Car GPS Navigation System Market Size, Share, Trends, Growth 2034

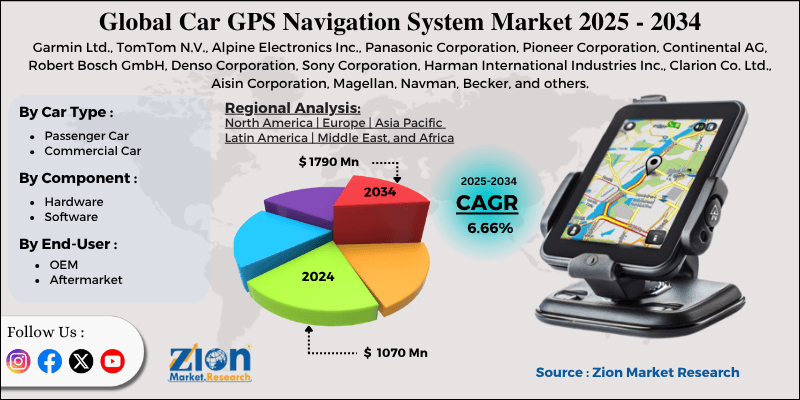

Car GPS Navigation System Market By Car Type (Passenger Car, Commercial Car), By Component (Hardware, Software), By End-User (OEM, Aftermarket), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

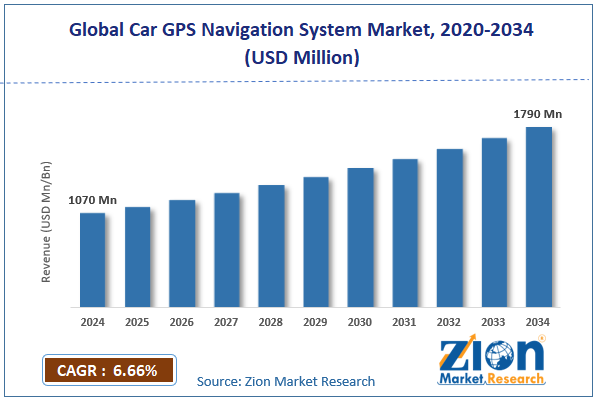

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1070 Million | USD 1,790 Million | 6.66% | 2024 |

Car GPS Navigation System Industry Perspective:

The global car GPS navigation system market size was approximately USD 1070 million in 2024 and is projected to reach around USD 1,790 million by 2034, with a compound annual growth rate (CAGR) of approximately 6.66% between 2025 and 2034.

Car GPS Navigation System Market: Overview

A car GPS navigation system is an automotive instrument that utilizes Global Positioning System (GPS) technology to provide real-time location tracking and route directions for vehicles. It helps drivers avoid traffic congestion, navigate unfamiliar areas, and reach destinations capably by providing simple instructions, live traffic updates, and voice prompts.

The global car GPS navigation system market is expected to experience significant growth due to the rise in global automotive sales, increasing demand for location data and real-time traffic information, and the growing integration of these systems with in-car infotainment systems and smartphones. Global automotive production surpassed 93 million units in 2023, driving the adoption of GPS systems in modern vehicles.

With the growing vehicle penetration, mainly in emerging economies, OEMs are actively integrating navigation systems as standard features to improve consumer appeal. Consumers are highly preferring continuous navigation with live updates, congestion warnings, and rerouting. GPS navigation systems are an ideal choice for these demands, reducing fuel costs and travel time.

Additionally, newer vehicles are equipped with Apple CarPlay, proprietary infotainment systems, and Android Auto, which integrate advanced GPS functionalities. This integration improves convenience and expands the global positioning system market scope beyond standalone devices.

Despite these advancements, the global market is challenged by high dependence on internet connectivity, cybersecurity concerns, and the availability of free smartphone navigation applications. Several GPS systems need real-time data via internet connections.

In developing regions or remote areas with poor connectivity, GPS becomes unreliable or limited. GPS systems collect sensitive location data, making them more susceptible to misuse or hacking. Regulators and consumers are increasingly worried about vehicle tracking and data privacy transparency.

In addition, free applications like Waze and Google Maps offer robust navigation features, decreasing consumer demand for in-built or paid navigation systems, particularly in budget vehicle segments.

Even so, the global car GPS navigation system industry is well-positioned due to the expansion of smart cities and the emergence of 5G, which enables improved real-time navigation. Smart city projects worldwide are integrating GPS into urban traffic management, public transit navigation, and vehicle tracking, thereby driving the growth of the GPS market.

Moreover, 5G connectivity enables ultra-fast data transmission, allowing GPS systems to access high-definition mapping, real-time data, and cloud-based updates with low latency.

Key Insights:

- As per the analysis shared by our research analyst, the global car GPS navigation system market is estimated to grow annually at a CAGR of around 6.66% over the forecast period (2025-2034)

- In terms of revenue, the global car GPS navigation system market size was valued at around USD 1070 million in 2024 and is projected to reach USD 1,790 million by 2034.

- The car GPS navigation system market is projected to grow significantly due to the global growth in automotive sales, increasing integration with in-car infotainment, and the expansion of ride-hailing and logistics services.

- Based on car type, the passenger car segment is expected to lead the market, while the commercial car segment is expected to grow considerably.

- Based on component, the hardware is the dominant segment, while the software segment is projected to witness sizable revenue growth over the forecast period.

- Based on end-user, the OEM segment is expected to lead the market compared to the aftermarket segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Car GPS Navigation System Market: Growth Drivers

Growth of the connected car ecosystem drives market growth

The speedy proliferation of connected cars is a leading propeller in the car GPS navigation system market. Car GPS navigation systems are a vital feature of this infrastructure, usually linked with infotainment, safety systems, and telematics.

Automakers are actively offering connected services through proprietary platforms, such as Ford SYNC, Mercedes-Benz MBUX, and Hyundai Bluelink, which incorporate in-dash real-time updates, voice control, and points of interest.

General Motors announced its growth of in-house connected services in its EV lineup in early 2025, with improvements in in-vehicle GPA mapping tied to charging infrastructure and battery management.

Cost reductions and technological advancements notably impel the market growth

Major technological enhancements transform the GPS navigation outlook. Advancements such as AR navigation, multi-GNSS support, voice-controlled navigation, and 3D mapping have significantly improved the user experience. These features are becoming increasingly accessible and affordable due to advancements in software innovation and mass production.

Manufacturers such as TomTom and HERE Technologies are offering lane-level accuracy and 3D maps in mainstream car models as of 2024. The Snapdragon Cockpit Platform, a new feature from Qualcomm, supports modernized navigation and infotainment systems utilizing 5G, AI, and edge computing.

Car GPS Navigation System Market: Restraints

Signal reliability and infrastructure issues in developing regions negatively impact market progress

Unreliable satellite coverage, outdated infrastructure, and poor digital mapping in several emerging nations reduce the efficiency and reliability of in-car GPS systems. Rural areas in Latin America, Southeast Asia, and Africa often experience signal dropouts, delayed real-time data, and inaccurate maps.

India's National Highway Authority acknowledged a 40% discrepancy between digital GPS maps and real-world routes, primarily in rural Uttar Pradesh and Northeast India, prompting efforts to incorporate the indigenous NavIC system more rigorously.

Car GPS Navigation System Market: Opportunities

Integration with 5G, AI, and V2X communication is favorable for the market growth

The convergence of 5G, AI, and V2X technologies is unveiling improved capabilities for GPS systems. These solutions enable hazard detection, predictive routing, platooning coordination, and dynamic rerouting, all of which depend on V2V and V2I communications. GPS systems modernized with V2X and AI can enhance safety, predict road conditions, and optimize vehicle performance.

NVIDIA and Qualcomm declared their collaboration to introduce AI-based navigation to mass-market automobiles, presenting V2X integration and edge computing in January 2025. These improvements position GPS navigation as the core of future smart mobility systems, offering fresh avenues for automakers that can connect connectivity and AI efficiently. This is a key opportunity for automakers, impacting the global car GPS navigation system industry.

Car GPS Navigation System Market: Challenges

Environmental concerns associated with energy consumption and e-waste restrict the market growth

With the amplified shift towards electronic components and digital dashboards in vehicles, there is a growing scrutiny of the ecological footprint of in-car GPS systems. These systems contribute to e-waste, especially when they are immediately replaced due to outdated interfaces or short hardware lifecycles.

In 2025, the environmental watchdog Green Electronics Council requested that regulators enforce modular design and stringent recycling standards for car navigation systems, particularly in Europe, where product sustainability regulations are tightening under the European Union's Green Deal framework.

Car GPS Navigation System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Car GPS Navigation System Market |

| Market Size in 2024 | USD 1070 Million |

| Market Forecast in 2034 | USD 1790 Million |

| Growth Rate | CAGR of 6.66% |

| Number of Pages | 215 |

| Key Companies Covered | Garmin Ltd., TomTom N.V., Alpine Electronics Inc., Panasonic Corporation, Pioneer Corporation, Continental AG, Robert Bosch GmbH, Denso Corporation, Sony Corporation, Harman International Industries Inc., Clarion Co. Ltd., Aisin Corporation, Magellan, Navman, Becker, and others. |

| Segments Covered | By Car Type, By Component, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Car GPS Navigation System Market: Segmentation

The global car GPS navigation system market is segmented based on car type, component, end-user, and region.

Based on car type, the global car GPS navigation system industry is divided into passenger car and commercial car. The passenger car segment holds a considerable share due to the high volume of passenger vehicle sales and production worldwide, primarily in North America, the Asia Pacific, and Europe. The rising consumer preference for smart navigation features, in-dash infotainment, and connected car services has majorly driven the adoption of GPS in this segment. Automotive manufacturers are actively offering built-in GPS navigation as a standard or optional feature in premium and economy vehicle models.

Based on component, the global car GPS navigation system market is segmented into hardware and software. The hardware segment registered a notable market share, accounting for the most significant revenue. The segment comprises physical components, such as receivers, in-dash navigation consoles, GPS antennas, display units, and processors. Every GPS navigation system is dependent on this hardware for location tracking, signal reception, and user interface. The high price and the necessity of hardware components in aftermarket and OEM-installed systems make the segment a larger contributor to the overall industry revenue.

Based on end-user, the global market is segmented into OEM and aftermarket. The OEM segment captured a remarkable market share, fueled by regulatory pressure for vehicle tracking in most regions, high production volumes, and consumer demand for factory-installed features. Leading automakers are integrating GPS navigation systems as optional or standard features in modern vehicles, primarily in premium and mid-range models. With the rising demand for in-vehicle infotainment, connectivity, and safety features, OEMs are offering navigation systems directly in infotainment units or as part of the dashboard.

Car GPS Navigation System Market: Regional Analysis

Asia Pacific to witness significant growth over the forecast period

The Asia Pacific continues to hold its leadership position in the car GPS navigation system market, driven by rapid urbanization, the rise of smart mobility, advancements in fleet logistics and the e-commerce sector, as well as technological improvements and local manufacturing.

The region is experiencing remarkable urbanization, with over 2.2 billion individuals anticipated to live in urban areas by 2030, resulting in increased traffic congestion. Cities and governments are integrating GPS systems for route optimization and traffic management. Urbanization drives consumer demand for reliable and real-time navigation tools in vehicles.

Asia Pacific's progressing e-commerce industry is expected to exceed USD 2.5 trillion by 2026. This increases the deployment of commercial fleets. These fleets are dependent on GPS for fuel optimization, real-time tracking, and route management. The growth of companies like Alibaba, JD.com, and Flipkart contributes to the continued demand for GPS.

The region also benefits from strong electronics manufacturing hubs, mainly in Japan, China, and South Korea. Companies like Pioneer, Alpine, and Huawei produce affordable software and GPS hardware locally. This enhances adoption and decreases costs, making GPS more accessible in the aftermarket and OEM segments.

North America leads the global car GPS navigation system industry due to advanced infrastructure and road networks, strong presence of OEMs, early tech adoption, and expanded penetration of digital services and smartphones. The region holds a complex and vast network of interstates, highways, and rural roads. Drivers majorly depend on in-car GPS systems to navigate effectively.

Leading automotive manufacturers, such as Tesla, Ford, and General Motors, are based in North America and invest in embedded technologies. These OEMs are the early adopters of GPS navigation in vehicles, strengthening the region's prominence in the industry. Particularly, Tesla uses exact GPS for its semi-autonomous driving systems.

North America has a higher smartphone penetration rate, surpassing 85%, resulting in heavy use of navigation applications and a demand for unified integration in cars. This trend prompts automotive manufacturers to equip their vehicles with features that surpass or mirror mobile navigation, thereby promoting the development of a well-established GPS infrastructure in both the aftermarket and OEM industries.

Car GPS Navigation System Market: Competitive Analysis

The major players operating in the global car GPS navigation system market include:

- Garmin Ltd.

- TomTom N.V.

- Alpine Electronics Inc.

- Panasonic Corporation

- Pioneer Corporation

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Sony Corporation

- Harman International Industries Inc.

- Clarion Co. Ltd.

- Aisin Corporation

- Magellan

- Navman

- Becker

Car GPS Navigation System Market: Key Market Trends

Over-the-air (OTA) and cloud-based updates:

Modern GPS systems are inclined to cloud navigation platforms that offer real-time construction, traffic, and road closure updates. OTA update capabilities enable manufacturers to improve navigation algorithms and map data remotely. This enhances user experience and accuracy, reducing the need for manual updates.

Rising integration with smart infrastructure and V2X:

Car GPS systems are evolving to facilitate V2X (vehicle-to-everything) communication, enabling interaction with smart roads, traffic signals, and surrounding vehicles. As smart city programs expand, GPS systems will increasingly integrate with infrastructure to provide dynamic routing, automated driving support, and safety alerts. Asia and North America are leading in V2X-ready navigation utilization.

The global car GPS navigation system market is segmented as follows:

By Car Type

- Passenger Car

- Commercial Car

By Component

- Hardware

- Software

By End-User

- OEM

- Aftermarket

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A car GPS navigation system is an automotive instrument that utilizes Global Positioning System (GPS) technology to provide real-time location tracking and route direction to vehicles. It helps drivers avoid traffic congestion, navigate unfamiliar areas, and reach destinations capably by providing simple instructions, live traffic updates, and voice prompts.

The global car GPS navigation system market is projected to grow due to mounting demand for location data and real-time traffic information, government initiatives and regulations aimed at enhancing vehicle safety and tracking, as well as the surging adoption of autonomous vehicles.

According to study, the global car GPS navigation system market size was worth around USD 1070 million in 2024 and is predicted to grow to around USD 1,790 million by 2034.

The CAGR value of the car GPS navigation system market is expected to be approximately 6.66% from 2025 to 2034.

Asia Pacific is expected to lead the global car GPS navigation system market during the forecast period.

The key players profiled in the global car GPS navigation system market include Garmin Ltd., TomTom N.V., Alpine Electronics, Inc., Panasonic Corporation, Pioneer Corporation, Continental AG, Robert Bosch GmbH, Denso Corporation, Sony Corporation, Harman International Industries, Inc., Clarion Co., Ltd., Aisin Corporation, Magellan, Navman, and Becker.

The report examines key aspects of the car GPS navigation system market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed