Automotive Fuel Cell Market Size, Share, Trends, Growth & Forecast 2034

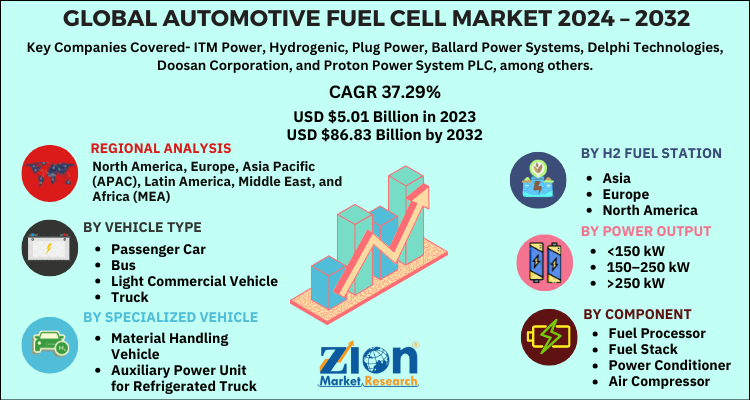

Automotive Fuel Cell Market By Fuel Cell Type (Direct Methanol Fuel Cells, Hydrogen, Ethanol, and Polymer Electrolyte Membrane Fuel Cells), By Power Output (100 kW, 100 - 200 kW, > 200 kW), By Application (Passenger Cars, Commercial Vehicle, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.06 Billion | USD 115.50 Billion | 41.81% | 2024 |

Automotive Fuel Cell Industry Perspective:

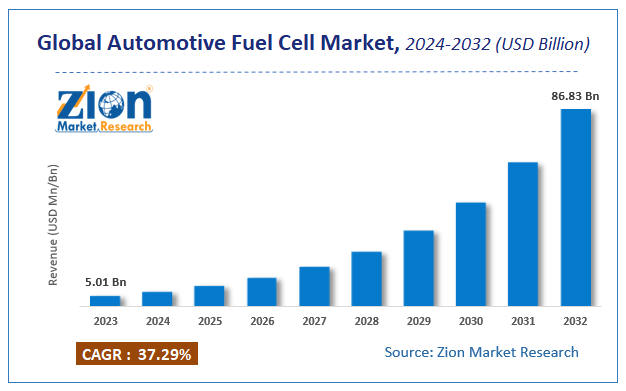

The global automotive fuel cell market size was worth around USD 7.06 billion in 2024 and is predicted to grow to around USD 115.50 billion by 2034, with a compound annual growth rate (CAGR) of roughly 41.81% between 2025 and 2034.

Automotive Fuel Cell Market: Overview

Automotive fuel cells generate electricity through an electrochemical reaction between oxygen and hydrogen, emitting only water as a byproduct. Fuel cell EVs offer long driving ranges, reduced greenhouse gas emissions, and refueling times as compared to regular internal combustion engines. The global automotive fuel cell market is likely to expand rapidly, driven by strict emission regulations, decarbonization and net-zero targets, and advancements in fuel cell technologies. Global emission regulations are becoming more stringent, forcing automakers to adopt clean technologies. Fuel cell vehicles release only water vapor, increasing their prominence under these policies.

Regulatory mandates like U.S. CAFÉ regulations and Euro 7 standards are major growth propellers. Governments are aligning their transport policies with carbon neutrality targets and climate goals. Economies like South Korea, Germany, and Japan are prioritizing hydrogen-powered mobility. This alignment amplifies research and development investments and industry-wide use of fuel cell vehicles. Furthermore, continuous advancements are improving the lifespan and efficacy of fuel cell stacks. Manufacturers are working on enhancing durability and reducing platinum use. These innovations make fuel cell systems cost-efficient and attractive for commercial production.

Despite the growth, the global market is impeded by factors such as a limited hydrogen refueling ecosystem and hydrogen storage and distribution challenges. Hydrogen stations are concentrated in specific regions, limiting accessibility. Developing nations have no or minimal infrastructure in place. This lack of availability deters consumers from preferring fuel cell vehicles. Also, hydrogen requires cryogenic or high-pressure storage tanks, which increases the complexity of logistics. Distributing and transporting hydrogen contribute to safety risks and costs. These intricacies make the scale hydrogen supply chain complex.

Nonetheless, the global automotive fuel cell industry stands to gain from a few key opportunities, like growth in green hydrogen production and heavy-duty vehicle applications. Green hydrogen, generated through renewable energy, promises sustainability. Dropping costs of wind and solar power are fueling this transition. A large-scale transition to green hydrogen will open plenty of opportunities for fuel cell electric vehicles. Fuel cells are ideal for buses, trucks, and long-haul transport. These vehicles require fast refueling and long ranges, which is where batteries may fall short. This segment could spur the global industry growth.

Key Insights:

- As per the analysis shared by our research analyst, the global automotive fuel cell market is estimated to grow annually at a CAGR of around 41.81% over the forecast period (2025-2034)

- In terms of revenue, the global automotive fuel cell market size was valued at around USD 7.06 billion in 2024 and is projected to reach USD 115.50 billion by 2034.

- The automotive fuel cell market is projected to grow significantly owing to increasing investments in fuel cell research and development, surging adoption of commercial fuel cell vehicles, and government subsidies and incentives for clean mobility.

- Based on fuel cell type, the polymer electrolyte membrane fuel cells segment is expected to lead the market, while the hydrogen segment is expected to grow considerably.

- Based on power output, the 100 – 200 kW segment is the dominating segment, while the > 200 kW segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the passenger cars segment is expected to lead the market compared to the commercial vehicle segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Automotive Fuel Cell Market: Growth Drivers

How are corporate commitments and collaborations fueling the automotive fuel cell market growth?

Energy companies and automakers are broadly partnering on fuel cell programs. Hyundai, Toyota, BMW, and Honda are scaling research and development investments, while companies like BP, Shell, and Sinopec are investing in hydrogen fueling infrastructure. BMW declared joint development of hydrogen vehicles with Toyota in 2023, aiming for pilot fleets by 2025. Likewise, General Motors partnered with Navistar to deploy 2,000 hydrogen trucks, which were then acquired by J.B. Hunt Transport. These collaborations boost commercialization by assimilating OEM expertise with the energy infrastructure provider's reach.

ESG and environmental pressures spur the market growth

Growing focus on ESG goals and sustainability is fueling government and corporations towards hydrogen adoption, contributing to the growth of the automotive fuel cell market. Fuel cells emit only water vapor, increasing their preference for economies seeking net-zero emissions by 2050. The World Economic Forum projected in 2023 that hydrogen may cut 6% of worldwide emissions by 2050, if scaled efficiently. Fleet operators like DHL and Amazon are already testing hydrogen-powered trucks to meet sustainability initiatives. With investors prioritizing green solutions, fuel-cell solutions are receiving increased funding as part of global ESG transitions.

Automotive Fuel Cell Market: Restraints

Durability and performance limitations in real-world conditions negatively impact market progress

Though fuel cell technology has modernized, challenges prevail in system durability, performance, and efficiency under varied operation conditions. Heavy-duty applications demand stacks lasting more than 30,000-40,000 hours, but present systems usually fall short, mainly in extreme climates. Cold-start capability below -20°C, vibration resistance, and high humidity tolerance are ongoing engineering barriers. Toyota and Hyundai launched updated stacks in 2023-2024, resolving durability issues, but warranty costs are still hindering scaling. Without low replacement costs and longer lifetimes, fleet operators hesitate to invest extensively.

Automotive Fuel Cell Market: Opportunities

How do collaborations with renewable hydrogen and green energy investments offer advantageous conditions for automotive fuel cell market development?

As renewable energy increases, green hydrogen production becomes more cost-efficient, offering a clean fuel source for fuel cell electric vehicles. The global electrolyzer capacity surpassed 1 GW in 2023 and is anticipated to reach 134 GW by 2030, according to IEA. Nations like the UAE, Australia, and Saudi Arabia are investing billions in hydrogen exports, some reserved for mobility. These investments stabilize supply chains and help lower costs for fuel cell transportation, thereby impacting the growth of the automotive fuel cell industry.

Automotive Fuel Cell Market: Challenges

How do performance issues and technical durability hamper the automotive fuel cell market?

Fuel cell systems are still experiencing challenges, especially in efficiency, durability, and cold-weather operation. Heavy-duty fleets require 30,000-40,000 hours of stack life, yet most current systems fall short. Cold-start below –20°C and stack degradation under vibration-heavy conditions are some key concerns. Hyundai’s early 2024 update of its Nexo underscored durability enhancements, but industry analysts still mark replacement stacks may cost >$30,000, restricting confidence of the fleet operator.

Automotive Fuel Cell Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Automotive Fuel Cell Market |

| Market Size in 2024 | USD 7.06 Billion |

| Market Forecast in 2034 | USD 115.50 Billion |

| Growth Rate | CAGR of 41.81% |

| Number of Pages | 221 |

| Key Companies Covered | Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co. Ltd., General Motors (GM), Daimler AG (Mercedes-Benz), BMW Group, Nikola Corporation, Ballard Power Systems, Plug Power Inc., Bloom Energy, Horizon Fuel Cell Technologies, Intelligent Energy, PowerCell Sweden AB, Cummins Inc., Symbio Fuel Cell Systems, and others. |

| Segments Covered | By Fuel Cell Type, By Power Output, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Automotive Fuel Cell Market: Segmentation

The global automotive fuel cell market is segmented based on fuel cell type, power output, application, and region.

Based on fuel cell type, the global automotive fuel cell industry is divided into direct methanol fuel cells, hydrogen fuel cells, ethanol fuel cells, and polymer electrolyte membrane fuel cells. The polymer electrolyte membrane fuel cells segment held a dominating share of the market owing to their high power density and compact design. They operate at comparatively low temperatures, increasing their suitability for buses, cars, and heavy-duty trucks. Their adaptability to changing power demand and fast start-up capability make them suitable for on-road applications. Backed by government incentives and robust research and development investments, PEM fuel cells have become widely commercialized fuel cell types in the automotive sector globally.

Based on power output, the global automotive fuel cell market is segmented into 100 kW, 100 – 200 kW, and > 200 kW. The 100-200 kW fuel cell segment holds leadership in the market since it is highly suitable for passenger cars, light commercial vehicles, and SUVs. This range offers the right balance of cost-efficiency and power, satisfying the mobility needs of intercity and urban transportation. Automakers like Honda, Hyundai, and Toyota predominantly use this output range in their FC models. Rising consumer adoption and government-based fleet programs strengthen its industry prominence.

Based on application, the global market is segmented into passenger cars, commercial vehicles, and others. The passenger cars segment captured the maximum market share due to strong adoption by consumers in APAC, especially in South Korea and Japan. Models like Hyundai NEXO and Toyota Mirai have promoted fuel cell technology for everyday mobility. Their long driving range, zero emissions, and quick refueling time make them a suitable attraction to battery EVs. Purchase subsidies, supportive policies, and expanding hydrogen refueling stations continue to drive prominence.

Automotive Fuel Cell Market: Regional Analysis

Why does Asia Pacific hold a dominant position in the global Automotive Fuel Cell Market?

Asia Pacific is anticipated to retain its leading role in the global automotive fuel cell market as a result of robust government incentives and policies, strong hydrogen infrastructure development, and growing adoption in public transport fleets. Asia Pacific economies, particularly South Korea, China, and Japan, have introduced ambitious roadmaps. Japan aims to have nearly 800,000 fuel cell vehicles by 2030, while South Korea aims to have 200,000 hydrogen cars by 2025. Tax benefits, subsidies, and national hydrogen strategies make the region a forerunner in adoption. The area ranks highest in hydrogen refueling station installation, promising consumer confidence.

In 2023, Japan operated over 160 stations, while South Korea installed more than 120 stations across the nation. China is also scaling hydrogen corridors to boost the deployment of heavy-duty fuel cell electric vehicles. Moreover, governments in Japan, South Korea, and China are speedily installing fuel cell trucks and buses. China alone held more than 12,000 hydrogen fuel cell vehicles on the road by 2022, with aggressive plans for growth. These large-scale deployments strengthen APAC's dominance and create robust demand.

Europe ranks as the second-leading region in the global automotive fuel cell industry, driven by the growth of the hydrogen refueling ecosystem, adoption in public transport and commercial fleets, and the presence of automotive players and leading fuel cell companies. Europe is speedily scaling hydrogen stations, led by France, Germany, and the United Kingdom. Germany alone held more than 90 public hydrogen refueling stations, the highest in the region, in 2023. The EU's Alternative Fuels Infrastructure Regulation mandates a hydrogen station every 200 km along significant transport corridors by 2030. Fuel cell trucks and buses are gaining prominence in the key cities of the region.

Additionally, fuel cell trucks and buses are gaining prominence in European cities. For instance, Europe deployed more than 2,000 hydrogen buses by 2022 through initiatives like the JIVE project. A massive investment in decarbonizing freight transport is also driving the demand. Europe also houses automakers like Renault, BMW, and Daimler Truck, all of which are improving fuel cell vehicle programs. Daimler Truck is partnering with Volvo to commercialize fuel-cell-powered heavy trucks by 2030. These initiatives place Europe at the top rank in hydrogen mobility advancement.

Automotive Fuel Cell Market: Competitive Analysis

The leading players in the global automotive fuel cell market are:

- Toyota Motor Corporation

- Hyundai Motor Company

- Honda Motor Co. Ltd.

- General Motors (GM)

- Daimler AG (Mercedes-Benz)

- BMW Group

- Nikola Corporation

- Ballard Power Systems

- Plug Power Inc.

- Bloom Energy

- Horizon Fuel Cell Technologies

- Intelligent Energy

- PowerCell Sweden AB

- Cummins Inc.

- Symbio Fuel Cell Systems

Automotive Fuel Cell Market: Key Market Trends

Rapid expansion of hydrogen refueling infrastructure:

Global investments are increasing in fueling networks and hydrogen corridors. By 2023, there were more than 1,000 hydrogen stations across the globe, led by APAC and Europe. Infrastructure growth is vital to consumer adoption and is now prioritized in government roadmaps.

Rising investments in green hydrogen production:

Green hydrogen, generated from renewable energy, is gaining prominence as the favored fuel for sustainable mobility. Japan, China, and the EU have declared billion-dollar projects to scale green hydrogen capacity. This move promises long-term sustainability and decreases reliance on fossil-based hydrogen.

The global automotive fuel cell market is segmented as follows:

By Fuel Cell Type

- Direct Methanol Fuel Cells

- Hydrogen

- Ethanol

- Polymer Electrolyte Membrane Fuel Cells

By Power Output

- 100 kW

- 100 – 200 kW

- > 200 kW

By Application

- Passenger Cars

- Commercial Vehicle

- Others

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Automotive fuel cells generate electricity through an electrochemical reaction between oxygen and hydrogen, emitting only water as a byproduct. Fuel cell EVs offer long driving ranges, reduced greenhouse gas emissions, and refueling times as compared to regular internal combustion engines.

The global automotive fuel cell market is projected to grow due to supportive regulatory frameworks for sustainable transport, rising demand for zero-emission vehicles, and the expansion of hydrogen refueling stations.

According to study, the global automotive fuel cell market size was worth around USD 7.06 billion in 2024 and is predicted to grow to around USD 115.50 billion by 2034.

The CAGR value of the automotive fuel cell market is expected to be around 41.81% during 2025-2034.

Market trends are shifting toward heavy-duty fuel cell vehicles, wider hydrogen infrastructure development, and green hydrogen integration. Consumer preferences are evolving toward quick-refueling, long-range, zero-emission cars as alternatives to battery-electric and conventional options.

Technological advancements are improving durability, fuel cell efficiency, and reducing reliance on expensive materials like platinum. These innovations are enhancing performance and lowering costs, making fuel cell vehicles more commercially viable.

Strict emission regulations, government-backed hydrogen policies, and net-zero carbon targets are surging the adoption of fuel cell vehicles. Environmental concerns over fossil fuel dependence and air pollution further augment the market growth.

Europe is expected to lead the global automotive fuel cell market during the forecast period.

The key players profiled in the global automotive fuel cell market include Toyota Motor Corporation, Hyundai Motor Company, Honda Motor Co., Ltd., General Motors (GM), Daimler AG (Mercedes-Benz), BMW Group, Nikola Corporation, Ballard Power Systems, Plug Power Inc., Bloom Energy, Horizon Fuel Cell Technologies, Intelligent Energy, PowerCell Sweden AB, Cummins Inc., and Symbio Fuel Cell Systems.

The report examines key aspects of the automotive fuel cell market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed