Self Driving Truck Technology Market Size & Forecast Report 2034

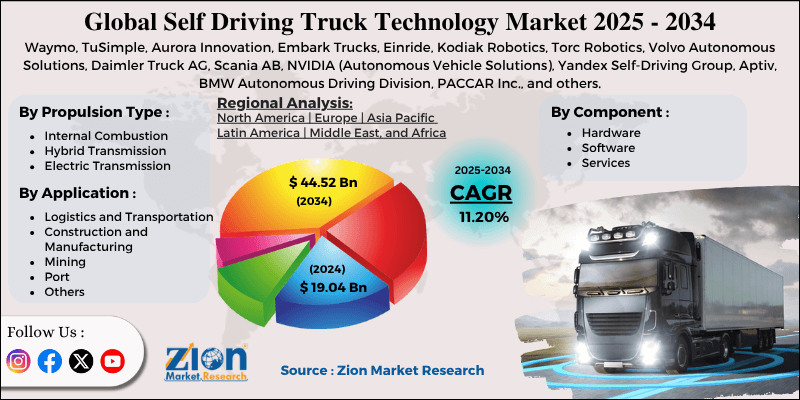

Self Driving Truck Technology Market By Propulsion Type (Internal Combustion, Hybrid Transmission, and Electric Transmission), By Component (Hardware, Software, Services), By Application (Logistics and Transportation, Construction and Manufacturing, Mining, Port, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

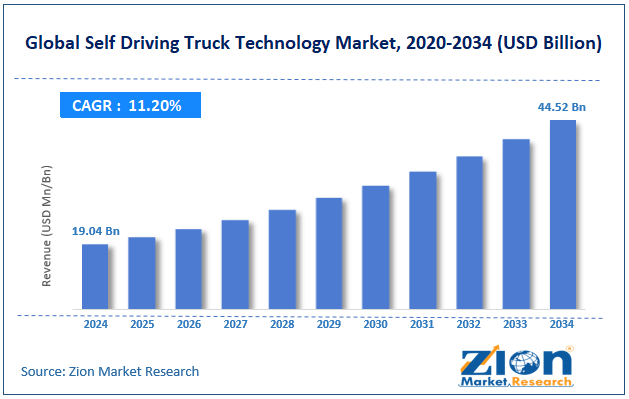

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 19.04 Billion | USD 44.52 Billion | 11.20% | 2024 |

Self Driving Truck Technology Industry Perspective:

The global self driving truck technology market size was around USD 19.04 billion in 2024 and is projected to reach USD 44.52 billion by 2034, with a compound annual growth rate (CAGR) of roughly 11.20% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global self driving truck technology market is estimated to grow annually at a CAGR of around 11.20% over the forecast period (2025-2034)

- In terms of revenue, the global self driving truck technology market was valued at around USD 19.04 billion in 2024 and is projected to reach USD 44.52 billion by 2034.

- The self-driving truck technology market is projected to grow significantly owing to improvements in machine learning, AI, and sensor technologies, increased investments by tech companies and OEMs in autonomous trucking, and the growth of e-commerce and last-mile delivery services.

- Based on propulsion type, the internal combustion segment is expected to lead the market, while the electric transmission segment is expected to grow considerably.

- By component, the hardware segment is the dominant, while the software segment is projected to record sizeable revenue over the forecast period.

- Based on application, the logistics and transportation segment is expected to lead the market, followed by construction and manufacturing

- .

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Self Driving Truck Technology Market: Overview

Self-driving truck technology refers to the development and deployment of autonomous trucks capable of operating on logistics and highway routes with minimal or no human intervention. These trucks use a group of advanced sensors, ML, AI, and GPS systems to navigate, optimize driving routes, and detect barriers. The global self driving truck technology market is poised for notable growth, driven by rising demand for efficient freight transport, driver shortages in the trucking industry, and operational cost reductions. The development of global trade and e-commerce is increasing the burden on logistics networks to deliver faster. Self-driving trucks can operate continuously without fatigue, enabling timely shipments. This efficiency decreases barriers in supply chains and enhances total productivity.

Moreover, the trucking industry faces chronic driver shortages, particularly in Europe and North America. Autonomous trucks offer a solution by decreasing dependency on human drivers. This promises continuous fleet operations despite labor constraints. Furthermore, autonomous trucks help cut operational costs through optimized driving and low fuel consumption. They also reduce human error and associated accident costs. Overall, fleets become more profitable and economical.

Nevertheless, the global market faces limitations, including high initial investment costs and legal and regulatory challenges. Developing and deploying autonomous trucks requires major capital for R&D, software, and sensors. Mid-sized and small logistics companies may struggle to invest. This slows large-scale adoption despite technological readiness. The lack of a seamless international standard and liability framework creates uncertainty. Accident responsibility and insurance issues are the leading concerns. This legal complexity may delay the commercialization of self-driving trucks.

Still, the global self driving truck technology industry benefits from several favorable factors, such as collaborations between tech companies and OEMs, integration with Electric truck fleets, and the development of mobility-as-a-service (MaaS) for freight. Associations between truck manufacturers and software/AI companies can accelerate advancement. Joint ventures enable faster integration of self-driving systems. This cooperation decreases development costs and reduces time-to-market. Assimilating self-driving technology with electric trucks improves sustainability. Fleet operators benefit from environmental compliance and reduced fuel costs. This dual benefit draws investment in green logistics solutions. Additionally, autonomous trucks can power on-demand freight services, enhancing fleet utilization. Logistics companies can offer scalable and flexible delivery solutions. MaaS models create new revenue streams while optimizing resources.

Self Driving Truck Technology Market Dynamics

Growth Drivers

How is cost reduction in freight transportation driving the self driving truck technology market?

Self-driving trucks offer significant long-term cost savings by decreasing fuel consumption, insurance premiums, and labor costs. According to a 2024 Frost & Sullivan report, autonomous trucks may reduce total freight operational costs by 15-25% compared to traditional trucking. Daimler Trucks disclosed a pilot in Germany in which self-driving trucks achieved fuel savings of nearly 10% through optimized driving patterns. These financial incentives make autonomous solutions appealing to the large fleet operators seeking ways to improve profit margins in a competitive logistics industry.

How are technological improvements in AI and Sensor Technologies fueling the self driving truck technology market?

Recent technological innovations in LiDAR, computer vision, artificial intelligence, and radar are the leading drivers of autonomous trucking adoption, fueling the global self driving truck technology market. AI algorithms now enable trucks to predict traffic patterns, detect barriers, and make real-time navigation decisions with great accuracy. Companies like NVIDIA and Waymo are actively deploying AI-powered platforms for commercial trucks. News from 2025 underscores that Waymo's AI-powered fleet has completed more than 1 million miles of autonomous testing without major incidents, indicating a surge in technological maturity.

Restraints

Safety and cybersecurity concerns negatively impact the market progress

Safety remains a key constraint due to the risk of accidents caused by software malfunctions, extreme weather, and sensor failures. Autonomous trucks are also susceptible to cyberattacks, which may hamper logistics operations or compromise sensitive cargo data. Incidents involving semi-autonomous vehicles increased by 8% in 2024 compared to 2023, according to the U.S. National Highway Traffic Safety Administration (NHTSA). Recent news reported a ransomware attack targeting a European autonomous trucking company, halting its deliveries temporarily. These security and safety risks make companies cautious about full-scale deployment.

Opportunities

How is rising investment and venture funding opening lucrative opportunities for the self driving truck technology industry?

Worldwide investment in autonomous trucking startups continues to increase, facilitating commercialization and technology advancement. Funding reached USD 2.3 billion in 2024, a 28% increase from 2023, according to Crunchbase. Embark Trucks and Aurora Innovation received multi-million-dollar investments in early 2025 to expand their autonomous freight networks. These capital inflows accelerate research and development, fleet deployment, and growth of the self driving truck technology industry, creating lucrative opportunities for logistics operators and technology providers.

Challenges

The complexity of mixed-traffic environments restricts the market growth

Autonomous trucks experience difficulties in mixed-traffic conditions with human-driven vehicles, cyclists, and pedestrians. According to a 2024 U.S. Department of Transportation study, over 65% of testing incidents happened in complex suburban or urban environments. Aurora Innovation acknowledged delays in deploying trucks in urban traffic due to unpredictable road-user behavior. Navigating these mixed environments is still a significant operational and technological challenge for broader adoption.

Self Driving Truck Technology Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Self Driving Truck Technology Market |

| Market Size in 2024 | USD 19.04 Billion |

| Market Forecast in 2034 | USD 44.52 Billion |

| Growth Rate | CAGR of 11.20% |

| Number of Pages | 216 |

| Key Companies Covered | Waymo, TuSimple, Aurora Innovation, Embark Trucks, Einride, Kodiak Robotics, Torc Robotics, Volvo Autonomous Solutions, Daimler Truck AG, Scania AB, NVIDIA (Autonomous Vehicle Solutions), Yandex Self-Driving Group, Aptiv, BMW Autonomous Driving Division, PACCAR Inc., and others. |

| Segments Covered | By Propulsion Type, By Component, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Self Driving Truck Technology Market: Segmentation

The global self driving truck technology market is segmented based on propulsion type, component, application, and region.

Based on propulsion type, the global self driving truck technology industry is divided into internal combustion, hybrid transmission, and electric transmission. The internal combustion segment leads the market due to its well-established infrastructure and broader availability. They offer long operational range and high payload capacity, making them ideal for long-haul logistics. Despite growing environmental concerns, they remain the cost-effective option for several fleet operators.

Based on component, the global self driving truck technology market is segmented into hardware, software, and services. The hardware segment holds a leading market share, as self-driving trucks rely heavily on cameras, radar, LiDAR, computing units, and sensors for autonomous operations. Investing in high-quality hardware ensures navigation accuracy, safety, and reliability. The upfront cost of hardware makes it a significant contributor to industry revenue.

Based on application, the global market is segmented into logistics and transportation, construction and manufacturing, mining, port, and others. The logistics and transportation segment holds a dominant market share, driven by growing demand for long-haul freight efficiency and e-commerce deliveries. Self-driving trucks allow 24/7 operations, low transportation costs, and reduced labor dependency. This sector registers the highest adoption, driven by high shipment volumes and established road networks.

Self Driving Truck Technology Market: Regional Analysis

Why is North America outperforming other regions in the global Self Driving Truck Technology Market?

North America is projected to maintain its dominant position in the global self driving truck technology market owing to early adoption of autonomous truck technology, well-developed road infrastructure, and high logistics and freight demand. North America has been a leader in autonomous vehicle research and testing, with companies like TuSimple, Aurora, and Waymo conducting extensive pilot programs. Early adoption has created a strong industry infrastructure for self-driving trucks. This head start adds to an increase in market share over other regions. Canada and the United States have extensive highway networks and advanced road infrastructure suitable for long-haul self-driving trucking. Well-maintained and smooth roads reduce operational challenges for self-driving trucks. According to the American Transportation Research Institute, more than 75% of freight routes run on major highways, favoring autonomous deployment.

Moreover, North America has the largest freight and logistics industry worldwide, with the United States trucking industry alone moving more than 70% of total freight by weight. The demand for faster, more reliable, and cost-efficient deliveries is driving the adoption of autonomous trucking solutions.

Europe maintains its position as the second-largest region in the global self driving truck technology industry, driven by strong government support and regulations, advanced logistics infrastructure, and the presence of major technology and automotive players. European nations, comprising the Netherlands, Sweden, and Germany, have adopted supportive regulations and pilot programs for autonomous trucks. The European Commission's 'Connected and Automated Mobility' initiative backs testing and deployment. Regulatory support is motivating companies to invest in autonomous trucking solutions in the region. The region also has a well-maintained, dense road network, primarily for cross-border freight corridors. Smart traffic systems and highways facilitate the efficient and safe operation of autonomous trucks.

According to Eurostat, more than 60% of European freight transport occurs on well-connected highways, aiding the adoption. Furthermore, the leading truck manufacturers, such as Volvo, Daimler, MAN, and Scania, have headquarters in Europe, and several others are actively investing heavily in autonomous technology. Associations with sensor technology and AI companies fuel advancement. This industrial infrastructure enhances the region's standing as a leader in self-driving trucking.

Self Driving Truck Technology Market: Competitive Analysis

The leading players in the global self driving truck technology market are:

- Waymo

- TuSimple

- Aurora Innovation

- Embark Trucks

- Einride

- Kodiak Robotics

- Torc Robotics

- Volvo Autonomous Solutions

- Daimler Truck AG

- Scania AB

- NVIDIA (Autonomous Vehicle Solutions)

- Yandex Self-Driving Group

- Aptiv

- BMW Autonomous Driving Division

- PACCAR Inc.

Self Driving Truck Technology Market: Key Market Trends

Shift toward electric and sustainable fleets:

Manufacturers are integrating self-driving technology into electric trucks to reduce emissions and comply with environmental regulations. Electric self-driving trucks reduce operating costs and fuel dependency. This trend aligns with green logistics goals and global sustainability initiatives.

Platooning and connected fleet operations:

Truck platooning, where multiple autonomous trucks travel closely together, is gaining prominence to reduce congestion and enhance fuel efficiency. Connected fleet systems allow real-time monitoring and coordinated operations. This trend enhances logistics and lowers transportation costs.

Expansion of pilot programs and commercial deployments:

Companies are moving from testing to real-world deployments in e-commerce, logistics, and long-haul freight. Pilot programs in Europe and North America are increasingly demonstrating commercial viability. This trend signals faster adoption and global industry growth.

The global self driving truck technology market is segmented as follows:

By Propulsion Type

- Internal Combustion

- Hybrid Transmission

- Electric Transmission

By Component

- Hardware

- Software

- Services

By Application

- Logistics and Transportation

- Construction and Manufacturing

- Mining

- Port

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Self-driving truck technology refers to the development and deployment of autonomous trucks capable of operating on logistics and highway routes with minimal or no human intervention. These trucks use a group of advanced sensors, ML, AI, and GPS systems to navigate, optimize driving routes, and detect barriers.

The global self driving truck technology market is projected to grow due to rising demand for autonomous logistics and freight transport, the global shortage of professional truck drivers, and enhanced safety features that reduce accidents and human error.

According to study, the global self driving truck technology market size was worth around USD 19.04 billion in 2024 and is predicted to grow to around USD 44.52 billion by 2034.

The CAGR value of the self driving truck technology market is expected to be around 11.20% during 2025-2034.

Significant challenges restraining the self-driving truck technology market include high costs, cybersecurity risks, regulatory hurdles, technological limitations in complex environments, and public trust issues.

Technological advancements in sensors, AI, vehicle-to-everything (V2X) communication, and LiDAR are enhancing navigation, safety, and operational efficiency, thereby accelerating adoption and market growth.

North America is expected to lead the global self driving truck technology market during the forecast period.

The United States is a key contributor to the global self-driving truck technology market due to advanced infrastructure, early adoption, and a strong presence of leading technology companies.

The key players profiled in the global self driving truck technology market include Waymo, TuSimple, Aurora Innovation, Embark Trucks, Einride, Kodiak Robotics, Torc Robotics, Volvo Autonomous Solutions, Daimler Truck AG, Scania AB, NVIDIA (Autonomous Vehicle Solutions), Yandex Self-Driving Group, Aptiv, BMW Autonomous Driving Division, and PACCAR Inc.

The report examines key aspects of the self driving truck technology market, including a detailed analysis of existing growth factors and restraints, as well as future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed