Frozen Food Packaging Market Size, Growth, Global Trends, Forecast 2034

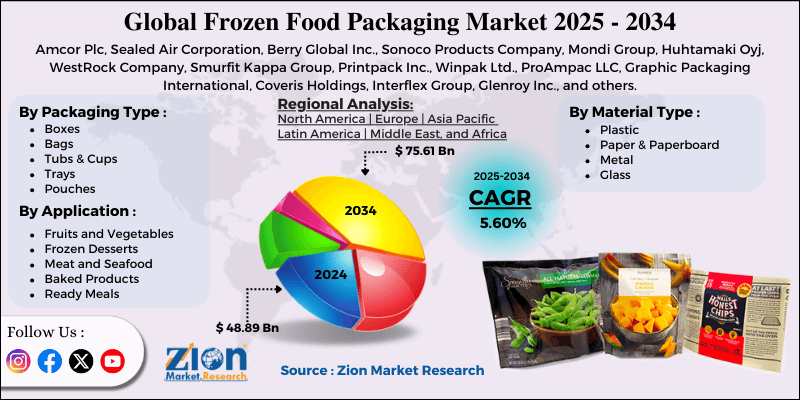

Frozen Food Packaging Market By Packaging Type (Boxes, Bags, Tubs & Cups, Trays, Pouches, Wraps & Films, and Others), By Material Type (Plastic, Paper & Paperboard, Metal, Glass, and Others), By Application (Fruits and Vegetables, Frozen Desserts, Meat and Seafood, Baked Products, Ready Meals, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

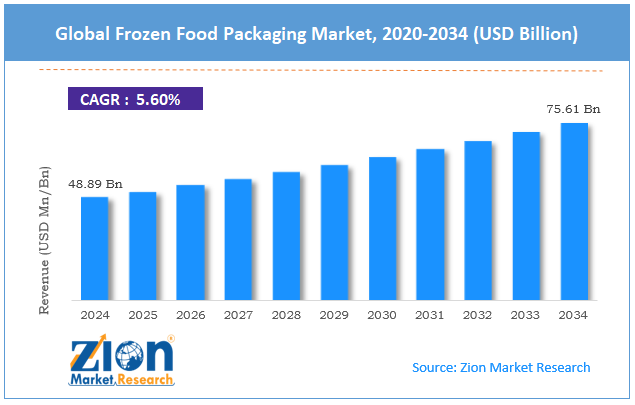

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 48.89 Billion | USD 75.61 Billion | 5.60% | 2024 |

Frozen Food Packaging Industry Perspective:

The global frozen food packaging market size was approximately USD 48.89 billion in 2024 and is projected to reach around USD 75.61 billion by 2034, with a compound annual growth rate (CAGR) of approximately 5.60% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global frozen food packaging market is estimated to grow annually at a CAGR of around 5.60% over the forecast period (2025-2034)

- In terms of revenue, the global frozen food packaging market size was valued at around USD 48.89 billion in 2024 and is projected to reach USD 75.61 billion by 2034.

- The frozen food packaging market is projected to grow significantly due to shifts in lifestyles and urbanization, advancements in the e-commerce and retail sectors, and improvements in packaging technologies.

- Based on packaging type, the bags segment is expected to lead the market, while the boxes segment is expected to grow considerably.

- Based on material type, the plastic segment is the dominant segment, while the paper & paperboard segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the meat and seafood segment is expected to lead the market compared to the ready meals segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Frozen Food Packaging Market: Overview

Frozen food packaging refers to specialized materials specially designed to preserve food products at low temperatures without compromising freshness, quality, and safety during transit. It utilizes materials such as paperboard, plastic, and aluminum, combined with advanced barrier solutions to prevent freezer burn, moisture loss, and contamination. The global frozen food packaging market is projected to experience substantial growth, driven by increasing demand for convenience and ready-to-eat foods, enhanced shelf life requirements, and shifting lifestyles and urbanization trends. Busy lifestyles are driving people to quick meal solutions, surging the demand for effective packaging and frozen foods. The packaging should assure safety and freshness, increasing its importance in this progressing trend.

Moreover, frozen food packaging plays a vital role in maintaining product quality over extended storage times. This is crucial for ensuring supply chain efficiency and minimizing food waste. Advancements in vacuum-sealed packaging and barrier films help improve shelf life by avoiding freeze burn and moisture loss.

Furthermore, with an increasing number of people residing in urban areas, the demand for processed and packaged foods has risen significantly. Urban consumers prefer products that are easy to prepare and store, leading to a surge in demand for frozen foods and robust packaging solutions.

Although drivers exist, the global market is challenged by factors such as environmental issues related to plastic waste and the energy-intensive nature of storage and manufacturing. A majority of frozen food packaging is made from plastic, which contributes to ecological pollution. The rising number of regulations on disposable plastics and sustainability pressures presents intricacies to producers. Additionally, the storage and production of frozen food packaging require significant energy to maintain low temperatures, resulting in a rising carbon footprint and increased operational costs.

Even so, the global frozen food packaging industry is well-positioned due to the inclination towards sustainable packaging materials, smart packaging, and the incorporation of automation in packaging processes. Rising environmental awareness is fueling the adoption of recyclable, biodegradable, and compostable packaging materials. Leading brands that invest in packaging solutions have significant growth potential.

Advancements such as QR codes for traceability, temperature-sensitive labels, and freshness indicators may enhance consumer trust and improve product security and safety, offering fresh opportunities. Automated packaging solutions also enhance efficiency, minimize errors, and lower labor costs, thereby increasing their appeal to large-scale manufacturers.

Frozen Food Packaging Market: Growth Drivers

How do refrigeration logistics and cold chain expansion drive the frozen food packaging market?

The increasing penetration of frozen foods in developing markets necessitates a reliable cold-chain ecosystem, driving demand for protective and durable packaging solutions. Packaging formats now comprise vacuum-sealed laminates, temperature-stable films, and shock-resistant trays for long-haul distribution. E-commerce delivery further emphasizes the need for thermal-resistant designs to maintain integrity during final-mile transport. As investments in cold storage continue, packaging that can tolerate prolonged storage and transportation conditions will be a key priority.

Raw material volatility, cost pressures, & circular economy economics favorably boost the market growth

Varying raw material prices, primarily for resins and polymers, have prompted manufacturers to adopt lightweight and cost-effective packaging solutions. Resin price variation in 2022-2023 created marginal pressures, motivating the use of mono-material structures and low-gauge films. Concurrently, the shift towards sustainable packaging formats introduces cost complexities, leading to phased rollouts and the selective adoption of specific SKUs. Leading brands are balancing cost control with environmental objectives, and current material price variability will continue to influence packaging optimization tactics and the growth of the frozen food packaging market.

Frozen Food Packaging Market: Restraints

How do stringent regulatory compliance and safety standards adversely impact the global frozen food packaging market?

Meeting global food packaging and safety standards requires exhaustive testing and certification, as well as surging development costs and time. Regulations such as the EU Packaging Waste Directives and FDA Food Contract Standards require migration testing, traceability, and proof of recyclability, creating significant compliance pressure. Failure to meet these standards may result in financial penalties, product recalls, and damage to brand reputation, as seen in 2024. The U.S. frozen food packaging recalls are due to non-compliant ink migration. This compliance barrier restricts industry entry and scaling prospects for smaller manufacturers.

Frozen Food Packaging Market: Opportunities

How do smart & intelligent packaging technologies present favorable prospects for the expansion of the frozen food packaging market?

The incorporation of smart sensors, time-temperature indicators (TTIs), and QR codes in frozen food packaging is enhancing consumer confidence and improving traceability. The smart packaging industry, anticipated to reach $43 billion by 2030, is witnessing food as a key application.

In 2024, a majority of the European brands introduced packs with TTIs that change color if cold-chain integrity is not well-maintained. These advancements not only promise food safety but also enable companies to differentiate themselves in premium markets, with adoption anticipated to progress as regulations become tougher worldwide. These technological advancements are notable for fueling the growth of the frozen food packaging industry.

Frozen Food Packaging Market: Challenges

Consumer perception of frozen food quality limits the market growth

Despite advancements in frozen food quality, many consumers still believe that frozen foods are less nutritious than their fresh counterparts, which restricts demand in several regions.

A 2023 survey presented that nearly 43% of European shoppers chose ready meals over frozen ones, negatively affecting the packaging needs. To overcome this, the leading brands are actively investing in premium graphics, resealable features, and transparent windows. Nonetheless, changing long-standing consumer views remains a key challenge and an expensive endeavor for the industry.

Frozen Food Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Frozen Food Packaging Market |

| Market Size in 2024 | USD 48.89 Billion |

| Market Forecast in 2034 | USD 75.61 Billion |

| Growth Rate | CAGR of 5.60% |

| Number of Pages | 214 |

| Key Companies Covered | Amcor Plc, Sealed Air Corporation, Berry Global Inc., Sonoco Products Company, Mondi Group, Huhtamaki Oyj, WestRock Company, Smurfit Kappa Group, Printpack Inc., Winpak Ltd., ProAmpac LLC, Graphic Packaging International, Coveris Holdings, Interflex Group, Glenroy Inc., and others. |

| Segments Covered | By Packaging Type, By Material Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Frozen Food Packaging Market: Segmentation

The global frozen food packaging market is segmented based on packaging type, material type, application, and region.

Based on packaging type, the global frozen food packaging industry is divided into boxes, bags, tubs & cups, trays, pouches, wraps & films, and others. The bags segment held a dominant market share due to its cost efficiency, lightweight nature, and flexibility. They are highly suitable for frozen vegetables, seafood, salads, fruits, and snacks, offering both resealable and easy-to-seal options for added convenience. The growth in demand for single-serve and portion-controlled frozen foods has further propelled the prominence of bags. Furthermore, their compatibility with advanced packaging solutions, such as vacuum sealing and high-barrier packaging, enhances their industry dominance.

Based on material type, the global frozen food packaging market is segmented into plastic, paper & paperboard, metal, glass, and others. The plastic segment holds leadership in the market due to its durability, versatility, and optimal barrier properties against contaminants and moisture. It is widely used in pouches, bags, trays, and wraps for products such as seafood, vegetables, and snacks. Its low-weight nature decreases transit costs, making it a more attractive choice for manufacturers who prefer cost savings. Additionally, advancements in biodegradable and recyclable plastics are resolving sustainability issues, promising consistent demand in the industry.

Based on application, the global market is segmented into fruits and vegetables, frozen desserts, meat and seafood, baked products, ready meals, and others. The meat and seafood segment captures a leading share of the market, as these products require stringent temperature control and high-quality packaging to prevent contamination and maintain optimal freshness. Vacuum-sealed plastic bags, wraps, and pouches are primarily used to extend shelf life and preserve flavor. The growing global consumption of protein-rich diets and rising seafood exports are driving the demand for secure packaging solutions. The rise of e-commerce in frozen meat delivery has augmented the segmental dominance.

Frozen Food Packaging Market: Regional Analysis

Why is North America outperforming other regions in the global Frozen Food Packaging Market?

North America is likely to maintain its leadership in the frozen food packaging market due to high frozen food consumption, a well-developed cold chain infrastructure, and technological advancements in packaging. North America has the highest food consumption rate globally, driven by the increasing demand for convenient meal options and the busy lifestyles that accompany them. The United States' frozen food sales surpassed $70 billion in 2023, according to the American Frozen Food Institute. This robust consumer base generates consistent demand for reliable and advanced frozen food packaging.

Moreover, the region benefits from a well-established cold chain network, promising adequate transportation and storage of frozen foods. Investments in advanced refrigerated logistics systems help maintain product quality and reduce spoilage. This infrastructure supports the large-scale packaging demand for various frozen food segments.

Additionally, North American packaging companies lead the way in advancements such as vacuum-sealed pouches, recycled films, and smart packaging solutions. These improvements cater to sustainability needs and improve product shelf life. The rapid adoption of automation in packaging processes further enhances the region's dominance.

Europe continues to hold the second-highest share in the frozen food packaging industry, driven by strong demand for frozen ready meals, increased adoption of sustainable packaging solutions, and the presence of established supermarket and retail chains. Europe has a significant consumer base for frozen ready meals, primarily in countries such as the United Kingdom, Germany, and France. The United Kingdom's frozen food industry was estimated to be worth more than $12 billion in 2023, according to the British Food Federation. The preference for convenient meal solutions continues to fuel substantial packaging demand.

Additionally, European regulators and consumers strongly favor recyclable and environmentally-friendly packaging materials. The European Union's Ban on Single-Use Plastics has boosted the inclination towards biodegradable plastics and paperboard. This trend makes the region a leading center for advancement in sustainable frozen food packaging. Leading retail chains, such as Aldi, Tesco, and Carrefour, dominate the frozen food distribution channel in the region. Their broader ecosystem promises high-volume packaging requirements for different frozen food categories. Appealing packaging designs are vital in the competitive retail environment.

Frozen Food Packaging Market: Competitive Analysis

The leading players in the global frozen food packaging market are:

- Amcor Plc

- Sealed Air Corporation

- Berry Global Inc.

- Sonoco Products Company

- Mondi Group

- Huhtamaki Oyj

- WestRock Company

- Smurfit Kappa Group

- Printpack Inc.

- Winpak Ltd.

- ProAmpac LLC

- Graphic Packaging International

- Coveris Holdings

- Interflex Group

- Glenroy Inc.

Frozen Food Packaging Market: Key Market Trends

Growing demand for portion-control packaging and convenience:

Consumers prefer packaging that complies with single-serve, microwave-safe, and resealable options for busy lifestyles. Compartmentalized trays and resealable pouches are gaining traction for ready snacks and meals. This trend supports the growing consumption of quick-prep food solutions and frozen ready meals.

Growth of insulated packaging solutions and E-commerce:

The rise of meal kit services and online grocery delivery is driving demand for thermal and insulated packaging solutions. The leading companies are launching advanced liners and lightweight boxes to maintain low temperatures during shipping. This trend aligns with the progressing e-commerce food industry worldwide.

The global frozen food packaging market is segmented as follows:

By Packaging Type

- Boxes

- Bags

- Tubs & Cups

- Trays

- Pouches

- Wraps & Films

- Others

By Material Type

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

By Application

- Fruits and Vegetables

- Frozen Desserts

- Meat and Seafood

- Baked Products

- Ready Meals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Frozen food packaging refers to specialized materials specially designed to preserve food products at low temperatures without compromising freshness, quality, and safety during transit. It utilizes materials such as paperboard, plastic, and aluminum, combined with advanced barrier solutions to prevent freezer burn, moisture loss, and contamination.

The global frozen food packaging market is projected to grow due to the rising global frozen food trade, enhanced cold chain infrastructure, and a growing working population with busy schedules.

According to study, the global frozen food packaging market size was worth around USD 48.89 billion in 2024 and is predicted to grow to around USD 75.61 billion by 2034.

The CAGR value of the frozen food packaging market is expected to be approximately 5.60% from 2025 to 2034.

The meat and seafood segment is expected to dominate the frozen food packaging market by 2034, driven by the need for high-quality preservation and growing global protein consumption.

Technological advancements are driving the frozen food packaging market by enabling sustainable, smart, and high-barrier packaging solutions that improve food safety and shelf life.

Growing environmental concerns and strict regulations on single-use plastics are driving the shift toward recyclable frozen food and sustainable packaging solutions.

North America is expected to lead the global frozen food packaging market during the forecast period.

The key players profiled in the global frozen food packaging market include Amcor Plc, Sealed Air Corporation, Berry Global Inc., Sonoco Products Company, Mondi Group, Huhtamaki Oyj, WestRock Company, Smurfit Kappa Group, Printpack Inc., Winpak Ltd., ProAmpac LLC, Graphic Packaging International, Coveris Holdings, Interflex Group, and Glenroy Inc.

The report examines key aspects of the frozen food packaging market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed