Gastrointestinal Endoscopic Devices Market Size, Share, Growth and Value 2032

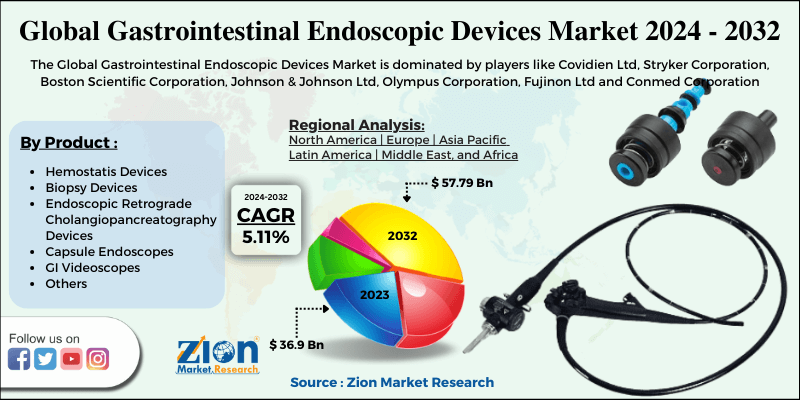

Gastrointestinal Endoscopic Devices Market By Product (Hemostatis Devices, Biopsy Devices, Endoscopic Retrograde Cholangiopancreatography Devices, Capsule Endoscopes, GI Videoscopes, and others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

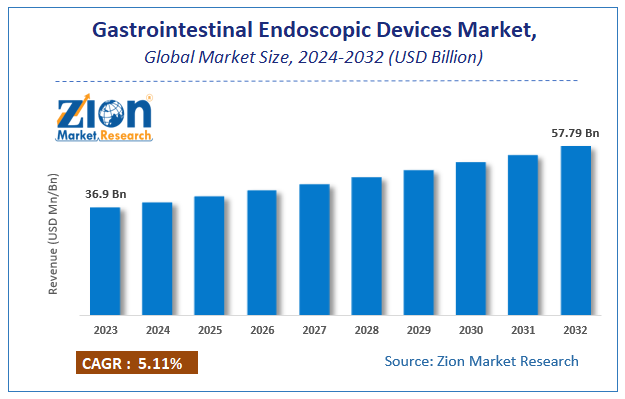

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 36.9 Billion | USD 57.79 Billion | 5.11% | 2023 |

Gastrointestinal Endoscopic Devices Market Insights

According to a report from Zion Market Research, the global Gastrointestinal Endoscopic Devices Market was valued at USD 36.9 Billion in 2023 and is projected to hit USD 57.79 Billion by 2032, with a compound annual growth rate (CAGR) of 5.11% during the forecast period 2024-2032.

This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Gastrointestinal Endoscopic Devices Market industry over the next decade.

Gastrointestinal Endoscopic Devices Market: Overview

Endoscopy is a procedure that diagnoses prevents, and treats complications associated with visceral organs. They are used to examine interior hollow organs or cavities in the body. These devices are either placed in the body through natural openings or cavities, especially in the case of arthroscopy. These devices are equipped with several other parts such as camera or light source which help physicians or medical professionals to analyze internal organs of interest. They are used to investigate symptoms in the digestive system, including nausea, vomiting, abdominal pain, difficulty swallowing, and gastrointestinal bleeding.

The partnerships and mergers and acquisitions of players in the Gastrointestinal Endoscopic Devices market is also set to propel the market growth. For example, in June 2017, US Endoscopy, a dominant player across endoscopy equipment design & manufacturing industry launched a new AquaShield® system CO2 – Fujinon, thereby adding to its existing AquaShield water bottle system portfolio. Sources cite that the innovative product is used along with CO2 to provide sterilized water to endoscope while performing of gastrointestinal procedures. The strategic move is anticipated to encourage other industry players to follow the suit, thereby leading to inflation in the growth of gastrointestinal endoscopic devices market.

Gastrointestinal Endoscopic Devices Market: Growth Factors

Shifting lifestyles, lack of physical activities, and growing intake of junk food leading to various gastrointestinal disorders is projected to steer the growth of gastrointestinal endoscopic devices market over the coming years. Apart from this, surge in the number of patients with colon & rectum cancer and increase in the geriatric population base affected as a result of gastrointestinal disorders is anticipated to push the gastrointestinal endoscopic devices market demand.

Fear of hospital acquired infections as a result of endoscopic devices, unfavorable compensation policies, and low government investments in GI devices production, however, is anticipated to hinder the gastrointestinal endoscopic devices market growth in the near future.

Gastrointestinal Endoscopic Devices Market: Segment Analysis

The main products available in gastrointestinal endoscopic devices market are hemostatis devices, GI Videoscopes, capsule endoscopes, biopsy devices, and retrograde cholangiopancreatography devices. Among them, the demand for GI Videoscopes is relatively higher and the trend is anticipated to remain so over the next few years.

Gastrointestinal Endoscopic Devices Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gastrointestinal Endoscopic Devices Market |

| Market Size in 2023 | USD 36.9 Billion |

| Market Forecast in 2032 | USD 57.79 Billion |

| Growth Rate | CAGR of 5.11% |

| Number of Pages | 145 |

| Key Companies Covered | Covidien Ltd, Stryker Corporation, Boston Scientific Corporation, Johnson & Johnson Ltd, Olympus Corporation, Fujinon Ltd and Conmed Corporation |

| Segments Covered | By Product, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Gastrointestinal Endoscopic Devices Market: Regional Preview

Regionally, North America has been leading the worldwide gastrointestinal endoscopic devices market and is anticipated to continue on the dominant position in the years to come, states the market study. For the record, North America contributed over 28% towards global gastrointestinal endoscopic devices market share in 2032.

Gastrointestinal Endoscopic Devices Market: Players & Competitive Landscape

The major players operating Gastrointestinal Endoscopic Devices market are

- Covidien Ltd

- Stryker Corporation

- Boston Scientific Corporation

- Johnson & Johnson Ltd

- Olympus Corporation

- Fujinon Ltd

- Conmed Corporation

The global Gastrointestinal Endoscopic Devices market is segmented as follows:

By Product

- Hemostatis Devices

- Biopsy Devices

- Endoscopic Retrograde Cholangiopancreatography Devices

- Capsule Endoscopes

- GI Videoscopes

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

According to a report from Zion Market Research, the global Gastrointestinal Endoscopic Devices Market was valued at USD 36.9 Billion in 2023 and is projected to hit USD 57.79 Billion by 2032.

According to a report from Zion Market Research, the global Gastrointestinal Endoscopic Devices Market a compound annual growth rate (CAGR) of 5.11% during the forecast period 2024-2032.

Some of the key factors driving the global Gastrointestinal Endoscopic Devices Market growth Shifting lifestyles, lack of physical activities, and growing intake of junk food leading to various gastrointestinal disorders.

Regionally, North America has been leading the worldwide gastrointestinal endoscopic devices market and is anticipated to continue on the dominant position in the years to come, states the market study. For the record, North America contributed over 30% towards global gastrointestinal endoscopic devices market share in 2032.

Some of the major players of global Gastrointestinal Endoscopic Devices market are Covidien Ltd., Stryker Corporation, Boston Scientific Corporation, Johnson & Johnson Ltd., Olympus Corporation, Fujinon Ltd and Conmed Corporation.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed