Energy Management Systems Market Trend, Share, Growth, Size, Analysis and Forecast 2032

Energy Management Systems Market - By Software (Utility, Industrial, Residential, Enterprise Energy Management, Others), and By Region: Global Industry Perspective, Market Size, Statistical Research, Market Intelligence, Comprehensive Analysis, Historical Trends, and Forecasts, 2024-2032

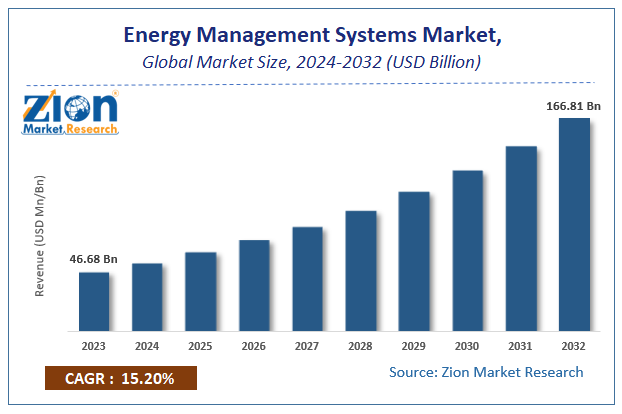

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 46.68 Billion | USD 166.81 Billion | 15.2% | 2023 |

Energy Management Systems Market Insights

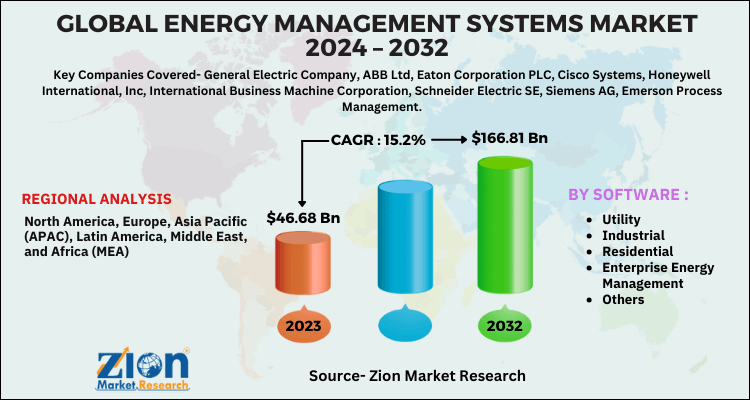

According to a report from Zion Market Research, the global Energy Management Systems Market was valued at USD 46.68 Billion in 2023 and is projected to hit USD 166.81 Billion by 2032, with a compound annual growth rate (CAGR) of 15.2% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Energy Management Systems Market industry over the next decade.

Energy Management Systems Market Overview

Energy management is a procedure of organizing and optimizing energy consumption. Increasing demand for renewable energy and wincing supply of non-renewable natural resources like coal is stimulating the overall market. Moreover, government mandates are insisting for more rigorous sustainability standards. Energy management enables reduction in cost, reduced carbon emission and maximize energy savings. An Energy management system (EnMS) delivers a framework for industrial services to accomplish current energy usage along with categorises prospects to embrace energy-convertible technologies, as well as those that do not inevitably have need of capital investment.

Moreover, the conclusion of a successful EnMS is not only to decrease in energy usage and cost, but also an assembly of additional non-energy competence welfares including efficiency, superiority, resource management, declined liability and asset ethics. Statically, a recent IEA study has revealed that certain non-energy associated impressions of enhanced energy efficiency conveyed 2.5 times the assessment of the energy demand drop.

Key players are integrating data analytics to their current energy management systems segments for proficient monitoring of data. Product enhancement, brand recognition and ongoing technological advancements are other factors the players are focusing on.

Energy Management Systems Market : Growth Factors

The global warming and climate change has forced the countries and the people to think over to reduce the carbon footprints. Rising demand for energy conservation and environment safety will strengthen the Energy management systems market. Evolution of smart grid and favourable government mandates are other factors fuelling the market growth.

Increasing awareness in industrial sectors for the efficient utilization of energy consumption is the major component which is driving energy management system market growth. Moreover, increasing alertness about carbon emission management serves as a major factor to fuel the growth of energy management system market over forecast periods. However, lack of awareness of consumer and financial resources are restraining the energy management system market growth. Nonetheless, technological advancement such as software-as-a-service is expected to spur the market growth of energy management system market over the forecast period.

Energy management system (EMS) is a system of computer-aided tools used by operators of electric utility grids to monitor, control, and optimize the performance of the generation and transmission asset in real time.Energy management system plays the key role in helping the businesses, industries, and individuals to become more energy efficient. In addition, this system will help them to lower the electricity expenses considerably. Factors like the rising in energy crisis and growth in industries in emerging economies help to impel demand of energy management system.

The key factors which are mainly driving the energy management system market is escalating energy consumption and price volatility. Furthermore, increasing awareness in industrial sectors for the efficient utilization of energy consumption is also fueling the growth of this market. In addition, stringent government policies and guidelines or government intervention over misuse of energy consumption spurs the growth of this market. However, lack of financial resources for new entrant enterprises serve as a major restraining factor which hampers the growth of energy management system market. A long period of return on investment for energy-intensive industries is the poising challenge to the growth of energy management system market.Nonetheless, upcoming smart city project in developing countries and technological advancement such as integration of energy management system with smart devices are offering new avenues to this market.

Energy Management Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Energy Management Systems Market |

| Market Size in 2023 | USD 46.68 Billion |

| Market Forecast in 2032 | USD 166.81 Billion |

| Growth Rate | CAGR of 15.2% |

| Number of Pages | 145 |

| Key Companies Covered | General Electric Company, ABB Ltd, Eaton Corporation PLC, Cisco Systems, Honeywell International, Inc, International Business Machine Corporation, Schneider Electric SE, Siemens AG, Emerson Process Management |

| Segments Covered | By Software and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

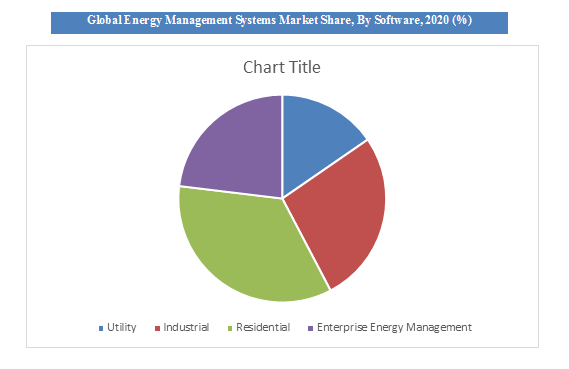

Software Segment Analysis Preview

The global market for Energy Management Systems is divided into two categories: Software and region. The market is segmented into industrial sectors based on the Software, such as Industrial, Utility, Enterprise Energy Management, Residential, and others. The industrial energy management software sector will have the significant growth and will also dominate the market in the forecast period. Energy use in industries is much more related to operational practices than in the residential and commercial sectors. The energy-using systems in industries are designed to support the production practices which may are relatively energy efficient under an initial production scenario. Industry management software is accounted for over 53.5% of the global energy management system market in 2020.

Energy Management Systems Market: Regional Analysis

North America held the largest share in energy management system and expected to dominate this market over the forecast period. The government of North America has been actively involved with the energy efficiency management standards for the residential sector.This has pushed the residential energy management market toward the energy management system. Asia Pacific is anticipated to show the fastest growth for energy management system due to the larger population and booming industrial sector, especially in China.

Key Market Players & Competitive Landscape

Some of the major players of global Energy Management Systems Market includes

- General Electric Company

- ABB Ltd

- Eaton Corporation PLC

- Cisco Systems

- Honeywell International, Inc

- International Business Machine Corporation

- Schneider Electric SE

- Siemens AG

- Emerson Process Management

The global Energy Management Systems Market is segmented as follows:

By Software

- Utility

- Industrial

- Residential

- Enterprise Energy Management

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Energy Management Systems Market size worth at USD 46.68 Billion in 2023

Energy Management Systems Market size worth at USD 46.68 Billion in 2023 and projected to USD 166.81 Billion by 2032, CAGR of around 15.2% between 2024-2032

Increasing number of smart city projects and rising cost of non-renewable sources are the major factors in the growth of the Energy Management Systems Market.

North America accounted towards a major share of Energy Management Systems Market and will continue to dominate the market over the next few years as the consumption and production is more in North America than the other regions.

Some of the major players of global Energy Management Systems Market includes General Electric Company, ABB Ltd, Eaton Corporation PLC Cisco Systems, Honeywell International, Inc., International Business Machine Corporation, Schneider Electric SE, Siemens AG, Emerson Process Management, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed