Perforated Packaging Market Size, Share, Trends, Growth 2034

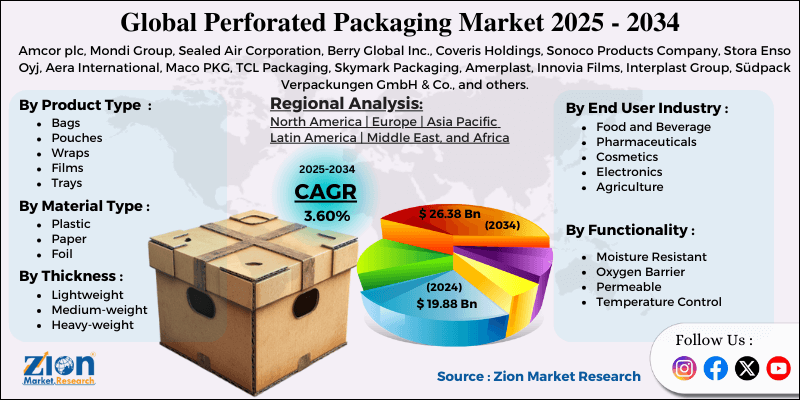

Perforated Packaging Market By Product Type (Bags, Pouches, Wraps, Films, Trays), By Material Type (Plastic, Paper, Foil, Biodegradable Materials), By Thickness (Lightweight, Medium-weight, Heavy-weight), By Functionality (Moisture Resistant, Oxygen Barrier, Permeable, Temperature Control), By End-User Industry (Food and Beverage, Pharmaceuticals, Cosmetics, Electronics, Agriculture), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

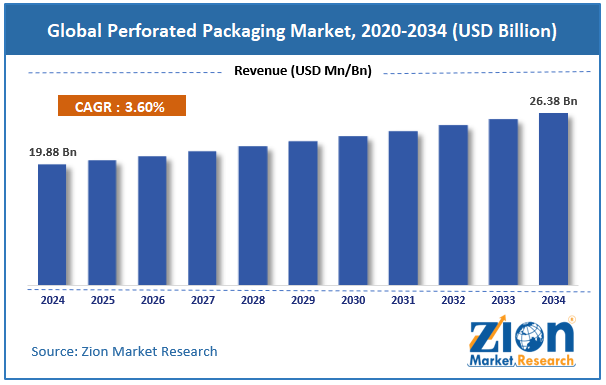

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 19.88 Billion | USD 26.38 Billion | 3.60% | 2024 |

Perforated Packaging Industry Perspective:

The global perforated packaging market size was approximately USD 19.88 billion in 2024 and is projected to reach around USD 26.38 billion by 2034, with a compound annual growth rate (CAGR) of approximately 3.60% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global perforated packaging market is estimated to grow annually at a CAGR of around 3.60% over the forecast period (2025-2034)

- In terms of revenue, the global perforated packaging market size was valued at around USD 19.88 billion in 2024 and is projected to reach USD 26.38 billion by 2034.

- The perforated packaging market is projected to grow significantly due to the increasing popularity of processed and ready-to-eat foods, the growth of online food delivery services and e-commerce, and the inclination towards recyclable and sustainable packaging materials.

- Based on product type, the films segment is expected to lead the market, while the bags segment is expected to grow considerably.

- Based on material type, the plastic segment is the dominant segment, while the biodegradable materials segment is projected to witness sizable revenue growth over the forecast period.

- Based on thickness, the lightweight segment is expected to lead the market compared to the medium-weight segment.

- Based on functionality, the permeable segment is the dominant segment, while the moisture-resistant segment is projected to witness sizable revenue growth over the forecast period.

- Based on end-user industry, the food and beverage segment is expected to lead the market compared to the agriculture segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Perforated Packaging Market: Overview

Perforated packaging is a dedicated packaging solution that features laser-cut perforations or small holes, allowing for controlled moisture exchange and airflow within the package. This design enhances the shelf life of bakery items, fresh produce, and other perishable goods by reducing condensation and maintaining optimal humidity levels. The global perforated packaging market is poised for notable growth, driven by the increasing demand for fresh produce packaging, the rise in convenience and ready-to-eat foods, and a growing focus on sustainable packaging solutions. Consumers are increasingly opting for fresh vegetables, fruits, and bakery items over frozen substitutes, driving the need for packaging that helps maintain their freshness and quality. Perforated films facilitate a more efficient exchange of oxygen, thereby enhancing shelf life and reducing spoilage. The rise in busy lifestyles and urbanization is amplifying the consumption of convenience and ready-to-eat foods. Perforated packaging assures moisture control in these products, maintaining texture and taste.

Furthermore, environmental regulations and concerns are prompting manufacturers to develop environmentally friendly perforated packaging using recyclable or biodegradable materials. Sustainability initiatives by the leading retailers are driving the need for reduced plastic waste. This trend is creating fresh opportunities for perforated packaging made with compostable polymers or paper.

Nevertheless, the global market faces limitations due to factors such as low strength in some applications and higher production costs. Perforations may compromise the mechanical strength of packaging films, thereby increasing their incompatibility with sharp-edged or heavy products. This restriction decreases their usability in some industrial applications. Producers should balance ventilation with durability. Additionally, micro-perforation and laser solutions require advanced machinery, which increases initial investments. Small manufacturers find this cost challenging, restricting adoption in budget-conscious markets. This hampers broader adoption than conventional films.

Still, the global perforated packaging industry benefits from several favorable factors, including integration with smart packaging technologies and the growing demand for fresh-cut and packaged produce. Assimilating perforated films with freshness indicators and sensors may improve value. Smart perforated packaging may monitor humidity, temperature, and spoilage levels. This advancement appeals to premium product domains and e-commerce supply chains.

Additionally, the fresh-cut vegetables and fruits segment is experiencing global growth, driving demand for breathable packaging. Perforated films maintain freshness by decreasing moisture accumulation. Retailers are actively using these solutions for cut produce and ready-to-eat salads.

Perforated Packaging Market: Growth Drivers

How is material innovation & light-weighting boosting the perforated packaging market growth?

The global perforated packaging market is experiencing breakthroughs in bio-based polymers, lightweight high-barrier materials, and recyclable mono-layer films, all of which are blended with perforation technology. Leading companies are transitioning from rigid packaging to perforated flexible pouches to reduce their carbon footprint and logistics costs.

Partnerships between packaging converters and film producers in 2023-2024 have amplified the introduction of sustainable perforated films. These advancements are helping brands meet their Scope-3 emission reduction goals, making perforated packaging a favored, environmentally friendly option.

Healthcare & sterilization demand considerably spur the market growth

The post-pandemic progress in healthcare packaging has elevated the demand for breathable and sterile packaging solutions. Perforated films are essential for medical devices that require moisture control or sterilization. Device manufacturers and hospitals prefer validated perforated packs for compliance and safety, as they adhere to strict regulatory norms.

Advanced sealing technologies and cleanroom-integrated perforation have progressed as significant investments for medical packaging suppliers. The segment remains resilient, with continued investments by prominent players in 2023-2024 aimed at increasing production of pouches, surgical drapes, and sterile device packs.

Perforated Packaging Market: Restraints

How is the perforated packaging market limited by the inability to control permeability for specific applications?

While perforated packaging is efficient for bakery items and fresh produce, it faces challenges in achieving precise permeability control for some applications, such as highly sensitive food products or pharmaceuticals. Inconsistent hole patterns or sizes may result in moisture ingress, product spoilage, or contamination risks, leading to recalls and quality failures. This technical restriction needs to be advanced to discourage adoption in high-value segments, where consistency and safety are crucial.

Perforated Packaging Market: Opportunities

How does the growth of e-commerce grocery & direct-to-consumer models create promising avenues for growth in the perforated packaging industry?

The rapid growth of e-commerce grocery platforms, such as Walmart+ and Amazon Fresh, has heightened the demand for protective, lightweight, and breathable packaging. Perforated packaging promises freshness during extended delivery times and decreases spoilage-associated returns. Micro-perforated pouches are actively being developed for temperature-sensitive products transported through direct-to-consumer (D2C) channels. This presents an opportunity for customized packaging solutions optimized for e-commerce logistics in the global perforated packaging industry.

Perforated Packaging Market: Challenges

Intense market competition from alternative packaging limits the market growth

The global market experiences intense competition from vacuum packaging, MAP films, active packaging solutions, and resealable pouches. The worldwide MAP packaging segment is anticipated to progress at a 4.5% CAGR, marginally faster than the perforated packaging segment. Advancements like absorbent pads and antimicrobial films are decreasing dependency on perforation for shelf-life extension. Several food brands are actively opting for zipper pouches for enhanced convenience, thereby limiting the adoption of perforated packaging. This competitive burden compels converters to invest in value-added and differentiation features.

Perforated Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Perforated Packaging Market |

| Market Size in 2024 | USD 19.88 Billion |

| Market Forecast in 2034 | USD 26.38 Billion |

| Growth Rate | CAGR of 3.60% |

| Number of Pages | 215 |

| Key Companies Covered | Amcor plc, Mondi Group, Sealed Air Corporation, Berry Global Inc., Coveris Holdings, Sonoco Products Company, Stora Enso Oyj, Aera International, Maco PKG, TCL Packaging, Skymark Packaging, Amerplast, Innovia Films, Interplast Group, Südpack Verpackungen GmbH & Co., and others. |

| Segments Covered | By Product Type, By Material Type, By Thickness, By Functionality, By End User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Perforated Packaging Market: Segmentation

The global perforated packaging market is segmented by product type, material type, thickness, functionality, end-user industry, and region.

Based on product type, the global perforated packaging industry is divided into bags, pouches, wraps, films, and trays. The films segment registered a substantial market share due to their extensive use in fresh produce packaging and meat packaging. They offer optimal gas exchange, moisture control, and flexibility for a wide range of food products.

Based on material type, the global market is segmented into plastic, paper, foil, and biodegradable materials. The plastic segment leads the global market due to its cost-efficiency, durability, and versatility. Plastic materials, such as polypropylene and polyethylene, are widely used for their flexibility and sealing properties.

Based on thickness, the global market is segmented into lightweight, medium-weight, and heavy-weight. The lightweight segment holds a leadership position in the market due to its widespread use in bakery products, fresh produce, and ready-to-eat food packaging. Another key reason for its dominance is the reduced shipping costs and ease of handling, particularly for grocery and e-commerce.

Based on functionality, the global perforated packaging market is segmented into moisture-resistant, oxygen-barrier, permeable, and temperature-control packaging. The permeable segment dominates the global market, as it allows for moisture exchange and controlled airflow, which is crucial for bakery products, fresh produce, and ready-to-eat meals. The rising demand for breathable packaging boosts its dominance.

Based on end-user industry, the global market is segmented into food and beverage, pharmaceuticals, cosmetics, electronics, and agriculture. The food and beverage segment captures a significant share of the market due to elevated demand for bakery products, ready-to-eat foods, and meat packaging. The rise in meal kits and grocery deliveries amplifies the segment's prominence.

Perforated Packaging Market: Regional Analysis

What enables the Asia Pacific to maintain a strong foothold in the global Perforated Packaging Market?

The Asia Pacific is projected to maintain its dominant position in the global perforated packaging market, driven by growing demand for convenience foods, robust e-commerce and grocery delivery, as well as a strong manufacturing base and cost benefits. Rapid urbanization and a growing middle-class population are driving the demand and consumption of ready-to-eat and convenience foods. Urbanization in Asia is anticipated to reach 64% by 2050, driving the sales of packaged foods, according to the Asian Development Bank. Perforated packaging helps maintain the freshness of food, increasing its significance in this rapidly evolving market.

Moreover, the APAC region is the leading market for e-commerce grocery, driven by platforms such as Flipkart, JD.com, and Alibaba. Online grocery penetration in China reached 35% in 2024, generating substantial demand for packaging that ensures product quality during delivery. Perforated films and bags are broadly used to ensure freshness in last-mile delivery. APAC boasts a robust manufacturing infrastructure for packaging films and materials, offering cost-efficient production. Economies like India, Vietnam, and China are the leading hubs for biodegradable and plastic material production. This cost-benefit increases the regional dominance for worldwide perforated packaging demand.

Europe maintains its position as the second-largest region in the global perforated packaging industry, driven by strong demand for organic and fresh produce, the adoption of advanced food packaging technology, and the growing meal kit market. Europe holds the leading position in the global organic food market, estimated at over € 54 billion in 2023. High consumer demand for fresh, minimally processed vegetables, fruits, and bakery products fuels the demand for breathable packaging. Perforated films help maintain freshness without the use of preservatives, aligning with regional health trends.

Additionally, Europe is a hub for advanced packaging solutions, featuring laser micro-perforation and MAP (Modified Atmosphere Packaging) integration. Economies such as Germany, France, and Italy are leaders in the adoption of high-tech packaging and food processing technologies. These advancements increase shelf life for fresh produce, ready meals, and bakery products, driving the use of perforated packaging.

Furthermore, regional online grocery penetration reached 14% in 2024, with key players such as Ocado, Carrefour, and Tesco driving growth. Meal kit delivery services like Gousto and HelloFresh are leading the way, requiring perforated packaging to maintain freshness during transport. This trend majorly boosts the demand in Northern and Western Europe.

Perforated Packaging Market: Competitive Analysis

The leading players in the global perforated packaging market are:

- Amcor plc

- Mondi Group

- Sealed Air Corporation

- Berry Global Inc.

- Coveris Holdings

- Sonoco Products Company

- Stora Enso Oyj

- Aera International

- Maco PKG

- TCL Packaging

- Skymark Packaging

- Amerplast

- Innovia Films

- Interplast Group

- Südpack Verpackungen GmbH & Co.

Perforated Packaging Market: Key Market Trends

Growing integration of laser micro-perforation technology:

Laser perforation is increasingly replacing traditional mechanical perforation techniques due to its accuracy, ability to control respiration rates, and customization options. This technology enables the creation of customized packaging for various foods, thereby enhancing their shelf life. Adoption is progressing in high-value segments, such as berries, bakery products, and salads, in North America and Europe.

Branding and customization through perforation patterns:

Brands are also actively using custom perforation designs for product differentiation and branding. Advanced laser technology enables pattern-controlled ventilation holes and logos that enhance both functionality and aesthetics. This trend is gaining prominence in snacks, premium bakery, and fresh product packaging.

The global perforated packaging market is segmented as follows:

By Product Type

- Bags

- Pouches

- Wraps

- Films

- Trays

By Material Type

- Plastic

- Paper

- Foil

- Biodegradable Materials

By Thickness

- Lightweight

- Medium-weight

- Heavy-weight

By Functionality

- Moisture Resistant

- Oxygen Barrier

- Permeable

- Temperature Control

By End User Industry

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Electronics

- Agriculture

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Perforated packaging is a dedicated packaging solution that features laser-cut perforations or small holes, allowing for controlled moisture exchange and airflow within the package. This design enhances the shelf life of bakery items, fresh produce, and other perishable goods by reducing condensation and maintaining optimal humidity levels.

The global perforated packaging market is projected to grow due to rising demand for convenience packaging solutions, advancements in packaging perforation techniques, and mounting applications in agricultural and industrial packaging.

According to study, the global perforated packaging market size was worth around USD 19.88 billion in 2024 and is predicted to grow to around USD 26.38 billion by 2034.

The CAGR value of the perforated packaging market is expected to be approximately 3.60% from 2025 to 2034.

High production costs, reliance on plastics, regulatory compliance, fluctuating raw material prices, and competition from alternative packaging solutions are the significant challenges hindering the growth of the perforated packaging market.

Emerging trends include laser micro-perforation, biodegradable materials, customized perforation designs, smart packaging integration, and increased use in meal kit delivery and e-commerce.

Asia Pacific is expected to lead the global perforated packaging market during the forecast period.

The key players profiled in the global perforated packaging market include Amcor plc, Mondi Group, Sealed Air Corporation, Berry Global Inc., Coveris Holdings, Sonoco Products Company, Stora Enso Oyj, Aera International, Maco PKG, TCL Packaging, Skymark Packaging, Amerplast, Innovia Films, Interplast Group, and Südpack Verpackungen GmbH & Co.

The perforated packaging market is highly fragmented and competitive, with players focusing on sustainability, innovation, and strategic partnerships to increase their market presence.

The report examines key aspects of the perforated packaging market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed