Long Duration Energy Storage Market Size, Share Report 2034

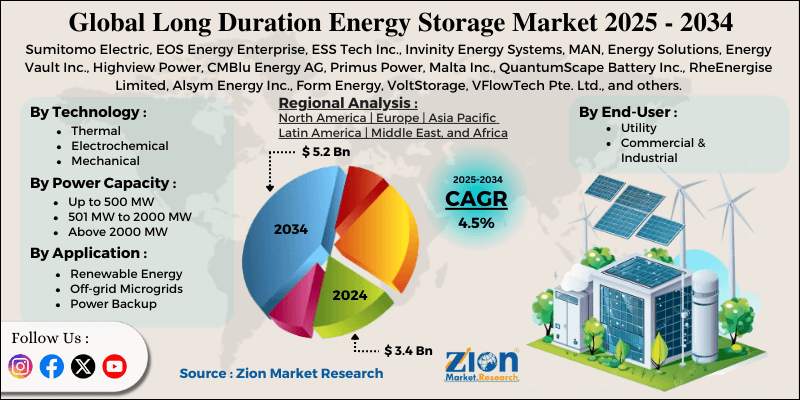

Long Duration Energy Storage Market By Technology (Thermal, Electrochemical and Mechanical), By Power Capacity (Up to 500 MW, 501 MW to 2000 MW and Above 2000 MW), By Application (Renewable Energy, Off-grid Microgrids, Power Backup, and Others), By End-User (Utility and Commercial & Industrial), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

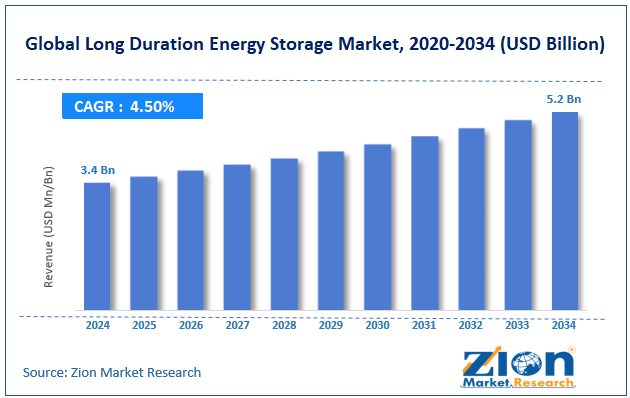

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.4 Billion | USD 5.2 Billion | 4.5% | 2024 |

Long Duration Energy Storage Industry Perspective:

The global long duration energy storage market size was worth around USD 3.4 billion in 2024 and is predicted to grow to around USD 5.2 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.5% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global long duration energy storage market is estimated to grow annually at a CAGR of around 4.5% over the forecast period (2025-2034).

- In terms of revenue, the global long duration energy storage market size was valued at around USD 3.4 billion in 2024 and is projected to reach USD 5.2 billion by 2034.

- Growing renewable energy integration is expected to drive the long duration energy storage market over the forecast period.

- Based on the technology, the mechanical segment is expected to capture the largest market share over the projected period.

- Based on the power capacity, the up to 500 MW segment is expected to capture the largest market share over the projected period.

- Based on the application, the renewable energy segment is expected to capture the largest market share over the projected period.

- Based on the end-user, the utility segment is expected to capture the largest market share over the projected period.

- Based on region, North America is expected to dominate the market during the forecast period.

Long Duration Energy Storage Market: Overview

Long-duration energy storage devices can hold energy for extended periods, typically 10 hours or more. As the number of variable renewable energy sources, such as wind and solar, grows, these systems are becoming increasingly crucial for balancing supply and demand. When demand is low, LDES technologies conserve energy. They let it go when demand is high. This ensures the power supply remains stable and reliable. LDES provides the independence and reliability needed to transition to a power source that doesn't rely on fossil fuels. These technologies can help strengthen the grid, store energy for long periods, and reduce demand for fossil-fuel peaking power plants. This not only helps us reach the climate goals, but it also makes energy safer and cheaper.

Long Duration Energy Storage Market Dynamics

Growth Drivers

How does the rising integration of renewable energy propel long duration energy storage industry growth?

The increasing use of renewable energy sources is driving demand for long duration energy storage systems. LDES technologies are essential for ensuring that renewable energy sources like solar and wind can be used reliably and consistently. This is because LDES systems may store excess energy generated during periods of high renewable energy and release it during periods of high demand or insufficient generation.

For instance, in October 2025, India's Ministry of New and Renewable Energy announced a proposal to invest in integrating renewable energy sources. This project is expected to boost the country's energy production by 1,500 megawatts. During the forecast period, these kinds of activities are expected to make LDES more popular in the country.

Restraints

Why is the limited commercial maturity of several technologies impeding the long duration energy storage market growth?

The long duration energy storage industry isn't growing as quickly as it should because many of the technologies aren't yet ready for commercial use. The prices are high at first, the return on investment takes a long time, and the technologies aren't ready yet. Utilities and other consumers are unwilling to adopt certain LDES technologies, such as flow batteries, compressed air energy storage, and thermal systems, because they are expensive to purchase and operate. Also, these technologies don't have clear means to track how well they're working or to connect with other systems, which makes them harder to use and scale across diverse grid settings. This makes individuals wait longer to adopt, even as demand for renewable energy rises.

Opportunities

Does the innovative product launch offer a potential opportunity for the long duration energy storage industry growth?

The long duration energy storage business has an excellent opportunity to grow as new technologies become increasingly accessible. Redox flow batteries and solid-state batteries are examples of advanced battery chemistries that are more stable, have a higher energy density, and last longer than regular lithium-ion batteries. These changes make it easier to store renewable energy that is only available at certain times and to power larger areas, leading more people to use LDES systems.

For instance, Delta, a world leader in innovative green solutions and power management, will launch its C-Series All-In-One Energy Storage Solution for commercial and industrial (C&I) uses in November 2025. This new technology combines LFP battery packs, a Power Conditioning System (PCS), a liquid-cooling system, and a unit controller to deliver a single cabinet with 125 kW/261 kWh capacity and a footprint of less than 1.5 square meters. In on-grid mode, it can hold up to ten cabinets for MW-scale energy storage. Its skid design makes it easy to use with a forklift, so one doesn't need to use complicated lifts or dig trenches below to run cables. This saves a lot of time and money on construction.

Challenges

High upfront cost poses a major challenge to market expansion

One big problem with growing the long duration energy storage market is the high upfront costs. Compared with short-term storage options, LDES solutions such as flow batteries, thermal systems, and other mechanical storage require a significant upfront investment. The expenses of LDES systems depend on their complexity, size, and the materials used. These systems sometimes require larger installations to achieve the same capacity.

Also, many LDES technologies are still in the early stages of commercialization, making it hard to achieve economies of scale. The LDES council states that the average cost of capital for pumped storage hydropower (PSH) worldwide is between USD 1,500 and 2,500 per kW. But the high initial costs, inadequate market incentives, and rules that favor short-term storage have made it harder for LDES projects to attract significant support and investment.

Long Duration Energy Storage Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Long Duration Energy Storage Market |

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2034 | USD 5.2 Billion |

| Growth Rate | CAGR of 4.5% |

| Number of Pages | 216 |

| Key Companies Covered | Sumitomo Electric, EOS Energy Enterprise, ESS Tech Inc., Invinity Energy Systems, MAN, Energy Solutions, Energy Vault Inc., Highview Power, CMBlu Energy AG, Primus Power, Malta Inc., QuantumScape Battery Inc., RheEnergise Limited, Alsym Energy Inc., Form Energy, VoltStorage, VFlowTech Pte. Ltd., and others. |

| Segments Covered | By Technology, By Power Capacity, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Long Duration Energy Storge Market: Segmentation

The global long duration energy storage industry is segmented based on technology, power capacity, application, end-user, and region.

Based on the technology, the global market is bifurcated into thermal, electrochemical and mechanical. The mechanical segment is expected to dominate the market. This segment is driven by scalability, a long operational life, and the ability to store large amounts of energy efficiently for extended periods.

Based on the power capacity, the global long duration energy storage industry is bifurcated into up to 500 MW, 501 MW to 2000 MW, and above 2000 MW. The up to 500 MW segment holds the major market share. This rise is due to a greater need for grid stability, the integration of renewable energy, and reductions in carbon emissions. They are used for peak demand control, renewable smoothing, and grid resilience because they are cost-effective and can be scaled up to 500 MW.

Based on the application, the global long duration energy storage market is divided into renewable energy, off-grid microgrids, power backup, and others. The renewable energy segment is expected to dominate the market over the forecast period, as renewable energy applications drive strong demand for long-duration energy storage (LDES) by addressing the intermittency and variability of resources such as wind and solar.

Based on the end-user, the global industry is divided into utility and commercial & industrial. The utility segment holds the largest market share. This is driven by the increasing integration of renewable energy sources like solar and wind power.

Long Duration Energy Storage Market: Regional Analysis

Will North America dominate the long duration energy storage market over the projected period?

The North America region is expected to dominate the long duration energy storage market over the analysis period. The region's renewable energy expansion, particularly solar and wind, demands LDES to control intermittency and shift peaks, with the renewable integration application playing an important role. According to WRI, installed solar capacity in the United States presently totals approximately 220 GW, enough to supply more than 7% of the country's electricity. Government incentives, grants, and legislation also help to accelerate deployment, as do infrastructure upgrades to manage electrification in data centers, EVs, and transportation.

For instance, in June 2025, the US Department of Energy announced a USD 15 million investment in three energy storage technology projects around the country. These government investments are likely to boost market expansion in the country throughout the forecast period.

Long Duration Energy Storage Market: Competitive Analysis

The global long duration energy storage market is dominated by players like:

- Sumitomo Electric

- EOS Energy Enterprise

- ESS Tech Inc.

- Invinity Energy Systems

- MAN

- Energy Solutions

- Energy Vault Inc.

- Highview Power

- CMBlu Energy AG

- Primus Power

- Malta Inc.

- QuantumScape Battery Inc.

- RheEnergise Limited

- Alsym Energy Inc.

- Form Energy

- VoltStorage

- VFlowTech Pte. Ltd.

The global long duration energy storage market is segmented as follows:

By Technology

- Thermal

- Electrochemical

- Mechanical

By Power Capacity

- Up to 500 MW

- 501 MW to 2000 MW

- Above 2000 MW

By Application

- Renewable Energy

- Off-grid Microgrids

- Power Backup

- Others

By End-User

- Utility

- Commercial & Industrial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed