Diesel Gensets Market Size, Share, Trends, Industry Report 2034

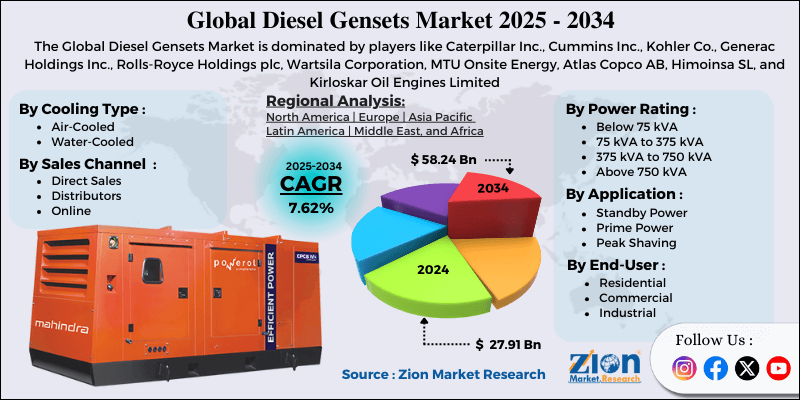

Diesel Gensets Market By Power Rating (Below 75 kVA, 75 kVA to 375 kVA, 375 kVA to 750 kVA, Above 750 kVA), By Application (Standby Power, Prime Power, Peak Shaving), By End-User (Residential, Commercial, Industrial), By Sales Channel (Direct Sales, Distributors, Online), By Cooling Type (Air-Cooled, Water-Cooled), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

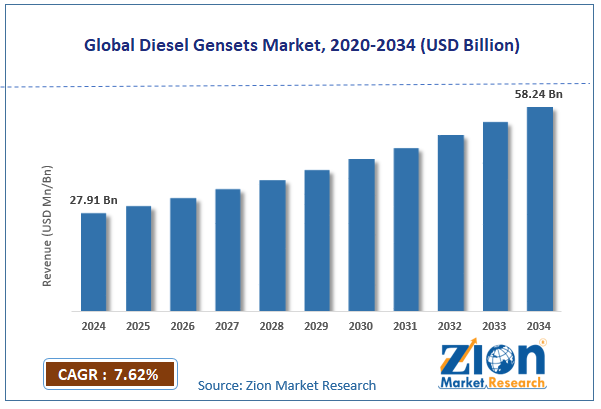

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 27.91 Billion | USD 58.24 Billion | 7.62% | 2024 |

Diesel Gensets Industry Perspective

The global diesel gensets market size was worth approximately USD 27.91 billion in 2024 and is projected to grow to around USD 58.24 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.62% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global diesel gensets market is estimated to grow annually at a CAGR of around 7.62% over the forecast period (2025-2034).

- In terms of revenue, the global diesel gensets market size was valued at approximately USD 27.91 billion in 2024 and is projected to reach USD 58.24 billion by 2034.

- The diesel gensets market is projected to grow significantly due to the rising power infrastructure challenges, increasing construction activities, growing data center deployments, and expanding telecommunications network requirements in developing regions.

- Based on power rating, the 75 kVA to 375 kVA segment is expected to lead the diesel gensets market, while the above 750 kVA segment is anticipated to experience significant growth.

- Based on application, the standby power segment is expected to lead the diesel gensets market, while the prime power segment is anticipated to witness notable growth.

- Based on end-user, the industrial segment is the dominating segment, while the commercial segment is projected to witness sizeable revenue over the forecast period.

- Based on the sales channel, distributors are the dominating segment, while the offline sales segment is projected to witness sizeable revenue over the forecast period.

- Based on cooling type, the global market is led by water-cooled segment, followed by air-cooled segment in the global market.

- Based on region, Asia Pacific is projected to dominate the global diesel gensets market during the estimated period, followed by North America.

Diesel Gensets Market: Overview

Diesel gensets are complete power systems designed to generate electricity by combining a diesel engine with an alternator serving backup, prime, or continuous power needs across many environments. These units include engines, generators, control panels, fuel tanks, cooling systems, and exhaust components, all arranged in a single, ready-to-use package that supports reliable operation. Their assembly involves selecting suitable engine ratings, matching alternator capacities, installing electronic controls, and configuring fuel delivery systems, ensuring stable performance under different load conditions. Diesel gensets are produced by specialized power manufacturers and large industrial companies supplying residential, commercial, and industrial users across global markets. Common designs include open-frame units, weatherproof enclosures, soundproof canopies, and containerized systems meeting various installation, protection, and noise requirements. Modern features include automatic transfer switches, remote monitoring platforms, parallel operation capabilities, and load management controls, improving convenience and system efficiency. Digital panels, synchronization tools, emission reduction components, and maintenance support systems further enhance long-term reliability and overall performance. Ongoing design improvements focus on higher efficiency and lower emissions, supporting broader adoption across diverse applications. The increasing frequency of power outages and growing energy security concerns are expected to drive growth in the diesel gensets market throughout the forecast period.

Diesel Gensets Market Dynamics

Growth Drivers

How is grid infrastructure instability driving the diesel gensets market growth?

The diesel gensets industry is expanding quickly because unreliable electrical grids and frequent power cuts create strong demand for backup systems supporting business operations and essential services during interruptions. Aging infrastructure in developed countries is prone to equipment failures, limited capacity, and maintenance issues, leading to unexpected outages that affect commercial and industrial activities. Extreme weather events such as hurricanes, heat waves, ice storms, and floods damage power lines and substations, creating long outages that require emergency support for recovery work. Developing areas face limited generation capacity, weak distribution networks, and gaps in rural electrification, leading to recurring shortages that require independent power solutions. Voltage swings and frequency shifts damage sensitive equipment, including medical devices, computers, and manufacturing systems, encouraging the use of stable backup sources. Planned maintenance work requires alternative power to support critical operations during repairs and equipment upgrades affecting the electricity supply. Rising industrial automation increases dependence on stable electricity, requiring reliable gensets supporting continuous production activities.

Increasing data center and telecommunications infrastructure expansion

The global diesel gensets market is growing steadily as digital transformation expands data centers and telecommunications facilities, requiring reliable backup power supporting important operations across many sectors. Cloud computing growth creates large server farms processing huge volumes of information for businesses and consumers, requiring continuous uptime supported by redundant power systems. Rising internet traffic increases demand for edge computing facilities placed closer to users, improving speed and service quality, supported by distributed power solutions. Streaming services, online gaming, and video conferencing expand bandwidth requirements, creating the need for new telecommunications facilities equipped with backup generators to ensure service continuity. Fifth-generation mobile networks deploy thousands of towers and base stations, requiring strong power reliability supporting advanced applications, including autonomous vehicles and smart cities. E-commerce growth is expanding warehouses, which use automated systems that require stable power to support order processing and inventory operations. Government and healthcare digitization create platforms and databases requiring continuous availability, supported through emergency power systems across critical environments.

Restraints

Environmental concerns and emission regulations affecting market adoption

The diesel gensets market faces several restraints influencing growth across many sectors and regions, as regulations and sustainability goals shape purchasing decisions and operational planning. Strict emission rules require costly after-treatment systems, including catalytic converters, particulate filters, and exhaust scrubbers, increasing equipment prices and long-term maintenance needs. Air quality limits in urban areas restrict operations by enforcing runtime caps, emission thresholds, and permitting steps, complicating installation and daily use. Noise concerns reduce deployment in residential zones and sensitive locations requiring sound-controlled enclosures and tightly managed operating schedules. Carbon footprint considerations encourage organizations to explore renewable options and energy storage systems supporting environmental goals and sustainability programs. Operating expenses, including fuel consumption, maintenance work, and compliance requirements, increase long-term financial pressure, affecting overall ownership costs. Competing technologies, including natural gas generators, battery storage, and renewable microgrids, offer cleaner alternatives, reducing diesel demand across various applications.

Opportunities

How is rising electrification creating new opportunities for the diesel gensets industry?

The diesel gensets industry is gaining strong growth opportunities as economic development and electrification challenges in emerging regions create rising demand for distributed power generation, supporting expansion and modernization goals across many sectors. Rural electrification programs bring electricity to remote communities where grid extension remains difficult, using gensets providing primary supply until infrastructure reaches these locations. Off-grid industries, including mining, agriculture, and manufacturing, depend on gensets providing reliable power to support production activities in distant areas. Island nations without interconnected grids rely on distributed generation, with diesel units providing electricity to homes, businesses, and industrial facilities across separate communities. Construction growth creates temporary power needs at project sites before permanent connections become available, using portable gensets, supporting equipment, and site operations. Infrastructure development includes building telecommunication towers, water treatment plants, and public facilities in remote areas that require independent power to support essential services. Tourism expansion establishes hotels and resorts in isolated locations requiring stable power supporting guest services and daily operations. Growing small business activity in remote regions increases demand for affordable gensets, supporting local economic development.

Challenges

How is renewable energy integration and storage technology creating challenges for the diesel gensets industry?

The diesel gensets industry faces many obstacles as advancing renewable technologies and improving battery systems shift power strategies toward cleaner alternatives, creating uncertainty about long-term demand across many applications. Solar systems with battery storage provide silent and emission-free backup power for homes and small businesses, reducing reliance on diesel units in these markets. Wind energy paired with storage supports renewable microgrids, reducing dependence on diesel generation for remote and grid-edge locations across diverse regions. Battery energy storage offers instant response, frequent cycling ability, and quiet operation, giving advantages over diesel units for several backup and stabilization needs. Hybrid systems combine multiple power sources, improving performance and lowering fuel use, reducing genset operating hours across various sites. Microgrid controllers manage generation from renewable, storage, and diesel units, reducing fossil fuel reliance and meeting long runtime requirements. Grid modernization investments improve reliability through automated monitoring and switching, reducing outages and lowering backup power demand across many sectors. Growing policy support for green energy solutions accelerates the shift away from traditional diesel gensets across global markets.

Diesel Gensets Market : Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Diesel Gensets Market Research Report |

| Market Size in 2024 | USD 27.91 Billion |

| Market Forecast in 2034 | USD 58.24 Billion |

| Growth Rate | CAGR of 7.62% |

| Number of Pages | 222 |

| Key Companies Covered | Caterpillar Inc., Cummins Inc., Kohler Co., Generac Holdings Inc., Rolls-Royce Holdings plc, Wartsila Corporation, MTU Onsite Energy, Atlas Copco AB, Himoinsa SL, and Kirloskar Oil Engines Limited |

| Segments Covered | By Power Rating, By Application, By End-User, By Sales Channel, By Cooling Type And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Diesel Gensets Market: Segmentation

The global diesel gensets market is segmented based on power rating, application, end-user, portability, tier standard, sales channel, cooling type, and region.

Based on power rating, the global diesel gensets industry is divided into below 75 kVA, 75 kVA to 375 kVA, 375 kVA to 750 kVA, and above 750 kVA. The 75 kVA to 375 kVA segment leads the market due to its versatility, balanced performance, and widespread adoption across commercial buildings, small industrial facilities, and telecommunications installations.

Based on application, the industry is classified into standby power, prime power, and peak shaving. Standby power leads the market due to widespread backup power requirements, regulatory compliance needs, business continuity priorities, and critical infrastructure protection across diverse sectors and facility types.

Based on end-user, the global diesel gensets market is categorized into residential, commercial, and industrial. Industrial is expected to lead the market during the forecast period due to continuous operations, high power demand, critical process protection requirements, and substantial investments in reliable power infrastructure.

Based on sales channel, the global market is segmented into direct sales, distributors, and online. Distributors hold the largest market share due to their local market presence, technical support capabilities, installation services, and established relationships with contractors and end-users requiring personalized assistance.

Based on cooling type, the global diesel gensets market is segregated into air-cooled and water-cooled. Water-cooled holds the largest market share due to its superior thermal efficiency, quieter operation, longer service life, and suitability for high-power applications requiring continuous or prime power operation.

Diesel Gensets Market: Regional Analysis

What factors are contributing to the Asia Pacific's dominance in the global diesel gensets market?

Asia Pacific leads the diesel gensets market because rapid economic growth, infrastructure limitations, and industrial expansion create strong demand for reliable power equipment supporting development across many countries and sectors. India experiences frequent power shortages with rolling blackouts, voltage swings, and limited grid capacity, forcing businesses and institutions to install backup generators, maintaining operations and productivity across large regions. China continues major infrastructure development, including factories, commercial complexes, and residential projects, that require temporary and backup power to support construction progress and ongoing facility operations across expanding cities. Manufacturing clusters establish industrial zones and export-focused factories requiring dependable power, as grid instability threatens production schedules and equipment safety across critical industries.

Telecommunications networks deploy cellular towers, fiber systems, and data centers requiring backup power to maintain connectivity, supporting fast-growing mobile and internet services across urban and rural areas. Rural electrification gaps leave millions without reliable access, requiring diesel gensets providing primary power for communities, businesses, and public facilities across distant regions. Data center expansion supports rising digital use, requiring power redundancy to protect cloud services, internet platforms, and business applications across large markets. Healthcare systems build hospitals, clinics, and medical centers requiring emergency generators protecting patient care equipment and essential services during outages across regional networks. Financial institutions operate branches, ATM networks, and processing centers requiring continuous power, preventing service disruptions and transaction failures across their widespread operations. Growing urbanization across emerging economies increases electricity demands, requiring dependable gensets supporting continuous regional development.

North America demonstrates stable market characteristics.

North America maintains a strong position in the diesel genset market because established infrastructure, strict regulations, and business continuity needs create steady demand for reliable backup power across many sectors and applications. The United States follows building codes requiring emergency generators in healthcare facilities, high-rise buildings, and critical infrastructure supporting occupant safety and uninterrupted operations during outages. Hurricane-prone regions along the Atlantic and Gulf coasts maintain high genset adoption rates, protecting homes, businesses, and public facilities from long power cuts after major storms across vulnerable areas. Healthcare systems operate hospitals, clinics, and research centers requiring emergency generators to maintain patient care, medical equipment, and essential services during electrical failures across regional networks. Financial institutions run trading platforms, banking centers, and payment systems requiring continuous power to prevent transaction failures and economic disruptions across interconnected markets.

Telecommunications infrastructure maintains cellular networks, internet routes, and emergency communication systems requiring backup power, ensuring connectivity during grid failures and severe weather across key regions. Manufacturing facilities use gensets to protect production equipment, automated processes, and safety systems, preventing equipment damage and product loss across industrial operations. Commercial real estate includes office buildings, hotels, and shopping centers requiring backup power to maintain elevators, fire systems, and emergency lighting, meeting compliance rules across urban areas. Expanding digital infrastructure across technology-driven cities increases backup power needs, supporting long-term market stability.

Recent Developments

- In June 2025, Cummins Inc. launched a new 17-liter engine platform generator set capable of producing up to 1 megawatt of power.

- In April 2025, Caterpillar Inc. introduced the Cat XQ20 mobile diesel generator set, a compact 20 kVA unit meeting U.S. EPA Tier-4 Final standards, aimed at small-scale and portable power needs.

Diesel Gensets Market: Competitive Analysis

The leading players in the global diesel gensets market are

- Caterpillar Inc

- Cummins Inc

- Kohler Co

- Generac Holdings Inc

- Rolls-Royce Holdings plc

- Wartsila Corporation

- MTU Onsite Energy

- Atlas Copco AB

- Himoinsa SL

- Kirloskar Oil Engines Limited.

The global diesel gensets market is segmented as follows:

By Power Rating

- Below 75 kVA

- 75 kVA to 375 kVA

- 375 kVA to 750 kVA

- Above 750 kVA

By Application

- Standby Power

- Prime Power

- Peak Shaving

By End-User

- Residential

- Commercial

- Industrial

By Sales Channel

- Direct Sales

- Distributors

- Online

By Cooling Type

- Air-Cooled

- Water-Cooled

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed