The hybrid cloud environment comprises of both public and private cloud deployment models which give the flexibility to choose appropriate deployment model as per the consumers need. Thus there is an increasing adoption of hybrid cloud deployment model by the enterprises as it provides security and scalability.

Commercial vehicles (CV) fleet is estimated to register high CAGR during the forecast period. IoT fleet management system is being widely utilized in the commercial vehicles as it helps in monitoring and tracking of the vehicles by providing real-time information about the vehicle, driver, and traffic. Thus the safety and security of the vehicles and the goods that are being transported increases proving beneficial to the business.

IoT Fleet Management Market: Regional Analysis

The Asia Pacific is estimated to register the highest CAGR growth during the forecasted period. Increasing opportunities in the transport business owing to the flourishing e-commerce market triggers the growth of the IoT fleet management market in the Asia Pacific. North America and Europe are having a significant share in the IoT fleet management market. Availability of the advanced network infrastructure and the growing sales of the commercial vehicles are factors contributing to the growth of the market in these regions.

IoT Fleet Management Market: Competitive Space

The report includes detailed profiles of the prominent market players that are trending in the market. The list of the players that are compiled in the report is

- Verizon Communications, Inc.

- Cisco Systems, Inc.

- AT&T, Inc.

- Trimble Inc.

- Tomtom International BV

- International Business Machines Corp.

- Telefónica, S.A.

- Sierra Wireless, Inc.

- Intel Corporation

- and Omnitracs

- among others.

The increasing partnership and collaboration between key players of the IoT fleet management are expected to generate immense opportunity for the global market.

The global breast pumps market is segmented as follows:

By Platform

- Device management

- Application Enablement Platform (AEP)

By Services

- Professional

- Managed

By Solutions

- Drive Time Analysis

- Driver Information System

- Fleet Analytics

- Fuel Management

- Remote Diagnostics

- Routing Management

- Tracking and Monitoring

- Vehicle Maintenance

By Cloud Deployment Model

- Hybrid

- Private

- Public

By Fleet Type

- Commercial Vehicles (CV)

- Passenger Cars (PC)

- Public Buses

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed