Third Party Logistics (3PL) Market Size, Share, Trends, Growth 2034

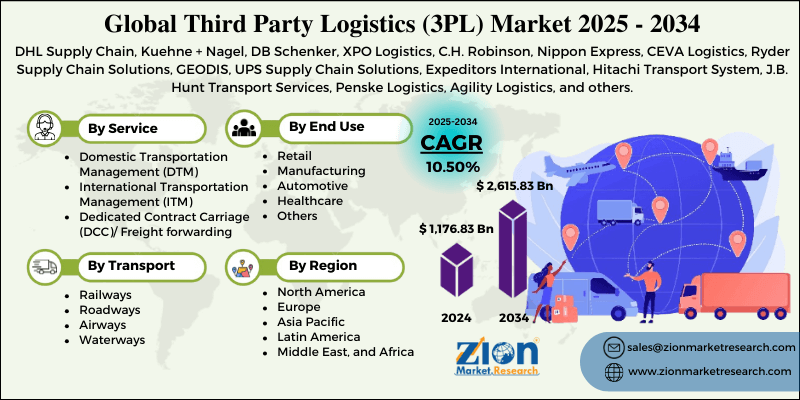

Third Party Logistics (3PL) Market By Service (Domestic Transportation Management [DTM], International Transportation Management [ITM], Dedicated Contract Carriage [DCC]/ Freight Forwarding, Value-Added Logistics Services [VALs], Warehousing & Distribution [W&D]), By Transport (Railways, Roadways, Airways, Waterways), By End-Use (Retail, Manufacturing, Automotive, Healthcare, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

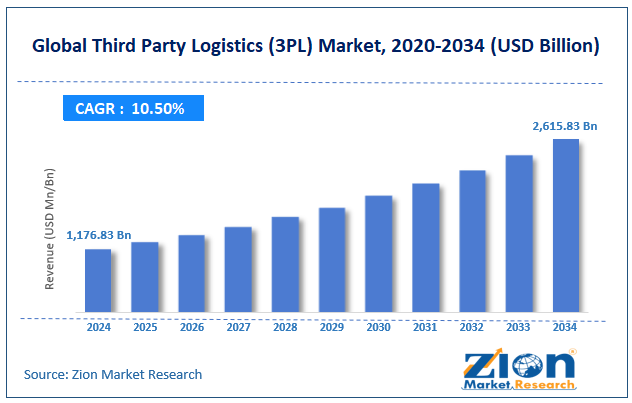

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1176.83 Billion | USD 2615.83 Billion | 10.50% | 2024 |

Third Party Logistics (3PL) Industry Perspective:

The global third party logistics (3PL) market size was worth around USD 1176.83 billion in 2024 and is predicted to grow to around USD 2615.83 billion by 2034, with a compound annual growth rate (CAGR) of roughly 10.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global third party logistics (3PL) market is estimated to grow annually at a CAGR of around 10.50% over the forecast period (2025-2034)

- In terms of revenue, the global third party logistics (3PL) market size was valued at around USD 1176.83 billion in 2024 and is projected to reach USD 2615.83 billion by 2034.

- The third party logistics (3PL) market is projected to grow significantly owing to the growth of omnichannel retail strategies, the rise of online retail and e-commerce, and technological advancements in automation and logistics.

- Based on service, the Domestic Transportation Management (DTM) segment is expected to lead the market, while the Warehousing & Distribution (W&D) segment is expected to grow considerably.

- Based on transport, the roadways segment is the dominating segment, while the waterways segment is projected to witness sizeable revenue over the forecast period.

- Based on end-use, the retail segment is expected to lead the market compared to the manufacturing segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Third Party Logistics (3PL) Market: Overview

Third party logistics is the outsourcing of logistics operations and supply chain to external service providers, allowing businesses to concentrate on their core activities while ensuring adequate transportation, inventory management, order fulfillment, and warehousing. The leading companies offer numerous services, leveraging advanced technology for optimization and real-time tracking. The global third party logistics (3PL) market is likely to expand rapidly, driven by the globalization of supply chains, operational efficiency, cost optimization, and technological advancements in logistics. As businesses expand globally, managing multi-country logistics increases complexity. The 3PL industry benefits from this trend, offering specialization in customs regulations, cross-border transportation, and international freight forwarding. Companies are outsourcing logistics to lessen operational costs. 3PL providers leverage advanced technology and economies of scale to offer competitive pricing and effective services.

Moreover, this adoption of technologies like big data analytics, IoT, AI, and blockchain is transforming 3PL services. Real-time visibility, route optimization, and predictive analytics enhance accuracy and delivery speed. Automation in warehousing, comprising autonomous vehicles and robotics, reduces labor dependency and improves efficiency.

Despite the growth, the global market is impeded by factors such as the lack of control over operations and cybersecurity risks. Outsourcing logistics to a third party may result in decreased control over delivery schedules, quality standards, and inventory. Any service failure by the 3PL provider notably impacts customer satisfaction and the company's reputation. Also, as 3PL providers are actively adopting digital solutions and sharing data, the risk of data breaches and cyberattacks increases. A significant security breach may damage trust between service providers and companies and disturb supply chains.

Nonetheless, the global third party logistics (3PL) industry stands to gain from a few key opportunities, such as the adoption of blockchain for security and transparency, and growing demand in cold logistics and healthcare. Blockchain technology enables 3PL companies to offer tamper-proof tracking, enhanced supply chain transparency, and smart contracts, which regulators and businesses highly demand. Furthermore, the healthcare sector, mainly biologics and pharmaceuticals, requires specialized temperature-controlled supply chain solutions. With global cold chain logistics projected to progress at a 15% CAGR, this notably offers fresh avenues for 3PL providers.

Third Party Logistics (3PL) Market: Growth Drivers

How does technology adoption drive the third party logistics (3PL) market growth?

Investment in warehouse management systems, real-time tracking, AI forecasting, and transportation management remarkably enhances accuracy and throughput. Robotics, automated sortation, voice/pick-to-light systems, and AMRs/ASRS decrease labor per order and speed order cycle times. AI-based route optimization and demand forecasting reduce fuel spend, enhance service reliability, and reduce empty miles. APIs and cloud platforms allow smooth integration with shippers’ systems and offer analytics as a value-add.

Cost pressures and labor market dynamics fuel the market growth

A combination of warehouse worker and chronic driver shortages, along with periodic labor actions and wage inflation, increases reliability risk and operating costs. Reliance on gig drivers and contingent labor further complicates quality control and scheduling while raising training costs and increasing turnover. Automation can decrease dependence on labor, but it requires significant upfront investment and slower ROI in low-margin domains. Labor regulations, upskilling initiatives, and safety compliance increase overhead but also create prospects for managed-service offerings, impacting the growth of the third party logistics (3PL) market.

Third Party Logistics (3PL) Market: Restraints

How do the lack of visibility and data security concerns hinder the progress of the third-party logistics (3PL) market?

Although digitalization is progressing worldwide, several logistics operations still lack real-time visibility in multimodal shipments. This lack of transparency causes inefficiencies in inventory management, tracking, and customer service, mainly during disturbances. Cybersecurity threats are another leading concern, as high-profile ransomware attacks on logistics companies have uncovered vulnerabilities.

Third Party Logistics (3PL) Market: Opportunities

How do sustainability and green logistics open lucrative opportunities for third party logistics (3PL) market advancement?

Growing focus on ESG regulations and environmental sustainability offers 3PLs prospects to distinguish their services. Adoption of electric delivery vehicles, carbon reporting, and energy-efficient warehouses may appeal to environment-conscious customers. Circular logistics solutions for refurbishment, recycling, and reverse flows create fresh revenue streams. Some governments offer initiatives for green logistics investments, reducing initial costs. Meeting sustainability expectations improves long-term competitiveness and brand reputation, fueling the global third party logistics (3PL) industry.

Rising focus on environmental sustainability and ESG regulations offers 3PLs opportunities to differentiate services. Adoption of electric delivery vehicles, energy-efficient warehouses, and carbon reporting can attract eco-conscious clients. Circular logistics solutions for reverse flows, recycling, and refurbishment create new revenue streams. Some governments offer incentives for green logistics investments, lowering initial costs. Meeting sustainability expectations enhances brand reputation and long-term competitiveness.

Third Party Logistics (3PL) Market: Challenges

Stringent trade barriers and regulatory compliance restrict the growth of the market

Compliance with international trade regulations, environmental standards, and customs safety is high-priced and complex. Recent carbon emission regulations and ESG reporting requirements in the EU have elevated compliance costs. Geopolitical tariffs and stresses, like the United States-China trade restrictions, further complicate cross-border logistics. Non-compliance can result in shipment delays, reputational damage, and fines. Regulatory pressures remain a significant operational challenge for global market players.

Third Party Logistics (3PL) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Third Party Logistics (3PL) Market |

| Market Size in 2024 | USD 1,176.83 Billion |

| Market Forecast in 2034 | USD 2,615.83 Billion |

| Growth Rate | CAGR of 10.50% |

| Number of Pages | 212 |

| Key Companies Covered | DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, C.H. Robinson, Nippon Express, CEVA Logistics, Ryder Supply Chain Solutions, GEODIS, UPS Supply Chain Solutions, Expeditors International, Hitachi Transport System, J.B. Hunt Transport Services, Penske Logistics, Agility Logistics, and others. |

| Segments Covered | By Service, By Transport, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Third Party Logistics (3PL) Market: Segmentation

The global third party logistics (3PL) market is segmented based on service, transport, end-use, and region.

Based on service, the global third party logistics (3PL) industry is divided into Domestic Transportation Management (DTM), International Transportation Management (ITM), Dedicated Contract Carriage (DCC)/Freight Forwarding, Value-Added Logistics Services (VALs), and Warehousing & Distribution (W&D). The Domestic Transportation Management (DTM) segment holds leadership in the market due to its crucial role in optimizing routes, managing domestic freight, and assuring timely deliveries within the nation. The rise in retail demand and e-commerce has significantly driven the need for effective domestic logistics solutions. Companies depend on DTM providers to decrease transportation costs and meet strict delivery timelines. The segment continues to grow as businesses prioritize real-time tracking solutions and last-mile delivery.

Based on transport, the global third party logistics (3PL) market is segmented into railways, roadways, airways, and waterways. Roadways is a leading transport segment in the worldwide market because of its versatility, ability to provide door-to-door delivery, and cost-effectiveness. It plays a vital role in supporting last-mile delivery and domestic freight movement, mainly for the retail and e-commerce sectors. Road transport networks are highly developed in regions like Europe, North America, and APAC, promising efficient connectivity. Technological improvements in real-time tracking and route optimization also drive this dominance.

Based on end-use, the global market is segmented into retail, manufacturing, automotive, healthcare, and others. The retail segment registers a substantial share of the market, fueled by the explosive growth of omni-channel retail strategies and e-commerce. Retailers largely depend on 3PL providers for inventory management, fast last-mile delivery, and warehousing to meet consumer demand for convenience and speed. The need for real-time tracking, scalable solutions, and reverse logistics has also boosted the adoption of 3PL in retail. This trend continues as cross-border shopping and online sales grow worldwide.

Third Party Logistics (3PL) Market: Regional Analysis

What enables Asia Pacific to have a strong foothold in the global Third Party Logistics (3PL) Market?

Asia Pacific is anticipated to retain its leading role in the global third party logistics (3PL) market as a result of the speedy growth of e-commerce, expanding industrial and manufacturing base, and investments in technology and logistics infrastructure. Asia Pacific holds leadership, registering for more than 60% of the worldwide online retail sales in 2024. Economies like India and China are experiencing exponential growth in online shopping, fueling the demand for fulfillment, warehousing, and last-mile delivery services. This growth in digital commerce has ranked 3PL providers as key partners for customer satisfaction and effective distribution.

Moreover, the region is a global manufacturing center, with Japan, India, South Korea, and China producing a significant share of global goods. APAC accounts for more than 45% of the worldwide manufacturing output, needing advanced logistics solutions for raw material supply and product distribution. This strong industrial base majorly drives the need for 3PL services in storage, transportation, and supply chain optimization.

Furthermore, massive investments in high-speed transportation networks, smart logistics hubs, and port expansions have increased supply chain efficacy in the region. The incorporation of IoT, AI, and automation in warehousing has also positioned the region as a forerunner in advanced logistics solutions.

North America ranks as the second-leading region in the global third party logistics (3PL) industry as a result of well-established transportation infrastructure, rising demand from the manufacturing and automotive sectors, and high adoption of advanced logistics solutions. The region boasts the most advanced logistics networks globally. This extensive infrastructure supports effective domestic transportation management, a key service segment for the providers of 3PL. Strong connectivity between the United States, Canada, and Mexico under the USMCA trade contract is essential for cross-border logistics.

Additionally, North America holds a strong manufacturing and automotive base, especially in Mexico and the U.S. The automotive industry alone adds more than $104 billion yearly in exports from the United States, needing well-developed supply chain solutions. 3PL firms provide crucial support for just-in-time delivery, distribution for these industries, and component sourcing. North America also holds a leading rank in implementing robotics, IoT, predictive analytics, and AI within supply chains.

More than 7-% of North America's 3PL providers have invested in digital platforms to enhance efficiency and visibility, according to the industry reports. This technological edge improved customer satisfaction and operational efficacy, increasing the dominance of the region as a robust competitor in the market.

Third Party Logistics (3PL) Market: Competitive Analysis

The leading players in the global third party logistics (3PL) market are:

- DHL Supply Chain

- Kuehne + Nagel

- DB Schenker

- XPO Logistics

- C.H. Robinson

- Nippon Express

- CEVA Logistics

- Ryder Supply Chain Solutions

- GEODIS

- UPS Supply Chain Solutions

- Expeditors International

- Hitachi Transport System

- J.B. Hunt Transport Services

- Penske Logistics

- Agility Logistics

Third Party Logistics (3PL) Market: Key Market Trends

Growth of last-mile delivery solutions and e-commerce:

The progressing e-commerce sector, anticipated to exceed $6.5 trillion worldwide by 2025, is fueling the demand for effective last-mile delivery services. 3PL companies are heavily investing in same-day delivery networks and micro-fulfillment centers to satisfy customer expectations for convenience and speed.

Growing focus on green and sustainable logistics:

Sustainability has become a key priority, with 3PL providers launching alternative fuels, electric vehicles, and carbon-neutral shipping options. Companies are optimizing routes and adopting environmentally friendly packaging to reduce emissions, thereby complying with global sustainability regulations and goals.

The global third party logistics (3PL) market is segmented as follows:

By Service

- Domestic Transportation Management (DTM)

- International Transportation Management (ITM)

- Dedicated Contract Carriage (DCC)/ Freight forwarding

- Value-Added Logistics Services (VALs)

- Warehousing & Distribution (W&D)

By Transport

- Railways

- Roadways

- Airways

- Waterways

By End-Use

- Retail

- Manufacturing

- Automotive

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Third-party logistics is the outsourcing of logistics operations and supply chain to external service providers, allowing businesses to concentrate on their core activities while ensuring adequate transportation, inventory management, order fulfillment, and warehousing. The leading companies offer numerous services, leveraging advanced technology for optimization and real-time tracking.

The global third party logistics (3PL) market is projected to grow due to the rising cross-border shipping and international trade, surging demand for cold chain logistics in pharma and food, and increasing adoption of Just-in-Time (JIT) Inventory models.

According to a study, the global third party logistics (3PL) market size was worth around USD 1176.83 billion in 2024 and is predicted to grow to around USD 2615.83 billion by 2034.

The CAGR value of the third party logistics (3PL) market is expected to be around 10.50% during 2025-2034.

Emerging trends and innovations in the 3PL market include blockchain for transparency, AI-driven automation, green logistics solutions, digital freight platforms, and advanced last-mile delivery technologies like autonomous vehicles and drones.

Asia Pacific is expected to lead the global third party logistics (3PL) market during the forecast period.

China is a major contributor to the global 3PL market, owing to its booming e-commerce sector, substantial manufacturing base, and extensive export activities.

The key players profiled in the global third party logistics (3PL) market include DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, C.H. Robinson, Nippon Express, CEVA Logistics, Ryder Supply Chain Solutions, GEODIS, UPS Supply Chain Solutions, Expeditors International, Hitachi Transport System, J.B. Hunt Transport Services, Penske Logistics, and Agility Logistics.

Stakeholders should adopt strategies such as investing in automation technologies and digitalization, forming strategic partnerships, expanding value-added services, enhancing last-mile delivery capabilities, and focusing on sustainable logistics solutions to stay competitive in the 3PL market.

The report examines key aspects of the third party logistics (3PL) market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed