China Jewelry Market Size, Share, Trends, Growth & Forecast 2034

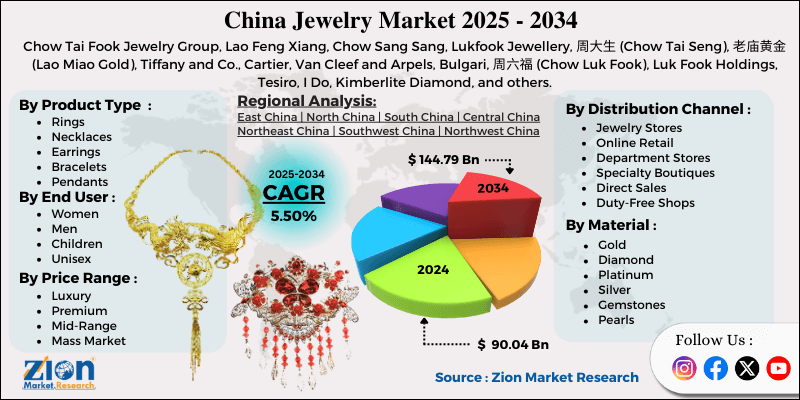

China Jewelry Market By Product Type (Rings, Necklaces, Earrings, Bracelets, Pendants, Bangles, Anklets), By Material (Gold, Diamond, Platinum, Silver, Gemstones, Pearls, Others), By Distribution Channel (Jewelry Stores, Online Retail, Department Stores, Specialty Boutiques, Direct Sales, Duty-Free Shops), By End-User (Women, Men, Children, Unisex), By Price Range (Luxury, Premium, Mid-Range, Mass Market), and By Region - Comprehensive Market Intelligence, Historical Data Analysis, and Forecasts 2025 - 2034

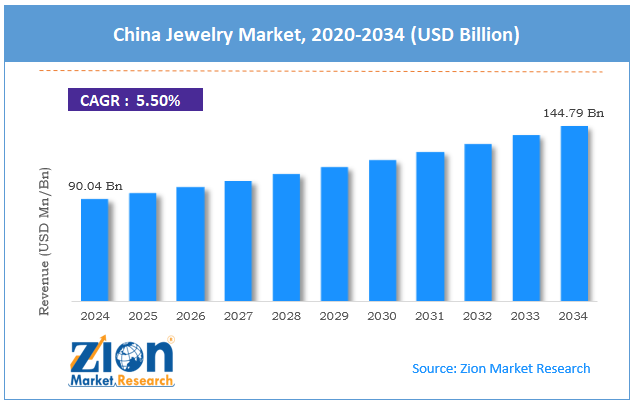

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 90.04 Billion | USD 144.79 Billion | 5.50% | 2024 |

China Jewelry Industry Perspective:

The China jewelry market size was worth approximately USD 90.04 billion in 2024 and is projected to grow to around USD 144.79 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.50% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the China jewelry market is estimated to grow annually at a CAGR of around 5.50% over the forecast period (2025-2034).

- In terms of revenue, the China jewelry market size was valued at approximately USD 90.04 billion in 2024 and is projected to reach USD 144.79 billion by 2034.

- The China jewelry market is projected to grow significantly due to rising disposable incomes, increasing urbanization, growing female workforce participation, and evolving consumer preferences toward branded and designer jewelry.

- Based on product type, the rings segment is expected to lead the China jewelry market, while the earrings segment is anticipated to experience significant growth.

- Based on material, the gold segment is expected to lead the China jewelry market, while the diamond segment is anticipated to witness notable growth.

- Based on the distribution channel, the jewelry stores segment is the dominating segment, while the online retail segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the women segment is expected to lead the market compared to the men segment.

- Based on price range, the mid-range segment is expected to dominate, while the luxury segment is anticipated to show strong growth.

China Jewelry Market: Overview

China jewelry refers to ornamental pieces crafted in China that combine precious metals, gemstones, and traditional cultural motifs with modern design influences. Chinese consumers have always valued gold and precious metals for their beauty, status, and symbolic meaning, and traditional designs often feature dragons, phoenixes, and other cultural motifs. Modern jewelry blends these heritage elements with Western design influences, creating styles that appeal strongly to younger buyers. The market includes everything from affordable fashion pieces to high-end creations with rare diamonds and gemstones, although gold jewelry remains the most popular because of cultural preferences and its perceived investment value. Diamond jewelry has also become widely accepted, especially for engagement rings and wedding bands influenced by Western customs. Consumers increasingly buy jewelry for themselves rather than wait for special occasions, signaling a shift in luxury habits. E-commerce and live-streaming have transformed how people discover and purchase jewelry. Both global luxury brands and domestic designers compete in a diverse market shaped by rising incomes, urban growth, and changing tastes, while gifting remains an important tradition.

The growing middle class and increasing female economic empowerment are expected to drive sustained growth in the China jewelry market throughout the forecast period.

China Jewelry Market Dynamics

Growth Drivers

Rising income levels and urbanization

The China jewelry market is growing quickly as rising incomes give more people the ability to spend on luxury products once considered difficult to afford. The expanding middle class enjoys higher disposable income, which supports regular purchases of jewelry across many retail formats. Urban populations continue to increase as cities develop, creating modern shopping spaces where jewelry buying becomes a common part of everyday consumer activity. Young professionals in major cities earn stable salaries that make frequent jewelry purchases possible throughout the year. Career women often buy jewelry for personal enjoyment, showing greater financial independence across urban regions.

Smaller cities are experiencing strong income growth, widening the market beyond traditional coastal locations. Consumer confidence remains high because jewelry is viewed as both a luxury product and a reliable store of value. Higher education levels have created informed shoppers who compare brands and study product details before purchasing. International travel and online platforms expose consumers to global trends and influence their preferences. Dual-income families have become common in cities, increasing household purchasing power for luxury items. Government policies encouraging domestic consumption have supported steady luxury spending across urban regions.

How are the cultural traditions and evolving gifting practices driving the China jewelry market growth?

The China jewelry industry grows strongly because cultural traditions give jewelry an important role in major life events and celebrations across many regions. Weddings drive the highest spending as families invest in gold pieces, diamond rings, and full bridal sets for meaningful ceremonies. The custom of gifting gold jewelry during weddings remains popular in smaller cities and rural communities where traditions hold strong. Lunar New Year encourages generous gifting as people buy jewelry for relatives, friends, and business partners during festive gatherings.

Birthdays, especially milestone years, prompt jewelry purchases that express wishes for prosperity, happiness, and long life. Jewelry for newborns, including gold bracelets and pendants, remains a common choice for families celebrating children. Coming-of-age events and graduations inspire jewelry gifts that mark important personal achievements for young people. Chinese Valentine’s Day and Western Valentine’s Day generate strong demand among younger couples seeking meaningful expressions of affection. Anniversary celebrations encourage repeat purchases as couples honor shared milestones. Zodiac-inspired jewelry attracts buyers each year due to cultural symbolism.

Restraints

How do economic uncertainties and shifting investment preferences limit growth in the China jewelry market?

The China jewelry market faces challenges because economic uncertainty and shifting preferences influence how consumers view jewelry as a purchase worth making. Slower economic growth makes many households more cautious about spending large amounts on luxury products during uncertain periods. Real estate corrections reduce household wealth because property remains the primary asset for most families nationwide. Stock market instability lowers confidence and reduces spare income for jewelry purchases among consumers in many regions. Younger buyers show reduced interest in traditional gold pieces, preferring financial products, technology, or meaningful experiences. High retail markups create doubts about value and encourage careful consideration before purchasing luxury jewelry.

Fluctuating gold prices cause hesitation as people wait for more favorable conditions during periods of uncertainty. Investment alternatives, such as mutual funds and wealth management products, attract capital that might otherwise have gone into jewelry. Digital assets and cryptocurrencies appeal strongly to younger investors who enjoy new financial opportunities. Concerns about job stability reduce the enthusiasm of working professionals for major luxury purchases.

Opportunities

Digital transformation and E-commerce

The China jewelry market is gaining strong growth opportunities through digital platforms and online models that reshape how consumers explore and purchase jewelry across many regions. E-commerce leaders such as Alibaba, JD.com, and Pinduoduo offer extensive jewelry selections supported by secure systems and smooth digital services. Live-streaming commerce attracts millions of viewers as influencers present jewelry pieces and encourage instant purchases during interactive sessions. Social commerce on WeChat and Little Red Book creates discovery through peer opinions, user reviews, and shared shopping experiences among online communities.

Virtual try-on tools using augmented reality help shoppers see how pieces look on them, reducing hesitation during online purchases. Direct-to-consumer brands sell through digital channels, providing better value by reducing retail markups for price-conscious buyers. Online customization services allow customers to design personal pieces that create emotional connections and memorable ownership experiences. Luxury platforms offer authentication services that build trust for high-value transactions conducted through mobile devices.

Digital advertising targets specific groups with product suggestions based on browsing patterns and previous purchases. Educational content online teaches consumers about quality, materials, and jewelry care, improving confidence during purchases. Flash sales and digital festivals generate huge sales through exclusive deals during limited-time events.

Challenges

How are authenticity concerns and quality trust issues creating challenges for the China jewelry market?

The China jewelry industry faces several challenges because product authenticity, quality consistency, and consumer trust influence purchasing behavior across many regions. Counterfeit jewelry spreads through unofficial channels and certain online spaces, harming brand reputations and lowering buyer confidence during luxury purchases. Quality inconsistencies appear even among trusted retailers, as gold purity or diamond grades differ from advertised descriptions during physical inspections.

Testing and certification systems vary across locations, creating confusion for consumers who struggle to understand which quality claims feel reliable. Laboratory-grown gemstones are sometimes sold as natural pieces without proper disclosure, misleading buyers who expect transparent information during purchases. Pricing lacks standardization, making it difficult for consumers to judge fair value for complex jewelry designs featuring multiple stones.

Small shops offer lower prices but may lack certification, creating risks for budget-conscious customers seeking affordable products. Complicated return policies leave some buyers stuck with items that fail to meet expectations after purchase. Limited resale markets reduce jewelry’s perceived investment value compared to other luxury products across major cities. Regional differences in quality expectations lead to inconsistent experiences for shoppers moving between urban centers. Online platforms create additional trust issues when product photos fail to match the actual appearance upon delivery.

China Jewelry Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | China Jewelry Market |

| Market Size in 2024 | USD 90.04 Billion |

| Market Forecast in 2034 | USD 144.79 Billion |

| Growth Rate | CAGR of 5.50% |

| Number of Pages | 216 |

| Key Companies Covered | Chow Tai Fook Jewelry Group, Lao Feng Xiang, Chow Sang Sang, Lukfook Jewellery, 周大生 (Chow Tai Seng), 老庙黄金 (Lao Miao Gold), Tiffany and Co., Cartier, Van Cleef and Arpels, Bulgari, 周六福 (Chow Luk Fook), Luk Fook Holdings, Tesiro, I Do, Kimberlite Diamond, and others. |

| Segments Covered | By Product Type, By Material, By Distribution Channel, By End User, By Price Range, and By Region |

| Regions Covered in China | East China, North China, South China, Central China, Northeast China, Southwest China, and Northwest China |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

China Jewelry Market: Segmentation

The China jewelry market is segmented based on product type, material, distribution channel, end-user, price range, and region.

Based on product type, the China jewelry industry is classified into rings, necklaces, earrings, bracelets, pendants, bangles, and anklets. Rings lead the market due to their essential role in weddings and engagements, cultural significance in symbolizing commitment and relationships, and versatile designs that serve both daily wear and special occasions.

Based on material, the industry is segregated into gold, diamond, platinum, silver, gemstones, pearls, and others. Gold leads the market due to its deep cultural significance in Chinese tradition, perceived investment value and wealth preservation properties, preferences for 24-karat and high-purity gold, and its central role in traditional gifting and wedding customs.

Based on distribution channel, the China jewelry market is divided into jewelry stores, online retail, department stores, specialty boutiques, direct sales, and duty-free shops. Jewelry stores are expected to lead the market during the forecast period due to their ability to provide physical product inspection, personalized customer service, and secure high-value transactions that remain important for jewelry purchases.

Based on end-user, the market is segmented into women, men, children, and unisex. Women hold the largest market share due to their dominant role as jewelry consumers, cultural traditions of receiving jewelry as gifts, and a greater variety of product options designed for female consumers.

Based on price range, the market is categorized into luxury, premium, mid-range, and mass market. The mid-range segment is expected to lead due to the expanding middle class, the balance between quality and affordability, and increasing accessibility of branded jewelry to broader income segments.

China Jewelry Market: Regional Analysis

Eastern China leads due to economic and retail strength.

Eastern China is emerging as a powerful center for the China jewelry market as prosperous cities, modern retail districts, and global fashion influences shape evolving luxury habits. Rising incomes in major metropolitan areas are encouraging consumers to explore premium jewelry as part of personal identity and social expression.

At the same time, luxury malls continue expanding jewelry offerings across gold, diamonds, and contemporary designs. Design schools, cultural institutions, and creative studios across the region are nurturing a new generation of jewelry designers who blend traditional artistry with modern aesthetics, strengthening the local talent pipeline. Consumers in cities like Shanghai, Suzhou, and Hangzhou increasingly follow international style trends, helping create steady interest in both classic and innovative jewelry collections.

Regional industry groups are introducing updated quality standards and professional training for retailers, and thriving commercial zones see jewelry as an important part of the luxury shopping experience. Digital platforms are accelerating market growth by offering virtual consultations, personalized recommendations, and streamlined online purchasing, while tourism adds additional demand in major shopping streets across the region. Growing appreciation for craftsmanship, branded storytelling, and investment-grade pieces is influencing buying patterns, and strong collaboration among designers, retailers, and emerging luxury brands positions Eastern China as a leading force in the country’s jewelry industry.

What drives Southern China’s strong dynamics in the China jewelry market?

Southern China is developing into a strong second-leading region in the jewelry market as manufacturing expertise, cultural traditions, and rising consumer confidence support expanding luxury demand. Jewelry hubs in Shenzhen and Guangzhou anchor the region’s industry by combining advanced production capabilities with active wholesale networks that distribute pieces nationwide. Local culture places meaningful emphasis on gold, jade, and symbolic designs, encouraging steady purchases for celebrations, family events, and significant life milestones.

Technical institutes and jewelry parks in the region are introducing new tools, modern equipment, and specialized training that enhance craftsmanship and support product innovation for domestic and global markets. Consumers in the Pearl River Delta show strong interest in personalized designs, high-karat gold pieces, and modern interpretations of traditional motifs, driving demand for diverse product lines. Regional trade associations promote best practices for gemstone testing and product certification.

At the same time, retailers expand through online shows, livestream sales, and cross-border shopping channels influenced by Hong Kong’s luxury landscape. Younger buyers, shaped by the region’s entrepreneurial and tech-driven culture, are showing growing interest in stylish, minimalist, or custom-made jewelry, adding momentum to modern product categories. With active collaboration among manufacturers, retailers, independent designers, and digitally engaged consumers, Southern China continues to strengthen its role as a major growth engine for the national jewelry market.

Recent Market Developments:

- In February 2025, Pandora stated that new U.S. tariffs on Chinese imports had a limited impact on its jewelry operations, affecting mainly display items and store furniture, with a revenue impact of around DKK 15 million.

China Jewelry Market: Competitive Analysis

The leading players in the China jewelry market are:

- Chow Tai Fook Jewelry Group

- Lao Feng Xiang

- Chow Sang Sang

- Lukfook Jewellery

- 周大生 (Chow Tai Seng)

- 老庙黄金 (Lao Miao Gold)

- Tiffany and Co.

- Cartier

- Van Cleef and Arpels

- Bulgari

- 周六福 (Chow Luk Fook)

- Luk Fook Holdings

- Tesiro

- I Do

- Kimberlite Diamond

The China jewelry market is segmented as follows:

By Product Type

- Rings

- Necklaces

- Earrings

- Bracelets

- Pendants

- Bangles

- Anklets

By Material

- Gold

- Diamond

- Platinum

- Silver

- Gemstones

- Pearls

- Others

By Distribution Channel

- Jewelry Stores

- Online Retail

- Department Stores

- Specialty Boutiques

- Direct Sales

- Duty-Free Shops

By End User

- Women

- Men

- Children

- Unisex

By Price Range

- Luxury

- Premium

- Mid-Range

- Mass Market

By Region

China

- East China

- North China

- South China

- Central China

- Northeast China

- Southwest China

- Northwest China

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed