Polyurethane Condom Market Size, Share, Trends, Growth & Forecast 2034

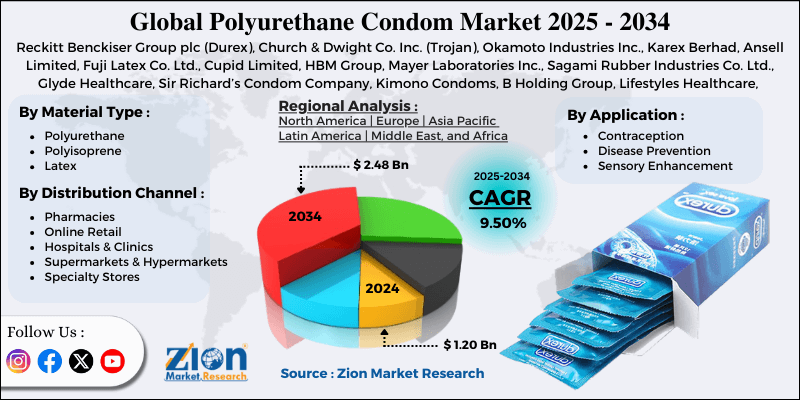

Polyurethane Condom Market By Material Type (Polyurethane, Polyisoprene, Latex), By Application (Contraception, Disease Prevention, Sensory Enhancement), By Distribution Channel (Pharmacies, Online Retail, Hospitals & Clinics, Supermarkets & Hypermarkets, Specialty Stores), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

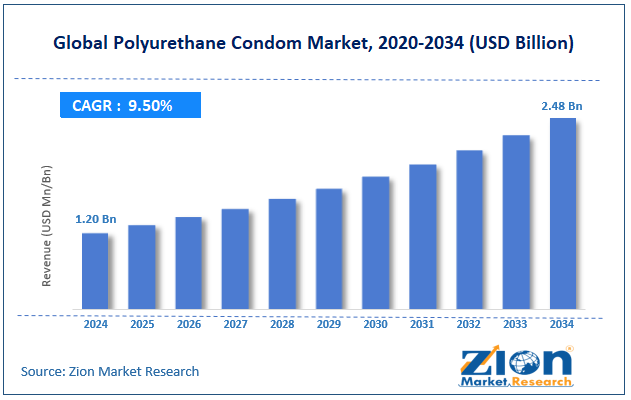

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.20 Billion | USD 2.48 Billion | 9.50% | 2024 |

Polyurethane Condom Industry Perspective:

The global polyurethane condom market size was approximately USD 1.20 billion in 2024 and is projected to reach around USD 2.48 billion by 2034, with a compound annual growth rate (CAGR) of roughly 9.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global polyurethane condom market is estimated to grow annually at a CAGR of around 9.50% over the forecast period (2025-2034)

- In terms of revenue, the global polyurethane condom market size was valued at around USD 1.20 billion in 2024 and is projected to reach USD 2.48 billion by 2034.

- The polyurethane condom market is projected to grow significantly owing to the growing demand for non-latex alternatives, escalating urban population, changing lifestyles, and more substantial support from NGO awareness campaigns and the government.

- Based on material type, the latex segment is expected to lead the market, while the polyisoprene segment is expected to grow considerably.

- Based on application, the contraception segment is the largest, while the disease prevention segment is projected to experience substantial revenue growth over the forecast period.

- Based on the distribution channel, the pharmacies segment is expected to lead the market compared to the online retail segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Polyurethane Condom Market: Overview

Polyurethane condoms are an advanced alternative to customary latex condoms, specially made for people with latex sensitivities or allergies. They are made from a durable and thin material and offer reliable protection from unwanted pregnancies and STIs (sexually transmitted infections), while providing a natural feel due to improved heat transfer properties. The global polyurethane condom market is likely to expand rapidly, fueled by the growing latex allergies, enhanced sensory experience, and compatibility with lubricants. Growing latex allergies and sensitivities are driving a majority of consumers to prefer polyurethane condoms as a safer alternative. Their hypoallergenic properties offer relief to consumers who experience discomfort with latex. This creates a steady demand from a niche but progressing consumer base.

Moreover, polyurethane allows enhanced heat transfer during intimacy, increasing the natural feel for individuals. This sensation is preferred mainly over latex, resulting in higher satisfaction among consumers. The promise of comfort contributes to its traction in the premium class. Unlike latex, polyurethane is compatible with water-based and oil-based lubricants. This versatility provides users with more options and reduces restrictions on use. This flexibility enhances the product's appeal to various consumer groups.

Despite the growth, the global market is impeded by factors such as low availability in the developing regions and consumer preference for familiar latex. In many areas, polyurethane condoms are not as extensively distributed as latex options. Hence, low availability limits user awareness and access. This gap slows overall adoption despite the growing demand. Latex condoms are still the most familiar and commonly bought choice across the globe. Several users stick to latex because of the comfort they feel. This intense loyalty reduces the growth of polyurethane substitutes.

Nonetheless, the global polyurethane condom industry stands to gain from a few key opportunities, like the growing sexual wellness market, product innovation, and customization. The rising focus on sexual wellness offers opportunities for premium products. Polyurethane condoms support this shift to expand their client base.

Additionally, launching flavored, textured, or ultra-thin polyurethane condoms may appeal to the young audience. These advancements add novelty and enhance user engagement. Customization may also create substantial brand diversity.

Polyurethane Condom Market: Growth Drivers

How does increasing focus on sexual health awareness fuel the polyurethane condom market growth?

The worldwide growth in sexual health education programs and government campaigns has significantly driven the use of condoms. According to the WHO (2023), nearly 374 million new STIs are recorded every year, underscoring the need for protective measures. Campaigns like UNAIDS' '95-95-95' target underscores condoms as necessary in HIV prevention strategies.

In June 2024, India's National AIDS Control Organization (NACO) introduced a campaign motivating the broader use of non-latex condoms for inclusivity and comfort. This rising awareness directly fuels the demand for polyurethane condoms, mainly among the health-conscious youth population.

Improvements in condom design have considerably fueled the market growth

Improvements in condom engineering and material science are remarkably propelling the polyurethane condom market. Polyurethane offers ultra-thin properties and optimal strength, aiding enhanced sensitivity without compromising safety. In 2024, Japanese producer Sagami launched a next-generation polyurethane condom that is 20 percent thinner than its predecessor, gaining huge media coverage.

According to the reports, innovation-based demand is mainly for 'feather-light' condoms designed for younger demographics. This product differentiation is helping producers capture industry share and set new benchmarks.

Polyurethane Condom Market: Restraints

Fit concerns and lower elasticity negatively impact market progress

Polyurethane lacks the natural elasticity of latex, which can sometimes lead to complaints about comfort and fit. Consumer feedback surveys in 2023 revealed that nearly 28% of users felt polyurethane condoms were comparatively less adaptable and tighter during use. This adversely impacted repeat purchases despite their strength, benefit, and thinness.

In June 2024, online forums in the United States experienced a surge in discussions about comfort issues with certain polyurethane companies, eroding consumer trust. These restrictions in fit and flexibility continue to limit the industry's growth.

Polyurethane Condom Market: Opportunities

How do growing subscription models and online distribution present favorable opportunities for the expansion of the polyurethane condom market?

E-commerce platforms create major growth prospects for premium condom sales, especially in regions where social stigma persists. According to a McKinsey 2024 survey, nearly 67% of condom buyers in Europe and the United States prefer online purchases for privacy. The leading companies, like Lifestyles and Durex, are influencing subscription services to deliver condoms discreetly.

In July 2024, Reckitt introduced a subscription model targeting the young population in the United Kingdom, focusing on polyurethane products. Online retail promises broader reach and consistent demand through recurring purchases, thus fueling the polyurethane condom industry.

Polyurethane Condom Market: Challenges

How do social taboos and cultural resistance adversely impact the worldwide polyurethane condom market?

In conservative societies, condom use is stigmatized, reducing the accessibility of polyurethane condoms. According to the reports, more than 50% of people in Asian and Middle Eastern nations avoid discussing contraceptives. This cultural resistance limits brands from introducing rigorous marketing campaigns.

In April 2024, an awareness campaign in Saudi Arabia experienced a backlash because of sensitivities over public discussions on condoms. Overcoming these social challenges is a consistent challenge for worldwide adoption.

Polyurethane Condom Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Polyurethane Condom Market |

| Market Size in 2024 | USD 1.20 Billion |

| Market Forecast in 2034 | USD 2.48 Billion |

| Growth Rate | CAGR of 9.50% |

| Number of Pages | 213 |

| Key Companies Covered | Reckitt Benckiser Group plc (Durex), Church & Dwight Co. Inc. (Trojan), Okamoto Industries Inc., Karex Berhad, Ansell Limited, Fuji Latex Co. Ltd., Cupid Limited, HBM Group, Mayer Laboratories Inc., Sagami Rubber Industries Co. Ltd., Glyde Healthcare, Sir Richard’s Condom Company, Kimono Condoms, B Holding Group, Lifestyles Healthcare, and others. |

| Segments Covered | By Material Type, By Application, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Polyurethane Condom Market: Segmentation

The global polyurethane condom market is segmented based on material type, application, distribution channel, and region.

Based on material type, the global polyurethane condom industry is divided into polyurethane, polyisoprene, and latex. The latex condoms held a dominating share of the market because of their elasticity, affordability, and broad accessibility. They are trusted by users worldwide, particularly in developing economies where price plays a significant role. Their ability to offer robust protection, blended with an extensive distribution ecosystem, augments their dominance. Despite the growth of alternatives, latex remains the more broadly accepted and default choice.

Based on application, the global polyurethane condom market is segmented into contraception, disease prevention, and sensory enhancement. The contraception segment held leadership in the market since preventing unwanted pregnancies is the key reason for condom use across the globe. Users believe condoms are a non-invasive, reliable, and easily accessible birth control technique. Polyurethane condoms serve as a suitable substitute for those sensitive to latex, offering comfort and safety. This strong functional demand promises contraception to dominate the application contribution.

Based on distribution channel, the global market is segmented as pharmacies, online retail, hospitals & clinics, supermarkets & hypermarkets, and specialty stores. The pharmacies segment registered the maximum share, as they are trusted, convenient, and accessible points of purchase for users. Several users prefer buying from pharmacies because of the guarantee of privacy and authenticity. Pharmacists also play a key role in guiding patients towards safe contraceptive choices. This broader availability and credibility keep pharmacies as the dominating sales channel.

Polyurethane Condom Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Polyurethane Condom Market?

The Asia Pacific is expected to maintain its leading position in the global polyurethane condom market, driven by its large population base, increasing awareness of sexual health, and the growth of e-commerce platforms. Asia Pacific holds a substantial share of the worldwide market because of its vast population and a high reproductive age group. Economies like India and China together register for more than 35% of the worldwide population. This demographic benefit fuels the consistent and strong demand for contraceptives, including these condoms.

Moreover, rising awareness of safe sex practices and STI prevention has significantly driven condom use in the region. Asia Pacific registered nearly 6 million people living with HIV, as of 2023, according to the UNAIDS. This results in elevated adoption of condoms, with polyurethane options rising among individuals with allergies to latex.

Furthermore, the APAC region is witnessing rapid growth in online retail, thereby increasing the accessibility of sexual wellness products. According to Statista, e-commerce penetration in the region reached over 60% in 2024, with robust adoption in Southeast Asia, China, and India. This move allows convenience and discreet purchase of premium polyurethane condoms.

North America ranks as the second-leading region in the global polyurethane condom industry as a result of high sexual wellness awareness, a strong sector for premium products, and broader e-commerce penetration. North America holds the leading awareness about contraceptive methods and safe sex. The CDC projects that approximately 47% of the U.S. high school students report using condoms in their last sexual intercourse. This cultural openness fuels a sturdy demand for non-latex and latex options.

Additionally, North American consumers show a higher acceptance of innovative and premium products in the sexual wellness category. The United States' sexual wellness industry was estimated at more than $12 billion in 2024, with condoms adding to the remarkable share. Polyurethane condoms benefit from this premiumization trend, since buyers prioritize enhanced experiences and comfort.

Likewise, online sales of sexual wellness products are rapidly growing in Canada and the U.S., according to Statista. More than 75% of regional adults purchased these products online in 2024, with sexual wellness among the leading categories. Discreet variety and delivery make these condoms more accessible in North America.

Polyurethane Condom Market: Competitive Analysis

The leading players in the global polyurethane condom market are:

- Reckitt Benckiser Group plc (Durex)

- Church & Dwight Co. Inc. (Trojan)

- Okamoto Industries Inc.

- Karex Berhad

- Ansell Limited

- Fuji Latex Co. Ltd.

- Cupid Limited

- HBM Group

- Mayer Laboratories Inc.

- Sagami Rubber Industries Co. Ltd.

- Glyde Healthcare

- Sir Richard’s Condom Company

- Kimono Condoms

- B Holding Group

- Lifestyles Healthcare

Polyurethane Condom Market: Key Market Trends

Growing demand for hypoallergenic alternatives:

Consumers are increasingly opting for non-latex options due to the rising prevalence of latex sensitivity. Polyurethane condoms are ranked and considered allergy-free and safe solutions for sensitive consumers. This trend is fueling their adoption in developed and developing economies.

Product innovation and premiumization

Manufacturers are emphasizing textured, ultra-thin, and improved-sensation polyurethane condoms. These advancements appeal to users looking for enhanced intimacy and protection. Premium branding is helping them differentiate from traditional latex options.

The global polyurethane condom market is segmented as follows:

By Material Type

- Polyurethane

- Polyisoprene

- Latex

By Application

- Contraception

- Disease Prevention

- Sensory Enhancement

By Distribution Channel

- Pharmacies

- Online Retail

- Hospitals & Clinics

- Supermarkets & Hypermarkets

- Specialty Stores

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Polyurethane condoms are an advanced alternative to customary latex condoms, specially made for people with latex sensitivities or allergies. They are made from a durable and thin material and offer reliable protection from unwanted pregnancies and STIs (sexually transmitted infections), while providing a natural feel due to improved heat transfer properties.

The global polyurethane condom market is projected to grow due to rising incidences of sexually transmitted infections (STIs), increasing awareness of safe sex practices, and the rise of e-commerce distribution channels.

According to study, the global polyurethane condom market size was worth around USD 1.20 billion in 2024 and is predicted to grow to around USD 2.48 billion by 2034.

The CAGR value of the polyurethane condom market is expected to be approximately 9.50% from 2025 to 2034.

The disease prevention application area will offer significant growth opportunities in the polyurethane condom market due to public health initiatives and rising STI awareness.

Asia Pacific is expected to lead the global polyurethane condom market during the forecast period.

India is a key contributor to the global polyurethane condom market due to its growing sexual wellness awareness and large population.

The key players profiled in the global polyurethane condom market include Reckitt Benckiser Group plc (Durex), Church & Dwight Co., Inc. (Trojan), Okamoto Industries, Inc., Karex Berhad, Ansell Limited, Fuji Latex Co., Ltd., Cupid Limited, HBM Group, Mayer Laboratories, Inc., Sagami Rubber Industries Co., Ltd., Glyde Healthcare, Sir Richard’s Condom Company, Kimono Condoms, B Holding Group, and Lifestyles Healthcare.

Leading players are adopting e-commerce expansion, product innovation, targeted marketing campaigns, and strategic partnerships to increase their market presence in the polyurethane condom segment.

The report examines key aspects of the polyurethane condom market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed