Fleet Decarbonization Market Size, Share, Trends, Growth 2034

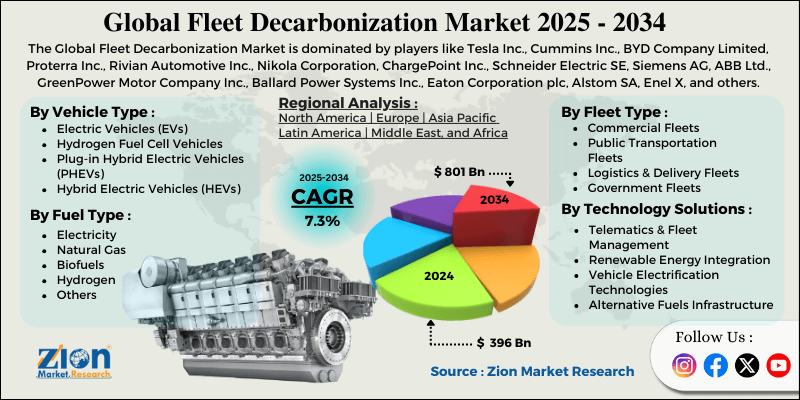

Fleet Decarbonization Market By Vehicle Type (Electric Vehicles (EVs), Hydrogen Fuel Cell Vehicles, Plug-in Hybrid Electric Vehicles (PHEVs), and Hybrid Electric Vehicles (HEVs)), By Fuel Type (Electricity, Natural Gas, Biofuels, Hydrogen, and Others), By Fleet Type (Commercial Fleets, Public Transportation Fleets, Logistics and Delivery Fleets, and Government Fleets), By Technology Solutions (Telematics and Fleet Management, Renewable Energy Integration, Vehicle Electrification Technologies, and Alternative Fuels Infrastructure), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

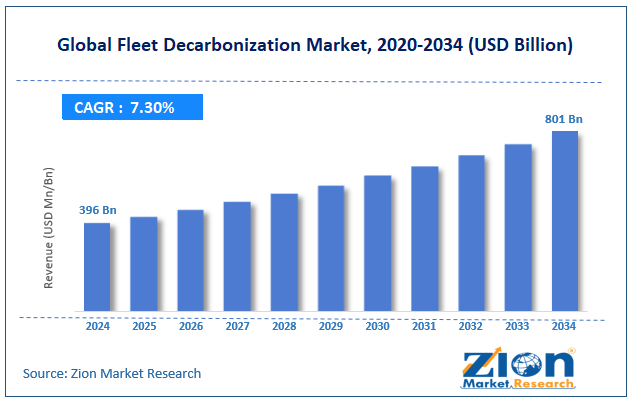

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 396 Billion | USD 801 Billion | 7.3% | 2024 |

Fleet Decarbonization Industry Perspective:

What will be the size of the global fleet decarbonization market during the forecast period?

The global fleet decarbonization market size was worth around USD 396 billion in 2024 and is predicted to grow to around USD 801 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.3% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global fleet decarbonization market is estimated to grow annually at a CAGR of around 7.3% over the forecast period (2025-2034).

- In terms of revenue, the global fleet decarbonization market size was valued at around USD 396 billion in 2024 and is projected to reach USD 801 billion by 2034.

- Stringent government regulation is expected to drive the fleet decarbonization market.

- Based on the vehicle type, in 2024, the Electric Vehicles (EVs) segment dominates the market.

- Based on the fuel type, the natural gas segment is expected to dominate the market over the projected period.

- Based on the fleet type, the commercial fleets segment held the largest revenue share in 2024 and is expected to continue the same pattern during the projected period.

- Based on the technology solutions, the telematics and fleet management segment held the largest revenue share in 2024 and is expected to continue the same pattern during the projected period.

- Based on region, North America is expected to lead the fleet decarbonization market over the projected period.

Decarbonization Market: Overview

Fleet decarbonization is the gradual reduction and eventual elimination of greenhouse gas (GHG) emissions from commercial, industrial, public transportation, and corporate vehicle fleets. It implies replacing traditional internal-combustion vehicles with electric, hybrid, hydrogen, and alternative-fuel vehicles that don't pollute the air. It also involves using digital fleet management, route optimization, telematics, and driver behavior monitoring to help things run more smoothly. Fleet decarbonization also entails constructing infrastructure to support it, such as charging and refueling networks, using renewable energy, and monitoring emissions throughout the fleet's life cycle. All of these measures are intended to help companies comply with environmental regulations, save money, and achieve their long-term sustainability and zero-emissions goals. The fleet decarbonization market is being driven by stringent emission regulations, rising adoption of electric vehicles (EVs), government incentives & infrastructure investment, and telematics and digital fleet management. The high upfront costs & financial barriers are hampering the market growth.

Fleet Decarbonization Market: Dynamics

Growth Drivers

How do the stringent emission regulations propel the development of the fleet decarbonization market?

Stringent emission standards are a significant factor in the fleet decarbonization market. This is because governments around the world are making it harder for commercial and public vehicle fleets to emit carbon dioxide and other pollutants. Fleet operators are being required to switch from internal-combustion-engine vehicles to electric, hybrid, and alternative-fuel vehicles due to regulations such as fuel-efficiency standards, zero-emission vehicle mandates, low-emission zones, and carbon reporting obligations. Not following the rules can lead to fines, limited vehicle access, or higher operating costs. This makes decarbonization more than just an environmental choice; it is also a legal duty. As a result, these policies encourage investment in electric vehicles, charging stations, and digital fleet management systems, thereby fostering market growth.

For instance, on March 20, 2024, the US Environmental Protection Agency (EPA) finalized new motor vehicle emissions regulations, setting the strictest federal limits to date for carbon dioxide, hydrocarbons, nitrogen oxides, and particulate matter. These standards require manufacturers to reduce emissions from new vehicles produced between model years 2027 and 2032, building on the EPA's 2021 rule for model years 2023 through 2026. The regulations apply to all new light-duty and medium-duty vehicles, including passenger vehicles, light trucks, and large pickups and vans.

By model year 2032, light-duty vehicles must achieve an industry-wide average of 85 grams of carbon dioxide emissions per mile, nearly 50% lower than the 2026 standard. Medium-duty vehicles must meet a target of 274 grams per mile by 2032, a 44% reduction from 2026 levels.

Restraints

High upfront costs & financial barriers are hampering the industry's growth

The fleet decarbonization sector isn't growing because it costs a lot of money up front, and people can't afford to transition from regular automobiles to low- or zero-emission ones. Electric and hydrogen cars are usually more expensive than cars with internal combustion engines, and charging or refueling infrastructure, grid modifications, and fleet conversion all need more money. These costs can make it difficult for small- and medium-sized fleet operators to stay within their budgets and delay the time required to recoup their costs, hindering the ability to implement significant changes, even though these changes will pay off in the long run. Because of this, capital constraints and financial limitations make it harder to make decisions and slow down fleet decarbonization plans, especially in nations sensitive to costs and just starting to develop.

Opportunities

How does increasing automotive key players' initiatives to reduce carbon emissions offer opportunities for fleet decarbonization industry expansion?

The efforts of major vehicle companies to lower carbon emissions are creating significant opportunities for growth in the fleet decarbonization sector by accelerating the adoption of new technologies, expanding ecosystems, and boosting market confidence. Tesla, Volkswagen, BMW, and Daimler Truck are just a few of the significant vehicle companies investing heavily in electric, hydrogen, and alternative-fuel cars, as well as energy-efficient powertrains and battery technology. These programs make it easier for logistics, public transportation, and commercial fleets to switch to low-emission cars by increasing availability and diversity.

By working with charging infrastructure providers, energy companies, and software firms, fleet operators may build end-to-end solutions that decrease their adoption risks. As major automakers build more cars, vehicle costs decline, technology advances, and the supporting infrastructure improves. This creates new income streams for fleet management platforms, charging services, energy storage, and carbon-tracking systems, all of which help the industry flourish.

For instance, in January 2026, the BMW Group again reduced the CO2 emissions of the cars it sold in the European Union in the 2025 financial year. Based on early internal estimates, the number was 90.0 kilos per kilometer (99.5 grams per kilometer in 2024). This is around 9.5% less than the emissions in 2024.

Challenges

Why does limited access to affordable green technology pose a significant threat to the fleet decarbonization industry's growth?

The fleet decarbonization industry isn't growing as quickly as it could because there aren't enough affordable green technologies available. This is especially true in emerging markets and for small and medium-sized fleet owners. It is hard to afford electric and alternative-fuel vehicles because they are so expensive, as are batteries, charging equipment, and energy management systems. In many places, expenses rise, and access to technology declines due to low local output, weak supply networks, and reliance on imports. Because of this, fleet operators still use conventional internal combustion engine vehicles, which slows the transition to low-carbon fleets and limits overall market growth.

Fleet Decarbonization Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fleet Decarbonization Market |

| Market Size in 2024 | USD 396 Billion |

| Market Forecast in 2034 | USD 801 Billion |

| Growth Rate | CAGR of 7.3% |

| Number of Pages | 213 |

| Key Companies Covered | Tesla Inc., Cummins Inc., BYD Company Limited, Proterra Inc., Rivian Automotive Inc., Nikola Corporation, ChargePoint Inc., Schneider Electric SE, Siemens AG, ABB Ltd., GreenPower Motor Company Inc., Ballard Power Systems Inc., Eaton Corporation plc, Alstom SA, Enel X, and others. |

| Segments Covered | By Vehicle Type, By Fuel Type, By Fleet Type, By Technology Solutions, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fleet Decarbonization Market: Segmentation

Vehicle Type Insights

Why do Electric Vehicles (EVs) dominate the fleet decarbonization market in 2024?

In 2024, the Electric Vehicles (EVs) segment dominates the market. The fast electrification of commercial fleets, including logistics, last-mile deliveries, public transportation, and corporate cars, is what drives most of the revenue growth. EVs have lower fuel and maintenance expenses than internal combustion engines. Battery technology is continually improving, leading to longer driving ranges, faster charging, and lower battery costs. This has made EVs more reliable and easier to deploy in large fleets.

Also, strict pollution restrictions, zero-emission mandates, and government incentives, such as subsidies, tax rebates, and lower tolls, are accelerating the transition to EVs among fleet operators. As companies make more commitments to sustainability and ESG, demand for EVs in the fleet decarbonization market continues to grow. This is because companies are prioritizing electric fleets to meet net-zero targets and improve their environmental performance.

Fuel Type Insights

How does natural gas hold the largest share in 2024 in the fleet decarbonization market?

The natural gas segment is expected to dominate the market over the projected period. Vehicles that run on compressed natural gas (CNG) and liquefied natural gas (LNG) release less carbon dioxide and particulate matter than regular diesel and petrol cars. This is especially true for heavy-duty trucks, buses, and municipal fleets, which help the company increase revenue. Natural gas cars cost less to buy than electric or hydrogen cars, and there are proven refueling stations in many places. This makes them a good choice for fleets looking to reduce their carbon footprint without significant operational disruptions.

Additionally, the volatility of diesel prices and the availability of renewable natural gas (biomethane) make it easier for fleets to switch to natural gas solutions, enabling them to achieve greater emission reductions while retaining their existing vehicles. This leads to steady revenue growth for natural gas solutions in the fleet decarbonization market.

Fleet Type Insights

Why are commercial fleets expected to capture a substantial revenue in the fleet decarbonization market?

The commercial fleets segment accounted for the largest revenue share in 2024 and is expected to maintain this pattern over the forecast period. Stringent emission limits, low-emission zone laws, and corporate sustainability pledges all drive revenue growth by compelling logistics companies, public transit companies, and service organizations to switch to electric, natural gas, and other low-carbon vehicles. Decarbonization significantly benefits commercial fleets by reducing the total cost of ownership through lower fuel use, lower maintenance expenses, and more efficient fleet operations. All of these things increase long-term profits.

Technology Solutions Insights

How do telematics and fleet management dominate the fleet decarbonization industry?

The telematics and fleet management dominate the market in 2024. Telematics systems can track fuel and energy consumption, identify optimal routes, manage vehicle utilization, and improve driver behavior. All of these things help cut carbon emissions and operational expenses, which leads to more sales. Innovative fleet management solutions are vital for tracking charging schedules, battery health, maintenance planning, and real-time performance as fleets add electric and alternative-fuel vehicles.

Also, stricter rules for reporting emissions and corporate ESG disclosures are increasing the need for digital monitoring and analytics solutions. This is making telematics and fleet management an essential part of decarbonization and a quickly growing source of income for the industry.

Regional Insights

What factor drives North America in the global fleet decarbonization market?

North America is expected to lead the fleet decarbonization market over the projected period. The market generates higher revenue because of strict emissions limits, some U.S. states and Canadian provinces require non-polluting automobiles, and the government provides significant funding for electric and alternative-fuel vehicles and charging stations. Electric and natural gas vehicles, as well as fleet optimization technologies, are in greater demand as logistics organizations, public transportation agencies, and corporate fleets adopt them more frequently, particularly for last-mile deliveries and city travel.

The telematics ecosystem in North America is also well-established, corporations are making more ESG commitments, and vehicle manufacturers and energy firms are making significant investments, all of which help the industry thrive. This makes the area a big part of the surge in global fleet decarbonization revenue.

Fleet Decarbonization Market: Competitive Analysis

The global fleet decarbonization market is dominated by players like;

- Tesla Inc.

- Cummins Inc.

- BYD Company Limited

- Proterra Inc.

- Rivian Automotive Inc.

- Nikola Corporation

- ChargePoint Inc.

- Schneider Electric SE

- Siemens AG

- ABB Ltd.

- GreenPower Motor Company Inc.

- Ballard Power Systems Inc.

- Eaton Corporation plc

- Alstom SA

- Enel X

The global fleet decarbonization market is segmented as follows:

By Vehicle Type

- Electric Vehicles (EVs)

- Hydrogen Fuel Cell Vehicles

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Hybrid Electric Vehicles (HEVs)

By Fuel Type

- Electricity

- Natural Gas

- Biofuels

- Hydrogen

- Others

By Fleet Type

- Commercial Fleets

- Public Transportation Fleets

- Logistics and Delivery Fleets

- Government Fleets

By Technology Solutions

- Telematics and Fleet Management

- Renewable Energy Integration

- Vehicle Electrification Technologies

- Alternative Fuels Infrastructure

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed