In Plant Logistics Market Size, Share, Trends, Growth & Forecast 2034

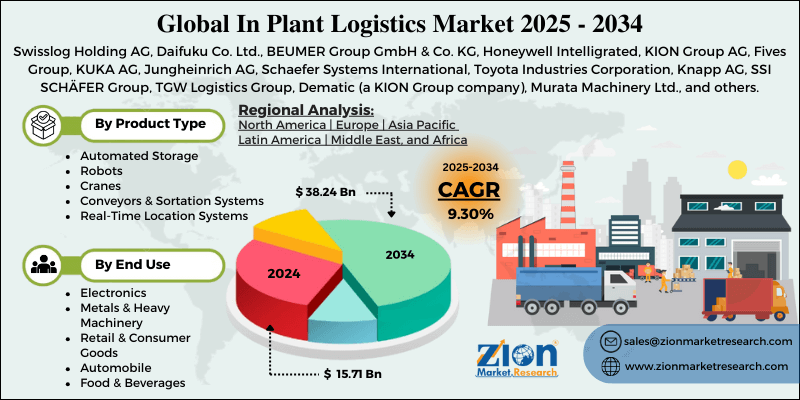

In Plant Logistics Market By Product Type (Automated Storage, Robots, Cranes, Conveyors & Sortation Systems, Real-Time Location Systems, Warehouse Management Systems (WMS), Automated Guided Vehicles (AGVs), and Automated Storage & Retrieval Systems), By End-User Industry (Electronics, Metals & Heavy Machinery, Retail & Consumer Goods, Automobile, Food & Beverages, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

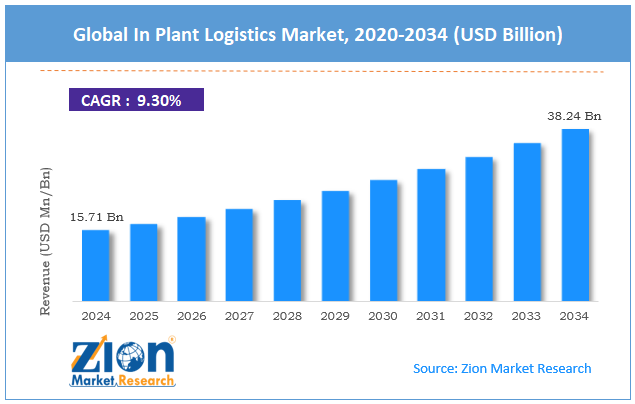

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 15.71 Billion | USD 38.24 Billion | 9.30% | 2024 |

In Plant Logistics Industry Perspective:

The global in plant logistics market size was worth around USD 15.71 billion in 2024 and is predicted to grow to around USD 38.24 billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.30% between 2025 and 2034.

In Plant Logistics Market: Overview

In-plant logistics refers to the process of movement of raw materials, sub-assemblies, and components within a production unit of an organization for final transformation in the form of finished goods. The movement can be tracked between product areas such as the stocking point or the line side until the site of final good production. The three main factors of primary importance in in-plant logistics are store & handling systems, building organization, and the overall infrastructure in the manufacturing facility. According to industry analysis, optimal in-plant logistics has several benefits including higher efficiency levels, greater productivity, lower costs, improved customer loyalty, and better control over the pieces.

During the forecast period, the industry for in-plant logistics is expected to deliver significant growth revenue led by rising applications across major end-user verticals. Companies worldwide are seeking novel technologies that can optimize business operations while controlling expenditure. The rising penetration of Industry 5.0 and automation will further propel market revenue in the coming years. The high cost associated with some of the more advanced in-plant logistics solutions will impact the final revenue generated by the industry.

Key Insights:

- As per the analysis shared by our research analyst, the global in-plant logistics market is estimated to grow annually at a CAGR of around 9.30% over the forecast period (2025-2034)

- In terms of revenue, the global plant logistics market size was valued at around USD 15.71 billion in 2024 and is projected to reach USD 38.24 billion, by 2034.

- The market is projected to grow at a significant rate due to the increasing adoption of Industry 5.0 and automation solutions across industries.

- Based on the product type, the robots segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the end-user industry, the automobile segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

In Plant Logistics Market: Growth Drivers

Increasing adoption of Industry 5.0 and automation solutions across industries to drive market demand

The global in-plant logistics market is expected to be driven by the rising integration of Industry 5.0 and advanced automation solutions across the industry. Industry 5.0 refers to creating an industrial ecosystem powered by a collaborative approach between next-generation technologies and humans. Industry 5.0 aims to improve business operations while advancing human resource performance and capabilities.

Furthermore, companies adopting technologies offered in Industry 5.0 are also known to promote sustainability and resilience to extreme volatility in market conditions. The rapid incorporation of automated solutions in business activities especially across manufacturing plants is a positive indication of increased demand for effective technologies offering in-plant logistics.

In February 2025, leading carmakers such as Mercedes-Benz, BMW, and Audi were reported to be exploring the use of humanoid robots in lineside logistics. The robots will be powered by machine learning (ML) and artificial intelligence (AI) technologies as per reports. Similarly, other companies with expansive manufacturing units are expected to incorporate cutting-edge solutions delivering enhanced in-plant logistics.

Expansion of warehousing & e-commerce industries to promote improved market revenue in the future

One of the largest contributors to the in-plant logistics industry is the thriving e-commerce sector. Additionally, the global warehousing industry also helps fuel the application of a wide range of in-plant logistic solutions. The global e-commerce and warehousing markets are expanding worldwide, especially with the proliferation of online shopping among customers.

E-commerce and warehousing companies are increasingly investing in smart storage facilities that can assist in improving business performance and deliver exceptional customer service. The global in-plant logistics market is expected to benefit from the rapid growth observed among warehousing solution providers and e-commerce companies.

In Plant Logistics Market: Restraints

High expenses related to advanced solutions will limit market growth trends in the future

The global plant logistics industry is projected to be restricted due to the high expenditure associated with advanced solutions. For instance, the average cost of an advanced autonomous mobile robot deployed within a factory for internal logistics can be more than USD 100,000 depending on the overall features of the device.

Additionally, large-scale deployment of modern in-plant logistics solutions such as programming software and automated tools can increase the operational budget for a manufacturing plant, limiting the overall adoption rate.

In Plant Logistics Market: Opportunities

Customized solutions and expansion of cloud-based solutions to generate growth opportunities

The global in-plant logistics market is projected to generate growth opportunities due to increased demand for customized solutions. In-plant logistics solution providers are actively investing in delivering personalized remedies that align with business demands and operations. Company needs are evolving and influenced by rapid technological advancements, changing consumer expectations, rising competitiveness, and other such factors.

In-plant logistics providers are increasingly offering solutions tailored to the needs and goals of individual businesses helping them align their overall profitability and growth in the future.

Surging integration of just-in-time (JIT) business model to create new expansion possibilities

Companies worldwide are increasingly adopting the JIT model of business operations. It deals with developing production lines with limited inventory. This lean method of production helps companies reduce unnecessary expenditure on overstocking. Effective in-plant logistics strategies facilitate smoother incorporation of JIT techniques across industries. This could lead to increased demand for JIT-enabling in-plant logistics solutions.

In Plant Logistics Market: Challenges

Limited supply of skilled labor and integration with existing infrastructure may challenge market expansion

The global in-plant logistics industry is expected to be challenged by the lack of a sufficient supply of skilled labor. Advanced in-plant logistics technologies require human resources with expertise in handling the solutions. Additionally, complexities associated with integrating next-generation in-plant logistics technologies with existing infrastructure may further affect market revenue in the long run.

In Plant Logistics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | In Plant Logistics Market |

| Market Size in 2024 | USD 15.71 Billion |

| Market Forecast in 2034 | USD 38.24 Billion |

| Growth Rate | CAGR of 9.30% |

| Number of Pages | 212 |

| Key Companies Covered | Swisslog Holding AG, Daifuku Co. Ltd., BEUMER Group GmbH & Co. KG, Honeywell Intelligrated, KION Group AG, Fives Group, KUKA AG, Jungheinrich AG, Schaefer Systems International, Toyota Industries Corporation, Knapp AG, SSI SCHÄFER Group, TGW Logistics Group, Dematic (a KION Group company), Murata Machinery Ltd., and others. |

| Segments Covered | By Product Type, By End-User Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

In Plant Logistics Market: Segmentation

The global in plant logistics market is segmented based on product type, end-user industry, and region.

Based on the product type, the global market segments are automated storage, robots, cranes, conveyors & sortation systems, real-time location systems, warehouse management systems (WMS), automated guided vehicles (AGVs), and automated storage & retrieval systems. In 2024, the highest growth was listed in the robot segment. It accounted for nearly 21% of the total revenue in 2024 due to the increasing use of robotic solutions to improve logistics within a manufacturing facility. The automated storage & retrieval systems are expected to deliver a CAGR of over 11.5% during the forecast period.

Based on the end-user industry, the global market segments are electronics, metals & heavy machinery, retail & consumer goods, automobiles, food & beverages, and others. In 2024, the automobile segment was the largest market share holder accounting for nearly 22.05% of the final result. The increasing development of smart automobile manufacturing facilities is helping the segment thrive. During the forecast period, the food & beverages industry is projected to register a CAGR of around 11.21%.

In Plant Logistics Market: Regional Analysis

North America to take the lead during the forecast period

The global in-plant logistics market will be dominated by North America during the projection duration. In 2024, It dominated nearly 32% of the global revenue with the US emerging as the largest regional market share holder. The presence of a robust and technologically advanced manufacturing sector across the US and Canada has helped the industry remain dominant in the last few years. The US holds control over 72% of the regional in-plant logistics industry share driven by an expanding e-commerce industry and smart warehousing facilities.

Asia-Pacific is the second-highest revenue generator across global platforms. During the forecast period, it is anticipated to generate a CAGR of around 12.7% led by countries such as Japan, China, South Korea, and India. China is home to some of the world's largest manufacturing facilities serving several end-user verticals.

For instance, the country is the most dominant producer of electric vehicles building highly automated production units. The rising development of next-generation factory robots and the increasing expansion of Industry 4.0 will fuel regional market revenue in the coming years.

In Plant Logistics Market: Competitive Analysis

The global in plant logistics market is led by players like:

- Swisslog Holding AG

- Daifuku Co. Ltd.

- BEUMER Group GmbH & Co. KG

- Honeywell Intelligrated

- KION Group AG

- Fives Group

- KUKA AG

- Jungheinrich AG

- Schaefer Systems International

- Toyota Industries Corporation

- Knapp AG

- SSI SCHÄFER Group

- TGW Logistics Group

- Dematic (a KION Group company)

- Murata Machinery Ltd.

The global in plant logistics market is segmented as follows:

By Product Type

- Automated Storage

- Robots

- Cranes

- Conveyors & Sortation Systems

- Real-Time Location Systems

- Warehouse Management Systems (WMS)

- Automated Guided Vehicles (AGVs)

- Automated Storage & Retrieval Systems)

By End-User Industry

- Electronics

- Metals & Heavy Machinery

- Retail & Consumer Goods

- Automobile

- Food & Beverages

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

In-plant logistics refers to the process of movement of raw materials, sub-assemblies, and components within a production unit of an organization for final transformation in the form of finished goods.

The global in-plant logistics market is expected to be driven by the rising integration of Industry 5.0 and advanced automation solutions across the industry.

According to study, the global in plant logistics market size was worth around USD 15.71 billion in 2024 and is predicted to grow to around USD 38.24 billion by 2034.

The CAGR value of in plant logistics market is expected to be around 9.30% during 2025-2034.

The global in-plant logistics market will be dominated by North America during the projection duration.

The global in plant logistics market is led by players like Swisslog Holding AG, Daifuku Co., Ltd., BEUMER Group GmbH & Co. KG, Honeywell Intelligrated, KION Group AG, Fives Group, KUKA AG, Jungheinrich AG, Schaefer Systems International, Toyota Industries Corporation, Knapp AG, SSI SCHÄFER Group, TGW Logistics Group, Dematic (a KION Group company) and Murata Machinery, Ltd.

The report explores crucial aspects of the in plant logistics market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed