Electric Vehicles Market Trend, Share, Growth, Size and Forecast 2032

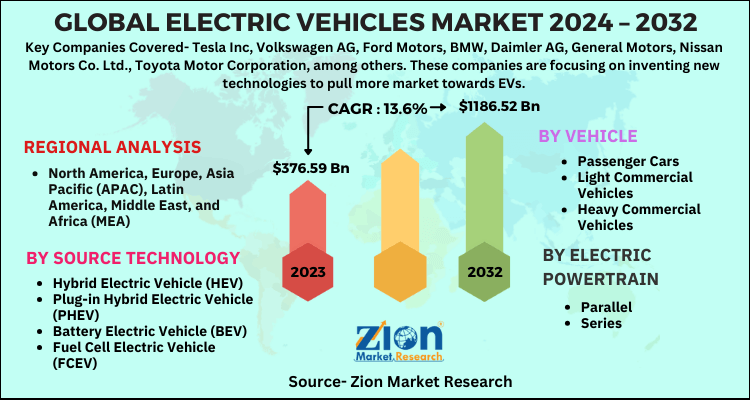

Electric Vehicles Market By Source Technology Type (Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV)), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), By Electric Powertrain (Parallel and Series): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024-2032

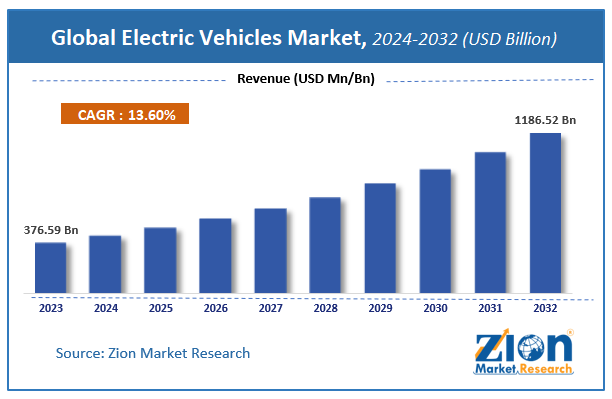

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 376.59 Billion | USD 1186.52 Billion | 13.6% | 2023 |

Electric Vehicles Market Insights

According to Zion Market Research, the global Electric Vehicles Market was worth USD 376.59 Billion in 2023. The market is forecast to reach USD 1186.52 Billion by 2032, growing at a compound annual growth rate (CAGR) of 13.6% during the forecast period 2024-2032.

The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Electric Vehicles Market industry over the next decade.

Electric Vehicles Market Size

The report analyzes the global electric vehicles market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the electric vehicles industry.

Electric Vehicles Market Overview

The contribution in increasing the Greenhouse Gases (GHG) emissions by the traditional fuel vehicles has paved the way to clean fuel vehicles. Electric Vehicles (EV) have gained popularity in such scenarios, considering a significant contributor to the new power system. These vehicles are operated on an electric motor which requires supply from the batteries.

The market is primarily driven by various benefits offered by EVs over conventional fuel vehicles, including lower carbon emission, higher fuel economy, low maintenance, rise in fuel prices, ease of charging the vehicle, and government policies to increase the sales of EVs. Ultra-fast charging facilities have become more popular recently, providing increased power output. The car manufacturers are significantly investing in procuring EV batteries and cloud-connected charging devices. This trend is expected to continue over the forecast period.

COVID-19 Impact Analysis

With production lines paused, the supply chain disrupted, and the demand from consumers abridged, the EV market suffered greatly in the pandemic. Tesla Inc initially suspended the production but saw steady sales and profitable quarters in 2020, with the company delivering 1,80,570 vehicles in the 4th quarter. The European EV market saw double the sales in 2020 as that of 2019.

Electric Vehicles Market: Growth Factors

With the government’s strict regulations on Vehicle Emissions to curb air pollution, manufacturers are switching to EVs. For instance, European Union, the US, and China have implemented strict government regulations and have asked manufacturers to use the technologies to Reduce Greenhouse Gases. Improved Batteries having continuous growth with newer technologies like vehicle-to-grid (V2G) systems will ultimately make sure consumers adopt electric vehicles.

Along with imposing regulations, the government has been providing new policies and subsidies to stimulate the adoption of EVs. With consumers getting more benefits like reduced price or more EV battery stations and automakers on grants like exempting from the taxes, it has encouraged both the parties to buy and sell the EVs. The competition between the automakers has undoubtedly made sure there is an arrival of less cheap Electric Vehicles with the complete package, thereby allowing consumers to lean towards the EVs market only.

Electric Vehicles Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Electric Vehicles Market |

| Market Size in 2023 | USD 376.59 Billion |

| Market Forecast in 2032 | USD 1186.52 Billion |

| Growth Rate | CAGR of 13.6% |

| Number of Pages | 130 |

| Key Companies Covered | Tesla Inc, Volkswagen AG, Ford Motors, BMW, Daimler AG, General Motors, Nissan Motors Co. Ltd., Toyota Motor Corporation, among others. These companies are focusing on inventing new technologies to pull more market towards EVs. |

| Segments Covered | By Source Technology, By Vehicle, By Electric Powertrain and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Electric Vehicles Market Segmentation

The global electric vehicles market is segmented by source technology type, by vehicle type, by electric powertrain, and region.

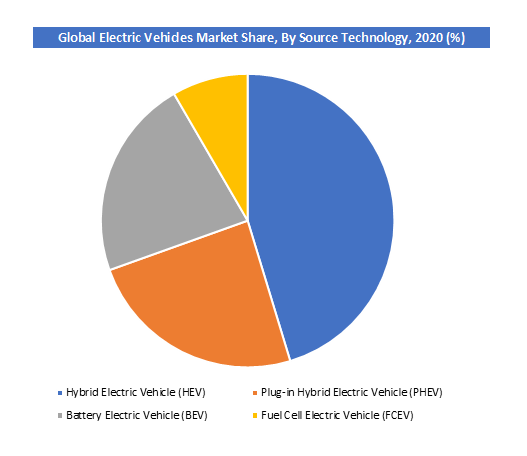

Source Technology Segment Analysis Preview

The Hybrid Electric Vehicle (HEV) held a share of 45.31% in 2020. HEV provides a combination of both electric motor and IC Engine, with the capability of conserving the energy that has been produced from different sources. It meets other objectives like improved fuel efficiency and an increase in power. The use of regenerative braking and automatic start and shutoff technologies have paved the way for HEV to rise in this segment. Plug-in Hybrid Electric Vehicle’s (PHEV) future seems bleak due to high cost and hard to maintain, but the manufacturers are looking forward to reducing the sales price. Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), and others form the industry type segment.

Vehicle Segment Analysis Preview

The passenger car segment is projected to grow at a CAGR of around 25.74% from 2021 to 2028. This is accredited to the rising demand for EVs especially in Europe and China. The two-wheelers and other passenger vehicles like cars and buses sales have witnessed increased sales numbers owing to the emergence of advanced batteries. Several other countries are also planning to replace the traditional fuel-based with electric vehicles. This trend will help the passenger car segment hold a substantial market share during the forecasted period. The commercial vehicle segment includes light and heavy commercial vehicles based on applications and the load capacity it has to bear. This segment is expected to witness notable growth during the forecast period as the EV market is witnessing frequent product launches in its commercial vehicles category.

Electric Powertrain Segment Analysis Preview

The Parallel segment is expected to witness substantial growth during the forecast period. This is accredited to its efficient functioning with the engine and motor to generate the power. The use of small battery packs and power from regenerative braking are some of the other factors that fuel the growth of parallel powertrains. This technology of braking allows the battery to recharge, and thus there is no requirement for an external generator.

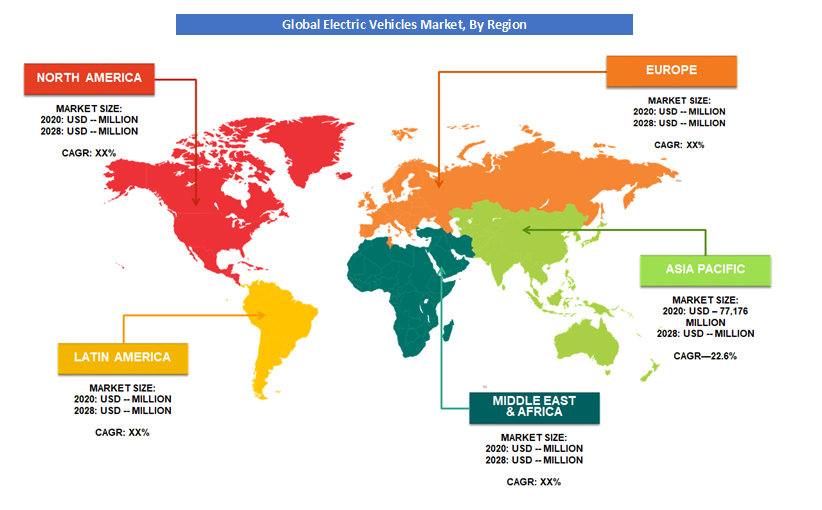

Electric Vehicles Market: Regional Analysis

Asia Pacific is projected to grow at a CAGR of 54.05% during the forecast period. Asia Pacific EV market is likely to witness a significant increase in the demand for passenger cars due to enhanced production capabilities, especially in developing economies such as China and India. China holds the largest share in passenger car segments in the global EV market. The ever-rising levels of air pollution in APAC countries and the increase in demand for private vehicles have paved an opportunity to grow the market. The need is backed by the government’s laws and subsidies to meet the objectives.

North America is expected to witness substantial growth during the forecast period. The rigid government regulations and improvement in charging infrastructure in the U.S. have led North America to contribute heavily to the global market. Tesla has been the largest manufacturer in California and will help the market witness the highest growth due to increased demand for commercial vehicles. Biden administration is on the path of electrifying the entire fleet and meet the sustainability achievements.

Key Market Players & Competitive Landscape

Some of the key players in the Electric Vehicle market include-

- Tesla Inc

- Volkswagen AG

- Ford Motors

- BMW

- Daimler AG

- General Motors

- Nissan Motors Co. Ltd.

- Toyota Motor Corporation

- among others

These companies are focusing on inventing new technologies to pull more market towards EVs.

Tesla Inc. (US) is among the leading top player in the electric vehicle market with the outset of producing the better innovative vehicle in terms of efficiency and enhancements in technologies. The EV trend set by Tesla Inc. is supported by environmental objectives too. The company has manufactured charging stations across the US and Canada. In addition to creating and selling high-speed EVs, the company has also developed Solar panels across the charging stations for power generations.

The global electric vehicles market is segmented as follows:

By Source Technology

- Hybrid Electric Vehicle (HEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

By Vehicle

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Electric Powertrain

- Parallel

- Series

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Electric Vehicles Market size is set to expand from $ 376.59 Billion in 2023

Electric Vehicles Market size is set to expand from $ 376.59 Billion in 2023 to $ 1186.52 Billion by 2032, with an anticipated CAGR of around 13.6% from 2024 to 2032.

Some of the key factors driving the global electric vehicle market growth are the government’s strict regulations on Vehicle Emissions to curb air pollution and key policies and subsidies to the buyer and the carmaker.

North America region held a substantial share of the electric vehicles market in 2020. The government in the U.S. is heavily investing in technology, and the administration is on the path of electrifying the entire fleet and meet the sustainability achievements. Asia Pacific region is projected to grow significantly due to the rise in demand for passenger vehicles in developing economies such as China and India.

Some of the key players in the Electric Vehicle market include Tesla Inc, Volkswagen AG, Ford Motors, BMW, Daimler AG, General Motors, Nissan Motors Co. Ltd., Toyota Motor Corporation, among others.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed