Home Healthcare Market Size, Share, Trends, Growth and Forecast 2032

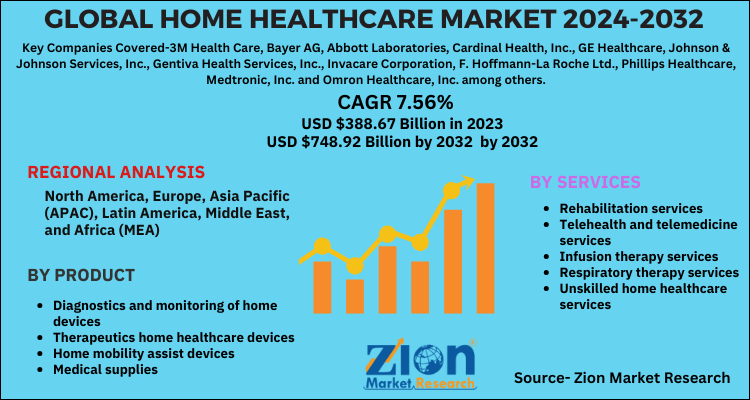

Home Healthcare Market By Product (Diagnostics and Monitoring Home Devices, Therapeutics Home Healthcare Devices, Home Mobility Assist Devices, and Medical Supplies), By Services (Rehabilitation Services, Telehealth And Telemedicine Services, Infusion Therapy Services, Respiratory Therapy Services, and Unskilled Home Healthcare Services): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

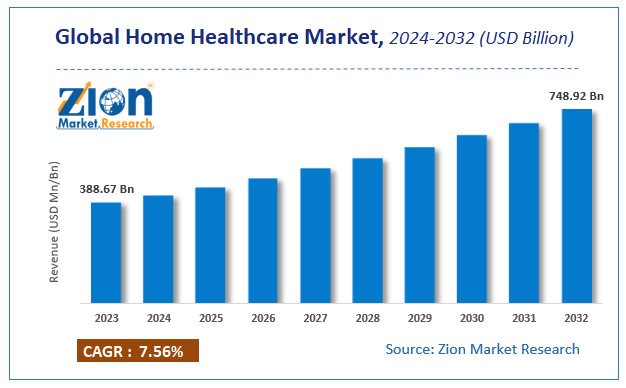

| USD 388.67 Billion | USD 748.92 Billion | 7.56% | 2023 |

Home Healthcare Market Insights

According to a report from Zion Market Research, the global Home Healthcare Market was valued at USD 388.67 Billion in 2023 and is projected to hit USD 748.92 Billion by 2032, with a compound annual growth rate (CAGR) of 7.56% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Home Healthcare Market industry over the next decade.

Global Home healthcare Market: Overview

Home health care is a diversified industry that includes home nursing care, infusion services, companion care, and others. Home healthcare is particularly referred to as home medical care. Home health care generally involves helping geriatric people to recover from an illness or injury and live independently for as long as possible. Home health care includes occupational & physical therapy, speech therapy, and skilled nursing. It may involve helping older adults with activities of daily living, like bathing, dressing, and eating. It can also include assistance with cooking, cleaning, other housekeeping, and monitoring one’s medication routine.

Home healthcare Market: Growth Factors

The global home healthcare market is mainly driven by the increasing geriatric population, rising healthcare costs, and technological advancements in healthcare devices. With increasing health awareness among people, and an increase in the number of people diagnosed with chronic diseases such as diabetes cardiac disorders, and respiratory diseases, the demand for the home healthcare market is expected to grow in the near future. The population of geriatric people is growing rapidly across the world. The geriatric population is more vulnerable to chronic diseases such as diabetes. This, in turn, is expected to fuel the growth of the home healthcare market. However, changing reimbursement policies and limited insurance coverage may pose a challenge to the home healthcare market growth in the near future. Rapid job growth in home healthcare services is expected open alluring avenues for market growth over the next few years.

Home Healthcare Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Home Healthcare Market |

| Market Size in 2023 | USD 388.67 Billion |

| Market Forecast in 2032 | USD 748.92 Billion |

| Growth Rate | CAGR of 7.56% |

| Number of Pages | 123 |

| Key Companies Covered | 3M Health Care, Bayer AG, Abbott Laboratories, Cardinal Health, Inc., GE Healthcare, Johnson & Johnson Services, Inc., Gentiva Health Services, Inc., Invacare Corporation, F. Hoffmann-La Roche Ltd., Phillips Healthcare, Medtronic, Inc. and Omron Healthcare, Inc. among others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Segment Analysis Preview

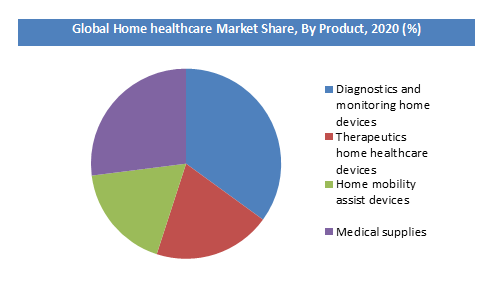

Based on product segments, the home healthcare market has been segmented into diagnostics and monitoring home devices, therapeutics home healthcare devices, medical supplies, and home mobility assists devices. Diagnostic and monitoring devices include blood pressure monitors, pregnancy test kits, heart rate monitors, temperature monitors, and others. In 2020, diagnostic and monitoring devices were the major segment of the global home healthcare market in terms of revenue and are expected to continue their dominance in the global market over the forecast period. The medical supplies product segment was the second largest segment of home healthcare and constituted a 27.89% share of the global demand in 2020. Further, it is expected to grow at the fastest pace in the forecast period. Conversely, the home mobility assistive devices product segment held a smaller share of the global home healthcare market in 2020.

Rehabilitation services, telehealth and telemedicine services, infusion therapy services, respiratory therapy services, and unskilled home healthcare services are the key services of the home healthcare market. The rehabilitation services segment dominated the home healthcare market with the largest share in terms of total revenue generated in 2020. This was mainly due to increased demand from the geriatric or aging population.

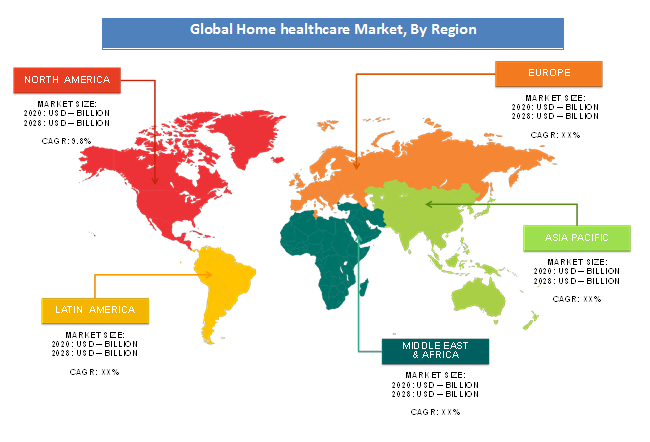

Home healthcare Market: Regional Analysis Preview

North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa are key regional markets for the home healthcare market. North America acquired the majority of share home healthcare market in 2020 and accounted for 41.05% of the overall market. North America is followed by Europe and Asia-Pacific in terms of demand for home healthcare. In terms of revenue, Asia Pacific was predicted to be the fastest-growing region in the forecast period. Increasing investments in the healthcare sector by the European government supports the growth of the home healthcare market in this region.

Home healthcare Market: Key Players & Competitive Landscape

Some of the major players in the global home healthcare market include -

- 3M Health Care

- Bayer AG

- Abbott Laboratories

- Cardinal Health

- GE Healthcare

- Johnson & Johnson Services

- Gentiva Health Services

- Invacare Corporation

- F. Hoffmann-La Roche Ltd.

- Phillips Healthcare

- Medtronic

- Omron Healthcare

- among others.

The global Home Healthcare Market is segmented as follows:

By Products

- Diagnostics and monitoring of home devices

- Therapeutics home healthcare devices

- Home mobility assist devices

- Medical supplies

By Services

- Rehabilitation services

- Telehealth and telemedicine services

- Infusion therapy services

- Respiratory therapy services

- Unskilled home healthcare services

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Home Healthcare Market size worth at USD 388.67 Billion in 2023

Home Healthcare Market size worth at USD 388.67 Billion in 2023 and projected to USD 748.92 Billion by 2032, with a CAGR of around 7.56% between 2024-2032.

Some of the key factors driving the global Home healthcare Market growth are increasing geriatric population, rising healthcare costs and technological advancements in healthcare devices.

North America is expected to remain the dominant region over the forecast period. North America followed by Europe and Asia-Pacific in terms of demand for home healthcare.

Some of the major players of global Home healthcare market 3M Health Care, Bayer AG, Abbott Laboratories, Cardinal Health, Inc., GE Healthcare, Johnson & Johnson Services, Inc., Gentiva Health Services, Inc., Invacare Corporation, F. Hoffmann-La Roche Ltd., Phillips Healthcare, Medtronic, Inc. and Omron Healthcare, Inc. among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed