Aromatic Market Size, Share, Trends, Growth and Forecast 2034

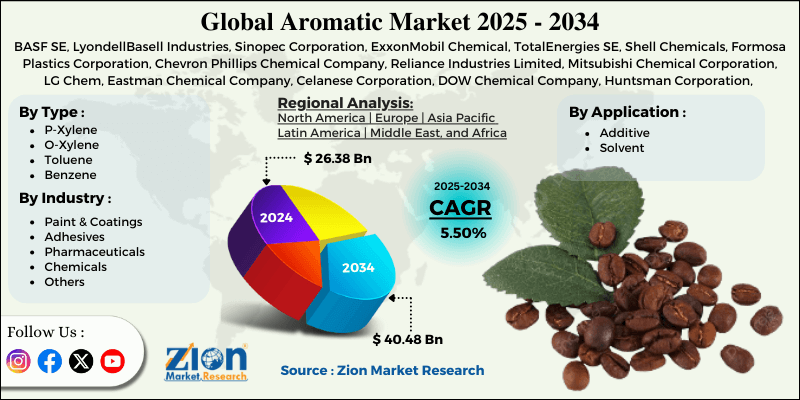

Aromatic Market By Type (P-Xylene, O-Xylene, Toluene, Benzene, and Others), By Application (Additive, Solvent), By Industry (Paint & Coatings, Adhesives, Pharmaceuticals, Chemicals, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

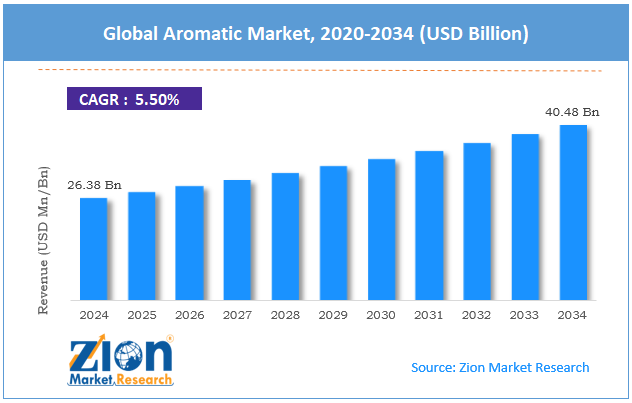

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.38 Billion | USD 40.48 Billion | 5.50% | 2024 |

Aromatic Industry Perspective:

The global aromatic market size was worth around USD 26.38 billion in 2024 and is predicted to grow to around USD 40.48 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.50% between 2025 and 2034.

Aromatic Market: Overview

Aromatic compounds are a group of chemical compounds classified by the existence of one or more benzene rings or similar ring structures with conjugated π-electrons, which offer exceptional chemical properties and optimal stability. They are extensively used in industries due to their significance in generating plastics, solvents, synthetic fibers, and pharmaceuticals. The global aromatic market is poised for notable growth owing to the surging demand from the polymers and plastics industry, progress of the packaging industry, and speedy urbanization and industrialization. Aromatic compounds like p-xylene and benzene are crucial for producing plastics like PET and polystyrene. These materials are broadly used in textiles, packaging, and consumer goods, fueling strong demand. Growing industrial production across the globe propels steady and continuous progress of the segment.

The packaging industry's rapid growth, particularly in e-commerce and food & beverage, has surged the demand for recyclable and lightweight materials. Aromatics obtained from polymers, especially PET, are extensively favored due to their sustainability and durability. This trend majorly supports worldwide industry growth.Furthermore, developing nations like Latin America and the Asia Pacific are undergoing speedy industrial expansion and urbanization. This drives automotive, construction, and manufacturing activities that highly depend on aromatic-based products. The subsequent elevated consumption makes these regions key propellers.

Nevertheless, the global market faces limitations due to factors such as safety and health concerns and unstable crude oil prices. Many aromatic hydrocarbons and benzene are carcinogenic and toxic, restricting their use in consumer products. Stringent workplace safety rules raise operational costs for producers. These issues limit the scope of aromatic utilization in some industries. Aromatics are petroleum-based; therefore, price fluctuations significantly affect market pricing and production economies. Unexpected price hikes may crush margins or disturb supply chains. This instability offers challenges to industry growth and planning.

Still, the global aromatic industry benefits from several favorable factors like the development of bio-based aromatics and innovation in specialty chemicals. Biotechnology improvements allow the production of aromatics from renewable feedstock like biomass. These ecological products attract eco-conscious customers and regulators. This progressing segment offers fresh growth prospects. Moreover, advanced materials and high-performing polymers use aromatics for improved properties. Specialty chemical growth diversifies aromatic uses beyond traditional industries. This advancement widens profitability and industry scope.

Key Insights:

- As per the analysis shared by our research analyst, the global aromatic market is estimated to grow annually at a CAGR of around 5.50% over the forecast period (2025-2034)

- In terms of revenue, the global aromatic market size was valued at around USD 26.38 billion in 2024 and is projected to reach USD 40.48 billion by 2034.

- The aromatic market is projected to grow significantly due to increasing demand for adhesives and solvents, expanding production capacity in APAC, and rising consumption in infrastructure and other sectors.

- Based on type, the benzene segment is expected to lead the market, while the P-Xylene segment is expected to grow considerably.

- Based on application, the additive segment is the dominating segment, while the solvent segment is projected to witness sizeable revenue over the forecast period.

- Based on industry, the chemicals segment is expected to lead the market compared to the paint & coatings segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by North America.

Aromatic Market: Growth Drivers

How are instability and trends in petrochemical feedstock and crude oil driving the aromatic market?

The global aromatic market is closely tied to naphtha and crude oil prices, as aromatics are primarily obtained through the catalytic reforming of these feedstocks. The latest fluctuations in crude oil prices have impacted the balance of supply and demand, as well as profitability, in the global market.

The Russia-Ukraine conflict and subsequent sanctions have disrupted crude supplies, resulting in tighter feedstock markets and price hikes in aromatics, which in turn positively fuel the aromatic trade flows. These price dynamics are a key driver, pushing market participants to advance in feedstock enhancement and sourcing aromatic derivatives from substitute raw materials.

How is the escalating use of aromatic compounds in consumer electronics fueling the aromatic market?

Aromatics are the leading forerunners in manufacturing high-performing resins and plastics used in electronic devices. As consumer electronics boom across the globe, with trends like IoT, 5G, and wearable devices progressing, the demand for durable and lightweight polymer components obtained from aromatics is increasing. Prominent electronics manufacturers, such as Apple and Samsung, have increased the production of wearable and foldable devices, utilizing aromatic-based polymer materials for flexibility and durability. This technological boom fuels aromatic consumption, especially benzene derivatives used in manufacturing several engineering plastics, including ABS.

Aromatic Market: Restraints

Safety and health concerns negatively impact market sentiment

Due to the toxic and carcinogenic nature of some aromatics like benzene, there is a surging workforce and public concern over safety and health, limiting usage and impacting regulatory scrutiny. Exposure to aromatics has been associated with severe health risks, including respiratory problems and leukemia. This has triggered elevated workplace safety measures, limited use in consumer products, and public opposition to aromatic-associated production facilities.

Protests in many regions, such as parts of Europe and India, have postponed the operations of aromatic plants because of community health concerns in 2025. This notably mandated companies to consider plant locations or actively invest in safety upgrades.

Aromatic Market: Opportunities

How do technological advancements in catalytic reforming and extraction create lucrative opportunities for the aromatic market's development?

Continuous advancements in catalytic reforming, process optimization, and extraction methods are fueling aromatic production and decreasing production costs, impacting the worldwide aromatic industry. Improved catalysts and integrated processes enhance efficacy, reduce power consumption, and allow higher purity aromatic outputs.

The adoption of advanced catalysts has elevated aromatic production by 5-10% over conventional techniques.

In 2024, key refiners in the Middle East adopted next-generation reforming units with AI-based process control, reducing downtime and driving aromatic output.

Aromatic Market: Challenges

High operational expenditure and capital limit the market growth

The global aromatic sector requires substantial investments in petrochemical and refining plants, along with significant maintenance and energy costs. This restricts expansions and new capacity additions, mainly in emerging economies with financial constraints. Energy costs constitute nearly 40% of the production expenditure in aromatic manufacturing. Several planned aromatic capacity developments in Southeast Asia were delayed in 2024 due to financing challenges and rising costs.

Aromatic Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aromatic Market |

| Market Size in 2024 | USD 26.38 Billion |

| Market Forecast in 2034 | USD 40.48 Billion |

| Growth Rate | CAGR of 5.50% |

| Number of Pages | 215 |

| Key Companies Covered | BASF SE, LyondellBasell Industries, Sinopec Corporation, ExxonMobil Chemical, TotalEnergies SE, Shell Chemicals, Formosa Plastics Corporation, Chevron Phillips Chemical Company, Reliance Industries Limited, Mitsubishi Chemical Corporation, LG Chem, Eastman Chemical Company, Celanese Corporation, DOW Chemical Company, Huntsman Corporation, and others. |

| Segments Covered | By Type, By Application, By Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aromatic Market: Segmentation

The global aromatic market is segmented based on type, application, industry, and region.

Based on type, the global aromatic industry is divided into P-Xylene, O-Xylene, toluene, benzene, and others. The benzene segment dominates the global market since it is an essential building block in the chemical sector. It is extensively used to produce various crucial downstream chemicals, comprising phenol (used in adhesives and resins), styrene (polystyrene plastics), and cyclohexane (nylon products). The demand for benzene is primarily driven by industries such as packaging, construction, textiles, and automotive, where its derivatives serve as vital materials. Its versatility and wide range of applications increase its demand as an aromatic compound across the globe.

Based on application, the global aromatic market is segmented into additive and solvent. The additive segment has maintained a leading market share, as additives are extensively used to manufacture performance-enhancing additives for lubricants, coatings, and plastics. These additives enhance properties like durability, stability, and efficiency, increasing their significance in industries like packaging, construction, and automotive. The growing demand for high-performing materials and strict environmental norms promoting cleaner fuels notably impact the growth of aromatic additives.

Based on industry, the global market is segmented into paint & coatings, adhesives, pharmaceuticals, chemicals, and others. The chemicals segment holds the maximum share of the market because aromatics like xylenes, toluene, and benzene are essential raw materials that help produce numerous types of downstream chemical products like synthetic fibers, solvents, resins, and plastics. This industry is the backbone of a majority of manufacturing industries, fueling large-scale and continuous demand for aromatic compounds worldwide.

Aromatic Market: Regional Analysis

What enables Asia Pacific's strong foothold in the global Aromatic Market?

Asia Pacific is projected to maintain its dominant position in the global aromatic market owing to the expanding packaging and automotive industries, availability of infrastructure, and raw materials. And a rising consumer goods market. The automotive sector in APAC is progressing remarkably and speedily, with the increasing production of durable and lightweight components sourced from aromatic chemicals. Concurrently, the packaging sector is progressing because of the growing food & beverage and e-commerce industries.

For example, China's packaging industry alone is anticipated to exceed USD 250 billion by 2030, majorly driving the aromatic demand. APAC also benefits from established petrochemical and refining infrastructure capable of manufacturing aromatics effectively. Economies like Japan, China, and South Korea have large refining capacities, assuring steady availability of toluene, benzene, and xylenes. This robust supply chain foundation backs the region's prominence, adding to over 50% of worldwide aromatic production capacity.

Additionally, changing lifestyles and rising disposable income in APAC are fueling the demand for consumer products like textiles, electronics, and household products. Aromatic derivatives are vital inputs in producing these goods, propelling regional leadership. Industry reports underscore that consumer goods demand in the region is anticipated to progress at a CAGR of nearly 6-7% by 2030, maintaining the market dominance.

North America maintains its position as the second-leading region in the global aromatic industry due to well-established refining and petrochemical infrastructure, robust demand from the packaging and automotive industries, and technological improvements. North America, especially the United States, holds a well-developed refining and petrochemical industry that produces a notable volume of aromatics like toluene, benzene, and xylene.

The region accounts for nearly 20-25% of the worldwide aromatic production capacity, supported by extensive integrated facilities along the Gulf Coast. This infrastructure allows steady, competitive pricing and supply for aromatic chemicals. Moreover, the automotive market in North America demands high-class plastics and synthetic fibers obtained from aromatics for fuel efficiency and lightweight vehicles.

Also, the packaging industry's progress is attributed to the growing food & beverages and e-commerce sectors, propelling aromatic consumption. The United States packaging market alone was estimated at more than USD 200 billion in 2023, fueling continuous demand. The region also dominates in R&D, with advancements in bio-based aromatics production and refining solutions. For instance, the adoption of advanced catalytic reforming has elevated aromatic production by nearly 10-15% in recent years.

Aromatic Market: Competitive Analysis

The leading players in the global aromatic market are:

- BASF SE

- LyondellBasell Industries

- Sinopec Corporation

- ExxonMobil Chemical

- TotalEnergies SE

- Shell Chemicals

- Formosa Plastics Corporation

- Chevron Phillips Chemical Company

- Reliance Industries Limited

- Mitsubishi Chemical Corporation

- LG Chem

- Eastman Chemical Company

- Celanese Corporation

- DOW Chemical Company

- Huntsman Corporation

Aromatic Market: Key Market Trends

Move towards bio-based aromatics:

There is a rising trend to produce aromatics from renewable resources like biomass, in place of conventional petroleum sources. This move is driven by growing consumer demand and increasing environmental regulations for sustainable products. The leading companies are investing in biotechnological processes to develop bio-based toluene and benzene, aiming to decrease carbon footprints.

Expansion of aromatics in pharmaceuticals and specialty chemicals:

Aromatics are used mainly as key intermediates in pharmaceutical and chemical applications. Advancements in performance materials and drug synthesis are fueling the demand for high-purity aromatic compounds, widening the industry beyond traditional uses like solvents and plastics.

The global aromatic market is segmented as follows:

By Type

- P-Xylene

- O-Xylene

- Toluene

- Benzene

- Others

By Application

- Additive

- Solvent

By Industry

- Paint & Coatings

- Adhesives

- Pharmaceuticals

- Chemicals

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Aromatic compounds are a group of chemical compounds classified by the existence of one or more benzene rings or similar ring structures with conjugated π-electrons, which offer exceptional chemical properties and optimal stability. They are extensively used in industries due to their significance in generating plastics, solvents, synthetic fibers, and pharmaceuticals.

The global aromatic market is projected to grow due to rising use in transportation and automotive sectors, the growth of the textile industry, and advancements in aromatic compound synthesis.

According to study, the global aromatic market size was worth around USD 26.38 billion in 2024 and is predicted to grow to around USD 40.48 billion by 2034.

The CAGR value of the aromatic market is expected to be around 5.50% during 2025-2034.

The additives application area offers significant growth opportunities due to increasing demand for fuel additives and performance-enhancing chemicals in the industrial and automotive sectors.

Significant challenges include health concerns related to the toxicity of certain aromatic compounds like benzene and stringent environmental regulations. Additionally, the rise of bio-based alternatives and fluctuating crude oil prices challenge the market growth.

North America is expected to lead the global aromatic market during the forecast period.

Macroeconomic factors, such as global economic growth, rising disposable incomes, and industrialization, will boost demand for aromatic-based products across industries. Nonetheless, geopolitical uncertainties and fluctuations in crude oil prices may cause price volatility and supply chain disruptions, impacting market stability.

The key players profiled in the global aromatic market include BASF SE, LyondellBasell Industries, Sinopec Corporation, ExxonMobil Chemical, TotalEnergies SE, Shell Chemicals, Formosa Plastics Corporation, Chevron Phillips Chemical Company, Reliance Industries Limited, Mitsubishi Chemical Corporation, LG Chem, Eastman Chemical Company, Celanese Corporation, DOW Chemical Company, and Huntsman Corporation.

The report examines key aspects of the aromatic market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed