Bread and Baked Food Market Size, Share, Forecast 2032

Bread and Baked Food Market by Type (Bread, Pastries, Cereals, Pies, Cakes, Cookies, Biscuits, Scones and Other Types): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

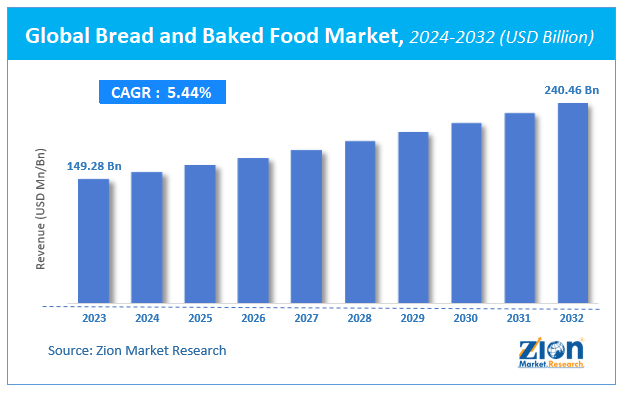

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 149.28 Billion | USD 240.46 Billion | 5.44% | 2023 |

Bread and Baked Food Market Insights

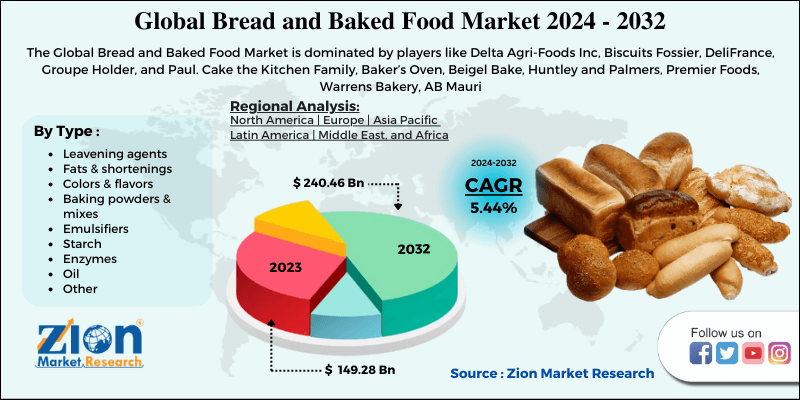

According to Zion Market Research, the global Bread and Baked Food Market was worth USD 149.28 Billion in 2023. The market is forecast to reach USD 240.46 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.44% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Bread and Baked Food Market industry over the next decade.

Bread and Baked Food Market: Overview

The reports by Mondelez company in December 2023 suggested that the biscuit category is among the fastest growing food segments in the last 6-8 months, led by in-home consumption during the Coronavirus (Covid-19) pandemic. Moreover, the reports by the company also suggest that the organized biscuit market in India was valued at US$ 5 Billion in size and expected to grow at a double rate in April-May against pre-Covid levels as people stocked up during the lockdown. The aforementioned dare the key factors expected to drive the overall market growth.

Moreover, key manufacturers in the market are focusing on strategies such as new product launches. For instance, in December 2023, Kellogg launched three new whole grain-centric bowls of cereal on the market. The grain cereal’s product portfolio includes Special Blueberry, Kellogg’s Frosted Mini-Wheat Cinnamon Roll, and Raisin Bran. Likewise, in September 2023, Nestle launched a new breakfast cereal for children. The new product is produced from natural ingredients, contains no artificial colors or flavors, and is high in fiber. And in August 2023, Mondelez India merged with Bournvita Fills. With the help of this merger, the company aims to enter the cereals market.

Bread and Baked Food Market: Growth Factors

The bread & baked food market is expected to rise in response to the rising demand for ready-to-eat foods. In developing markets, Moreover, the adoption of a westernized lifestyle, dual-income households, a focus on healthy lifestyles, increased wellness awareness, and a rise in disposable income are the main factors driving the baked foods industry growth.

Growing product launches by key players in the market are expected to drive the overall growth of the market. For instance, in December 2023, Mondelez extended its brand born into cookies. Moreover, the rising contribution of the baking industry the global revenue is expected to boost the market growth. For instance, In the U.S. today the baking industry accounts for over 600,000 jobs and over $102 billion a year.

The Bread and Baked Food Market is experiencing steady growth due to evolving consumer preferences and lifestyle changes. The increasing demand for convenient, ready-to-eat food products has significantly boosted the consumption of bread and baked goods globally. Health-conscious consumers are driving innovation in the market, leading to the development of whole-grain, gluten-free, and low-calorie options.

The rising popularity of artisanal and premium baked products, which emphasize quality and unique flavors, is also a key growth factor. Furthermore, the growth of online retail and food delivery services has made baked goods more accessible, expanding the consumer base. Technological advancements in baking processes and the use of clean-label ingredients are additional factors enhancing the market's appeal and driving growth.

Bread and Baked Food Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Bread and Baked Food Market |

| Market Size in 2023 | USD 149.28 Billion |

| Market Forecast in 2032 | USD 240.46 Billion |

| Growth Rate | CAGR of 5.44% |

| Number of Pages | 140 |

| Key Companies Covered | Delta Agri-Foods Inc, Biscuits Fossier, DeliFrance, Groupe Holder, and Paul. Cake the Kitchen Family, Baker’s Oven, Beigel Bake, Huntley and Palmers, Premier Foods, Warrens Bakery, AB Mauri |

| Segments Covered | By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bread and Baked Food Market: Segmentation

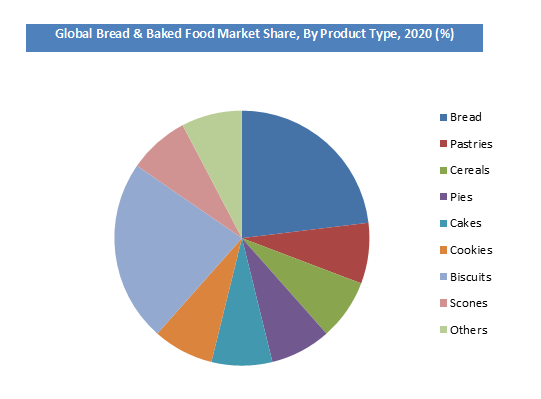

Type Segment Analysis Preview

Based on type, the Global Bread & Baked Food Market is segmented into Bread, Pastries, Cereals, Pies, Cakes, Cookies, Biscuits, Scones, and Other Types

The rising consumption of bread across the globe is expected to boost the growth of the bread and baked food market. For instance, it is estimated that the total bread consumption accounted for 129,000 tonnes in 2016 as compared to 122,000 tonnes in 2007.

The biscuits segment is expected to grow at a considerable rate during the forecast period due to increased biscuit production in tandem with biscuit demand, and the commodity has established a strong foothold in people's nutrition, especially in children's meals. Furthermore, with product diversification and technological advancements in response to demand, biscuit demand is on the rise. The aforementioned factors are some of the key reasons contributing to the growth of the market.

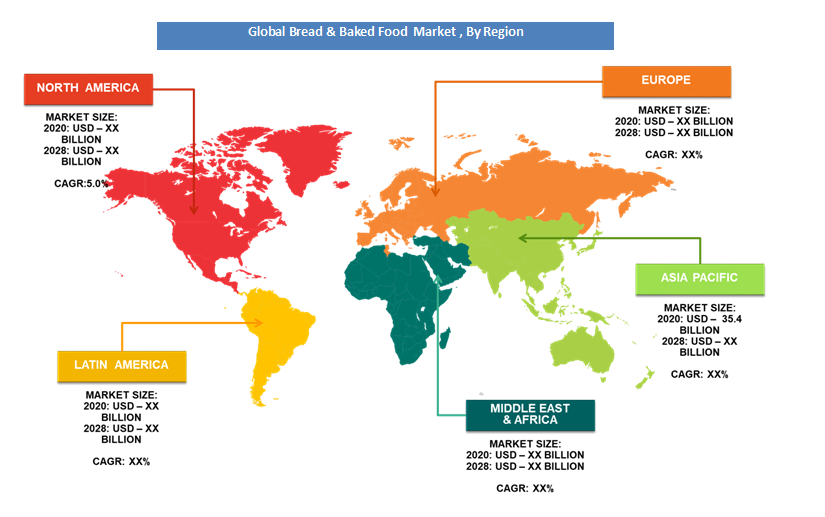

Bread and Baked Food Market: Regional Analysis Preview

Asia Pacific region is expected to grow at the fastest rate during the forecast period. For instance, the bakery industry in India is the largest segment of the food processing industry and has enormous growth potential. More than 2,000 organized or semi-organized bakeries produce 1.3 million tonnes of bakery products in India, while 1,000,000 unorganized small-scale bakeries produce 1.7 million tonnes. North America held a significant share in the overall bread & baked food market in 2020 and is expected to continue its dominance over the forecast period owing to the rising number of bakeries in the region. For instance, Currently, in the United States, there are 2,800 private bakeries and 6,000 retail bakeries. Moreover, various strategies adopted by the major player also support the growth of the market. For instance, recently, Grupo Bimbo acquired Sara Lee and Weston Bread Unit, making it the largest baked 6 goods company in the US. The aforesaid reasons are some of the key factors contributing to the growth of the market.

Bread and Baked Food Market: Competitive Landscape

Some of the key players in Bread & baked food market are Key players of the bread and baked food market include

- Delta Agri-Foods Inc

- Biscuits Fossier

- DeliFrance

- Groupe Holder

- Paul.

- Cake the Kitchen Family

- Baker’s Oven

- Beigel Bake

- Huntley and Palmers

- Premier Foods

- Warrens Bakery

- AB Mauri

- among others

The Global Bread & Baked Food Market is segmented as follows:

By Type

- Leavening agents

- Fats & shortenings

- Colors & flavors

- Baking powders & mixes

- Emulsifiers

- Starch

- Enzymes

- Oil

- Other

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The Global Bread & Baked Food Market was valued at USD 149.28 Billion in 2023.

The Global Bread & Baked Food Market is expected to reach USD 240.46 Billion by 2032, growing at a CAGR of 5.44% between 2024 to 2032.

Some of the key factors driving growth of the Global Bread & Baked Food Market is rising consumption of bskery industry worldwide

North America region held a substantial share of the Bread & baked food market in 2023. This is attributable to the increased consumption of bread in the region

Some of the major companies operating in Bread & baked food market are Delta Agri-Foods Inc, Biscuits Fossier, DeliFrance, Groupe Holder, Paul. Cake the Kitchen Family, Baker’s Oven, Beigel Bake, Huntley and Palmers, Premier Foods, Warrens Bakery, AB Mauri among others

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed