Smart Packaging Market Size, Trends, Forecast to 2034

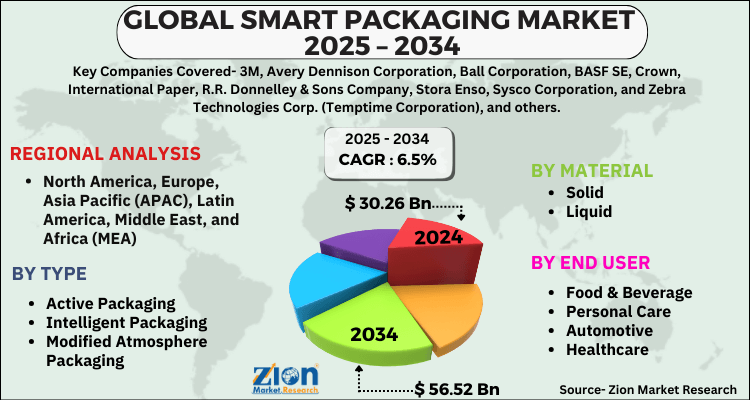

Smart Packaging Market - By Type (Active Packaging, Intelligent Packaging, and Modified Atmosphere Packaging), By Material (Solid and Liquid), By End-user (Food & Beverage, Personal Care, Automotive, Healthcare, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

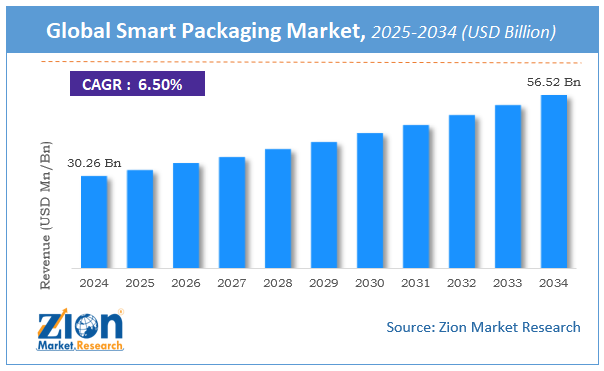

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 30.26 Billion | USD 56.52 Billion | 6.5% | 2024 |

Smart Packaging Market: Industry Perspective

The global smart packaging market size was worth around USD 30.26 Billion in 2024 and is predicted to grow to around USD 56.52 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 6.5% between 2025 and 2034. The report analyzes the global smart packaging market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the smart packaging industry.

The report analyzes the global smart packaging market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the smart packaging industry.

Smart Packaging Market: Overview

Smart packaging offers a detailed insight into the product that it envelops and this is what majorly drives its popularity of it. Consumers are becoming more aware and this is expected to turn the tide of the packaging industry in the coming years hence the demand for smart packaging is expected to bolster over the forecast period through 2028.

Smart packaging for food is expected to see a rise in demand as consumers want to know the contents of the food they are consuming owing to the rise in healthy eating and fitness trends. Smart packaging is aimed at improving the shelf life of packaged goods by proper monitoring of multiple parameters such as temperature, etc.

Key Insights

- As per the analysis shared by our research analyst, the global smart packaging market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2025-2034).

- Regarding revenue, the global smart packaging market size was valued at around USD 30.26 Billion in 2024 and is projected to reach USD 56.52 Billion by 2034.

- The smart packaging market is projected to grow at a significant rate due to demand for active and intelligent packaging solutions, iot integration, and growing emphasis on product safety and traceability.

- Based on Type, the Active Packaging segment is expected to lead the global market.

- On the basis of Material, the Solid segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user, the Food & Beverage segment is projected to swipe the largest market share.

- Based on region, North America & Europe is predicted to dominate the global market during the forecast period.

A drop in demand for packaged goods, reduced e-commerce activity, and closure of sales channels such as malls, grocery stores, and retail stores led to a major drop in demand for smart packaging. However, the demand is expected to see a steady spike in rising as lockdown restrictions are lifted and demand for packaged goods returns to its normal trend.

With industrial activity resuming and increasing demand, smart packaging companies would have to focus on boosting their production and distribution capabilities in the post-pandemic world to cater to the growing demand.

Smart Packaging Market: Growth Drivers

Changing lifestyle trends to Foster Demand for Smart packaging

Consumers prefer to know more about the product and this rising demand for more information about the product is what majorly drives the demand for smart packaging. Increasing technological proliferation, rising urbanization, and growing demand for monitoring and tracking are some crucial factors that are positively influencing smart packaging market growth through 2028. Rising urbanization is expected to play a pivotal role in the global smart packaging market growth over the forecast period.

Smart Packaging Market: Restraints

High Costs of Smart Packaging

Smart packaging comprises sensors, RFID (radio frequency identification) tags, and other technological components which make it a very expensive packaging setup for multiple small businesses and increase the overall cost of the product as well. This is expected to majorly restrain the adoption of smart packaging across the world. The collection of consumer data through smart packaging could also lead to adverse situations where this data could be manipulatively used and this is also expected to hinder smart packaging market growth through 2028.

Smart Packaging Market: Challenges

Rising Demand for Sustainable Packaging Solutions

Smart packaging components comprise some elements that cannot be recycled or reused and this creates a major barrier for smart packaging companies as pressure on them is mounting to innovate and launch sustainable packaging solutions to reduce waste and conserve the environment.

Smart Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Smart Packaging Market |

| Market Size in 2024 | USD 30.26 Billion |

| Market Forecast in 2034 | USD 56.52 Billion |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 170 |

| Key Companies Covered | 3M, Avery Dennison Corporation, Ball Corporation, BASF SE, Crown, International Paper, R.R. Donnelley & Sons Company, Stora Enso, Sysco Corporation, and Zebra Technologies Corp. (Temptime Corporation), and others. |

| Segments Covered | By Type, By Material, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Smart Packaging Market: Segmentation

The global smart packaging market is segregated based on type, material, end-user, and region.

By type, the market is divided into modified atmosphere packaging (MAP), active packaging, and intelligent packaging. The modified atmosphere packaging segment held a dominant market share in 2020 and is expected to see a bright outlook over the forecast period. Rising demand for high-quality fresh food is what majorly drives this segment and is expected to further bolster smart packaging market growth through 2028 as this trend picks up the pace on a global scale.

By End-user, the smart packaging market is segmented into food & beverage, personal care, automotive, healthcare, and others. The increasing demand for smart packaging in the food & beverage industry is expected to majorly influence smart packaging market growth. Increasing consumer preference for knowing the ingredients of it and the freshness of food are two major factors propelling demand for smart packaging in the global smart packaging market landscape.

Smart Packaging Market: Regional Landscape

Asia Pacific region will lead the global smart packaging market in terms of revenue and volume share owing to changing lifestyle trends, increasing demand for packaging solutions with longer sustainability, increasing demand for packaged goods, and growing demand for fresh & quality food products. China, Japan, and India are estimated to be the most lucrative markets in this region owing to their expanding consumer base and increasing sales of packaged goods.

The market for smart packaging in North America and Europe is expected to provide lucrative opportunities and is expected to see high demand from food & beverages and personal care end-use industry verticals in these regions.

Recent Developments

- In March 2022 – Procter and Gamble’s Lenor brand announced a change in its sustainable packaging trends as it banished opaque bottles and adopted transparent ones with integrated digital watermarking that will be beneficial in the recycling process and help the company achieve its sustainability goals.

Smart Packaging Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the smart packaging market on a global and regional basis.

Some of the main competitors dominating the global smart packaging market include -

- 3M

- Avery Dennison Corporation

- Ball Corporation

- BASF SE

- Crown

- International Paper

- R.R. Donnelley & Sons Company

- Stora Enso

- Sysco Corporation

- Zebra Technologies Corp. (Temptime Corporation)

The global smart packaging market is segmented as follows:

By Type

- Active Packaging

- Intelligent Packaging

- Modified Atmosphere Packaging

By Material

- Solid

- Liquid

By End User

- Food & Beverage

- Personal Care

- Automotive

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global smart packaging market is expected to grow due to increasing demand for intelligent tracking solutions, rising adoption of iot in packaging, and growing consumer preference for sustainable materials.

According to a study, the global smart packaging market size was worth around USD 30.26 Billion in 2024 and is expected to reach USD 56.52 Billion by 2034.

The global smart packaging market is expected to grow at a CAGR of 6.5% during the forecast period.

North America & Europe is expected to dominate the smart packaging market over the forecast period.

Leading players in the global smart packaging market include 3M, Avery Dennison Corporation, Ball Corporation, BASF SE, Crown, International Paper, R.R. Donnelley & Sons Company, Stora Enso, Sysco Corporation, and Zebra Technologies Corp. (Temptime Corporation), among others.

The report explores crucial aspects of the smart packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed