Food Processing Market Size, Trend, Growth, Industry Analysis 2034

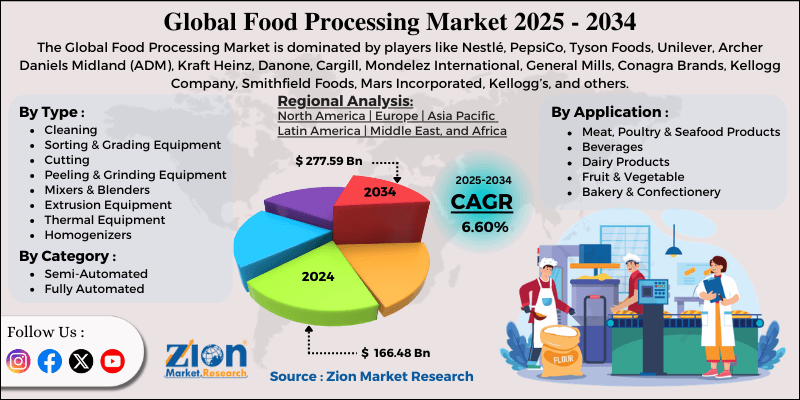

Food Processing Market By Type (Cleaning, Sorting & Grading Equipment, Cutting, Peeling & Grinding Equipment, Mixers & Blenders, Extrusion Equipment, Thermal Equipment, Homogenizers, and Others), By Category (Semi-Automated, Fully Automated), By Application (Meat, Poultry & Seafood Products, Beverages, Dairy Products, Fruit & Vegetable, Bakery & Confectionery, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

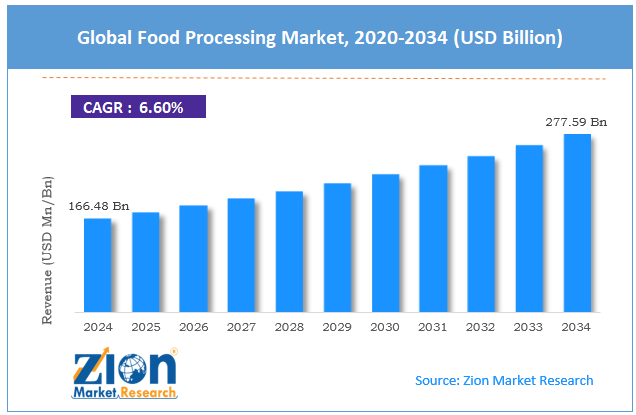

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 166.48 Billion | USD 277.59 Billion | 6.60% | 2024 |

Food Processing Industry Perspective:

What will be the size of the global food processing market during the forecast period?

The global food processing market size was around USD 166.48 billion in 2024 and is projected to reach USD 277.59 billion by 2034, with a compound annual growth rate (CAGR) of roughly 6.60% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global food processing market is estimated to grow annually at a CAGR of around 6.60% over the forecast period (2025-2034)

- In terms of revenue, the global food processing market size was valued at around USD 166.48 billion in 2024 and is projected to reach USD 277.59 billion by 2034.

- The food processing market is projected to grow significantly, driven by increasing urbanization, technological advancements in processing, and rising disposable incomes.

- Based on type, the mixers & blenders segment is expected to lead the market, while the extrusion equipment segment is expected to grow considerably.

- Based on category, the fully automated segment is the dominating segment, while the semi-automated segment is projected to witness sizeable revenue over the forecast period.

- Based on application, the meat, poultry & seafood products segment is expected to lead the market, followed by the bakery & confectionery segment.

- By region, North America is projected to dominate the global market during the forecast period, followed by Europe.

Food Processing Market: Overview

Food processing is the practice of transforming raw ingredients into food products that are convenient, safe, and ready to cook or eat. It comprises steps like cooking, drying, freezing, and packaging, helping reduce food waste and enhance shelf life. Food processing makes food transport and storage easier and enhances texture, flavor, and nutritional value. The global food processing market is projected to grow substantially, driven by urbanization and busy lifestyles, rising disposable incomes, and technological advancements. Speedy urbanization has remarkably changed eating habits, with a growing reliance on ready-to-eat and packaged foods. Hectic lifestyles have limited time for traditional cooking. This strongly fuels the demand for convenient food processing solutions.

Moreover, rising incomes allow users to spend more on value-added and branded food products. Frozen, premium, and processed foods are becoming more affordable. This trend is majorly prevalent in the developing nations. Furthermore, AI, automation, and advanced preservation technologies enhance processing efficacy and food quality. These improvements enhance shelf life and reduce waste. Technology also supports consistent, large-scale production.

Although drivers exist, the global market faces challenges such as high operating costs, capital constraints, and strict regulatory frameworks. Food processing needs expensive infrastructure and machinery. Maintenance, labor, and energy costs are also significant. These factors restrict entry for medium- and small-sized businesses. Likewise, food safety regulations vary across regions and are challenging to enforce. Compliance raises documentation and operational costs. This may slow down product expansion and launches.

Even so, the global food processing industry is well-positioned due to demand for functional and healthy foods, the adoption of smart manufacturing, and sustainable packaging innovations. Consumers increasingly prefer high-protein, low-fat, and fortified foods. Plant-based and organic products are gaining prominence. This creates strong innovation prospects. Use of IoT, AI, and automation enhances quality control and productivity. Smart factories reduce operating costs and errors. This improves scalability and competitiveness. Additionally, eco-friendly and biodegradable packaging is in higher demand. Companies adopting sustainable practices gain brand loyalty. This also helps meet environmental regulations.

Food Processing Market: Dynamics

Growth Drivers

How do growing health consciousness and clean-label trends fuel the food processing market?

Consumers are steadily prioritizing nutrition, health, and ingredient transparency in their food choices. Demand for low-sugar, clean-label, and plant-based products continues to grow worldwide. Food processors are reformulating products to improve nutritional value and reduce reliance on artificial additives. Sustainable, environmentally friendly packaging is also influencing brand perception and purchase decisions. Health and wellness trends are fueling advancement in product variety and design. Brands that align with consumer expectations for sustainability and transparency gain a competitive edge. This inclination is reshaping product portfolios and market dynamics in categories.

How are technological advancements and automation positively driving the development of the food processing market?

Robotics, AI, and automation are transforming food processing by reducing errors and enhancing efficacy. Real-time monitoring and smart sensors improve safety, quality controls, and traceability. Predictive maintenance reduces downtime and reduces operational costs. Preservation technologies and advanced packaging extend shelf-life while maintaining nutritional quality. These advancements drive productivity, allow faster responses to market trends, and improve overall competitiveness. Hence, these advancements ultimately drive the growth of the food processing market.

Restraints

Shelf-life and storage limitations adversely impact the market progress

Perishable foods have a short shelf life, making proper handling, storage, and distribution crucial to prevent spoilage. Inadequate preservation or weak cold-chain infrastructure may result in major product loss and financial barriers. Shelf-life restrictions also hamper the distribution of products (export and domestic). Investments in technologies such as refrigeration, modified atmosphere, and vacuum packaging help maintain product quality. These factors collectively limit industry growth, especially in regions with underdeveloped logistics networks.

Opportunities

How does the expansion of e-commerce and online grocery platforms present favorable prospects for the food processing market growth?

The speedy growth of food delivery platforms and online grocery services allows processors to reach consumers directly. E-commerce enables regional and small brands to expand their industry presence without substantial retail investment. Direct-to-consumer models and subscription services offer consistent revenue streams. Digital platforms also facilitate data-driven insights into consumer behavior. Advances in packaging for online delivery may further enhance shelf life and convenience. Online sales channels reduce geographic restraints and allow faster product introductions. This digital shift offers major growth prospects for players in the food processing industry.

Challenges

Rising operational costs restrict the market growth

Growing energy, labor, and raw-material prices increase overall production costs. Maintaining profitability while keeping products affordable is a constant balancing act. Investment in cold-chain infrastructure and modern technology adds further financial pressure. Mid-sized and small companies may find it challenging to deal with such high costs. Inflationary pressures impact consumer demand and production. Companies should enhance efficiency and supply chain management to remain competitive. High operational costs remain a key challenge to industry scaling.

Food Processing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Food Processing Market |

| Market Size in 2024 | USD 166.48 Billion |

| Market Forecast in 2034 | USD 277.59 Billion |

| Growth Rate | CAGR of 6.60% |

| Number of Pages | 214 |

| Key Companies Covered | Nestlé, PepsiCo, Tyson Foods, Unilever, Archer Daniels Midland (ADM), Kraft Heinz, Danone, Cargill, Mondelez International, General Mills, Conagra Brands, Kellogg Company, Smithfield Foods, Mars Incorporated, Kellogg’s, and others. |

| Segments Covered | By Type, By Category, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Food Processing Market: Segmentation

The global food processing market is segmented based on type, category, application, and region.

Why is the Mixers & Blenders segment projected to dominate the food processing market?

Based on type, the global food processing industry is divided into cleaning, sorting & grading equipment, cutting, peeling & grinding equipment, mixers & blenders, extrusion equipment, thermal equipment, homogenizers, and others. The mixers & blenders segment holds a leading 3% share of the total market. They are crucial in dairy, beverages, bakery, and ready-to-eat foods for consistent texture and uniform mixing. Their versatility makes them widely adopted in both large-scale and small-scale operations.

The extrusion equipment segment ranks second in the market with 26% share. They are essential for producing cereals, snacks, heat-treated products, and plant-based foods. Their role in cooking, shaping, and ensuring food safety fuels robust worldwide demand.

What factors help the Fully Automated segment lead the food processing market?

Based on category, the global food processing market is segmented into semi-automated and fully automated. The fully automated segment registers a dominant 62% share of the market, driven by growing demand for high throughput, minimal labor input, and consistent quality. These systems use integrated controls, advanced sensors, and robotics to simplify end-to-end processing with little human intervention. High-volume plants and large manufacturers mainly favor fully automated systems for hygiene and efficiency.

Conversely, the semi-automated systems segment ranks second with a 40% share. They serve businesses that need a balance between human oversight and automation efficiency. They combine operator involvement with machine handling, making them more flexible and more affordable for medium- and small-scale processors. This segment remains strong in developing regions and where cost-effective automation is in demand.

What are the key reasons for the leadership of the Meat, Poultry & Seafood Products segment in the food processing market?

Based on application, the global market is segmented into meat, poultry & seafood products, beverages, dairy products, fruit & vegetable, bakery & confectionery, and others. The meat, poultry & seafood products segment captures a leading 29% market share, indicating strong demand for processed protein foods. This segment comprises deboning, cutting, packaging, and marinating operations tailored to different dietary preferences. Its volumes and complexity fuel significant equipment investment and industry value.

Nonetheless, the bakery & confectionery segment holds a second-leading 31% share of the market, supported by high consumption of pastries, bread, sweets, and snacks worldwide. Rising urban lifestyles and on-the-go eating trends strengthen demand for processed baked goods. Advanced mixers, ovens, and forming equipment are major propellers in this category.

Food Processing Market: Regional Analysis

What gives North America a competitive edge in the global Food Processing Market?

North America is likely to sustain its leadership in the food processing market, with a CAGR of over 6.4%, driven by substantial market share and industrial base, adoption of advanced technologies, and high consumption of convenience and processed foods. North America ranked first in the worldwide market in 2024, ahead of the rest. This dominance signifies a mature, large-scale processing industry in Canada and the US, with significant production capacity across major applications. This also translates into significant equipment investment and ongoing advancements in processing lines.

Moreover, the region’s food processors are early adopters of robotics, automation, and digital controls, enabling them to boost throughput, enhance food safety outcomes, and reduce labor dependency. Furthermore, consumers in the region have a strong appetite for ready-to-eat, processed, and convenience foods, backed by busy lifestyles and high disposable incomes. A large share of household food consumption comes from processed products, aiding sustain equipment demand and high production volumes.

Why does Europe rank second in the global Food Processing Market?

Europe continues to hold the second-highest share, with an approximately 6.4% CAGR in the food processing industry, owing to strong market presence, a well-developed industry structure, high-quality standards and regulatory frameworks, innovation, consumer preferences, and sustainability. Europe registers for nearly 30% of the total market, making it the second-leading region. Key economies such as Italy, Germany, the UK, and France have well-developed industries with significant production capacity. This mature structure backs consistent market dominance.

Moreover, stringent food safety, labeling, and traceability regulations drive processors to adopt quality controls and advanced solutions. These standards enhance consumer trust and product safety. They also help European processed foods maintain a premium position worldwide. Additionally, the growing demand for plant-based, organic, and minimally processed foods fuels regional growth, and sustainability initiatives and environmentally friendly practices boost industry value.

Food Processing Market: Competitive Analysis

The leading players in the global food processing market are:

- Nestlé

- PepsiCo

- Tyson Foods

- Unilever

- Archer Daniels Midland (ADM)

- Kraft Heinz

- Danone

- Cargill

- Mondelez International

- General Mills

- Conagra Brands

- Kellogg Company

- Smithfield Foods

- Mars Incorporated

- and Kellogg’s

What are the key trends in the global Food Processing Market?

Increased adoption of innovative technologies and automation:

Food processors are rapidly integrating robotics, automation, and data-driven systems such as AI and IoT to improve efficiency, enhance traceability, and reduce errors. Smart processing lines back predictive maintenance and real-time monitoring, improving product consistency and cutting costs. This digital transformation is growing into a significant competitive differentiator.

Focus on eco‑friendly practices and sustainability:

Environmental concerns are driving investment in energy-efficient equipment, sustainable packaging solutions, and waste-reduction methods. Companies are redesigning supply chains to enhance resource use and lower their carbon footprint. Sustainability commitments are steadily used as brand value propositions.

The global food processing market is segmented as follows:

By Type

- Cleaning

- Sorting & Grading Equipment

- Cutting

- Peeling & Grinding Equipment

- Mixers & Blenders

- Extrusion Equipment

- Thermal Equipment

- Homogenizers

- Others

By Category

- Semi-Automated

- Fully Automated

By Application

- Meat, Poultry & Seafood Products

- Beverages

- Dairy Products

- Fruit & Vegetable

- Bakery & Confectionery

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed