Image sensor Market Size, Share, Trends, Growth 2032

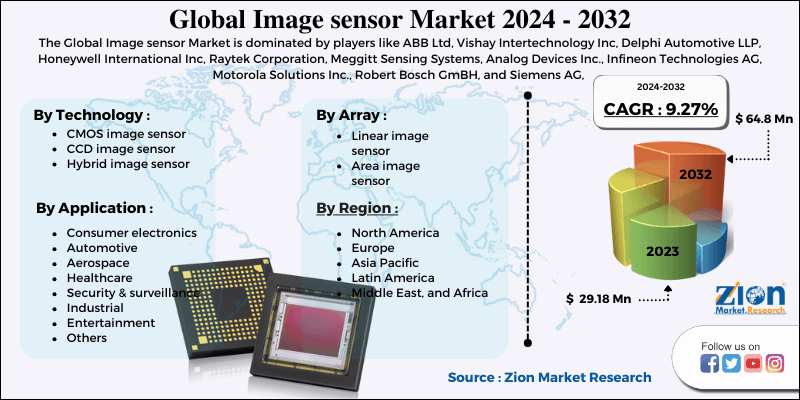

Image sensor Market By Technology (CMOS image sensor, CCD image sensor and Hybrid image sensor), Array Type (Linear image sensor and Area image sensor), By Application (Consumer electronics, Automotive, Aerospace, Healthcare, Security & surveillance, Industrial, Entertainment, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024 - 2032-

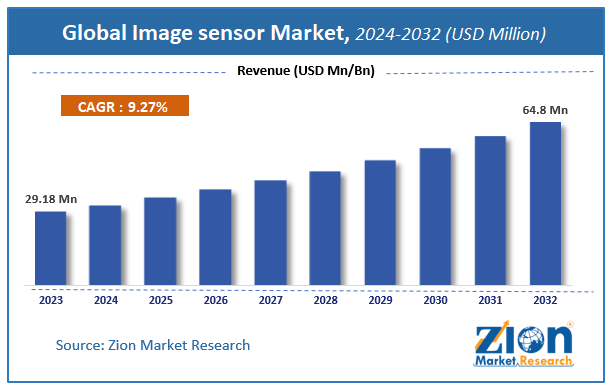

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 29.18 Million | USD 64.8 Million | 9.27% | 2023 |

Image sensor Market Insights

Zion Market Research has published a report on the global Image sensor Market, estimating its value at USD 29.18 Million in 2023, with projections indicating that it will reach USD 64.8 Million by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 9.27% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Image sensor Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Image sensor Market Overview

Image sensors are electronic devices that convert an optical image into an electronic signal. It is mainly used in digital cameras as well as imaging devices to convert the light received on the imaging device lens or camera into a digital image. It is being used in a large number of imaging devices used in industrial, media, medical, and consumer applications. The Complementary metal-oxide-semiconductor (CMOS) technology enabled a shift in the industry for designing advanced image sensors owing to its enhanced efficiency; hence, driving the image sensors market growth.

COVID-19 Impact Analysis:

The global Image sensor market has witnessed a slight decline in sales for the short term to the lockdown enforcement placed by governments in order to contain COVID spreading. The restrictions imposed by various nations to contain COVID had stopped production resulting in disruption across the whole supply chain.

However, the global markets are slowly opening to their full potential, and theirs a surge in demand. The market would remain bullish in the upcoming year. The decrease in the global Image sensor market size in 2020 is estimated on the basis of the COVID-19 outbreak and its negative impact on the economies and industries across the globe. Various scenarios have been analyzed on the basis of inputs from various secondary sources and the current data available about the situation.

Image sensor Market Growth Factors

With the growing demand for cameras, smartphones, and security cameras the image sensors market is experiencing significant growth. Furthermore, growing competition between established charge-coupled device (CCD) image sensors and the new complementary metal oxide semiconductor (CMOS) image sensors is impelling the growth of this industry. With CMOS image sensors improving gradually and moving toward higher-level performance with better integration capabilities and cost advantages.

The main difference between the two types of sensors is that Pixels in a CCD image sensor capture the light and move it to the edge of the chip where it is converted into a digital signal. In contrast, pixels in a CMOS sensor capture light and directly convert it into a digital signal. The uptake of CMOS image sensors in automotive and consumer electronics devices is anticipated to be a growth driver for the CMOS image sensor market. However, the declining growth of still cameras and the high manufacturing cost of image sensors are restraining the growth of this market.

Nonetheless, increasing the application of these sensors in gesture recognition devices, self-driving cars, and in body-worn camera applications will give momentum to the image sensor market during the forecast period.

Image sensor Market Segment Analysis

Market segmentation of the image sensors is done on the basis of technology, array type, application, and region. Technology is classified by a CMOS image sensor, a CCD image sensor, and a hybrid image sensor. CMOS image sensor held the largest share in 2020 due to advanced features and cost-effective technology used in this sensor. The hybrid image sensor is composed of CMOS and CCD used for cameras and other camera recording devices.

Image sensor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Image sensor Market |

| Market Size in 2023 | USD 29.18 Million |

| Market Forecast in 2032 | USD 64.8 Million |

| Growth Rate | CAGR of 9.27% |

| Number of Pages | 160 |

| Key Companies Covered | ABB Ltd, Vishay Intertechnology Inc, Delphi Automotive LLP, Honeywell International Inc, Raytek Corporation, Meggitt Sensing Systems, Analog Devices Inc., Infineon Technologies AG, Motorola Solutions Inc., Robert Bosch GmBH, and Siemens AG, among others. |

| Segments Covered | By Technology, Array Type, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Image sensor Market Regional Analysis

Geographically, Asia Pacific is the leading regional market for image sensor market and is projected to record the highest revenue generation for the global market over the forecast period. The extensive usage of electronic devices and increasing expenditure is boosting this market in this region. However, North America is the second highest market for image sensors due to increasing application of different image sensor in consumer electronics, automotive and other industries. Rising competition between manufacturers in Latin America is expected considerable grow in this region. Competition in the image sensors market is high, with manufacturers striving to outperform their rivals with respect to pixel size, pixel count, resolution, and performance.

Request Free Sample

Request Free Sample

Image sensor Market Key Market Players & Competitive Landscape

The major players operating in the image sensor market are

- ABB Ltd

- Vishay Intertechnology, Inc

- Delphi Automotive LLP

- Honeywell International, Inc

- Raytek Corporation

- Meggitt Sensing Systems

- Analog Devices Inc

- Infineon Technologies AG

- Motorola Solutions, Inc

- Robert Bosch GmBH

- Siemens AG

The global Image sensor market is segmented as follows:

By Technology

- CMOS image sensor

- CCD image sensor

- Hybrid image sensor

By Array Type

- Linear image sensor

- Area image sensor

By Application

- Consumer electronics

- Automotive

- Aerospace

- Healthcare

- Security & surveillance

- Industrial

- Entertainment

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Zion Market Research has published a report on the global Image sensor Market, estimating its value at USD 29.18 Million in 2023, with projections indicating that it will reach USD 64.8 Million by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 9.27% over the forecast period 2024-2032.

Some of the key factors driving the global Image sensor market growth are growing demand for cameras, smartphones, and security cameras and growing competition between established charge-coupled device (CCD) image sensors.

Asia Pacific is the leading regional market for image sensor market and is projected to record the highest revenue generation for the global market over the forecast period.

The major players operating in the image sensor market are ABB Ltd, Vishay Intertechnology, Inc, Delphi Automotive LLP, Honeywell International, Inc, Raytek Corporation, Meggitt Sensing Systems, Analog Devices Inc., Infineon Technologies AG, Motorola Solutions, Inc., Robert Bosch GmBH, and Siemens AG, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed