Women Luxury Footwear Market Size, Share, Trends, Growth 2034

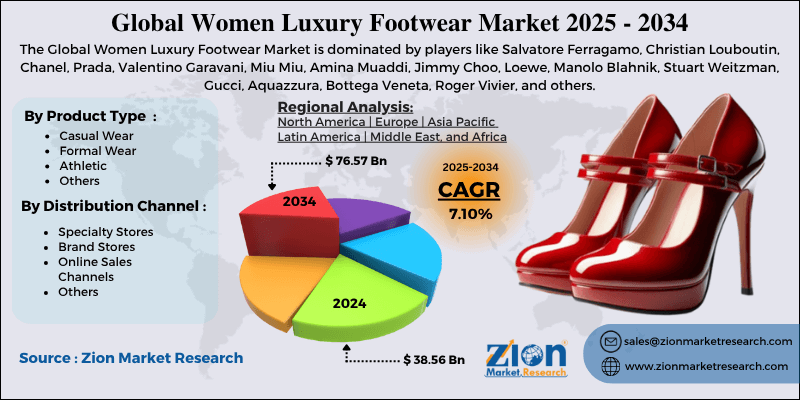

Women Luxury Footwear Market By Product Type (Casual Wear, Formal Wear, Athletic, and Others), By Distribution Channel (Specialty Stores, Brand Stores, Online Sales Channels, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

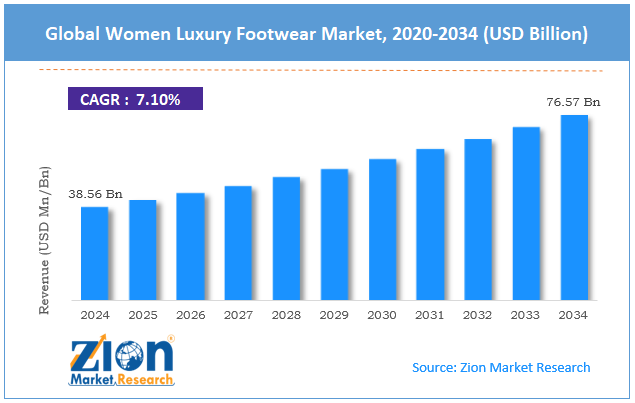

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 38.56 Billion | USD 76.57 Billion | 7.10% | 2024 |

Women Luxury Footwear Industry Perspective:

The global women luxury footwear market size was worth around USD 38.56 billion in 2024 and is predicted to grow to around USD 76.57 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global women luxury footwear market is estimated to grow annually at a CAGR of around 7.10% over the forecast period (2025-2034)

- In terms of revenue, the global women luxury footwear market size was valued at around USD 38.56 billion in 2024 and is projected to reach USD 76.57 billion by 2034.

- The women luxury footwear market is projected to grow at a significant rate due to the growing disposable income of the general population.

- Based on the product type, the casual wear segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the distribution channel, the brand stores segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Women Luxury Footwear Market: Overview

Women’s luxury footwear market deals with the production, distribution, and consumption of high-end footwear items that are more expensive than conventional footwear products. In most cases, luxury shoes, whether for formal wear, casual wear, or athletic use, are made from premium quality materials, including both leather and non-leather items. In addition to this, most high-end footwear for women is made by prominent luxury brands, such as Prada, Gucci, Hermes, Louis Vuitton, Christian Louboutin, and others.

In addition to this, luxury shoes are also fragmented in terms of final cost and brand value depending on the end-demand, brand prestige, craftsmanship, and exclusivity. For instance, the industry is divided into affordable luxury, mid-tier luxury, heritage, and bespoke items. The demand for women luxury footwear is expected to continue growing during the forecast period, driven by several factors.

For instance, rising disposable income of the general population, along with higher consumer awareness and changing lifestyle, will emerge as the most prominent growth factors for the market. Additionally, the growing expansion of e-commerce channels and improving consumer accessibility to high-end products will further aid industry expansion. However, the market is projected to be affected by growing cases of labor law violations reported in the luxury goods industry.

Women Luxury Footwear Market Dynamics

Will the growing disposable income of the general population influence the women luxury footwear market revenue?

The global women luxury footwear market is expected to grow due to the rising disposable income of the general population. Additionally, consumer awareness has also witnessed a sharp increase in the last few years, further influencing demand for luxury items, including footwear. As per industry research, disposable income increased by more than 0.29% in November 2024 compared to the previous three months.

Although recent economic uncertainty is expected to influence consumer trends, the overall growth prospects for luxury footwear designed for women are expected to remain positive by the end of the forecast period. Factors such as increased job opportunities, evolving consumer shopping habits, and a surge in public awareness will play crucial roles in accelerating demand for luxury footwear. For instance, a growing number of the population considers unique or bespoke footwear as long-term investments, particularly in limited-edition items.

Surging demand among celebrities and high-net-worth (HNW) individuals is keeping the market expansion fueled

Luxury footwear for women is highly popular among individuals with high net worth and celebrities. Luxury footwear brands are often considered a status symbol and have an influence on society. Furthermore, celebrities and high-profile individuals often use premium footwear as a form of soft power to influence cultural trends and showcase their wealth.

For instance, Vibe, a leading magazine, reported that Beyoncé, a famous music artist, will be donning around 41 pairs of custom-made Jimmy Choo shoes at the Renaissance World Tour. Luxury footwear makers are expected to continue targeting HNW individuals to make higher sales during the forecast period.

Restraints

Do the growing concerns over labor law violations affect the women luxury footwear market revenue?

The global women luxury footwear industry is expected to be restricted due to the rising cases of labor law violations reported in the market. In July 2025, luxury brand Loro Piana was found guilty of labor law violations by an Italian court. According to official findings, the brand was employing laborers at a rate of USD 5 per hour and requiring them to work over 90 hours per week.

Several other such incidents have emerged worldwide, highlighting poor working conditions for laborers, child employment, and unfair wages, among other malpractices. These incidents have resulted in wider consumer boycotts of luxury brands and a shift toward local producers offering high-quality products and following sustainable practices.

Opportunities

Growing demand for used footwear creates growth opportunities for the industry players

The global women luxury footwear market is expected to generate growth opportunities due to the rising number of customers preferring used or preloved products. A large number of pre-owned luxury product sellers have emerged worldwide, further helping the segment grow. Used products are relatively less priced than their brand-new counterparts.

In addition to this, pre-owned products promote sustainability and the circular economy, which further encourages higher adoption among environmentally conscious customers.

How does the rising integration of sustainable business practices open novel growth avenues for women luxury footwear industry?

Companies worldwide are adopting sustainable business practices to align with the evolving expectations of their customer base. For instance, according to the official website of Jimmy Choo, a world-renowned luxury footwear maker, the brand has incorporated recycled materials into its production line. Additionally, Jimmy Choo is also inclining more toward certified materials for product manufacturing and packaging.

In February 2021, Alexander McQueen, another leading player in the market, announced a novel partnership with Vestiaire Collective. The brands will collaborate to encourage circular practices using innovative technology. Through the Brand Approved program launched by the firm, selected clients will be contacted by the sales team of Alexander McQueen. When clients sell a product from the brand, they will be awarded a credit note, allowing them to make further purchases from brand-owned stores.

Challenges

High cost of the products, economic uncertainty, and growing sales of fake products are challenging market expansion

The global women luxury footwear industry is expected to be challenged by the high cost of premium products. The industry faces tough competition from affordable alternatives.

Additionally, growing economic uncertainty worldwide may further impede market expansion in the long run. Industry players have also raised concerns over the growing sale of counterfeit products, which not only cause monetary loss but also impact brand value.

Women Luxury Footwear Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Women Luxury Footwear Market |

| Market Size in 2024 | USD 38.56 Billion |

| Market Forecast in 2034 | USD 76.57 Billion |

| Growth Rate | CAGR of 7.10% |

| Number of Pages | 212 |

| Key Companies Covered | Salvatore Ferragamo, Christian Louboutin, Chanel, Prada, Valentino Garavani, Miu Miu, Amina Muaddi, Jimmy Choo, Loewe, Manolo Blahnik, Stuart Weitzman, Gucci, Aquazzura, Bottega Veneta, Roger Vivier, and others. |

| Segments Covered | By Product Type, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Women Luxury Footwear Market: Segmentation

The global women luxury footwear market is segmented based on product type, distribution channel, and region.

Based on the product type, the global market segments are casual wear, formal wear, athletic wear, and others. In 2024, the casual wear segment experienced the highest growth, driven by the increased popularity of this footwear type. These shoes are designed to deliver enhanced design as well as higher comfort to the wearer. The most common types of casual luxury footwear for women include slides, loafers, flat sandals, ankle boots, and luxury sneakers. The average starting price of luxury footwear for women can range between USD 400 and USD 800, depending on the brand.

Based on the distribution channel, the global market divisions are specialty stores, brand stores, online sales channels, and others. In 2024, the brand stores segment was the highest revenue-generating distributional channel. Brand-owned stores guarantee product originality. Furthermore, the growing expansion of luxury brands in emerging economies will facilitate improved revenue during the forecast period. As per official reports, Gucci, a leading luxury brand, owns around 529 stores globally.

Women Luxury Footwear Market: Regional Analysis

What factors will help North America lead the women luxury footwear market during the forecast period?

The global women luxury footwear industry is expected to be led by North America during the forecast period. The region has a strong presence of luxury goods buyers, helping North America thrive. The US will emerge as the largest revenue generator in the region, driven by higher demand for luxury footwear among individuals with high net worth. Additionally, rising sales of pre-owned premium and bespoke items in the US and Canada will further facilitate regional expansion in the future.

Europe is another prominent region in the women luxury footwear industry. It is home to some of the world’s leading luxury brands, including Salvatore Ferragamo, Dolce & Gabbana, Tod’s, and many more. Europe is renowned as a shopping destination among tourists from around the globe, as luxury products are often priced more affordably in the region compared to other parts of the world.

European brands are rapidly expanding into new markets such as Asian countries and Middle Eastern nations, promoting regional revenue. Asia-Pacific is a growing market with China, India, and South Korea leading the region. The growing disposable income of the regional population and growing entry of international brands in Asian countries will promote higher revenue in the Asia-Pacific region.

Women Luxury Footwear Market: Competitive Analysis

The global women luxury footwear market is led by players like:

- Salvatore Ferragamo

- Christian Louboutin

- Chanel

- Prada

- Valentino Garavani

- Miu Miu

- Amina Muaddi

- Jimmy Choo

- Loewe

- Manolo Blahnik

- Stuart Weitzman

- Gucci

- Aquazzura

- Bottega Veneta

- Roger Vivier

The global women luxury footwear market is segmented as follows:

By Product Type

- Casual Wear

- Formal Wear

- Athletic

- Others

By Distribution Channel

- Specialty Stores

- Brand Stores

- Online Sales Channels

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Women’s luxury footwear market deals with the production, distribution, and consumption of high-end footwear items that are more expensive than conventional footwear products.

The global women luxury footwear market is expected to grow due to the rising disposable income of the general population.

According to study, the global women luxury footwear market size was worth around USD 38.56 billion in 2024 and is predicted to grow to around USD 76.57 billion by 2034.

The CAGR value of the women luxury footwear market is expected to be around 7.10% during 2025-2034.

The global women luxury footwear industry is expected to be led by North America during the forecast period.

The global women luxury footwear market is led by players like Salvatore Ferragamo, Christian Louboutin, Chanel, Prada, Valentino Garavani, Miu Miu, Amina Muaddi, Jimmy Choo, Loewe, Manolo Blahnik, Stuart Weitzman, Gucci, Aquazzura, Bottega Veneta, and Roger Vivier.

The report explores crucial aspects of the women luxury footwear market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed