Ingestible Smart Pills Market Trend, Share, Growth, Size, Analysis and Forecast 2032

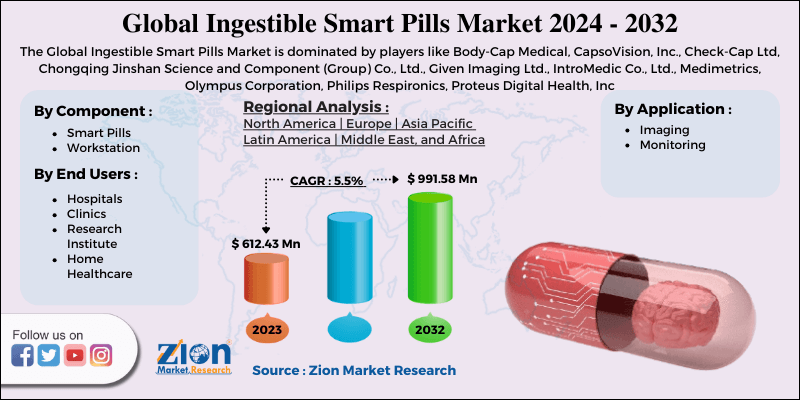

Ingestible Smart Pills Market By Component (Smart Pills and Workstation), By Application (Imaging and Monitoring), By End Users (Hospitals, Clinics, Research Institute, and Home Healthcare), and By Region: Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

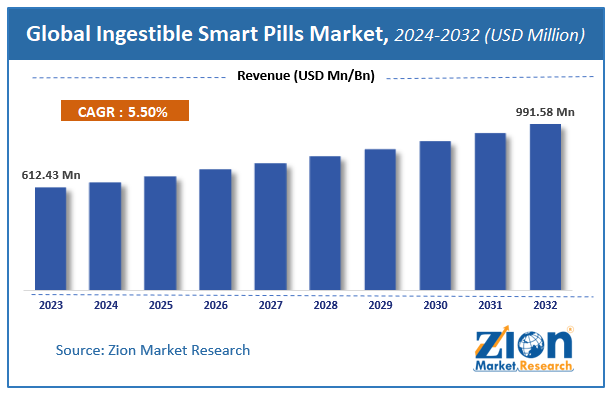

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 612.43 Million | USD 991.58 Million | 5.5% | 2023 |

Ingestible Smart Pills Market Insights

According to a report from Zion Market Research, the global Ingestible Smart Pills Market was valued at USD 612.43 Million in 2023 and is projected to hit USD 991.58 Million by 2032, with a compound annual growth rate (CAGR) of 5.5% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Ingestible Smart Pills Market industry over the next decade.

Global Ingestible Smart Pills Market: Overview

The ingestible smart pill is a revolutionary technological innovation that has reduced the gap between healthcare and digital technology. Smart pills are basically medical devices and small embedded electronic appliances such as sensors, cameras, and trackers. This electronic device can be easily swallowed and provides a complete evaluation of the gastrointestinal tract (GIT).

The emergence of these healthcare-cum-technology devices has addressed the soaring need for better diagnostics and monitoring. It has outperformed the conventional GI monitoring endoscopy with more convenient smart pill technology, which has now become the standard non-invasive diagnosis technique for motility disorders. Moreover, it helps physicians in real-time patient monitoring through remote controlling options.

COVID-19 Impact Analysis:

The pandemic has led to increasing demand for drugs, APIs, pills, and others. The second wave of deficiency is observed among various diseases patients which is needed to care. As the pandemic progresses, the manufacturer of pills works around the clock to ensure patients have access to the drugs they need.

The covid-19 has created an opportunity for the number of patients as there is a high chance of adverse health effects of COVID-19 on people. However, the covid-19 has positively impacted the ingestible smart pill market.

Ingestible Smart Pills Market: Growth Factors

The elderly population is more prone to gastrointestinal disorders. Capsule endoscope plays a pivotal role in early diagnosis and proper treatment. With new component innovations and hybrid imaging technologies, more patients undergo screening and diagnostic endoscopy. This particular factor is creating a positive impact on the smart pills segment. Also, this segment is seen as the next big frontier by component in the global ingestible smart pills market, where many of the novel and most interesting advances are expected to take place in the near future.

The population with the utmost need for home health care services experiences difficulty in operating these devices. Therefore, creators and developers are striving to increase the usability and accessibility of smart pills, so that these devices offer valuable insights on user health. The devices are developed in such a manner that a layman can interpret the data easily.

Most companies in this market provide compatible software that collects data over a long period and offers valuable information on patient health along with suggestions to improve lifestyle. These smart pill devices can also be connected to smartphones through the Bluetooth component. Thus, users can view data in a statistical and user-friendly format. This has increased market demand for smart pills globally.

Ingestible Smart Pills Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Ingestible Smart Pills Market |

| Market Size in 2023 | USD 612.43 Million |

| Market Forecast in 2032 | USD 991.58 Million |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 140 |

| Key Companies Covered | Body-Cap Medical, CapsoVision, Inc., Check-Cap Ltd, Chongqing Jinshan Science and Component (Group) Co., Ltd., Given Imaging Ltd., IntroMedic Co., Ltd., Medimetrics, Olympus Corporation, Philips Respironics, Proteus Digital Health, Inc. |

| Segments Covered | By Component, By Application, By End Users and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ingestible Smart Pills Market: Segment Analysis

By Component Segment Analysis Preview

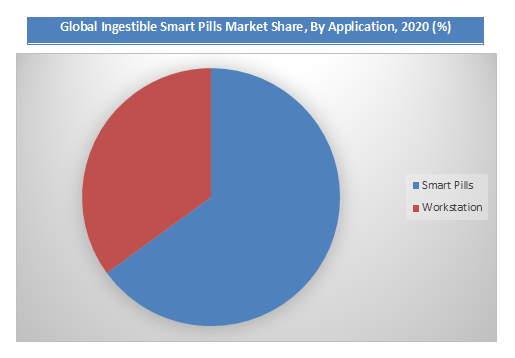

Based on Component, the global Ingestible Smart Pills market is segmented into Smart Pills and Workstation. Smart pills are sub-segmented into Patient Monitoring and Capsule Endoscopy. Furthermore, the Capsule Endoscopy is segmented into Small Bowel Endoscopy, Esophagus Endoscopy, and Colon Endoscopy. Smart pills segment is expected to grow at fastest rate in the global market over the forecast period.

By Application Segment Analysis Preview

On the basis of Application, the Ingestible Smart Pills market is segmented into Imaging, and Monitoring. Patient monitoring segment is expected to grow at fastest rate in global market over the forecast period.

By End Users Segment Analysis Preview

Hospitals, clinics, research institutes and home health care are key end-users of the global ingestible smart pills market. The hospital's segment dominated the market in terms of revenue in 2023.

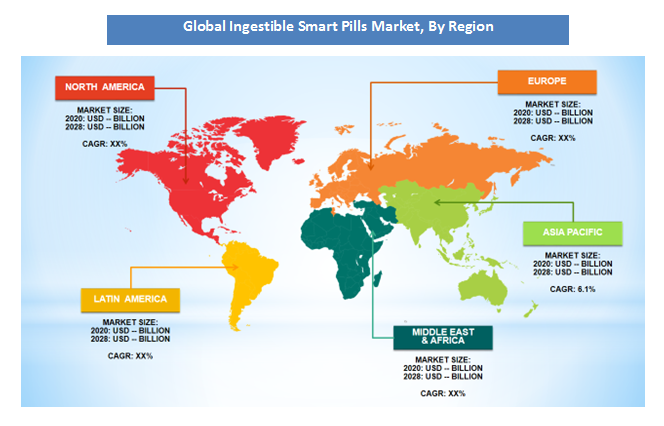

Ingestible Smart Pills Market: Regional Segment Analysis Preview

North America is anticipated to remain the leading region over the forecast period. Gastrointestinal diseases affect around 60 to 70 million Americans annually. Spending on gastrointestinal diseases in the U.S. has been estimated at $142 Million per year in direct and indirect costs. The Asia Pacific is expected to be the fastest growing region in the ingestible smart pills market during the forecast period reasons being the large geriatric population and increasing investment/expansion by companies.

Ingestible Smart Pills Market: Competitive Landscape

The major players operating in the Ingestible Smart Pills market are-

- Body-Cap Medical

- CapsoVision

- Check-Cap Ltd

- Chongqing Jinshan Science and Component (Group) Co.

- Given Imaging Ltd.

- IntroMedic Co.

- Medimetrics

- Olympus Corporation

- Philips Respironics

- Proteus Digital Health

The global Ingestible Smart Pills market is segmented as follows:

By Component

- Smart Pills

- Patient Monitoring

- Capsule Endoscopy

- Small Bowel Endoscopy

- Esophagus Endoscopy

- Colon Endoscopy

- Workstation

By Application

- Imaging

- Monitoring

By End Users

- Hospitals

- Clinics

- Research Institute

- Home Healthcare

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Ingestible Smart Pills Market size worth at USD 612.43 Million in 2023

The global Ingestible Smart Pills market is projected to USD 991.58 Million by 2032, with a CAGR of around 5.5% between 2024 to 2032

Major driving factors for the growth of Ingestible Smart Pills market are Escalating demand for clean and reliable power supply.

North America is anticipated to remain the leading region over the forecast period.

The major players operating in the Ingestible Smart Pills market are Body-Cap Medical, CapsoVision, Inc., Check-Cap Ltd, Chongqing Jinshan Science and Component (Group) Co., Ltd., Given Imaging Ltd., IntroMedic Co., Ltd., Medimetrics, Olympus Corporation, Philips Respironics, Proteus Digital Health, Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed