Diesel Engine Market Size, Share, Trends, Growth & Forecast 2034

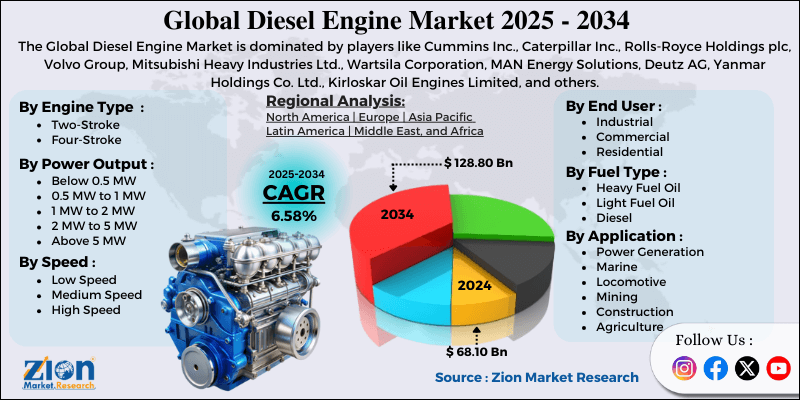

Diesel Engine Market By Engine Type (Two-Stroke, Four-Stroke), By Power Output (Below 0.5 MW, 0.5 MW to 1 MW, 1 MW to 2 MW, 2 MW to 5 MW, Above 5 MW), By Speed (Low Speed, Medium Speed, High Speed), By Application (Power Generation, Marine, Locomotive, Mining, Construction, Agriculture, Automotive, and Others), By End-User (Industrial, Commercial, Residential), By Fuel Type (Heavy Fuel Oil, Light Fuel Oil, Diesel), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

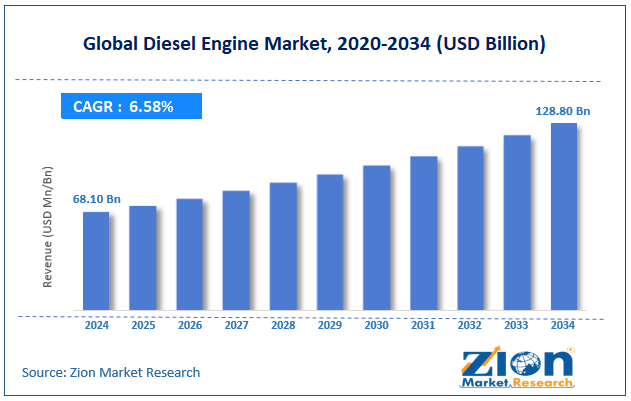

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 68.10 Billion | USD 128.80 Billion | 6.58% | 2024 |

Diesel Engine Industry Perspective:

The global diesel engine market size was worth approximately USD 68.10 billion in 2024 and is projected to grow to around USD 128.80 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.58% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global diesel engine market is estimated to grow annually at a CAGR of around 6.58% over the forecast period (2025-2034).

- In terms of revenue, the global diesel engine market size was valued at approximately USD 68.10 billion in 2024 and is projected to reach USD 128.80 billion by 2034.

- The diesel engine market is projected to grow significantly due to the rising infrastructure development, increasing power generation requirements, growing construction activities, and expanding mining operations in developing economies.

- Based on engine type, the four-stroke segment is expected to lead the diesel engine market, while the two-stroke segment is anticipated to experience significant growth in marine applications.

- Based on power output, the 0.5 MW to 1 MW segment is expected to lead the diesel engine market, while the above 5 MW segment is anticipated to witness notable growth.

- Based on speed, the medium speed segment is the dominating segment, while the high speed segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the power generation segment is expected to lead the market compared to the automotive segment.

- Based on region, the Asia Pacific is projected to dominate the global diesel engine market during the estimated period, followed by North America.

Diesel Engine Market: Overview

Diesel engines are internal combustion machines designed to convert the chemical energy of diesel fuel into mechanical power through a process called compression ignition. They work by compressing air to very high temperatures, injecting fuel at the right moment, and using the resulting combustion to move pistons that turn the crankshaft. Their manufacturing includes careful production of cylinder blocks, pistons, crankshafts, injection systems, and cooling components to ensure strength and long-term performance. These engines are built by both specialized companies and major industrial manufacturers serving transportation, power generation, and heavy equipment needs across global markets. Common designs include inline, V-shaped, horizontal, and radial layouts chosen based on space, power demand, and installation needs. Modern improvements such as turbocharging, intercooling, direct injection, and electronic control systems help increase efficiency and lower emissions. Technologies like common rail injection, variable geometry turbochargers, and exhaust gas recirculation also support stronger performance and cleaner operation.

The increasing demand for reliable power sources and growing infrastructure development activities are expected to drive growth in the diesel engine market throughout the forecast period.

Diesel Engine Market Dynamics

Growth Drivers

How is infrastructure development and industrialization driving the diesel engine market growth?

The diesel engine market is growing rapidly because expanding construction work, transport networks, and industrial facilities create steady demand for reliable power equipment supporting economic development across regions. Infrastructure upgrades in emerging economies require heavy machinery working in remote areas without stable grid connections, depending on diesel power for continuous operation. Road construction projects use excavators, bulldozers, graders, and compactors powered by diesel engines, performing well in tough terrain and harsh weather conditions, requiring dependable equipment. Bridge construction teams operate cranes, concrete mixers, and drilling rigs powered by diesel, offering mobility and freedom from fixed power sources during complex tasks.

Railway expansion programs deploy locomotives, track-laying machines, and maintenance vehicles using diesel engines, enabling long-distance operations across wide territories. Port development work uses cargo handlers, container cranes, and logistics vehicles powered by diesel systems, supporting trade and smooth cargo movement. Mining operations run haul trucks, excavators, drilling rigs, and processing machines on diesel fuel, working efficiently in isolated locations far from urban support.

Growing demand for backup power and off-grid solutions

The global diesel engine market is growing steadily as organizations use emergency power systems, ensuring business continuity and stable operations during grid failures and natural disasters disrupting essential infrastructure. Natural disasters, including hurricanes, earthquakes, floods, and severe storms, damage electrical networks, requiring backup power to support essential services until utilities restore normal supply. Grid instability in developing regions creates frequent interruptions, forcing businesses to install generators to maintain productivity and protect equipment during voltage fluctuations. Remote locations, including island communities, rural areas, and frontier regions, lack reliable grid access, requiring diesel generators to provide primary power for residential and commercial activities.

Military bases deploy mobile generators to support field operations, communication systems, and equipment charging in tactical situations that require dependable power sources. Construction sites use temporary power systems, enabling operations before permanent electrical connections become available, supporting equipment use, and project timelines. Event management companies employ portable generators powering concerts, festivals, sporting events, and temporary venues requiring flexible power for limited durations. These growing needs strengthen the importance of diesel engines as dependable power solutions across many critical applications.

Restraints

Environmental regulations and emission standards affecting market dynamics

The diesel engine market faces several restraints influencing growth across regions, as strict emission rules require costly after-treatment systems, including selective catalytic reduction, diesel particulate filters, and exhaust gas recirculation, thereby increasing design complexity for manufacturers. Air quality concerns in busy cities encourage policies restricting diesel vehicle movement and promoting cleaner options, reducing market opportunities across major transport applications. Particulate matter emissions create health concerns, linking diesel exhaust to respiratory issues and cardiovascular conditions, shaping negative public perception, and influencing user preferences.

Nitrogen oxide emissions contribute to smog formation and environmental damage, prompting regulators to introduce tighter limits requiring continuous technological upgrades. Fuel price fluctuations create cost uncertainties for businesses using diesel machinery, affecting purchase decisions and encouraging consideration of alternative power options. These challenges create steady pressure on the diesel engine market to adapt through cleaner technologies and more efficient power solutions.

Opportunities

How are emerging infrastructural investments expanding new opportunities for the diesel engine market?

The diesel engine industry is gaining strong growth opportunities as rapid economic development and rising infrastructure investment in developing countries create increasing demand for reliable power equipment supporting modernization goals across regions. Population growth across Africa, Asia, and Latin America increases electricity needs, requiring additional generation capacity where grid expansion cannot keep pace with rising consumption patterns. Rural electrification programs deploy distributed power systems, bringing electricity to remote communities using diesel generators as practical solutions until permanent infrastructure reaches underserved areas.

Industrialization drives factory construction, manufacturing facility expansion, and production capability improvement, requiring reliable power to support machinery operations and continuous workflows. Agricultural modernization replaces manual labor with mechanized tools, including tractors, harvesters, and irrigation systems powered by diesel engines, increasing productivity, supporting food security, and rural incomes. Manufacturing sector expansion establishes production plants, assembly units, and processing operations requiring backup power, protecting operations from frequent grid instabilities affecting developing regions. These opportunities reinforce the continued importance of diesel engines in growing economies.

Challenges

How is technological transition and alternative energy competition creating challenges for the diesel engine industry?

The diesel engine industry faces many obstacles as emerging technologies and environmental priorities shift market preferences toward cleaner alternatives, creating uncertainty for long-term demand and future investment decisions across global markets. Electric vehicle adoption grows quickly in the passenger car and light commercial segments, reducing diesel engine use in transportation applications that traditionally generate strong sales volumes. Battery technology improvements increase energy density, shorten charging times, and lower overall costs, making electric options more competitive in sectors previously dominated by diesel power.

Hydrogen fuel cell progress offers zero-emission solutions for heavy-duty trucks, buses, and industrial equipment, potentially replacing diesel engines in demanding applications. Research and development costs rise as manufacturers invest in emission-control systems, efficiency upgrades, and alternative-fuel compatibility to maintain competitiveness under strict regulations. Skilled workforce shortages challenge manufacturing operations and service networks as experienced technicians retire and younger workers show limited interest in combustion engine technologies.

Diesel Engine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Diesel Engine Market |

| Market Size in 2024 | USD 68.10 Billion |

| Market Forecast in 2034 | USD 128.80 Billion |

| Growth Rate | CAGR of 6.58% |

| Number of Pages | 212 |

| Key Companies Covered | Cummins Inc., Caterpillar Inc., Rolls-Royce Holdings plc, Volvo Group, Mitsubishi Heavy Industries Ltd., Wartsila Corporation, MAN Energy Solutions, Deutz AG, Yanmar Holdings Co. Ltd., Kirloskar Oil Engines Limited, and others. |

| Segments Covered | By Engine Type, By Power Output, By Speed, By Application, By End-User, By Fuel Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Diesel Engine Market: Segmentation

The global diesel engine market is segmented based on engine type, power output, speed, application, end-user, fuel type, and region.

Based on engine type, the global diesel engine industry is segregated into two-stroke and four-stroke. Four-stroke engines lead the market due to better fuel efficiency, lower emissions, wider application range, and established manufacturing infrastructure supporting diverse power requirements across industries.

Based on power output, the industry is divided into below 0.5 MW, 0.5 MW to 1 MW, 1 MW to 2 MW, 2 MW to 5 MW, and above 5 MW. The 0.5 MW to 1 MW segment leads the market due to its versatility, balanced performance characteristics, and widespread adoption in commercial and industrial backup power installations.

Based on speed, the global diesel engine market is segmented into low-speed, medium-speed, and high-speed. Medium-speed engines are expected to lead the market during the forecast period due to an optimal balance of efficiency and power density, suitability for marine propulsion, and industrial power generation applications.

Based on application, the global market is classified into power generation, marine, locomotive, mining, construction, agriculture, automotive, and others. Power generation holds the largest market share due to continuous electricity demand, grid reliability concerns, backup power requirements, and off-grid power needs across residential, commercial, and industrial sectors.

Based on end-user, the global market is categorized into industrial, commercial, and residential. Industrial holds the largest market share due to manufacturing facilities that require reliable power, heavy equipment operations, and continuous processes that support production activities.

Based on fuel type, the global market is classified into heavy fuel oil, light fuel oil, and diesel. Diesel holds the largest market share due to widespread availability, established distribution infrastructure, and compatibility with diverse engine designs serving multiple applications.

Diesel Engine Market: Regional Analysis

What factors are contributing to the Asia Pacific's dominance in the global diesel engine market?

Asia Pacific leads the diesel engine market because massive infrastructure expansion, rapid industrial growth, and rising energy needs create strong demand for power generation equipment and heavy machinery across many countries in the region. China supports significant construction activity through urban development projects, transport network expansion, and industrial facility growth, requiring large volumes of diesel-powered equipment to support national growth plans. India implements major infrastructure programs, including highway development, railway upgrades, port expansion, and urban renewal, creating steady demand for construction machinery and reliable power systems supporting project timelines. Manufacturing sector expansion builds production facilities, assembly plants, and processing units requiring backup power, protecting operations from grid issues and ensuring smooth workflows for businesses.

Mining activities extract coal, minerals, and raw materials requiring heavy equipment operating in remote areas, depending on diesel power for mobility and dependable functioning. Construction growth builds residential towers, commercial centers, and public facilities, generating demand for excavators, cranes, concrete mixers, and other diesel-powered machines supporting development work. Power generation needs exceed grid capacity in many regions, requiring distributed generation with diesel generators supplying electricity to communities and businesses facing unreliable grids. Marine shipping activity increases with regional trade growth, deploying cargo vessels, container ships, and bulk carriers powered by large diesel engines, supporting international commerce flows.

Railway networks expand across vast territories using diesel locomotives on routes where electrification remains impractical or economically difficult for long distances. Off-grid locations across island nations and remote areas rely on diesel generators for primary power when grid connections remain unavailable or are extremely costly to install. These factors collectively strengthen Asia Pacific’s position as the leading region in the diesel engine market.

North America maintains a substantial market presence.

North America maintains a strong position in the diesel engine market through established industrial strength, extensive infrastructure, and rising demand for backup power systems supporting business continuity and operational stability across the region. The United States operates many manufacturing facilities, data centers, healthcare institutions, and commercial buildings requiring emergency generators to protect operations during grid failures and severe natural events. The oil and gas industry uses diesel engines to power drilling rigs, pumping stations, and remote facilities in regions without grid access, supporting national energy production.

The agriculture sector relies on tractors, combines, and irrigation equipment across large farming regions where diesel engines provide dependable power for mechanized crop production and harvesting. The construction industry maintains steady demand for excavators, bulldozers, and other diesel-powered machinery supporting ongoing infrastructure work and building projects across multiple states. Mining operations extract resources, including coal, metals, and minerals, using heavy diesel-powered equipment in remote western locations. The transportation sector includes freight railways, which depend on diesel locomotives to move goods over long distances, where electrification remains impractical for many major routes.

Marine applications include fishing vessels, tugboats, and inland waterway transport using diesel engines, providing reliable propulsion for diverse maritime operations. Military bases deploy diesel generators supporting daily operations, field activities, and emergency preparedness, maintaining capability under varying conditions. Telecommunications networks require backup power to maintain tower operations and communication services during outages and emergencies. Regulatory framework balances emission limits with practical needs, allowing diesel engine use in applications where alternatives remain unsuitable or economically difficult.

Recent Market Developments

- In January 2025, Cummins Inc. launched its next-generation 6.7-liter turbo diesel engine for Ram Heavy Duty trucks, offering higher power, improved torque, and better driveability with an upgraded 8-speed transmission.

- In November 2025, Volvo Trucks introduced a new stop/start feature for its 13-liter diesel engines in FH and FH Aero trucks, helping reduce fuel use and emissions by shutting the engine during idling.

Diesel Engine Market: Competitive Analysis

The leading players in the global diesel engine market are:

- Cummins Inc.

- Caterpillar Inc.

- Rolls-Royce Holdings plc

- Volvo Group

- Mitsubishi Heavy Industries Ltd.

- Wartsila Corporation

- MAN Energy Solutions

- Deutz AG

- Yanmar Holdings Co. Ltd.

- Kirloskar Oil Engines Limited

The global diesel engine market is segmented as follows:

By Engine Type

- Two-Stroke

- Four-Stroke

By Power Output

- Below 0.5 MW

- 0.5 MW to 1 MW

- 1 MW to 2 MW

- 2 MW to 5 MW

- Above 5 MW

By Speed

- Low Speed

- Medium Speed

- High Speed

By Application

- Power Generation

- Marine

- Locomotive

- Mining

- Construction

- Agriculture

- Automotive

- Others

By End-User

- Industrial

- Commercial

- Residential

By Fuel Type

- Heavy Fuel Oil

- Light Fuel Oil

- Diesel

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed