Packaged Food Essence Ingredient Market Size, Share, Forecast 2034

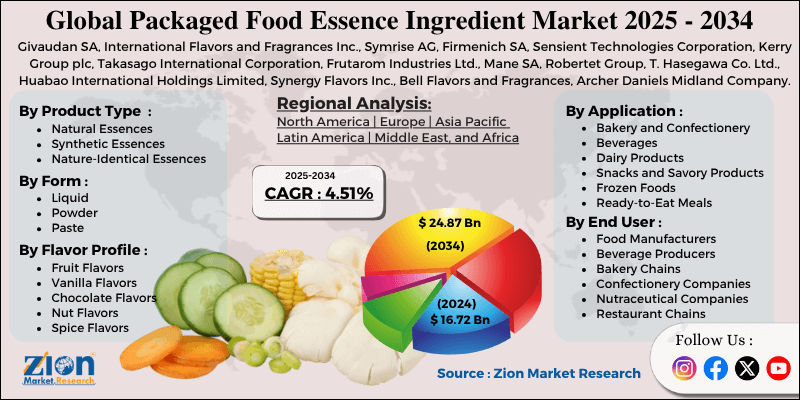

Packaged Food Essence Ingredient Market By Product Type (Natural Essences, Synthetic Essences, Nature-Identical Essences, Essential Oils, Flavor Concentrates, Aromatic Extracts, and Others), By Form (Liquid, Powder, Paste, Emulsion), By Flavor Profile (Fruit Flavors, Vanilla Flavors, Chocolate Flavors, Nut Flavors, Spice Flavors, Herbal Flavors, Savory Flavors, Others), By Application (Bakery and Confectionery, Beverages, Dairy Products, Snacks and Savory Products, Frozen Foods, Ready-to-Eat Meals, Dietary Supplements), By End-User (Food Manufacturers, Beverage Producers, Bakery Chains, Confectionery Companies, Nutraceutical Companies, Restaurant Chains), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

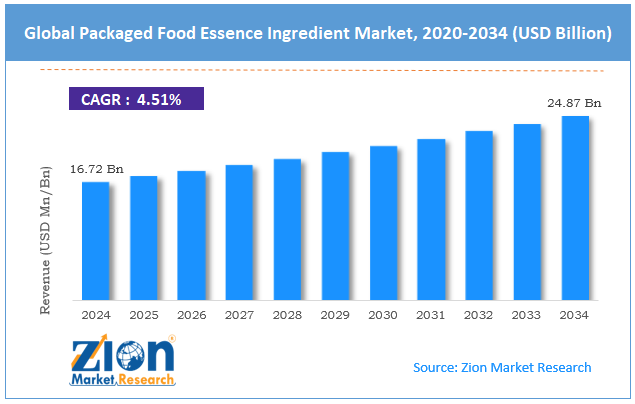

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.72 Billion | USD 24.87 Billion | 4.51% | 2024 |

Packaged Food Essence Ingredient Industry Perspective:

The global packaged food essence ingredient market size was worth approximately USD 16.72 billion in 2024 and is projected to grow to around USD 24.87 billion by 2034, with a compound annual growth rate (CAGR) of roughly 4.51% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global packaged food essence ingredient market is estimated to grow annually at a CAGR of around 4.51% over the forecast period (2025-2034).

- In terms of revenue, the global packaged food essence ingredient market size was valued at approximately USD 16.72 billion in 2024 and is projected to reach USD 24.87 billion by 2034.

- The packaged food essence ingredient market is projected to grow significantly due to rising consumer demand for diverse flavor experiences, expansion of the processed food industry, increasing preference for natural flavoring ingredients, and growing consumption of convenience foods globally.

- Based on product type, the natural essences segment is expected to lead the packaged food essence ingredient market, while the nature-identical essences segment is anticipated to experience significant growth.

- Based on form, the liquid segment is expected to lead the packaged food essence ingredient market, while the powder segment is anticipated to witness notable growth.

- Based on flavor profile, the fruit flavors segment is the dominating segment, while the vanilla flavors segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the beverages segment is expected to lead the market compared to the dietary supplements segment.

- Based on end-user, the food manufacturers segment is expected to dominate compared to the restaurant chains segment.

- Based on region, North America is projected to dominate the global packaged food essence ingredient market during the estimated period, followed by Europe.

Packaged Food Essence Ingredient Market: Overview

Packaged food essence ingredients are strong flavoring substances added to processed foods, drinks, and sweets to give them a specific taste and smell. These ingredients either come from natural sources or are made using scientific methods to create the required flavor. Natural essences derived from fruits, herbs, spices, and plants impart a genuine and fresh taste, and are preferred by consumers seeking simple and clean label products. Synthetic essences made through chemical processes provide low-cost, reliable, and uniform flavors throughout the year. Nature-identical essences are chemically the same as flavors found in nature, offering a natural taste with better stability and affordable pricing. Flavor concentrates combine different flavor elements to create rich and unique tastes for many food products. These ingredients help maintain the same taste in large-scale production, replace flavors lost during cooking or processing, and support the creation of new and interesting flavors. Essences are widely used in beverages, bakery, dairy, confectionery, and ready-to-eat foods to improve taste, reduce sugar without reducing sweetness, and build a unique product identity. New technologies like encapsulation protect delicate flavors and help them stay fresh for longer.

The increasing demand for convenient, flavorful packaged foods and the continuous innovation in flavor technology are expected to drive substantial growth in the packaged food essence ingredient market throughout the forecast period.

Packaged Food Essence Ingredient Market Dynamics

Growth Drivers

Expanding convenience food trends

The packaged food essence ingredient market is growing rapidly due to an increasing number of consumers opting for easy and ready-to-eat food products that require minimal preparation yet still offer a good taste. Busy lifestyles, long working hours, and urban living are increasing the use of packaged foods for daily meals. Ready-to-eat meals are becoming popular as people look for good flavors in simple food options. Frozen food companies use essences to keep flavor intact during freezing, storage, and heating. Single-serve snacks for on-the-go eating use essences to create strong and memorable flavors. Meal kit brands add essences to keep the flavor the same in every pack.

Reduced home cooking among younger consumers is increasing the demand for tasty packaged foods. Busy professionals often switch to packaged breakfast choices. Instant drink mixes and ready-to-drink beverages rely on essences for a pleasant taste. Health-aware consumers want convenience foods with good flavor and nutrition. Portion-controlled snacks use essences to make small servings feel satisfying. The growth of online food shopping is also helping the market.

How is the rising demand for natural and authentic flavor experiences driving the packaged food essence ingredient market growth?

The global packaged food essence ingredient industry is growing as consumers increasingly prefer natural ingredients and real flavor experiences linked to familiar food sources. Many people want simple and clean labels, so food companies are replacing synthetic flavorings with natural essences from plants. Parents show strong concern about artificial ingredients when choosing food for children. Social media and food bloggers are increasing awareness of ingredient quality and sourcing. Premium food products are encouraging consumers to pay more for items with natural essences. The organic food segment needs certified organic essences, creating new market opportunities.

Rising interest in ethnic cuisines is increasing demand for spice and herb essences with traditional flavor profiles. Small artisanal brands utilize natural essences to differentiate themselves and attract discerning buyers, as safety concerns associated with certain synthetic compounds are prompting manufacturers to shift toward natural options. The farm-to-table trend is also shaping packaged food choices, with consumers seeking closer links to farms and natural ingredients.

Restraints

How are the high costs and supply chain vulnerabilities for natural essences creating restraints for the packaged food essence ingredient market?

A key challenge for the packaged food essence ingredient market is the high cost and unstable supply of natural essences, especially those linked to farming and changing climate conditions. Natural essence extraction needs large amounts of raw material, and output depends on crop quality and processing methods. Weather issues can affect crops used for essences, leading to limited supply and sudden price rises. Political issues in regions that grow important aromatic plants also create sourcing problems and push companies to find backup suppliers. Organic certification makes sourcing harder and more expensive for brands focused on clean-label products.

Seasonal availability of fruits and plants creates storage and planning difficulties and may force recipe changes when supply is low. Food, cosmetic, and pharmaceutical industries compete for the same natural ingredients, increasing price pressure. Small producers face higher costs because they cannot produce in large volumes like bigger companies.

Opportunities

How is expansion in emerging markets creating new opportunities for the market?

The packaged food essence ingredient industry is growing due to fast economic development, urban living, and increasing interest in global food habits across Asia, Africa, and Latin America. Higher incomes in countries such as India, Indonesia, Vietnam, and Nigeria are creating a larger middle class willing to buy convenient packaged foods. Urban living brings more modern retail stores that offer a wide range of packaged products using essence ingredients. Young consumers in these regions are open to new flavors and packaged food options. Western fast-food chains introduce standard flavor profiles that local brands copy using essences.

Supermarkets and convenience stores are replacing traditional markets, increasing access to packaged foods. More women working outside the home reduces the time available for cooking from scratch, thereby increasing demand for ready-made products. Government support for food processing and social media trends also encourage growth in flavored products. Improved cold-chain logistics and wider e-commerce penetration are helping flavor-based packaged foods reach smaller towns and rural areas, expanding the customer base for essence ingredients across these regions.

Challenges

Regulatory complexity and reformulation pressures

The packaged food essence ingredient market faces many challenges due to different rules across countries for ingredient approval, labeling, and usage limits. Regulations vary widely, so companies often need separate formulas for each market. The meaning of “natural flavor” and labeling rules vary across different regions, causing confusion for both manufacturers and consumers. Limits on the amount of each flavor compound that can be used also necessitate recipe adjustments when entering new regions. Allergen labeling rules make it harder to use essences made from nuts, soy, or other sensitive sources.

Sometimes, research raises safety concerns about flavor ingredients that were once considered safe, leading to sudden product reformulation. Consumer pressure can push governments to restrict synthetic flavors, creating uncertainty for future planning. Meeting regulatory requirements is costly for small producers. Differences in intellectual property protection across regions also affect investment in new flavor development.

Packaged Food Essence Ingredient Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Packaged Food Essence Ingredient Market |

| Market Size in 2024 | USD 16.72 Billion |

| Market Forecast in 2034 | USD 24.87 Billion |

| Growth Rate | CAGR of 4.51% |

| Number of Pages | 216 |

| Key Companies Covered | Givaudan SA, International Flavors and Fragrances Inc., Symrise AG, Firmenich SA, Sensient Technologies Corporation, Kerry Group plc, Takasago International Corporation, Frutarom Industries Ltd., Mane SA, Robertet Group, T. Hasegawa Co. Ltd., Huabao International Holdings Limited, Synergy Flavors Inc., Bell Flavors and Fragrances, Archer Daniels Midland Company, and others. |

| Segments Covered | By Product Type, By Form, By Flavor Profile, By Application, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Packaged Food Essence Ingredient Market: Segmentation

The global packaged food essence ingredient market is segmented based on product type, form, flavor profile, application, end-user, and region.

Based on product type, the global packaged food essence ingredient industry is classified into natural essences, synthetic essences, nature-identical essences, essential oils, flavor concentrates, aromatic extracts, and others. Natural essences lead the market due to strong consumer preference for clean label ingredients, perceived health benefits, premium product positioning, and increasing regulatory support for natural flavoring in food applications.

Based on form, the industry is segregated into liquid, powder, paste, and emulsion. Liquid form leads the market due to ease of incorporation into food matrices, uniform dispersion during manufacturing, flexibility in dosing, and compatibility with most production processes across beverage and food applications.

Based on flavor profile, the global packaged food essence ingredient market is divided into fruit flavors, vanilla flavors, chocolate flavors, nut flavors, spice flavors, herbal flavors, savory flavors, and others. Fruit flavors are expected to lead the market during the forecast period due to universal consumer appeal, versatility across multiple product categories, strong association with health and freshness, and continuous innovation in exotic and tropical fruit profiles.

Based on application, the global market is segmented into bakery and confectionery, beverages, dairy products, snacks and savory products, frozen foods, ready-to-eat meals, and dietary supplements. Beverages hold the largest market share due to high volume consumption, continuous new product launches, intense competition driving flavor innovation, and the critical role of flavor in beverage purchase decisions.

Based on end-user, the global packaged food essence ingredient market is categorized into food manufacturers, beverage producers, bakery chains, confectionery companies, nutraceutical companies, and restaurant chains. Food manufacturers dominate the market due to diverse product portfolios requiring multiple essence ingredients, large production volumes, and continuous product development activities.

Packaged Food Essence Ingredient Market: Regional Analysis

North America leads the global market

North America leads the packaged food essence ingredient market due to its well-developed processed food industry, advanced flavor technologies, and strong consumer interest in new and diverse taste experiences. The United States is home to many large food and beverage companies that spend heavily on essence ingredients for a wide range of products. People in the region are used to buying packaged foods and often look for variety, new flavors, and limited-edition products.

Established flavor houses in North America use advanced research, testing, and technology to create complex and high-quality flavor systems for different food categories. The craft beverage industry, including beer, spirits, and specialty drinks, uses unique essences to offer new and exciting taste options. Premium snack brands use rich and creative flavors to offer a better taste experience and support higher pricing.

Functional foods and drinks use essences to improve taste when adding vitamins, minerals, or other nutrients. Coffee culture is strong, leading to growth in coffee-flavored snacks, desserts, dairy items, and drinks. Seasonal and holiday product launches require quick flavor development and flexible production. The region also has strong food safety rules and a reliable supply chain, helping essence producers serve manufacturers smoothly. Consumers are open to trying new flavors, which supports ongoing innovation and experimentation in the market.

What factors are contributing to Europe’s steady growth in the packaged food essence ingredient industry?

Europe is seeing steady growth in the packaged food essence ingredient market as countries combine long-standing food traditions with modern convenience needs. Consumers in the region value real and traditional flavors, which increases demand for essences that reflect regional taste profiles. There is a strong interest in natural and organic essences linked to clean eating. Strict food regulations in Europe encourage clear labeling and the use of natural ingredients, shaping how manufacturers create their products.

Premium chocolate and confectionery brands use high-quality essences to stand out in the market. Traditional bakeries are adding essences to update recipes while still respecting regional heritage. The dairy sector, especially yogurt and desserts, uses many types of essences to offer more flavor choices. Alcoholic beverage makers also develop creative flavors for liqueurs and flavored spirits. Growing tea consumption and interest in flavored blends create opportunities for fruit and herbal essences. Health-aware consumers want products with less sugar but good taste, so essences help maintain flavor.

Sustainability goals encourage sourcing from local, traceable plant ingredients. Europe’s cultural diversity increases demand for different ethnic flavors. Quality labels and origin certifications guide how essences are sourced and used. Premium brands are willing to invest in natural essences even with higher costs.

Recent Market Developments:

- In March 2025, BASF Aroma Ingredients launched two new biotechnology-derived natural flavor ingredients under its Isobionics brand, namely Isobionics Natural beta-Sinensal 20 and Isobionics Natural alpha-Humulene 90, produced by fermentation to support citrus, woody, and beverage applications.

Packaged Food Essence Ingredient Market: Competitive Analysis

The leading players in the global packaged food essence ingredient market are:

- Givaudan SA

- International Flavors and Fragrances Inc.

- Symrise AG

- Firmenich SA

- Sensient Technologies Corporation

- Kerry Group plc

- Takasago International Corporation

- Frutarom Industries Ltd.

- Mane SA

- Robertet Group

- T. Hasegawa Co. Ltd.

- Huabao International Holdings Limited

- Synergy Flavors Inc.

- Bell Flavors and Fragrances

- Archer Daniels Midland Company

The global packaged food essence ingredient market is segmented as follows:

By Product Type

- Natural Essences

- Synthetic Essences

- Nature-Identical Essences

- Essential Oils

- Flavor Concentrates

- Aromatic Extracts

- Others

By Form

- Liquid

- Powder

- Paste

- Emulsion

By Flavor Profile

- Fruit Flavors

- Vanilla Flavors

- Chocolate Flavors

- Nut Flavors

- Spice Flavors

- Herbal Flavors

- Savory Flavors

- Others

By Application

- Bakery and Confectionery

- Beverages

- Dairy Products

- Snacks and Savory Products

- Frozen Foods

- Ready-to-Eat Meals

- Dietary Supplements

By End User

- Food Manufacturers

- Beverage Producers

- Bakery Chains

- Confectionery Companies

- Nutraceutical Companies

- Restaurant Chains

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Packaged food essence ingredients are strong flavoring substances added to processed foods, drinks, and sweets to give them a specific taste and smell.

The global packaged food essence ingredient market is projected to grow due to rising demand for convenient packaged foods, increasing consumer preference for diverse and authentic flavors, expansion of the processed food industry, growing clean label movements, and continuous innovation in flavor technology and natural essence extraction methods.

According to a study, the global packaged food essence ingredient market size was worth around USD 16.72 billion in 2024 and is predicted to grow to around USD 24.87 billion by 2034.

The CAGR value of the packaged food essence ingredient market is expected to be around 4.51% during 2025-2034.

North America is expected to lead the global packaged food essence ingredient market during the forecast period.

The major players profiled in the global packaged food essence ingredient market include Givaudan SA, International Flavors and Fragrances Inc., Symrise AG, Firmenich SA, Sensient Technologies Corporation, Kerry Group plc, Takasago International Corporation, Frutarom Industries Ltd., Mane SA, Robertet Group, T. Hasegawa Co. Ltd., Huabao International Holdings Limited, Synergy Flavors Inc., Bell Flavors and Fragrances, and Archer Daniels Midland Company.

The report examines key aspects of the packaged food essence ingredient market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

In the packaged food essence ingredient market, macroeconomic factors such as inflation, fluctuating raw material costs, changing household incomes, and currency instability are expected to influence pricing, demand patterns, and sourcing decisions.

In the packaged food essence ingredient market, pricing trends show rising costs for natural essences due to limited raw material availability, certification expenses, and high extraction costs, while synthetic and nature-identical essences remain more cost-efficient. Premium pricing for clean-label and organic essences is increasing, along with value-based pricing for customized flavor solutions.

In the packaged food essence ingredient market, stakeholders should focus on innovation in natural and clean label essences, invest in sustainable and traceable sourcing, develop region-specific flavor profiles, and adopt technology such as microencapsulation and fermentation.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed