Plant-Based Protein Market Size, Share, Industry Forecast 2032

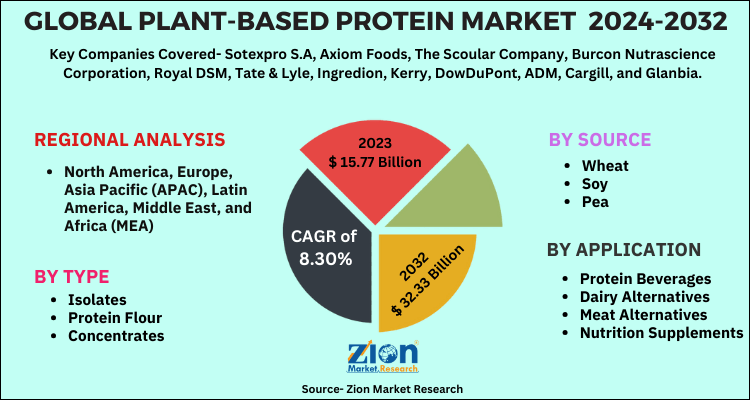

Plant-Based Protein Market by Type (Isolates, Protein Flour, and Concentrates), by Source (Soy, Wheat, Pea, and Others), by Application (Protein Beverages, Dairy Alternatives, Meat Alternatives, Nutrition Supplements, and Others), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032

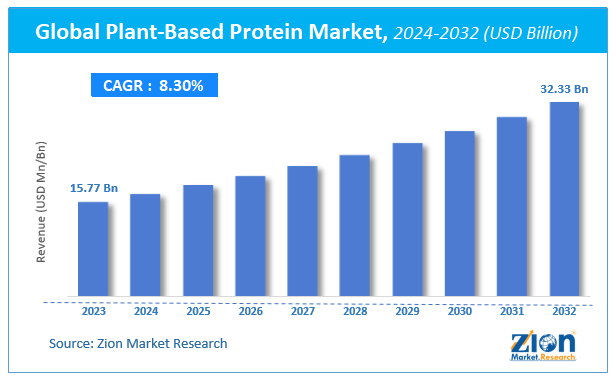

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.77 Billion | USD 32.33 Billion | 8.30% | 2023 |

Plant-Based Protein Market: Industry Perspective

The global plant-based protein market size was worth around USD 15.77 billion in 2023 and is predicted to grow to around USD 32.33 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.30% between 2024 and 2032. The report analyzes the global plant-based protein market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the plant-based protein industry.

Plant-Based Protein Market: Overview

Plant-based protein is extracted from plant sources such as wheat, soy, peas, and others. Plant-based proteins find various applications in nutritional supplements, dairy alternatives, protein bars, meat alternatives, poultry & seafood, bakery foods, and others. The major factors that are expected to drive the global plant-based protein market are consumer preference towards a vegan diet and the nutritional benefits offered by plant-based food. Moreover, the “clean-eating” trends among the geriatric population are the factors that are expected to bolster the market growth over the forecast years.

Plant-Based Protein Market: Segmentation Analysis

Based on the type, the global plant-based protein market has been classified into isolates, concentrates, and protein flour. The isolated segment has accounted for substantial growth in a couple of years. As the protein in isolate form has more bioavailability with greater digestibility and is in huge demand in nutrition-oriented applications such as sports protein and nutritional supplements, the segment is anticipated to witness high demand over the forecast period.

By source, the global plant-based protein market has been classified into soy, wheat, peas, and others. The soy segment in the global plant-based protein market has accounted for the largest market share in terms of revenue. The increasing popularity of soy foods and the rising demand for high-protein foods among individuals have paved the way for the market. Moreover, soy food in the diet helps in reducing cholesterol levels, and bone mineral density, improves metabolism, and may help in decreasing the risk of cancer.

On the basis of application, the global plant-based protein market is categorized into protein beverages, dairy alternatives, meat alternatives, nutrition supplements, and others. In the global plant-based protein market nutritional supplements segment was accredited for the maximum market share in 2023. Growing health concerns, along with the rising fitness industry across the world promoting protein supplements are expected to fuel the demand for plant-based protein products in the forecast timeline.

Plant-Based Protein Market: Regional Analysis

Based on the region, currently, North America dominates the market share. The remarkable growth in the fitness industry in this region, coupled with increasing health concerns among the geriatric population regarding plant-based protein foods is expected to propel the market growth in the forecast timeline. The increasing demand for nutritional supplements in the Asia-Pacific region owing to the growing fitness industry along with rising trends of healthy eating expected to fuel the market demand over the forecast years.

Plant-Based Protein Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plant-Based Protein Market |

| Market Size in 2023 | USD 15.77 Billion |

| Market Forecast in 2032 | USD 32.33 Billion |

| Growth Rate | CAGR of 8.30% |

| Number of Pages | 110 |

| Key Companies Covered | Sotexpro S.A, Axiom Foods, The Scoular Company, Burcon Nutrascience Corporation, Royal DSM, Tate & Lyle, Ingredion, Kerry, DowDuPont, ADM, Cargill, and Glanbia |

| Segments Covered | By Type, By Source, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plant-Based Protein Market Size: Competitive Space

The major players operating in the plant-based protein market are:

- Sotexpro S.A

- Axiom Foods

- The Scoular Company

- Burcon Nutrascience Corporation

- Royal DSM

- Tate & Lyle

- Ingredion

- Kerry

- DowDuPont

- ADM

- Cargill

- Glanbia

The major schemes implemented by these leading companies in the market are new product launches, mergers & acquisitions, and partnerships. These companies are more focused on investing in innovations, collaborations, and expansions, to increase their market share.

The global plant-based protein market is segmented as follows;

By Type

- Isolates

- Protein Flour

- Concentrates

By Source

- Wheat

- Soy

- Pea

- Others

By Application

- Protein Beverages

- Dairy Alternatives

- Meat Alternatives

- Nutrition Supplements

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a study, the global plant-based protein market size was worth around USD 15.77 billion in 2023 and is expected to reach USD 32.33 billion by 2032.

North America is expected to dominate the plant-based protein market over the forecast period.

The major players operating in the plant-based protein market are Sotexpro S.A, Axiom Foods, The Scoular Company, Burcon Nutrascience Corporation, Royal DSM, Tate & Lyle, Ingredion, Kerry, DowDuPont, ADM, Cargill, and Glanbia.

The major factors that are expected to drive the global plant-based protein market are consumer preference towards a vegan diet and nutritional benefits offered by plant-based food. Moreover, the “clean-eating” trends among the geriatric population are the factors that are expected to bolster the market growth over the forecast years.

The global plant-based protein market is expected to grow at a CAGR of 8.30% during the forecast period.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed