Wearable Sensor Market Size, Share, Growth and Forecast 2032

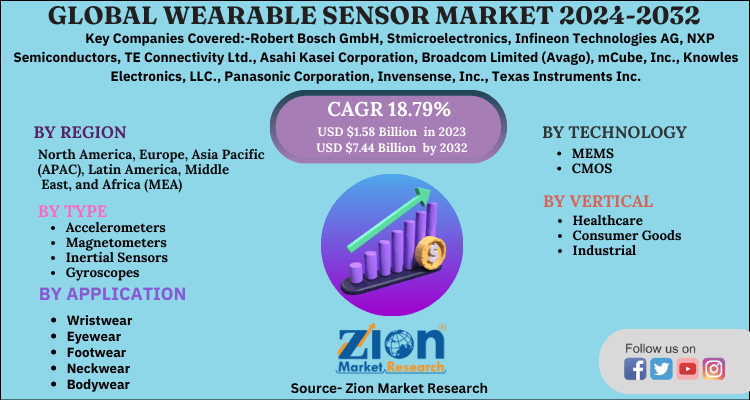

Wearable Sensor Market By Type (Accelerometers, Magnetometers, Inertial Sensors, Gyroscopes, Motion Sensors, Pressure & Force Sensors, Temperature & Humidity Sensors, Medical-Based Sensors, Image Sensors, Touch Sensors And Others) By Application (Wrist Wear, Eye Wear, Neck Wear, Foot Wear, Body Wear And Others) By Technology (MEMS, CMOS And Others) By Vertical (Healthcare, Consumer Goods, Industrial And Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

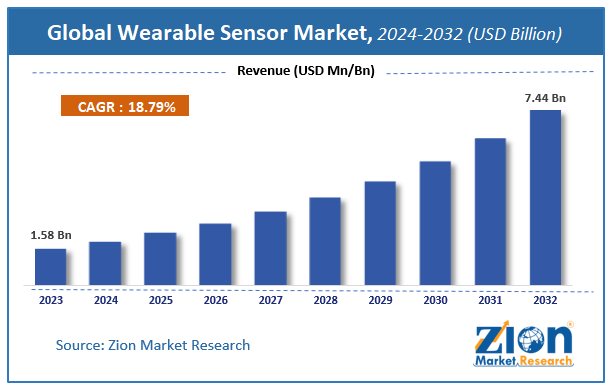

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.58 Billion | USD 7.44 Billion | 18.79% | 2023 |

Wearable Sensor Market Insights

According to a report from Zion Market Research, the global Wearable Sensor Market was valued at USD 1.58 Billion in 2023 and is projected to hit USD 7.44 Billion by 2032, with a compound annual growth rate (CAGR) of 18.79% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Wearable Sensor Market industry over the next decade.

Wearable Sensor Market: Overview

Wearable sensors are devices which are designed to maintain health by monitoring it continuously. It tracks all the physical activities and behavioral changes in humans. There are various types of wearable sensors such as accelerometers, magnetometers, inertial sensors, gyroscopes, motion sensors, pressure & force sensors, temperature & humidity sensors, medical-based sensors, image sensors, touch sensors, among others.

The growing health and fitness awareness among the consumers is one of the primary reasons for augmenting the growth of the market. The emerging trends such as evolution of 5G technology in smart devices and increasing in the number of connected devices worldwide along with smart living has fueled the market.

Wearable Sensor Market: Growth Factors

The rising demand of various wearable devices in healthcare for remote patient monitoring purpose and tracking all the vitals continuously is anticipated to augment the market in the forecast period. These devices can be connected to tablets and mobile phones which easily helps in gathering and collecting the data of the patients in real time. At the same these devices are very easy to mount on patient’s body. As a result, the demand for wearable sensors for efficient supervision of patients at hospitals and homes have increased.

The advancements in technologies for manufacturing sensors and other components needed for making these smart devices and the devices being very compact and portable has gained popularity among consumers. Hence companies are focusing more on integrating these devices with the trending technologies such as Big Data, ML, and IoT among others and providing more privacy for the data. This in turn is stimulating the growth of the market.

Wearable Sensor Market: Segment Analysis

The accelerometer sensors are used to capture the motion data which estimates the location of the device on the human body. The ability of these sensors to provide the data with high accuracy and correctness has increased the demand for wearable devices market. The type segment of wearable sensors market also comprises of magnetometers, inertial sensors, gyroscopes, motion sensors, pressure & force sensors, temperature & humidity sensors, medical-based sensors, image sensors, touch sensors and others.

The healthcare segment is predicted to hold the largest share in 2020 followed by consumer goods segment among others. An increase in the number of patients due to the pandemic and reduction in availability of hospital facilities has resulted in demand for use of wearable devices as they are capable of monitoring the patients remotely. The demand for these wearables by consumers for personal wellness and fitness has also increased the market growth.

Wearable Sensor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Wearable Sensor Market |

| Market Size in 2023 | USD 1.58 Billion |

| Market Forecast in 2032 | USD 7.44 Billion |

| Growth Rate | CAGR of 18.79% |

| Number of Pages | 110 |

| Key Companies Covered | Robert Bosch GmbH, Stmicroelectronics, Infineon Technologies AG, NXP Semiconductors, TE Connectivity Ltd., Asahi Kasei Corporation, Broadcom Limited (Avago), mCube, Inc., Knowles Electronics, LLC., Panasonic Corporation, Invensense, Inc., Texas Instruments Inc, ARM Holdings PLC, Sensirion AG, Analog Devices, Inc., Freescale Semiconductor, Inc., among others. |

| Segments Covered | By Type, By Application, By Technology, By Vertical and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

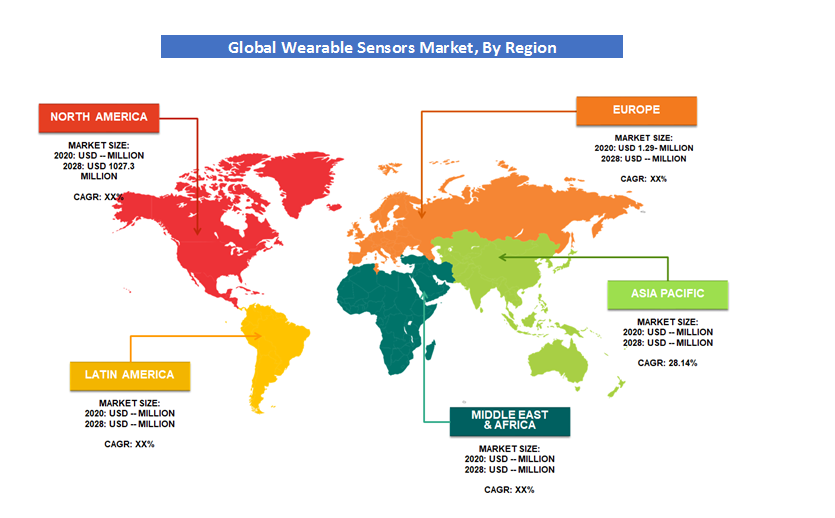

Wearable Sensor Market: Regional Analysis

This is due to the development of new technologies and more wearable products which are coming in the market. Along with that, the healthcare and consumer goods sector have been a major factor to augment the growth of market in the North America region.

This is attributed to rapid use of automation and advance technologies in developing countries, such as China and India. The growing awareness of the benefits of wristwear, eyewear, bodywear and other devices in these economies is also increasing the demand of the market. Additionally, adoption of Internet of Things (IoT), ML and Big Data technologies in various industries is expected to open new avenues for the wearable sensor market over the coming years.

Key Market Players & Competitive Landscape

Some of key players in wearable sensor market are

- Robert Bosch GmbH

- Stmicroelectronics

- Infineon Technologies AG

- NXP Semiconductors

- TE Connectivity Ltd.

- Asahi Kasei Corporation

- Broadcom Limited (Avago)

- mCube, Inc

- Knowles Electronics, LLC.

- Panasonic Corporation

- Invensense, Inc.

- Texas Instruments Inc

- ARM Holdings PLC

- Sensirion AG

- Analog Devices, Inc

- Freescale Semiconductor, Inc

The global wearable sensor market is segmented as follows:

By Type

- Accelerometers

- Magnetometers

- Inertial Sensors

- Gyroscopes

- Motion Sensors

- Pressure & Force Sensors

- Temperature & Humidity Sensors

- Medical-based Sensors

- Image Sensors

- Touch Sensors

- Others

By Application

- Wristwear

- Eyewear

- Footwear

- Neckwear

- Bodywear

- Others

By Technology

- MEMS

- CMOS

- Others

By Vertical

- Healthcare

- Consumer Goods

- Industrial

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed