Global Infrared Detectors Market Size, Share, Growth Analysis Report - Forecast 2034

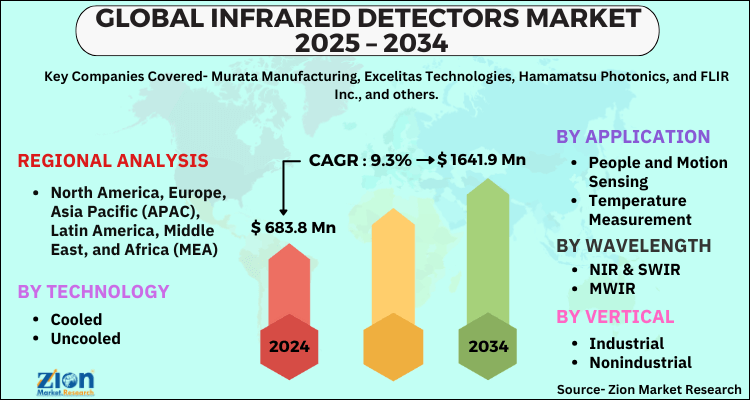

Infrared Detectors Market By Technology (Cooled, Uncooled, Mercury Cadmium Telluride, Indium Gallium Arsenide, Pyroelectric, Thermopile, Microbolometer, Others), By Application (People and Motion Sensing, Temperature Measurement, Security and Surveillance, Gas & Fire Detection, Spectroscopy, Biomedical Imaging, and Scientific Applications), Wavelength (NIR & SWIR, MWIR, and LWIR), Vertical (Industrial, and Nonindustrial), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

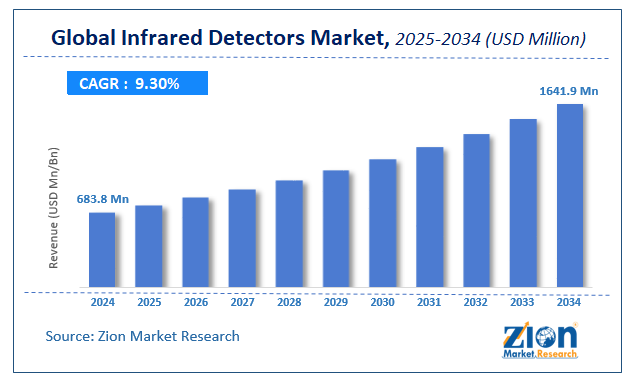

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 683.8 Million | USD 1641.9 Million | 9.3% | 2024 |

Infrared Detectors Market: Industry Perspective

The global infrared detectors market size was worth around USD 683.8 Million in 2024 and is predicted to grow to around USD 1641.9 Million by 2034 with a compound annual growth rate (CAGR) of roughly 9.3% between 2025 and 2034. The report analyzes the global infrared detectors market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the infrared detectors industry.

Infrared Detectors Market: Overview

An infrared sensor is a type of electronic equipment that detects and/or emits infrared radiation to sense particular features of its surroundings. Infrared sensors can also detect motion and measure the heat radiated by an item. They are components that can detect and produce light in the infrared wavelength range. One of the primary reasons driving market expansion in the forecast period is the increased demand for motion- and people-sensing devices. In addition, the growing use of the product in the military and defense industries for surveillance, target detection, and target tracking due to its compact size and ability to detect light from a distance is boosting market growth in the coming years. The extensive use of products in industrial facilities to monitor the operation of boilers, motors, electrical peripherals, and bearings is favorably influencing the market growth. Other factors, such as increased product deployment in smart homes and increased use of IR detectors at airports and railway stations, are expected to drive the market in the forthcoming years. Moreover, product developments such as the introduction of revolutionary infrared sensors for phone cameras, augmented reality (AR) glasses, and driverless vehicles that allow users to see through fog and smoke are propelling market expansion in the approaching years.

Key Insights

- As per the analysis shared by our research analyst, the global infrared detectors market is estimated to grow annually at a CAGR of around 9.3% over the forecast period (2025-2034).

- Regarding revenue, the global infrared detectors market size was valued at around USD 683.8 Million in 2024 and is projected to reach USD 1641.9 Million by 2034.

- The infrared detectors market is projected to grow at a significant rate due to increasing security applications, industrial automation, and thermal imaging in defense.

- Based on Technology, the Cooled segment is expected to lead the global market.

- On the basis of Application, the People and Motion Sensing segment is growing at a high rate and will continue to dominate the global market.

- Based on the Wavelength, the NIR & SWIR segment is projected to swipe the largest market share.

- By Vertical, the Industrial segment is expected to dominate the global market.

- Based on region, North America & Asia-Pacific is predicted to dominate the global market during the forecast period

Infrared Detectors Market: Driver

Infrared detectors in motion and people sensing technologies are becoming more popular.

The market for motion- and people-sensing devices is expanding. People and motion-sensing have always been important applications for infrared detectors. Increasing building automation and widespread implementation of people/object counting systems in commercial buildings are two important factors driving up demand for motion- and people-sensing devices. The ability to detect motion in both the presence and absence of light, as well as non-contact detection, has led to the widespread use of infrared technology in motion and people-sensing applications. Moreover, infrared detectors are gaining popularity in the field of robotics since they are utilised to detect the relative motion of IR emitting bodies and calculate distance. This can be achieved using both proximity IR sensor and passive IR (PIR) sensor. These detectors are also employed in the automotive sector for people and motion sensing, primarily to improve driver safety.

Infrared Detectors Market: Restraint

Camera import and export laws are subject to restrictions.

According to the International Traffic in Arms Regulations (ITAR) imposed by the US Department of State, the sale of prohibited infrared cameras in the US requires commodity jurisdiction permission. Manufacturers of infrared cameras are prohibited from exchanging their products with any person or entity, whether within the United States or overseas, without first obtaining export authorization, and are subject to penalties if they do so. Distributors must additionally obtain commodity jurisdiction clearance in order to sell these products. This complicates and increases the cost of selling and purchasing infrared cameras in the United States. This legislation makes it difficult for US-based infrared camera manufacturers to grow their operations outside of the country. It also prevents infrared camera producers based outside the United States from expanding their presence in the country. Some manufacturers, like Sensors Unlimited (US), FLIR Systems (US), and Xenics (Belgium), sell infrared cameras that do not require commodity jurisdiction clearance. However, due to the crucial nature of infrared camera applications, many manufacturers and distributors must obtain permission more than once.

Infrared Detectors Market: Opportunity

In emerging markets, there is a growing demand for infrared detectors.

The expanding markets of APAC, the Middle East, and South America are increasing their demand for infrared detectors. Building automation is one of the primary elements driving up demand for infrared detectors in emerging markets. Smart buildings that use IoT connectivity, sensors, and the cloud to remotely monitor and operate a variety of building functions such as heating and air conditioning, lighting, and security systems are opening up new opportunities. Infrared sensors allow smart buildings to self-regulate by monitoring and regulating temperature, controlling lighting, security cameras, and burglar alarm systems and boosting the intelligence and autonomy of various smart gadgets. Increasing government-led investments and incentives for military and defense industry modernization are also fuelling demand for infrared detectors in emerging markets.

Infrared Detectors Market: Challenge

Availability of substitute technologies

Infrared detectors are utilized in most chemical and petrochemical facilities to detect or identify gas leakage from the facility to the outside atmosphere or within the plant. A catalytic detector, on the other hand, is a popular replacement for infrared detectors in gas detection applications. Catalytic detectors have a significant advantage over infrared detectors in that they can easily recognize hydrogen gas. Furthermore, these detectors are convenient to use, simple to install, standardized, and have a long lifespan with low replacement costs. Catalytic detectors can detect flammable hydrocarbons and gases such as methane, ethane, propane, butane, hexane, butadiene, propylene, ethylene oxide, propylene oxide, isopropylamine, ethanol, and methanol in dusty and humid situations and at high temperatures. These variables are causing an increase in the penetration of catalytic detectors in gas detection applications, which is influencing the sale of infrared detectors.

Infrared Detectors Market: Segmentation

The global infrared detectors market is segmented based on Technology, Application, Wavelength, Vertical, and region.

By Technology, the market is classified into Cooled, Uncooled, Mercury Cadmium Telluride, Indium Gallium Arsenide, Pyroelectric, Thermopile, Microbolometer, Others. During the forecast period, the market for cooled infrared detectors will develop at the fastest rate. The cooled infrared detectors are typically cooled thermoelectrically or cryogenically. Liquid nitrogen is also used to cool detectors in some circumstances. Cooled infrared detectors are used in scientific research, astronomy, security and surveillance, and spectroscopy, among other fields where great accuracy is critical. In general, cooled infrared detectors work in the mid-wave infrared (MWIR) spectral band.

By Application, the market is classified into People and Motion Sensing, Temperature Measurement, Security and Surveillance, Gas & Fire Detection, Spectroscopy, and Biomedical Imaging, and Scientific Applications. The infrared detector is mostly utilised in people and motion sensing applications, and it is expected to dominate the total market over the projection period. The rising usage of infrared detectors for counting people and motion detection in areas such as retail stores, airports, houses, museums, and libraries have contributed to its market dominance. The increased adoption of smart home gadgets may raise the demand for infrared detectors. Infrared detectors in homes offer two basic functions: intrusion detection and occupancy detection.

By Wavelength, the market is classified into NIR & SWIR, MWIR, and LWIR. Because of its wide application range and inexpensive price, the LWIR market is predicted to be the largest and most appealing market segment over the projection period.

By Vertical, the market is classified into Industrial, and Nonindustrial. The non-industrial category is expected to remain the market's largest end-user during the forecast period, owing to strong demand from the military & defense and residential & commercial sectors.

Infrared Detectors Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Infrared Detectors Market |

| Market Size in 2024 | USD 683.8 Million |

| Market Forecast in 2034 | USD 1641.9 Million |

| Growth Rate | CAGR of 9.3% |

| Number of Pages | 140 |

| Key Companies Covered | Murata Manufacturing, Excelitas Technologies, Hamamatsu Photonics, and FLIR Inc., and others. |

| Segments Covered | By Technology, By Application, By Wavelength, By Vertical, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Infrared Detectors Market: Regional Landscape

North America is expected to remain the largest market over the forecast period, with the United States serving as the region's primary growth engine. The region's domination is due to the huge defense industry of the United States and the rapid adoption of technology by the region's other non-industrial sectors. The market growth can be attributed to the growing use of spectroscopy and the rising use of biomedical devices.

The Asia Pacific is expected to grow at a considerable growth due to the presence of a large number of manufacturers in the region. In addition, the increasing focus on the enhancement of security in retail stores and shopping malls is expected to fuel the market growth in the region. China is expected to dominate the regional market for IR detectors in terms of volume export due to high volume production and low pricing. Moreover, an increase in investment by the government in defense and increased demand for consumer electronics, in turn, are expected to drive the growth of the infrared detector market in the near future.

Recent Development

- In 2021, Excelitas Technologies has released a new OnLine Lens Configurator tool for vision system designers and engineers. The tool identifies and configures all essential lens solutions and mechanical attachments.

- In 2021, Hamamatsu Photonics has created a novel profile sensor for position sensing that has an embedded computing capability. The model S15366-256 sensor is specifically developed to calculate signals from the incident light spot within its processor chip and output incident light location information.

Infrared Detectors Market: Competitive Landscape

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the infrared detectors market on a global and regional basis.

The global infrared detectors market is dominated by players like:

- Murata Manufacturing

- Excelitas Technologies

- Hamamatsu Photonics

- FLIR Inc.

The infrared Detectors Market is segmented as follows:

By Technology

- Cooled

- Uncooled

- Mercury Cadmium Telluride

- Indium Gallium Arsenide

- Pyroelectric

- Thermopile

- Microbolometer

- Others

By Application

- People and Motion Sensing

- Temperature Measurement

- Security and Surveillance

- Gas & Fire Detection

- Spectroscopy and Biomedical Imaging

- Scientific Applications

By Wavelength

- NIR & SWIR

- MWIR

- LWIR

By Vertical

- Industrial

- Nonindustrial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An infrared sensor is a type of electronic equipment that detects and/or emits infrared radiation to sense particular features of its surroundings. Infrared sensors can also detect motion and measure the heat radiated by an item.

The global infrared detectors market is expected to grow due to growing applications in security, surveillance, consumer electronics, and industrial automation drive demand for advanced infrared sensing technologies.

According to a study, the global infrared detectors market size was worth around USD 683.8 Million in 2024 and is expected to reach USD 1641.9 Million by 2034.

The global infrared detectors market is expected to grow at a CAGR of 9.3% during the forecast period.

North America & Asia-Pacific is expected to dominate the infrared detectors market over the forecast period.

Leading players in the global infrared detectors market include Murata Manufacturing, Excelitas Technologies, Hamamatsu Photonics, and FLIR Inc., among others.

The report explores crucial aspects of the infrared detectors market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed