Freeze Dried Foods Market Size, Share, Growth, Demand and Forecast 2032

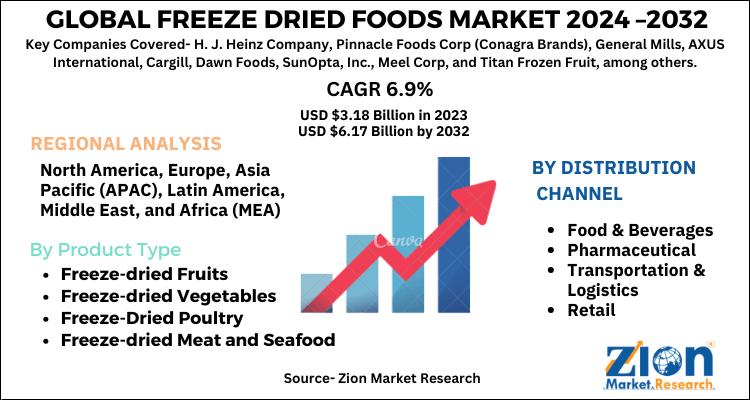

Freeze Dried Foods Market: By Product Type (Freeze-dried Fruits, Freeze-dried Vegetables, Freeze-Dried Poultry, Freeze-dried Meat and Seafood and Others), by Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

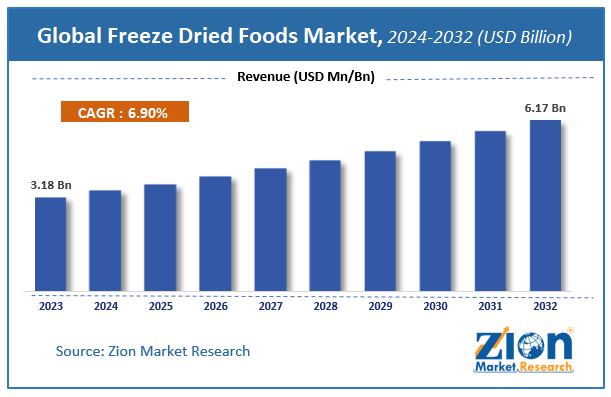

| USD 3.18 Billion | USD 6.17 Billion | 6.9% | 2023 |

Freeze Dried Foods Market Insights

Zion Market Research has published a report on the global Freeze Dried Foods Market, estimating its value at USD 3.18 Billion in 2023, with projections indicating that it will reach USD 6.17 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.9% over the forecast period 2024-2032.

The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Freeze Dried Foods Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Freeze Dried Foods Market Size Overview

Global freeze-dried food market is projected to grow at a healthy CAGR. The demand for these food products is projected to keep on increasing across the globe on account of shifting consumer preferences, increasing disposable income, increasing number of stores and supermarkets keeping freeze-dried food products, rising demand for ready-to-cook frozen meal, among others. Today, all kinds of freeze-dried food products are available in the market including vegetables, fruits, meat and seafood, and poultry.

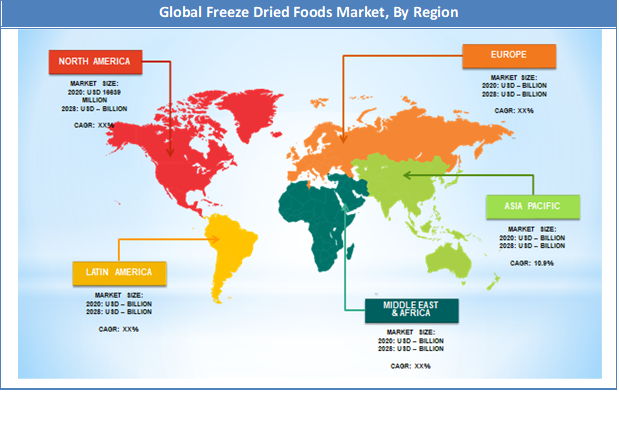

As per our findings, Europe is projected to lead the global market, which is followed by North America and Asia Pacific. Wherein, Asia Pacific is projected to emerge as the fastest-growing market for freeze-dried food products. Most of the manufacturers are looking at this region as a lucrative market on account of rising employment, increasing urbanization, changing market dynamics, a growing number of supermarkets, and increasing disposable income. India and China are the key markets, which is followed by Japan.

COVID-19 Impact Analysis

COVID-19 pandemic has affected almost all sectors across the globe. However, the freeze-dried food market has remained unaffected during this period. On top of that, several leading market players in the region reported improvement in revenue as people found to be stockpiling their favorite freeze-dried food items, especially vegetables, fruits, and meat and seafood. Since they are staying in home for longer time and spending less time outside, they have started consuming more comfort food. For instance, it has been found that 51% of people In Spain prefer meat and fish as their comfort food and the remaining 49% are considering it as their favorite food.

However, the market witnessed a little impact on the retail sale as numerous retail outlets had to shut down their shops. Moreover, consumers could not move freely, which further impacted total sale through this segment. On the other hand, the shut down or limited operation of retail shops has benefited supermarkets and e-commerce sites. In fact, consumers found ordering more than need quantity through online channel. It has also become difficult for many companies to keep up with the increased consumer demand. Freeze-dried is one of the grocery store aisles where there has been a lot of out of out-of-stock products. It is also found that several brands are struggling to keep up with the increased demand. There's also logistics in manufacturing, so a lot of companies are trying to handle extra stress, and workloads on their teams from a logistics standpoint, like even the amount of truck drivers available.

Freeze Dried Foods Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Freeze Dried Foods Market |

| Market Size in 2023 | USD 3.18 Billion |

| Market Forecast in 2032 | USD 6.17 Billion |

| Growth Rate | CAGR of 6.9% |

| Number of Pages | 177 |

| Key Companies Covered | H. J. Heinz Company, Pinnacle Foods Corp (Conagra Brands), General Mills, AXUS International, Cargill, Dawn Foods, SunOpta, Inc., Meel Corp, and Titan Frozen Fruit, among others. |

| Segments Covered | By Product Type, By Distribution Channel, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

The market may witness a considerable decline in overall consumption after the lockdown restrictions are removed and the pandemic is over. This is because people that have consumed freeze-dried food during the initial period are likely to part their ways from consuming as they are more likely to prefer other fresh and regular alternatives in order to maintain health.

Freeze Dried Foods Market Growth Factors

Growing middle-class population, along with rising health-conscious consumers, has been boosting the growth of the market. Shifting consumer preference for healthy and nutritious foods owing to rise in obesity and growing aging population are driving the market for dried fruit. Furthermore, increased acceptance for nutritious packaged food and wide application of dried fruit in the dairy, bakery, snack, and confectionery industries have fueled the demand for dried fruit over the years. Demand for dried fruit has been influenced by research studies highlighting the role of the product in weight management and disease prevention. Numerous scientific studies have stated that certain types of dehydrated fruits and vegetables can help in lowering the risk of progression of specific cancers. For instance, in August 2019, Dried Fruit Intake and Cancer, a research study, suggested that the consumption of dried fruit may reduce the risk of developing certain types of cancers, including cancers of the prostate, pancreas, stomach, colon, and bladder. As a result, consumers have been including dried fruit in their diets.

Many consumers are increasingly looking for a convenient frozen dessert-based snack, which delivers health benefits, tastes good, and offers a healthy snacking experience. The dairy industry in this sector is able to offer products with minimal processing, and low sugar content (particularly beneficial for diabetic patients) for easy eating experiences that go beyond the traditional three-square meal experience (good and filling meal). Frozen desserts provide food rich in nutrients, like vitamin D, calcium; potassium, magnesium, and vitamin A. Snacks also add more calories, protein, and a number of vitamins and minerals. They can, therefore, provide positive nutrition and help reduce nutrition deficiency. The nutrients in dairy-based frozen products include calcium, vitamin D, phosphorus, potassium, and vitamin A. Further, calcium, phosphorus, and protein contained in ice creams, yogurts, etc. drive up the demand for these products among consumers.

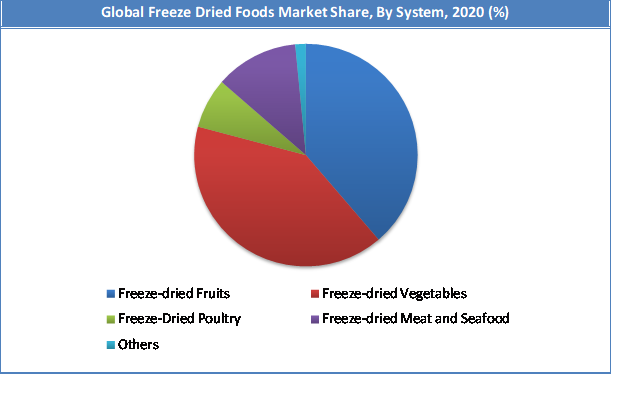

Freeze Dried Foods Market: Product Segment Analysis Preview

The freeze-dried vegetables segment held a share of around 40.39% in 2020. It has been found that most of consumers across the globe majorly buying vegetables such as potato, peas, corn, mushroom and leafy vegetables such as spinach. Wherein, corn is expected to register the fastest growth. It has been found the demand for frozen vegetables is primarily driven commercial establishments such as restaurants, hotels, food courts, among others. They are buying such vegetables in bulk for convenience. The global market is witnessing surging demand for mix-vegetables along with corns.

Distribution Channel Segment Analysis Preview

Hypermarkets/Supermarkets segment will grow at a substantial CAGR and hold a share of 48.83% in the year 2032. It has been found that consumers based in European and North American countries are predominantly buying the products from this channel. This is further supported by countries based in the Asia Pacific such as Japan, Malaysia, Singapore, India, and China, among others. In the last few years, consumers based in the Asia Pacific and Latin America has more preferably started purchasing such products from supermarkets. This is majorly attributed to the growing number of supermarkets/hypermarkets, easy availability of various brands, heavy discounts, and availability of different flavors.

Regional Analysis Preview

The European region held a share of 32.55% in 2020. The region has several developed economies such as the U.K, Germany, France, Italy, Spain, Russia, Sweden, among others. As per our analysis, Germany is leading the regional market, which is followed by the U.K and France. In Europe, people prefer buying fish, pizza, and meat. In 2016, over 3.5 million tons of freeze-dried food products were sold in Germany alone. On average, each household consumed 109 kg of freeze-dried food in 2020, which was 90 kg in 2016.

However, per capita spending on freeze-dried product is considerably high in the U.K. With each passing year, more consumers are turning to freeze dried food. For instance, European purchased 5.8 million tons of freeze-dried fruits and vegetables in 2015. In 2018, over 2.7 billion units of freeze-dried frozen food items were sold in the U.K through supermarket. Wherein, most of the food items were vegetables. Freeze dried meat is less popular in the U.K compared to other countries in the region. The increase in the demand for freeze dried products is primarily attributed to changing lifestyle, growing preferences to eat at home, hectic work schedule, increasing disposable income, and easy availability of these food items with long shelf life if stored properly..

The region is holding world’s more than 64% of the population. Wherein, 35% of the population is residing in India and China alone. However, the consumption of freeze-dried food products is relatively low in these countries. There are multiple factors that are responsible for the lower consumption of such products such as socio-economic factors, cultural differences, high preferences for fresh fruits, vegetables, fish, and meat, lower number of supermarkets, and limited availability of varieties, among others.

The scenario has started changing in recent years as more consumers have started buying freeze-dried products. To our finding, China is holding a dominant position in the regional market, which is followed by India and Japan. The region is expected to witness the fastest growth in the coming years on account of an increasing number of shops selling freeze-dried products, and a rising number of supermarkets and product manufacturers. The growth is further supported by the rising adoption of the western lifestyle, increasing disposable income, and growing urbanization in China and India.

Key Market Players & Competitive Landscape

Some of the key players in freeze dried foods market are

- H. J. Heinz Company,

- Pinnacle Foods Corp (Conagra Brands),

- General Mills,

- AXUS International,

- Cargill,

- Dawn Foods,

- SunOpta,

- Meel Corp, and Titan Frozen Fruit,

- among others.

The global freeze dried foods market is segmented as follows:

By Product Type

- Freeze-dried Fruits

- Melons

- Citrus

- Berries

- Mango

- Kiwi

- Others

- Freeze-dried Vegetables

- Peas

- Mushrooms

- Carrots

- Beans

- Corn

- Others

- Freeze-Dried Poultry

- Freeze-dried Meat and Seafood

- Others

By Distribution Channel

- Food & Beverages

- Pharmaceutical

- Transportation & Logistics

- Retail

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Freeze Dried Foods Market market size valued at US$ 3.18 Billion in 2023

Freeze Dried Foods Market market size valued at US$ 3.18 Billion in 2023, set to reach US$ 6.17 Billion by 2032 at a CAGR of about 6.9% from 2024 to 2032.

Some of the key factors driving the global freeze dried foods market growth are shifting consumer preference, and demand for nutritious frozen desserts among consumers, among others.

Asia Pacific region held a substantial share of the freeze dried foods market in 2020. The region is expected to witness fastest growth in the coming years on account of increasing number of shops selling freeze dried products, rising number of supermarkets and products manufacturers. The growth is further supported by rising adoption of western lifestyle, increasing disposable income, growing urbanization in China and India.

Some of the major companies operating in the freeze dried foods market are H. J. Heinz Company, Pinnacle Foods Corp (Conagra Brands), General Mills, AXUS International, Cargill, Dawn Foods, SunOpta, Inc., Meel Corp, and Titan Frozen Fruit, among others.

List of Contents

Market InsightsMarket Size OverviewCOVID-19 Impact AnalysisReport ScopeMarket Growth FactorsProduct Segment Analysis PreviewDistribution Channel Segment Analysis PreviewRegional Analysis PreviewKey Market Players Competitive LandscapeThe global freeze dried foods market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed