Global Flexible Pipes For Oil & Gas Market Size, Share, Growth Analysis Report - Forecast 2034

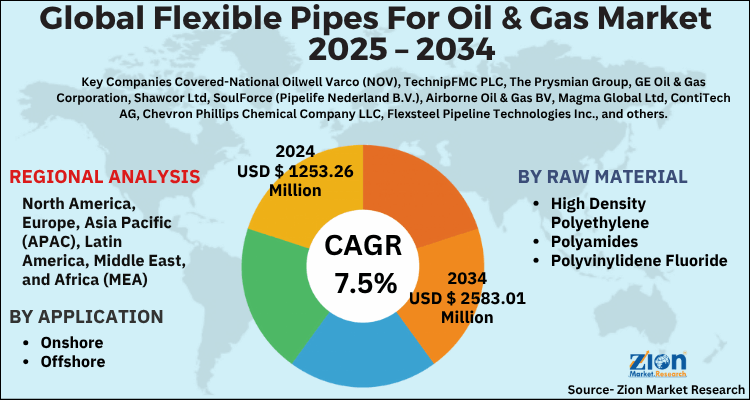

Flexible Pipes For Oil & Gas Market By Raw Material (High Density Polyethylene, Polyamides, Polyvinylidene Fluoride, Others), By Application (Onshore, Offshore), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

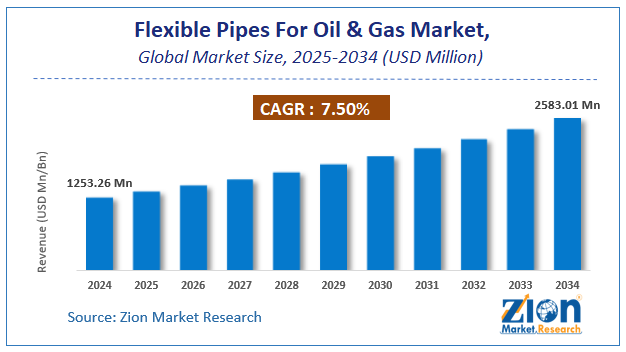

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1253.26 Million | USD 2583.01 Million | 7.5% | 2024 |

Global Flexible Pipes For Oil & Gas Market: Industry Perspective

The global flexible pipes for oil & gas market size was worth around USD 1253.26 Million in 2024 and is predicted to grow to around USD 2583.01 Million by 2034 with a compound annual growth rate (CAGR) of roughly 7.5% between 2025 and 2034. The report analyzes the global flexible pipes for oil & gas market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the flexible pipes for oil & gas industry.

The market report offers quantitative and qualitative insights into the key drivers, opportunities, constraints, and challenges impacting global flexible pipes for the oil & gas industry.

Global Flexible Pipes for Oil & Gas Market: Overview

In the oil and gas industry, flexible pipes are highly preferred over rigid pipes due to their ability to withstand harsh environments, high-pressure conditions, and extreme temperatures. Flexible pipes can also be easily installed and maintained, making them a popular choice for both onshore and offshore applications. They are designed to meet the specific needs of each project and can be customized to suit different types of fluids and gases. With the increasing demand for oil and gas worldwide, the demand for flexible pipes is expected to grow, especially in emerging economies where new exploration and production activities are taking place.

Global Flexible Pipes for Oil & Gas Market: Growth Factors

Rapid urbanization and rise in global population have surged the demand for oil and gas

There are several drivers of the global oil and gas flexible pipe market, which have contributed to its significant growth in recent years. One of the key drivers is the increasing demand for oil and gas globally, driven by population growth and urbanization. This has led to a rise in offshore drilling and exploration activities, where flexible pipes are used extensively. Additionally, the advantages offered by flexible pipes over traditional rigid pipes, such as ease of installation, reduced maintenance, and resistance to corrosion & fatigue, have driven their adoption in the oil and gas industry. Moreover, the development of new technologies and materials, along with increasing investments in the oil and gas industry, has fueled the growth of the flexible pipe market.

Restraints:

Extortionate cost of flexible pipes and the presence of substitutes hinder the growth of the industry to an extent

Despite the significant growth of the oil and gas flexible pipe industry, there are several restraints that are hindering its growth. One of the key restraints is the high cost of flexible pipes compared to traditional rigid pipes, which may limit their adoption in some applications. Additionally, the availability of alternative materials and technologies for oil and gas transportation, such as pipelines and LNG, may also restrain the growth of the flexible pipe market. Furthermore, the COVID-19 pandemic has impacted the oil and gas industry, leading to a decline in demand for oil & gas and a reduction in exploration & drilling activities, which may have a negative impact on the flexible pipe market's growth.

Opportunities:

Persistent technological advancements in flexible pipe design to create ample opportunities for the industry

Despite the restraints, the oil and gas flexible pipe industry presents several opportunities for growth. One of the key opportunities is the increasing demand for renewable energy sources, which is driving investments in the development of offshore wind farms. This has led to a rise in the demand for flexible pipes for subsea power cables, creating a new market opportunity for the flexible pipe industry. Moreover, technological advancements in flexible pipe design and manufacturing are creating opportunities for the industry to develop high-performance and cost-effective products that can cater to a wider range of applications in the oil and gas industry. Additionally, the expanding oil and gas exploration and drilling activities in emerging markets, particularly in Africa and the Middle East, present significant opportunities for the flexible pipe market to expand its global footprint and increase its market share.

Challenges:

Requirement of regular maintenance and inspection of flexible pipes might act as a challenge for the market

The global oil and gas flexible pipe market also faces several challenges, including the need for regular maintenance and inspection to ensure their safe and efficient operation. Moreover, the increasing focus on renewable energy sources and the transition towards a low-carbon economy may also impact the demand for oil and gas and, consequently, the flexible pipe market. Additionally, stringent regulations and safety standards imposed by governments and regulatory bodies may also present challenges to the market's growth.

Key Insights

- As per the analysis shared by our research analyst, the global flexible pipes for oil & gas market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2025-2034).

- Regarding revenue, the global flexible pipes for oil & gas market size was valued at around USD 1253.26 Million in 2024 and is projected to reach USD 2583.01 Million by 2034.

- The flexible pipes for oil & gas market is projected to grow at a significant rate due to increasing offshore exploration and production activities, rising demand for cost-effective and corrosion-resistant piping solutions, technological advancements in materials and design, and the expansion of deepwater and ultra-deepwater drilling operations.

- Based on Raw Material, the High Density Polyethylene segment is expected to lead the global market.

- On the basis of Application, the Onshore segment is growing at a high rate and will continue to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Global Flexible Pipes for Oil & Gas Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Flexible Pipes For Oil & Gas Market |

| Market Size in 2024 | USD 1253.26 Million |

| Market Forecast in 2034 | USD 2583.01 Million |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 214 |

| Key Companies Covered | National Oilwell Varco (NOV), TechnipFMC PLC, The Prysmian Group, GE Oil & Gas Corporation, Shawcor Ltd, SoulForce (Pipelife Nederland B.V.), Airborne Oil & Gas BV, Magma Global Ltd, ContiTech AG, Chevron Phillips Chemical Company LLC, Flexsteel Pipeline Technologies Inc., and others. |

| Segments Covered | By Raw Material, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Flexible Pipes for Oil & Gas Market: Segmentation

The global flexible pipes for oil & gas market is segmented based on type, application, and region. All the segments have been analyzed based on present and future trends and the market is estimated from 2025 to 2034.

Based on type, the market is segmented into high-density polyethylene, polyamides, and polyvinylidene fluoride. They are commonly used in the manufacturing of oil and gas flexible pipes. Among these, the high-density polyethylene (HDPE) segment held the largest market share in 2024 and is further predicted to grow rapidly at a remarkable CAGR during the forecast period. This is mainly because HDPE is widely used in the oil and gas industry for its excellent resistance to corrosion, abrasion, and chemicals, as well as its high tensile strength and flexibility. HDPE pipes are also lightweight, which makes them easy to handle and install, reducing overall costs. Moreover, increasing investments in the offshore oil and gas industry, particularly in subsea applications, have driven the demand for HDPE flexible pipes. The material is expected to continue its dominance in the market due to its advantages over other materials and its increasing adoption in the oil and gas industry.

Based on application, the market is bifurcated into the onshore and offshore segments. The offshore segment held the dominating market share in 2024 and is further projected to grow at a notable CAGR during the forecast period. This can be attributed to the increasing exploration and production activities in offshore locations, which require the transportation of fluids and gases from seabed wells to the surface. Moreover, offshore flexible pipes offer several advantages over traditional rigid pipes, including ease of installation, reduced maintenance, and resistance to corrosion and fatigue. The increasing demand for subsea flowlines, risers, and jumpers in offshore drilling and production is also driving the growth of the offshore application segment.

The Regional, this segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America,and the Middle East and Africa.

Recent Developments

- In March 2024, TechnipFMC announced the launch of its new flexible pipe product, called Deep Blue. The product is designed to meet the needs of the offshore oil and gas industry, offering enhanced performance and reduced costs. The Deep Blue is a composite pipe that combines the benefits of steel and polymer materials, providing high mechanical strength, corrosion resistance, and flexibility. The launch of Deep Blue marks a significant milestone for TechnipFMC in its efforts to improve the efficiency and sustainability of offshore oil and gas production.

- In January 2024, Shawcor announced that it had been awarded a contract by McDermott International to provide coating services for the Tyra Redevelopment Project in the North Sea. Shawcor's coating services will be used to protect flexible pipelines and umbilical during installation and operation. The Tyra Redevelopment Project is one of the largest offshore oil and gas projects in the North Sea, and Shawcor's involvement highlights the company's position as a leading provider of pipeline coating solutions for the industry.

Global Flexible Pipes for Oil & Gas Market: Regional Analysis

The flexible pipes for oil and gas market shows distinct regional trends driven by offshore exploration activities, infrastructure development, and investments in energy projects. North America holds a substantial share due to robust shale exploration and offshore projects in the Gulf of Mexico, while Europe remains strong with developments in the North Sea and increasing focus on extending the life of existing offshore assets. The Asia-Pacific region is experiencing significant growth fueled by rising energy demand, new offshore discoveries, and expanding subsea infrastructure, particularly in countries like China, Australia, and Malaysia. Meanwhile, regions such as the Middle East and Africa are also witnessing steady demand, supported by ongoing offshore developments, deepwater projects, and the drive to enhance oil and gas production capacities. Overall, global energy needs and the shift toward deeper and more challenging offshore reserves continue to underpin demand for flexible pipes across regions.

Global Flexible Pipes For Oil & Gas Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the flexible pipes for oil & gas market on a global and regional basis.

The global flexible pipes for oil & gas market is dominated by players like:

- National Oilwell Varco (NOV)

- TechnipFMC PLC

- The Prysmian Group

- GE Oil & Gas Corporation

- Shawcor Ltd

- SoulForce (Pipelife Nederland B.V.)

- Airborne Oil & Gas BV

- Magma Global Ltd

- ContiTech AG

- Chevron Phillips Chemical Company LLC

- Flexsteel Pipeline Technologies Inc.

Global Flexible Pipes For Oil & Gas Market: Segmentation Analysis

The global flexible pipes for oil & gas market is segmented as follows;

By Raw Material

- High Density Polyethylene

- Polyamides

- Polyvinylidene Fluoride

- Others

By Application

- Onshore

- Offshore

Global Flexible Pipes For Oil & Gas Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

In the oil and gas industry, flexible pipes are highly preferred over rigid pipes due to their ability to withstand harsh environments, high-pressure conditions, and extreme temperatures. Flexible pipes can also be easily installed and maintained, making them a popular choice for both onshore and offshore applications. They are designed to meet the specific needs of each project and can be customized to suit different types of fluids and gases.

The global flexible pipes for oil & gas market is expected to grow due to rising deepwater exploration activities, cost-efficiency advantages, demand for corrosion-resistant solutions, and increasing offshore drilling projects.

According to a study, the global flexible pipes for oil & gas market size was worth around USD 1253.26 Million in 2024 and is expected to reach USD 2583.01 Million by 2034.

The global flexible pipes for oil & gas market is expected to grow at a CAGR of 7.5% during the forecast period.

North America is expected to dominate the flexible pipes for oil & gas market over the forecast period.

Leading players in the global flexible pipes for oil & gas market include National Oilwell Varco (NOV), TechnipFMC PLC, The Prysmian Group, GE Oil & Gas Corporation, Shawcor Ltd, SoulForce (Pipelife Nederland B.V.), Airborne Oil & Gas BV, Magma Global Ltd, ContiTech AG, Chevron Phillips Chemical Company LLC, Flexsteel Pipeline Technologies Inc., among others.

The report explores crucial aspects of the flexible pipes for oil & gas market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Global Flexible Pipes For Oil Gas Industry PerspectiveGlobal Flexible Pipes for Oil Gas OverviewGlobal Flexible Pipes for Oil Gas Growth FactorsRestraints:Opportunities:Challenges:Key InsightsGlobal Flexible Pipes for Oil Gas Report ScopeGlobal Flexible Pipes for Oil Gas SegmentationRecent DevelopmentsGlobal Flexible Pipes for Oil Gas Regional AnalysisGlobalFlexible Pipes For Oil Gas Competitive AnalysisGlobalFlexible Pipes For Oil Gas Segmentation AnalysisGlobalFlexible Pipes For Oil Gas Regional Segment AnalysisRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed