Traction Control System Market Size, Share, Trends, Growth 2034

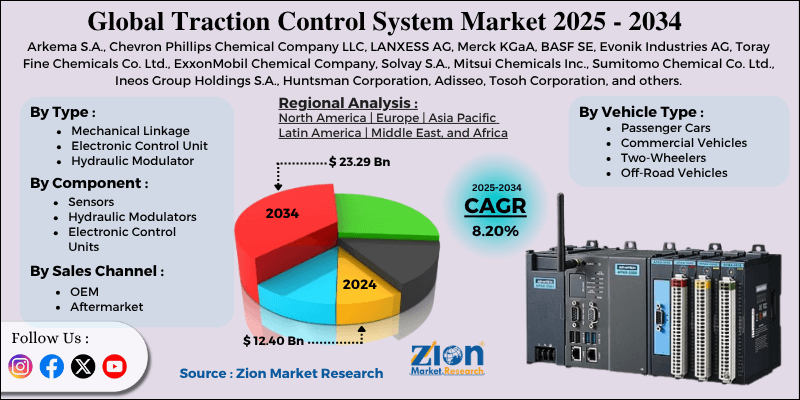

Traction Control System Market By Type (Mechanical Linkage, Electronic Control Unit, Hydraulic Modulator), By Component (Sensors, Hydraulic Modulators, Electronic Control Units, and Others), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Off-Road Vehicles), By Sales Channel (OEM, Aftermarket), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

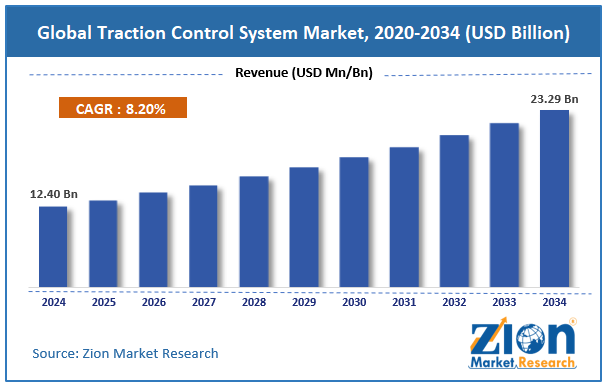

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.40 Billion | USD 23.29 Billion | 8.20% | 2024 |

Traction Control System Industry Perspective:

The global traction control system market size was approximately USD 12.40 billion in 2024 and is projected to reach around USD 23.29 billion by 2034, with a compound annual growth rate (CAGR) of approximately 8.20% between 2025 and 2034.

The report analyzes the global traction control system market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the retail earplugs industry.

Key Insights:

- As per the analysis shared by our research analyst, the global traction control system market is estimated to grow annually at a CAGR of around 8.20% over the forecast period (2025-2034)

- In terms of revenue, the global traction control system market size was valued at around USD 12.40 billion in 2024 and is projected to reach USD 23.29 billion by 2034.

- The traction control system market is projected to grow significantly due to increasing demand for luxury and premium vehicles, advancements in automotive electronics and sensors, and the integration of advanced driver-assistance systems (ADAS).

- Based on type, the electronic control unit segment is expected to lead the market, while the hydraulic modulator segment is expected to grow considerably.

- Based on component, the ‘electronic control units’ segment is the dominating segment, while the sensors segment is projected to witness sizeable revenue over the forecast period.

- Based on vehicle type, the passenger cars segment holds a leading share, while the commercial vehicles segment is projected to grow steadily over the coming years.

- Based on sales channel, the OEM segment is expected to lead the market compared to the aftermarket segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Traction Control System Market: Overview

A traction control system is an advanced safety feature in automobiles designed to prevent wheel slip and automatically adjust engine power or apply brakes to individual wheels when it senses a loss of grip. This improves vehicle control, stability, and performance. The global traction control system market is poised for significant growth, driven by the increasing demand for vehicle safety features, integration with advanced driver assistance systems, and the rising production of luxury and passenger vehicles. Consumers are actively prioritizing vehicle safety, driving the demand for technologies that enhance stability and reduce skidding. Traction control systems effectively manage traction in harsh terrain and weather conditions. The growing focus on occupant protection is driving broader adoption across all vehicle classes. TCS forms a vital component of ADAS, working continuously with ABS (Anti-Lock Braking Systems) and ESC (Electronic Stability Control). As the automotive sector inclines towards semi-autonomous and autonomous driving, TCS promises reliable traction management. Its integration with ADAS improves driving control and precision.

Moreover, the rise in worldwide passenger vehicle production, particularly in the premium and luxury segments, fuels the adoption of TCS. Consumers in these categories expect improved comfort, performance, and safety features to be standard. Manufacturers are hence equipping TCS in fresh models to maintain a competitive edge.

Nevertheless, the global market faces limitations due to factors such as the high cost of advanced safety systems and the complexity of integrating them with vehicle electronics. The inclusion of TCS adds substantial manufacturing costs because of its advanced electronic components. For price-sensitive markets, this cost intricacy restricts installation in entry-level models. Manufacturers experience pressure to balance safety integration and affordability.

Likewise, TCS should coordinate with multiple systems, such as ESC, ABS, and the powertrain, as design complexity rises. This integration requires rigorous testing and precise engineering, which increases development time. Any calibration mistake may compromise system performance, hindering adoption.

Still, the global traction control system industry benefits from several favorable factors, including the integration with hybrid and electric vehicles, as well as improvements in AI and sensor technologies. Hybrid and electric vehicles require precise traction control to manage energy distribution and deliver instant torque. TCS integration promises smooth acceleration and energy efficiency in these cars. As EV production increases, the demand for smart traction systems will also rise.

Additionally, next-generation sensors and AI-based predictive analytics improve TCS responsiveness. These systems can predict traction loss in advance, thereby enhancing overall driving safety and security. AI-based traction management denotes a new horizon in vehicle stability control.

Traction Control System Market Dynamics

Growth Drivers

How is the traction control system market fueled by the growth in premium and high-performance vehicle segments?

The luxury and high-performance automotive segment’s growth is another pivotal propeller in the traction control system market. Brands like Porsche, Mercedes-Benz, BMW, and Audi are integrating mature multi-mode traction control systems to improve performance on variable terrains. High-performance vehicles, which typically deliver 500+ horsepower, require precise wheel torque management, underscoring the importance of TCS as a standard feature. Additionally, motorsport solutions are now being incorporated into mass-market performance vehicles, enhancing the technological maturity of TCS.

How are technological improvements in automotive electronics and AI integration fueling the traction control system market?

Speedy improvements in microcontrollers, sensors, and artificial intelligence are revolutionizing the capabilities of TCS. The incorporation of AI-based predictive control algorithms allows real-time adjustments to enhance traction in complex driving scenarios. Companies such as Continental, Bosch, and ZF Friedrichshafen have introduced next-generation TCS modules that continuously interface with ABS and ADAS. These advancements are making TCS more adaptive, more intelligent, and integral to autonomous driving solutions.

Restraints

Dependence on road conditions and tire quality adversely impacts the market progress

Traction control systems are primarily dependent on the quality of the road surface, tire condition, and environmental factors for optimal performance. Slippery and uneven roads, as well as poor-quality tires, can compromise the efficiency of TCS, resulting in suboptimal performance. According to reports, more than 35% of accidents in developing regions are attributed to poor road infrastructure, which undermines the perceived reliability of advanced traction systems. Hence, consumer trust may be impacted, which in turn restricts the demand for high-end TCS in markets with poor road conditions.

Opportunities

How do technological improvements and smart features create advantageous conditions for the development of the traction control system market?

Innovations in AI, electronics, and sensor technologies are creating opportunities for next-generation traction control systems. Companies like Continental and ZF Friedrichshafen are developing predictive TCS that adjust torque in real-time depending on weather and road conditions. Integration with IoT systems and vehicle connectivity allows TCS to offer more innovative and adaptive safety solutions. Continuous advancements enable manufacturers to differentiate their products and capture premium market segments in the traction control system industry.

Challenges

Competition from alternative safety technologies restricts the market growth

TCS experiences intense competition from ADAS, ABS, and ESC features. As OEMs bundle multiple systems, TCS may be considered less important, mainly in standard vehicles. According to the 2025 reports, ADAS-equipped sales are expected to grow at a 14% CAGR, possibly overriding standalone traction control systems. This strong competition forces manufacturers to differentiate and innovate their offerings.

Traction Control System Market: Segmentation

The global traction control system market is segmented based on type, component, vehicle type, sales channel, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2023 to 2030.

Based on type, the global traction control system industry is divided into mechanical linkage, electronic control unit, and hydraulic modulator. The electronic control unit segment holds a substantial market share due to its real-time and precise traction management, as well as its continuous integration with modern vehicle safety systems.

On the other hand, the hydraulic modulator segment held the second position, as it effectively controls brake pressure to prevent wheel slip, thereby improving performance and stability.

Based on component, the global market is segmented into sensors, hydraulic modulators, electronic control units, and others. The ‘electronic control units’ segment dominates the market since it processes traction data in real-time and effectively coordinates all system components for the best vehicle stability.

Conversely, the sensors segment held a second-leading share since they offer crucial wheel-speed and traction information that facilitates accurate TCS operation.

Based on vehicle type, the global traction control system market is segmented into passenger cars, commercial vehicles, two-wheelers, and off-road vehicles. The passenger cars segment has held leadership since the growing consumer demand for safety features and regulatory mandates make TCS a standard offering in the segment.

Nonetheless, the commercial segment holds a second rank since TCS improves stability and traction for heavy loads, promising safer operation in transport and logistics applications.

Based on sales channel, the global market is segmented into OEM and aftermarket. The OEM segment is leading because TCS is primarily installed as a standard feature during vehicle manufacturing to meet consumer expectations and safety regulations.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa. this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

However, the aftermarket segment is expected to grow considerably, as retrofitting old vehicles with TCS kits offers additional safety upgrades, primarily for individual buyers and fleets.

Traction Control System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Traction Control System Market |

| Market Size in 2024 | USD 12.40 Billion |

| Market Forecast in 2034 | USD 23.29 Billion |

| Growth Rate | CAGR of 8.20% |

| Number of Pages | 212 |

| Key Companies Covered | Arkema S.A., Chevron Phillips Chemical Company LLC, LANXESS AG, Merck KGaA, BASF SE, Evonik Industries AG, Toray Fine Chemicals Co. Ltd., ExxonMobil Chemical Company, Solvay S.A., Mitsui Chemicals Inc., Sumitomo Chemical Co. Ltd., Ineos Group Holdings S.A., Huntsman Corporation, Adisseo, Tosoh Corporation, and others. |

| Segments Covered | By Type, By Component, By Vehicle Type, By Sales Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Traction Control System Market: Regional Analysis

What enables the Asia Pacific to have a strong foothold in the global Traction Control System Market?

Asia Pacific is projected to maintain its dominant position in the global traction control system market owing to the speedy growth in the passenger vehicle market, high adoption of ADAS, and rising production of electric and commercial vehicles. The APAC region has experienced notable growth in passenger vehicle sales, with economies such as India and China accounting for more than 50% of global vehicle production in recent years. Growing disposable income and rapid urbanization are fueling the demand for technologically advanced and safer vehicles.

Moreover, the region is rapidly adopting ADAS technologies, including TCS, as consumer awareness of safety increases. Regions like South Korea and Japan show ADAS penetration rates surpassing 40-50% in newer vehicles. TCS is typically integrated with ESC and ABS, thereby increasing its significance for modern vehicle safety systems. The APAC region leads in commercial vehicle production, particularly in China, India, and ASEAN nations, accounting for approximately 60% of the regional commercial vehicle count. The growth of EVs in China also requires advanced traction systems to effectively manage high torque outputs, reinforcing the demand for TCS.

Europe maintains its position as the second-largest region in the global traction control system industry, driven by strong vehicle safety regulations, high consumer awareness of vehicle safety, and a large passenger volume. Europe imposes some of the strictest automotive safety standards worldwide, comprising mandatory traction and stability control systems in new vehicles. Over 95% of newer vehicles sold in the EU in 2024 were embedded with ESC or TCS, according to the European Commission. These norms fuel high penetration of TCS in commercial and passenger vehicles in Europe.

Furthermore, European consumers prioritize vehicle safety, with surveys indicating that nearly 80% of consumers consider stability and traction systems essential factors in their purchasing decisions. Awareness of insurance benefits and the reduction of road accidents incentivize vehicle manufacturers to incorporate vehicles with TCS, thereby driving sustained market adoption.

Additionally, Europe boasts a sophisticated passenger car market, with economies such as France, Germany, and the UK collectively reporting yearly car sales exceeding 15 million units. Premium vehicles and SUVs, which dominate regional sales, are primarily equipped with TCS for enhanced handling. The combination of high vehicle volumes and the growth of the premium segment supports the demand for TCS.

Traction Control System Market: Competitive Analysis

The leading players in the global traction control system market are:

- Arkema S.A.

- Chevron Phillips Chemical Company LLC

- LANXESS AG

- Merck KGaA

- BASF SE

- Evonik Industries AG

- Toray Fine Chemicals Co. Ltd.

- ExxonMobil Chemical Company

- Solvay S.A.

- Mitsui Chemicals Inc.

- Sumitomo Chemical Co. Ltd.

- Ineos Group Holdings S.A.

- Huntsman Corporation

- Adisseo

- Tosoh Corporation

Traction Control System Market: Key Market Trends

Technological advancements in control units and sensors:

Advancements in wheel-speed sensors, predictive algorithms, and ECUs are enhancing TCS responsiveness and reliability. Machine learning and AI are being applied to predict traction loss and improve real-time performance. These innovations make TCS more effective and cost-efficient.

Integration with Advanced Driver Assistance Systems (ADAS):

TCS is primarily integrated with ADAS features, including adaptive cruise control, lane-keeping assist, and electronic stability control. This integration improves overall vehicle safety and driving comfort. Automobile manufacturers are prioritizing these systems to meet the rising demand for safer and smarter vehicles.

The global traction control system market is segmented as follows:

By Type

- Mechanical Linkage

- Electronic Control Unit

- Hydraulic Modulator

By Component

- Sensors

- Hydraulic Modulators

- Electronic Control Units

- Others

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Off-Road Vehicles

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A traction control system is an advanced safety feature in automobiles designed to prevent wheel slip and automatically adjust engine power or apply brakes to individual wheels when it senses a loss of grip. This improves vehicle control, stability, and performance.

The global traction control system market is projected to grow due to rising vehicle safety regulations, the increase in hybrid and electric vehicle adoption, and the growth of autonomous and connected vehicles.

According to study, the global traction control system market size was worth around USD 12.40 billion in 2024 and is predicted to grow to around USD 23.29 billion by 2034.

The CAGR value of the traction control system market is expected to be approximately 8.20% from 2025 to 2034.

Emerging trends include integration with ADAS, AI-driven predictive traction control, and enhanced sensor and ECU technologies, all aimed at creating safer and smarter vehicles.

The value chain of the TCS industry includes component manufacturers (sensors, ECUs, hydraulic modulators), raw material suppliers, OEMs, system integrators, distributors/dealers, and aftermarket service providers.

Asia Pacific is expected to lead the global traction control system market during the forecast period.

The key players profiled in the global traction control system market include Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Hitachi Automotive Systems Ltd., WABCO Holdings Inc., Nissin Kogyo Co., Ltd., Hyundai Mobis Co., Ltd., Autoliv Inc., Delphi Technologies, Magneti Marelli S.p.A., Mando Corporation, Johnson Electric Holdings Limited, Infineon Technologies AG, and Texas Instruments Incorporated.

Investment opportunities exist in EV-specific TCS development, OEM-tech collaborations, aftermarket retrofitting, sensor/ECU partnerships, and expansion into emerging markets.

The report examines key aspects of the traction control system market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed