Temperature Sensor Market Size, Share, Growth Report 2032

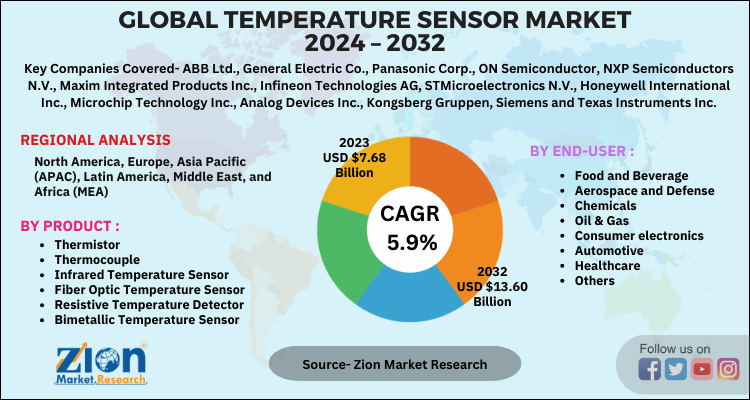

Temperature Sensor Market: By Product (Thermistor, Resistive Temperature Detector, Thermocouple, Infrared Temperature Sensor, Fiber Optic Temperature Sensor, Bimetallic Temperature Sensor And Others), By End-User (Food And Beverage, Aerospace And Defense, Chemicals, Oil & Gas, Consumer Electronics, Automotive, Healthcare And Others), and By Region: Global Industry Perspective, Comprehensive Analysis And Forecast, 2024 - 2032

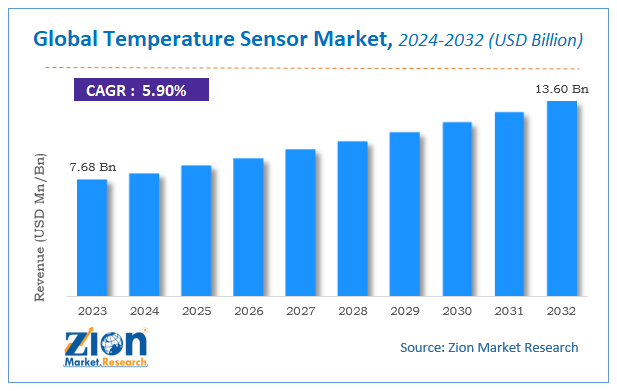

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 7.68 Billion | USD 13.60 Billion | 5.9% | 2023 |

Temperature Sensor Market Insights

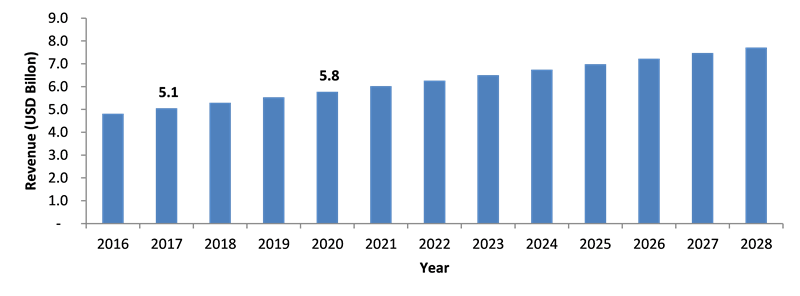

According to Zion Market Research, the global Temperature Sensor Market was worth USD 7.68 Billion in 2023. The market is forecast to reach USD 13.60 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.9% during the forecast period 2024-2032. The report offers a comprehensive analysis of the market, highlighting the factors that will determine growth, potential challenges, and opportunities that could emerge in the Temperature Sensor Market industry over the next decade.

Market Overview

A temperature Sensor is nothing but a tool typically an RTD or thermocouple provides for temperature measurement through an electrical signal. Temperature sensor plays an important role in various applications like food processing, medical devices, HVAC environmental control, chemical handling and automotive under the hood monitoring. Mounting significance of advanced & portable healthcare devices and high-performing sensor devices will propel the expansion of the temperature sensor market within the years ahead. Fierce competition and saturation witnessed across the Pc sector, however, is foreseen to hinder the expansion propensity of the temperature sensor market within the near future. Nevertheless, massive product applications across oil & gas, food & beverages, aerospace & defense, and chemicals sectors will further leverage the expansion graph of the temperature sensors market within the coming years.

Growth Factors

The major growth drivers that impact the temperature sensors market are new technological advancements in the petrochemical industry. The growing huge demand for medical sensors owing to the rise within the number of diseases boosts the expansion of the thermistor sort of temperature sensor. Another foremost driver for temperature sensors in consumer electronics is that the substantial growth of tablets and mobile phones owing to research and development's immense innovations.

Temperature Sensor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Temperature Sensor Market |

| Market Size in 2023 | USD 7.68 Billion |

| Market Forecast in 2032 | USD 13.60 Billion |

| Growth Rate | CAGR of 5.9% |

| Number of Pages | 130 |

| Key Companies Covered | ABB Ltd., General Electric Co., Panasonic Corp., ON Semiconductor, NXP Semiconductors N.V., Maxim Integrated Products Inc., Infineon Technologies AG, STMicroelectronics N.V., Honeywell International Inc., Microchip Technology Inc., Analog Devices Inc., Kongsberg Gruppen, Siemens and Texas Instruments Inc |

| Segments Covered | By Product, By End-User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Segment Analysis Preview

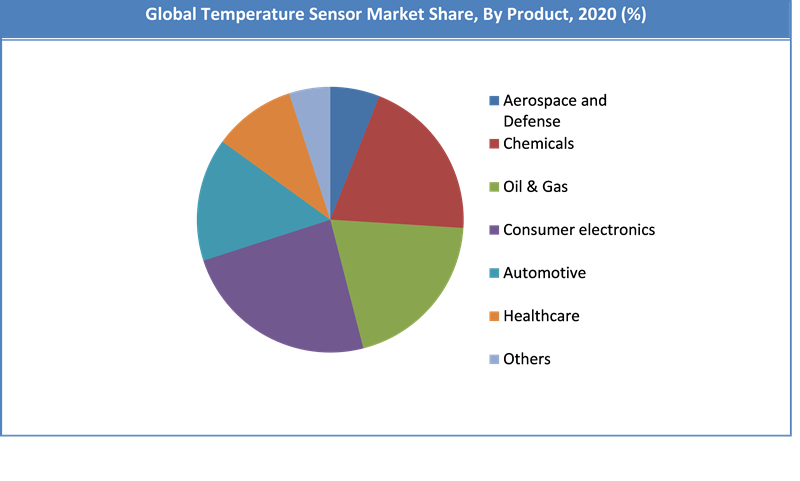

The main products available in this temperature sensor market are Thermocouple, Thermistor, Temperature Sensor, Resistive Temperature Detector, Bimetallic Temperature Sensor, Infrared Temperature Sensor, and Fiber Optic Temperature Sensor. Among them, the demand for Thermocouple is relatively higher and the trend is anticipated to remain so over the next few years.

Based on application, the chemicals end-user industry segment is projected to hold the largest share in the temperature sensor industry during the forecast period. Temperature sensors play an important role in the chemicals end-user industry. Processes such as refining, heat tracing, cracking, and incineration, and systems such as sanitary systems and piping systems use temperature sensors for temperature monitoring and control.

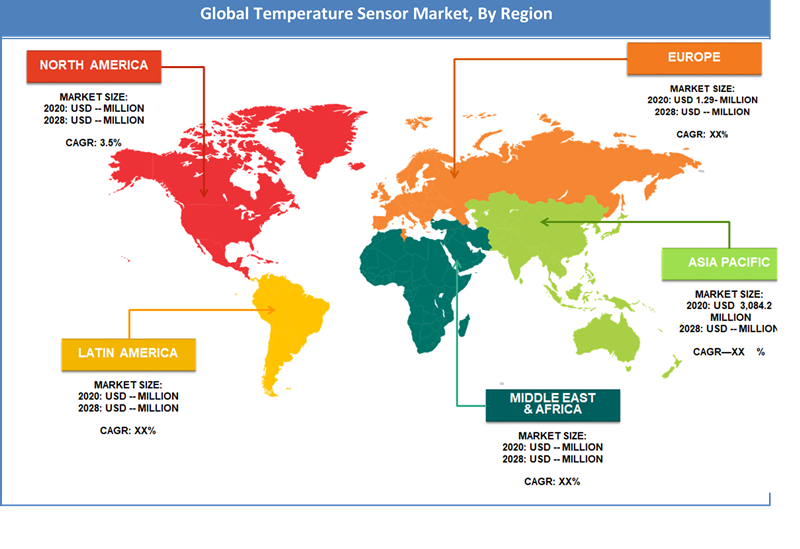

Regional Analysis Preview

Regionally, North America has been leading the worldwide temperature sensor market and is anticipated to continue on the dominant position within the years to return. Favorable state guidelines to market the expansion of medical & healthcare sectors are the most factor behind the dominance of the North American temperature sensor market. For the record, in 2018, North America contributed quite 40% towards the general temperature sensor market share 2018.

Key Market Players & Competitive Landscape

The key players of temperature sensor market include :

- ABB Ltd.

- General Electric Co.

- Panasonic Corp.

- ON Semiconductor

- NXP Semiconductors N.V.

- Maxim Integrated Products Inc.

- Infineon Technologies AG

- STMicroelectronics N.V.

- Honeywell International Inc.

- Microchip Technology Inc.

- Analog Devices Inc.

- Kongsberg Gruppen

- Siemens

- Texas Instruments Inc.

The global Temperature Sensor Market is segmented as follows:

By Product

- Thermistor

- Thermocouple

- Infrared Temperature Sensor

- Fiber Optic Temperature Sensor

- Resistive Temperature Detector

- Bimetallic Temperature Sensor

- Others

By End-User

- Food and Beverage

- Aerospace and Defense

- Chemicals

- Oil & Gas

- Consumer electronics

- Automotive

- Healthcare

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Temperature Sensor Market was valued at $ 7.68 Billion in 2023.

The global Temperature Sensor Market is expected to reach $ 13.60 Billion by 2032, with an anticipated CAGR of around 5.9% from 2024 to 2032.

The temperature sensor industry growth is driven mainly by increasing penetration of temperature sensors in advanced and portable healthcare equipment, growing demand for temperature sensors in the automotive sector, and rising adoption of home and building automation systems.

The Asia Pacific is projected to account for the largest share in the temperature sensor market during the forecast period. China, India, South Korea, and Japan are the major contributors to the growth of the temperature sensor industry in APAC.

The key players of temperature sensor market include ABB Ltd., General Electric Co., Panasonic Corp., ON Semiconductor, NXP Semiconductors N.V., Maxim Integrated Products Inc., Infineon Technologies AG, STMicroelectronics N.V., Honeywell International Inc., Microchip Technology Inc., Analog Devices Inc., Kongsberg Gruppen, Siemens and Texas Instruments Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed