Healthcare IT Consulting Market Size, Share, Trends, Growth and Forecast 2032

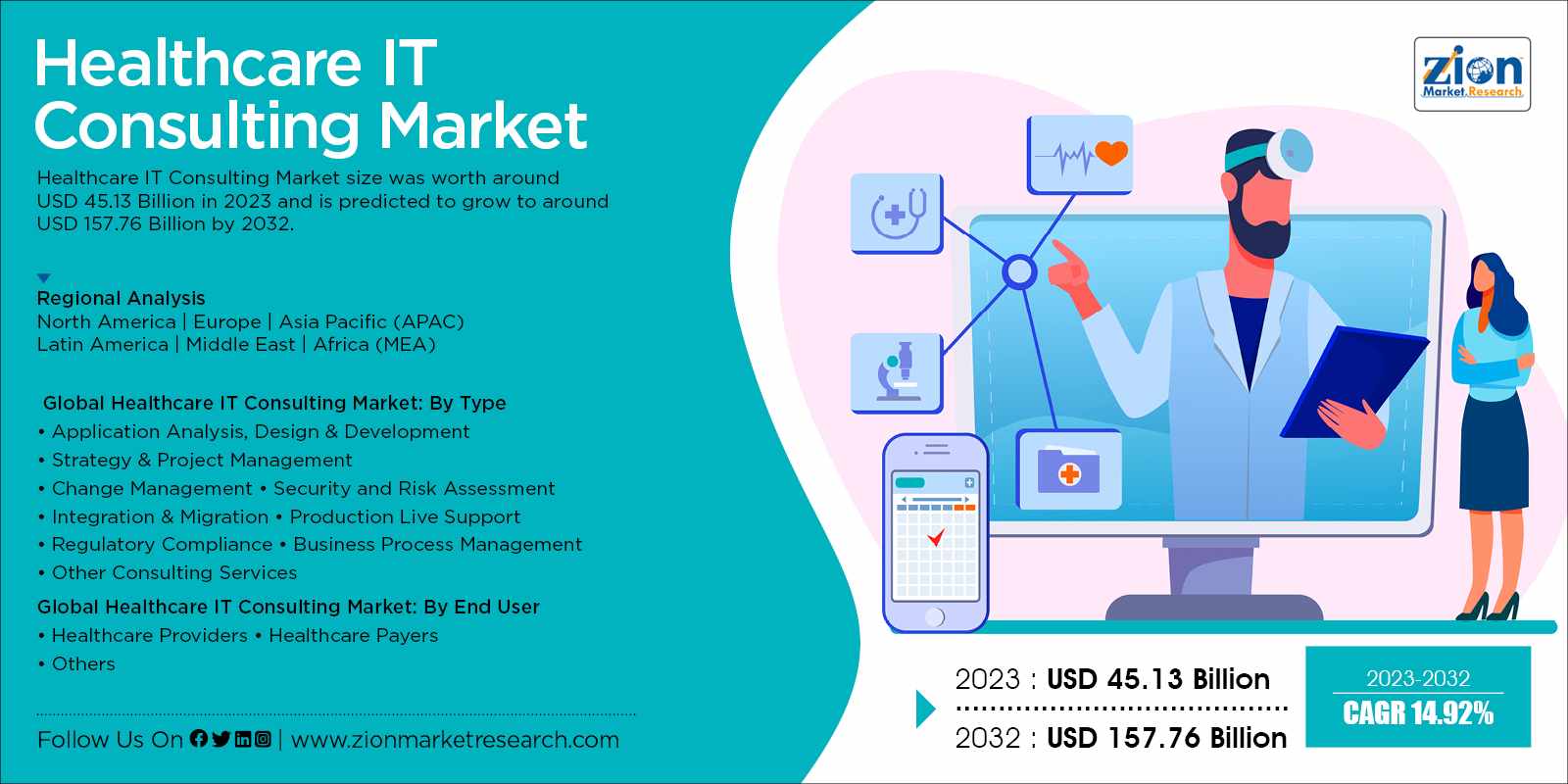

Healthcare IT Consulting Market by Type (Application Analysis, Design & Development, Strategy & Project Management, Change Management, Security & Risk Assessment, Integration & Migration, Production Live Support, Regulatory Compliance, Business Process Management, and Other Consulting Services) and by End User (Healthcare Providers, Healthcare Payers, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

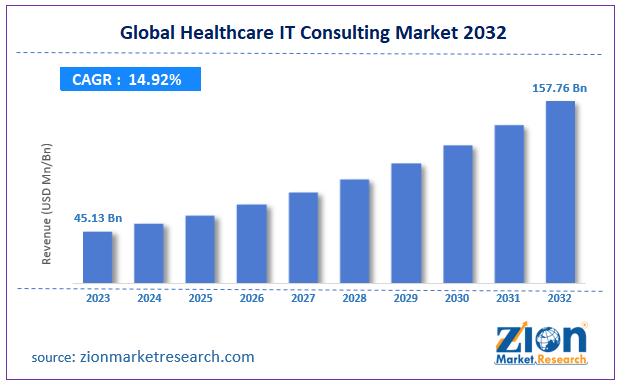

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 45.13 Billion | USD 157.76 Billion | 14.92% | 2023 |

Healthcare IT Consulting Industry Perspective:

The global Healthcare IT Consulting Market size was worth around USD 45.13 Billion in 2023 and is predicted to grow to around USD 157.76 Billion by 2032 with a compound annual growth rate (CAGR) of roughly 14.92% between 2024 and 2032.

Key Insights

- As per the analysis shared by our research analyst, the healthcare IT consulting market is anticipated to grow at a CAGR of 14.92% during the forecast period (2024-2032).

- The global healthcare IT consulting market was estimated to be worth approximately USD 45.13 billion in 2023 and is projected to reach a value of USD 157.76 billion by 2032.

- The growth of the healthcare IT consulting market is being driven by experiencing robust growth as healthcare providers increasingly adopt advanced digital solutions to improve patient care, operational efficiency, and regulatory compliance.

- Based on the type, the application analysis, design & development segment is growing at a high rate and is projected to dominate the market.

- On the basis of end user, the healthcare providers segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Healthcare IT consulting market provides a consumer with the resources which allow access to the wide variety of industry data along with the consulting services on rapidly changing regulations, technology, analytics software, programs, and many more. Moreover, providers are focusing on providing customized services to their consumer to ensure proper management and integration of data along with securing the data from any kind of cyber attack. Healthcare IT consulting market is providing a strong platform for better and foster collaboration among the wide range of healthcare providers and patients. Moreover, healthcare IT consulting market is estimated to provide effective, efficient, error-free, and affordable healthcare service which, in turn, will prove beneficial for both the healthcare provider and consumer.

The global healthcare IT consulting market is experiencing strong growth due to the strict government regulations and rapid adoption of digitalization in healthcare. Moreover, rise in burden of chronic or infectious disease and increase in demand for IT consulting services in the healthcare industry is expected to propel growth of the market. However, factors such as high cost of deployment and concerns regarding data safety are expected to hamper the market growth.

In order to give the users of this report a comprehensive view of the healthcare IT consulting market, we have included the competitive landscape and analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein the type and end-use segments are benchmarked based on their market size, growth rate, and general attractiveness.

The report provides company market share analysis in order to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product launch, agreements, partnerships, collaborations & joint ventures, research & development, regional expansion of major participants involved in the market on the global and regional basis.

Request Free Sample

Request Free Sample

Recent Development

- In 2025, Cognizant unveiled the TriZetto AI Gateway, embedding generative AI into its TriZetto ecosystem to enhance healthcare delivery and support digital transformation initiatives for payers and providers.

- In September 2023, Thoma Bravo acquired NextGen Healthcare for approximately US$1.8 billion, taking the ambulatory EHR and clinical software vendor private and expanding its footprint in health IT consulting and implementation.

- Founded in 2025, The ValueCare Group (UK) entered the health tech and life sciences space, developing scalable AI-powered platforms for both public and private health and social care sectors.

- In 2024, Swedish investment firm EQT secured a controlling stake in GeBBS Healthcare Solutions—an international provider of healthcare outsourcing, health information management, and revenue cycle services—for over US$850 million, aiming to accelerate growth and innovation in health IT operations.

- Later in 2024, Elevate Patient Financial Solutions (ElevatePFS) acquired NYX Health Eligibility Services, strengthening its front-end eligibility, claims verification, and enrollment capabilities within its revenue cycle consulting and IT-enabled services portfolio.

- In 2025, Samsung Electronics acquired Xealth, a U.S.-based digital health platform that facilitates hospital-patient connectivity, marking Samsung’s strategic expansion into mobile healthcare and integrated digital health services.

- In April 2024, Johnson & Johnson announced the completion of its acquisition of Shockwave Medical. Shockwave is now part of Johnson & Johnson and will function as a business unit within Johnson & Johnson MedTech. This acquisition strengthens Johnson & Johnson MedTech's standing in cardiovascular intervention and speeds up its move into higher-growth markets.

Healthcare IT Consulting Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Healthcare IT Consulting Market Size Report |

| Market Size in 2023 | USD 45.13 Billion |

| Market Forecast in 2032 | USD 157.76 Billion |

| Growth Rate | CAGR of 14.92% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Deloitte Touche Tohmatsu Limited Cerner Corporation, Cognizant Technology Solutions Corporation, Cisco Systems Inc., Cerner Corporation, Atos Se, Allscripts Healthcare Solutions Inc., Accenture Plc., HCL Technologies Limited, Genpact Limited, General Electric Company, Epic Systems Corporation, Microsoft Corporation, Mckesson Corporation, Larsen & Toubro Limited, Koninklijke Philips N.V., Infosys Ltd., Infor Inc., IBM Corporation, Hexaware Technologies Ltd. and others. |

| Segments Covered | By End User, By B Type And By region. |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Healthcare IT Consulting Market: Segmentation

The study provides a decisive view of the healthcare IT consulting market by segmenting the market based on type, application, end-user, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

The healthcare IT consulting market is segmented on the basis of the type as application analysis, design & development, strategy & project management, change management, security & risk assessment, integration & migration, production live support, regulatory compliance, business process management and other consulting services. By type segment, design & development is estimated to cover prominent market value share as it is a significant tool which is required for developing, designing and implementation of all IT solutions.

Based on end user, healthcare IT consulting market is segmented as healthcare providers, healthcare payers, and others. By end user segment, healthcare providers are covering the large market value share, attributed to the fact that growing adoption of electronic record maintenance along with the integration of the hospital to provide more prominent services to the patient base.

Region Analysis Preview

The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa with its further divided into major countries including the U.S., Canada, Germany, France, the UK, China, Japan, India, and Brazil. This segmentation includes demand for healthcare IT consulting based on individual segment and applications in all the regions and countries.

Based on geography, the global healthcare IT consulting market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Among regions, North America is expected to gain highest share in the market during the forecast period due to the stringent government regulations, need to improve the quality of care and reduce healthcare cost, and growing trend of digitalization in healthcare in the region. For instance, as per the U.S. Food & Drug Administration (FDA), digital health technologies (healthcare IT solutions) help providers reduce inefficiencies, improve access and quality, reduce costs, and make medicine more personalized for patients. Moreover, such technologies enable the patients and consumers to manage and track health and wellness-related activities more efficiently.

Europe and Asia Pacific are also expected to witness significant growth in the global healthcare IT consulting market due to the stringent government regulations, rise in adoption of healthcare IT services or solutions, and rising demand for effective, efficient, and advanced treatment solutions. For instance, in March 2023, India planned to launch a global initiative on digital health. According to the Government of India, digital health is a great enabler in delivery of healthcare services and has proved instrumental for various path-breaking digital health intervention ensuring availability, accessibility and affordability, and equity of health services.

Key Market Players & Competitive Landscape

The report also includes detailed profiles of end players such as -

- Deloitte Touche Tohmatsu Limited Cerner Corporation

- Cognizant Technology Solutions Corporation

- Cisco Systems Inc.

- Cerner Corporation

- Atos Se

- Allscripts Healthcare Solutions Inc.

- Accenture Plc.

- HCL Technologies Limited

- Genpact Limited

- General Electric Company

- Epic Systems Corporation

- Microsoft Corporation

- Mckesson Corporation

- Larsen & Toubro Limited

- Koninklijke Philips N.V.

- Infosys Ltd.

- Infor Inc.

- IBM Corporation

- Hexaware Technologies Ltd. .

This report segments the global healthcare IT consulting market as follows:

Global Healthcare IT Consulting Market: By Type

- Application Analysis, Design & Development

- Strategy & Project Management

- Change Management

- Security and Risk Assessment

- Integration & Migration

- Production Live Support

- Regulatory Compliance

- Business Process Management

- Other Consulting Services

Global Healthcare IT Consulting Market: By End User

- Healthcare Providers

- Ambulatory Care Centers

- Hospitals, Physician Groups, and Integrated Delivery Networks

- Diagnostic and Imaging Centers

- Home Healthcare Agencies, Nursing Homes & Assisted Living Facilities

- Other Healthcare Providers

- Healthcare Payers

- Public Payers

- Private Payers

- Others

Global Healthcare IT Consulting Market: By Region

- North America

- The U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Healthcare IT Consulting Market size was worth around USD 45.13 Billion in 2023 and is predicted to grow to around USD 157.76 Billion by 2032

Annual growth rate (CAGR) of roughly 14.92% between 2024 and 2032.

The largest share of the Healthcare IT Consulting Market is held by Asia Pacific. Developing countries of Asia Pacific such as China, Japan, and India will be dominating the market scenario mainly due to the rising constructional activities. The growth of Asia-Pacific region is expected to be followed by the Middle East and North America. Also, significant growth is expected from Western Europe owing to the developments taking place in this region especially in countries such as Italy, Germany, the U.K, France, and Spain. However, growth in Africa, Latin America, and Eastern Europe is anticipated to be moderate over the forecast period.

Deloitte Touche Tohmatsu Limited Cerner Corporation, Cognizant Technology Solutions Corporation, Cisco Systems Inc., Cerner Corporation, Atos Se, Allscripts Healthcare Solutions Inc., Accenture Plc., HCL Technologies Limited, Genpact Limited, General Electric Company, Epic Systems Corporation, Microsoft Corporation, Mckesson Corporation, Larsen & Toubro Limited, Koninklijke Philips N.V., Infosys Ltd., Infor Inc., IBM Corporation, Hexaware Technologies Ltd. and others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed