Biometrics as a Service Market Size, Share, Growth Report 2032

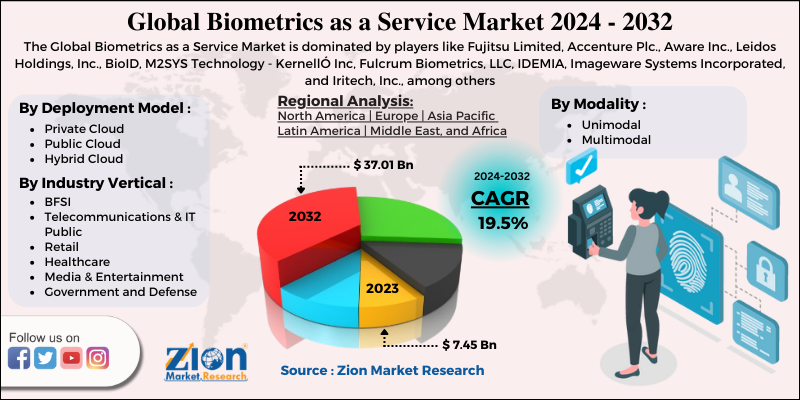

Biometrics as a Service Market, by Modality Type (Unimodal and Multimodal), Deployment Model (Private Cloud, Public Cloud, and Hybrid Cloud), and Industry Vertical (BFSI, Telecommunications and IT, Retail, Healthcare, Media and Entertainment, Government and Defense, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

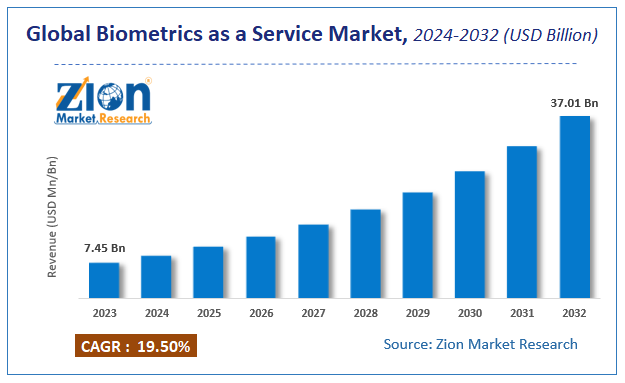

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.45 Billion | USD 37.01 Billion | 19.5% | 2023 |

Biometrics as a Service Market Insights

According to Zion Market Research, the global Biometrics as a Service Market was worth USD 7.45 Billion in 2023. The market is forecast to reach USD 37.01 Billion by 2032, growing at a compound annual growth rate (CAGR) of 19.5% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Biometrics as a Service Market industry over the next decade.

Market Overview

Biometrics as a Service is a service that allows people to be authenticated and identified based on their behavioral and biological characteristics. It provides a solution to ensure that only genuine users can access the services, primarily through the use of facial recognition and microphones for voice capture. Growing demand for cost-effective solutions to access advanced biometrics competences and rising adoption of cloud-based services are two major drivers of the biometrics as a service market.

The increasing security of biometric data stored on the cloud, as well as the integration of biometrics-as-a-service into existing systems, are two factors that could stymie the biometrics as a service market. However, rising e-commerce demand, increased mobile device usage, and increased security awareness are all creating opportunities for the biometrics as a service market to grow in the forecast period.

Growth Factors

The traditional biometric technique for integrating biometric capabilities into business applications is costly and time-consuming. Biometrics-as-a-Service is a cloud-based platform that combines cloud capabilities and technologies with biometrics infrastructure. This allows for biometric onboarding and authentication on the cloud platform while also removing the costs of the database, network, and storage components. The biometric capture device is the only hardware component required to capture individual biometric input, making these solutions easier to deploy and driving their adoption across various industries.

In addition, the majority of biometrics-as-a-service providers provide integration services to assist customers in integrating biometrics capabilities into their existing systems. This reduces the amount of technical resources required to integrate the service even more. Companies are constantly in need of such low-cost solutions, which is driving demand for them all over the world. One of the key factors driving the market's positive outlook is the growing demand for comprehensive authentication systems, as well as the increasing adoption of cloud-based services by businesses all over the world. To combat security attacks and identity theft, both government and private organizations are implementing advanced BaaS solutions.

Biometrics as a Service Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Biometrics as a Service Market |

| Market Size in 2023 | USD 7.45 Billion |

| Market Forecast in 2032 | USD 37.01 Billion |

| Growth Rate | CAGR of 19.5% |

| Number of Pages | 150 |

| Key Companies Covered | Fujitsu Limited, Accenture Plc., Aware Inc., Leidos Holdings, Inc., BioID, M2SYS Technology - KernellÓ Inc, Fulcrum Biometrics, LLC, IDEMIA, Imageware Systems Incorporated, and Iritech, Inc., among others |

| Segments Covered | By Modality Type, By Deployment Model, By Industry Vertical And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Modality Type Segment Analysis Preview

Unimodal solutions are simpler to implement and maintain than multimodal technologies. Unimodal technologies, on the other hand, are more vulnerable to threats like spoofing and are less reliable than multimodal systems. As a result, these systems are used in industries where high levels of security and reliability are not necessary. These are mostly famous because of their reduced cost and easy availability. Multimodality forms the other type of modality type.

Deployment Model Segment Analysis Preview

The market's growth is expected to be boosted by the Cloud Based segment. Cloud-based services typically support upgrades and maintenance services that are either included in a subscription plan or available as a stand-alone service. In addition, integration services with complex enterprise applications account for the majority of service revenues. Hybrid cloud holds the largest revenue and share in market. Private Cloud, and Public Cloud forms the deployment model segment.

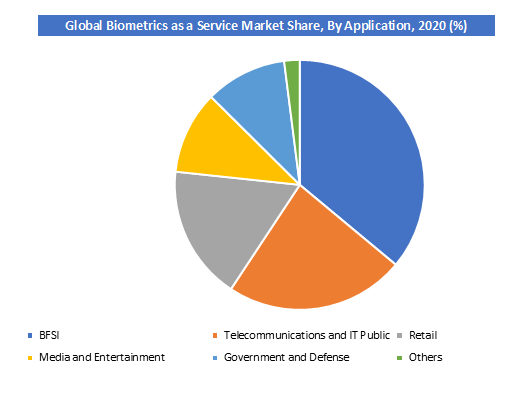

Industry Vertical Segment Analysis Preview

In the forecast period, BFSI is expected to be the fastest-growing market. The pressure to provide safe banking services through mobile apps persists as banking service providers invest in mobile app services to operate. Advanced authentication methods, such as fingerprint and two-factor authentication, facial and voice recognition, are used by the majority of banking apps and wallets. Telecommunications and IT, Retail, Healthcare, Media and Entertainment, Government and Defense, and others forms the industry vertical.

Regional Analysis Preview

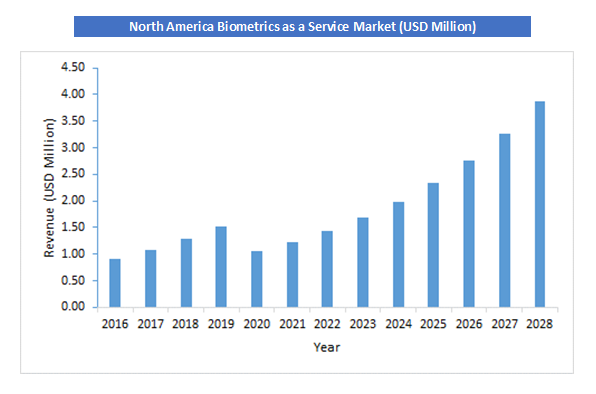

North America is expected to hold the largest market share during the forecast period because it is a technologically advanced region with a large number of early adopters and the presence of major market players. The revenue growth in this region is being driven by factors such as large-scale funded programs and employee access monitoring in buildings. The rapid growth of online transactions, the rise in advanced cyber-attacks, and high IT security spending are all major factors driving the BaaS market in this region. Furthermore, the use of advanced biometrics in various IoT-based devices in this region has boosted demand for biometrics-as-a-service in this region.

As it becomes technologically equipped through early adoption of new technologies, Asia Pacific is expected to contribute to the fastest-growing region with the highest CAGR of 22.1% during the forecast period. Increased cyber-attacks, as well as the inability of large and small businesses in this region to manage and mitigate the risks associated with identity-related cyberattacks, are driving the trend. The growth of the biometrics-as-a-service market in Asia-Pacific is expected to be influenced by an increase in government investments in biometric projects such as national ID cards and e-passports, as well as the development of smart cities and connected devices.

Key Market Players & Competitive Landscape

Some of key players of Biometrics as a Service Market are:

- Fujitsu Limited

- Accenture Plc.

- Aware Inc.

- Leidos Holdings, Inc.

- BioID

- M2SYS Technology - KernellÓ Inc

- Fulcrum Biometrics, LLC

- IDEMIA

- Imageware Systems Incorporated

- Iritech, Inc., among others.

To gain a competitive advantage, these players are increasing collaborations and partnerships among industry participants, as well as various hospitals and research centers. Nuance is a well-known voice biometrics and Natural Language Understanding (NLU) solution provider with a large geographic footprint. Healthcare, enterprise, automotive, and imaging are among the company's segments. It also serves a variety of industries, including finance, government, healthcare, legal, manufacturing, education, and logistics. By partnering with BioCatch, a leading behavioral biometrics solutions provider, the company has expanded its biometrics solution portfolio to include behavioral biometrics solutions. Customers can now get multi-factor authentication solutions thanks to this partnership.

The global biometrics as a service market is segmented as follows:

By Modality Type

- Unimodal

- Multimodal

By Deployment Model

- Private Cloud

- Public Cloud

- Hybrid Cloud

By Industry Vertical

- BFSI

- Telecommunications and IT Public

- Retail

- Healthcare

- Media and Entertainment

- Government and Defense

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global biometrics as a service market was valued at $ 7.45 Billion in 2023.

The global biometrics as a service market is expected to reach $ 37.01 Billion by 2032, with CAGR of around 19.5% from 2024 to 2032.

The growing demand for comprehensive authentication systems, to combat security attacks and identity theft, both government and private organizations are implementing advanced BaaS solutions are some of the key factors driving the biometrics as a service market growth.

North America held a share of over 37.56% in the global biometrics as a service market. This is due to it is a technologically advanced region with a large number of early adopters and the presence of major market players.

Some of key players biometrics as a service market market include Fujitsu Limited, Accenture Plc., Aware Inc., Leidos Holdings, Inc., BioID, M2SYS Technology - KernellÓ Inc, Fulcrum Biometrics, LLC, IDEMIA, Imageware Systems Incorporated, and Iritech, Inc., among others.

List of Contents

Market InsightsMarket Overview Growth FactorsReport ScopeModality Type Segment Analysis PreviewDeployment Model Segment Analysis PreviewIndustry Vertical Segment Analysis PreviewRegional Analysis Preview Key Market Players Competitive LandscapeThe global biometrics as a service market is segmented as follows:By Modality TypeBy Deployment ModelBy Industry Vertical By RegionRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed