Vegan Cosmetics Market Size, Share, Trends, Growth and Forecast 2032

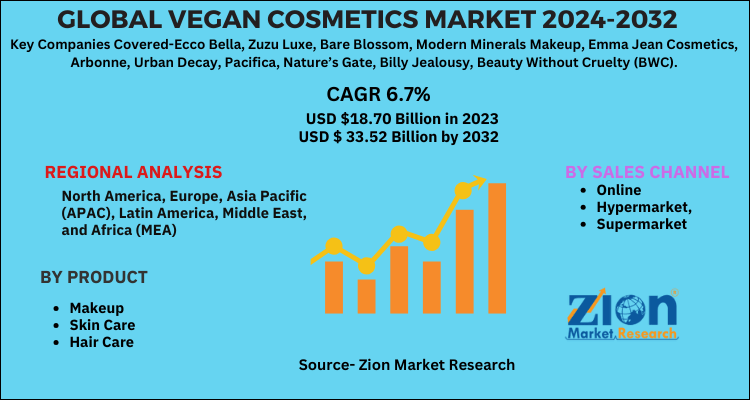

Vegan Cosmetics Market By Product (Makeup, Skin Care, Hair Care, and Others), By Sales Channel (Online, Hypermarket, Supermarket, and Others): Global Industry Perspective, Comprehensive Analysis and Forecast, 2024-2032

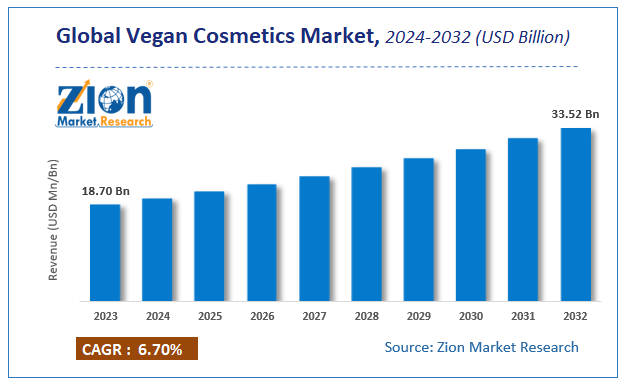

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 18.70 Billion | USD 33.52 Billion | 6.7% | 2023 |

Vegan Cosmetics Market Insights

Zion Market Research has published a report on the global Vegan Cosmetics Market, estimating its value at USD 18.70 Billion in 2023, with projections indicating that it will reach USD 33.52 Billion by 2032. The market is expected to expand at a compound annual growth rate (CAGR) of 6.7% over the forecast period 2024-2032. The report explores the factors fueling market growth, the hitches that could hamper this expansion, and the opportunities that may arise in the Vegan Cosmetics Market industry. Additionally, it offers a detailed analysis of how these elements will affect market demand dynamics and market performance throughout the forecast period.

Vegan Cosmetics Market: Overview

Vegan cosmetics are clear of traces of animal origin or materials made from animal origin. Beeswax, honey, collagen, lanolin, elastin, and other animal-derived ingredients are substituted in vegan cosmetics by materials derived from minerals or plants. Rapidly evolving cosmetic trends are having an impact on the global marketplace, as most consumers consider animal cruelty to be immoral and are raising concerns about it. Furthermore, adopting healthier alternatives such as plant-based personal care goods is working in favor of the market.

In addition, increased demand for vegan-certified products from mainstream customers around the world is projected to drive sales generation in the global industry. Market players are launching new outlets in different parts of the world. These outlets are critical for evaluating consumer buying habits, making it possible for marketers to develop new goods. Online stores are a growing sales outlet and can be a quick way for consumers to purchase these products.

Vegan Cosmetics Market: Growth Factors

In recent years, a significant increase in the number of beauty bloggers and social media pages dedicated to the benefits of going chemical-free has benefited the industry by increasing customer awareness. The market for animal free products is being fueled by a shift in consumer perceptions of animal-free products, as well as the popularity of environmentally sustainable products. Natural-derived commodity manufacturing helps to reduce emissions and dependency on petroleum-based materials.

In addition to these factors, the growing trend of veganism particularly among the younger generation, and is playing an important role in the market's growth. Veganism is no longer considered uncommon, as more millennials embrace the diet. It has become trendy, with many A-list celebrities endorsing the virtues of a vegan diet and more vegan choices available online and in stores.

Vegan Cosmetics Market: Segment Analysis

This is attributable to the various advantages associated with the use of makeup products that are animal-free such as they include fewer additives, no traces of toxic additives, zero presence animal byproducts, contain good amount of plant extracts’ moisture, and they are better for sensitive ad delicate skin. The demand is expected to grow as more people become aware of the advantages of these products. In addition to the regular cosmetics for women available worldwide, several key players are developing men's grooming products. Body wash, deodorants and face washing gels are among the most popular products used by men.

This is attributable to the fact that consumers around the world have access to a variety of user-friendly websites that provide a seamless shopping experience. Women are the primary end consumers of vegan cosmetics, so e-commerce is a big part of the industry. The convenience of shopping provided, as well as the availability of promotional offers and listed promotions on a range of brands are all factors contributing to the segment's growth.

Vegan Cosmetics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Vegan Cosmetics Market |

| Market Size in 2023 | USD 18.70 Billion |

| Market Forecast in 2032 | USD 33.52 Billion |

| Growth Rate | CAGR of 6.7% |

| Number of Pages | 110 |

| Key Companies Covered | Ecco Bella, Zuzu Luxe, Bare Blossom, Modern Minerals Makeup, Emma Jean Cosmetics, Arbonne, Urban Decay, Pacifica, Nature’s Gate, Billy Jealousy, Beauty Without Cruelty (BWC), and MuLondon Organic, among others |

| Segments Covered | By Product, By Sales Channel and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Vegan Cosmetics Market: Regional Analysis

This is attributable to the fact that in the last few years, developed countries in Europe have seen an increase in vegan population. According to studies conducted by the Vegan Society in collaboration with Vegan Life magazine, the number of people identified as vegans in the UK has grown by about 350 percent in the last decade. This factor is expected to fuel sales of vegan cosmetics in the future. In addition to this a large majority of European consumers choose one brand to others because of its natural formulation. In recent years, this has fueled an increase in demand for clean, natural, and organic deodorant products. The sales are made based on effectiveness, as well as clinical properties and longer-lasting protection.

This surge can be attributed to the fact that consumers in Asia Pacific are becoming increasingly concerned about cosmetics' composition, which is fueling the development of animal-free cosmetics in the field. Color cosmetics, followed by skincare, hair care, and face care products, are becoming more common. In Asia Pacific, China and Japan are the two countries with the highest growth rates. The most popular retail platforms in the area are department stores and supermarkets. One of the key drivers of the regional market is the rising demand for cruelty-free items such as colour cosmetics, skin, sun care, and hair care.

Key Market Players & Competitive Landscape

Some of key players in vegan cosmetics market are

- Ecco Bella

- Zuzu Luxe

- Bare Blossom

- Modern Minerals Makeup

- Emma Jean Cosmetics

- Arbonne

- Urban Decay

- Pacifica

- Nature’s Gate

- Billy Jealousy

- Beauty Without Cruelty (BWC)

- MuLondon Organic

The Global Vegan Cosmetics Market is segmented as follows:

By Product

- Makeup

- Skin Care

- Hair Care

- Others

By Sales Channel

- Online

- Hypermarket,

- Supermarket

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Zion Market Research has published a report on the global Vegan Cosmetics Market, estimating its value at USD 18.70 Billion in 2023, with projections indicating that it will reach USD 33.52 Billion by 2032.

The market is expected to expand at a compound annual growth rate (CAGR) of 6.7% over the forecast period 2024-2032.

Some of the key factors driving the Global Vegan Cosmetics Market growth are adoption of healthier alternatives such as plant-based personal care goods coupled increased demand for vegan-certified products from mainstream customers around the world is projected to drive sales generation in the global industry.

The European region held a substantial share of the vegan cosmetics market in 2023. This is attributable to the fact that in the last few years, developed countries in Europe have seen an increase in vegan population. In addition to this a large majority of European consumers choose one brand to others because of its natural formulation. In recent years, this has fueled an increase in demand for clean, natural, and organic deodorant products.

Some of the major companies operating in the Vegan Cosmetics Market are Ecco Bella, Zuzu Luxe, Bare Blossom, Modern Minerals Makeup, Emma Jean Cosmetics, Urban Decay, Arbonne, Pacifica, Nature’s Gate, Beauty Without Cruelty (BWC), Billy Jealousy and MuLondon Organic, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed