Tractor Shovel Loader Market Size, Share, Trends, Growth 2034

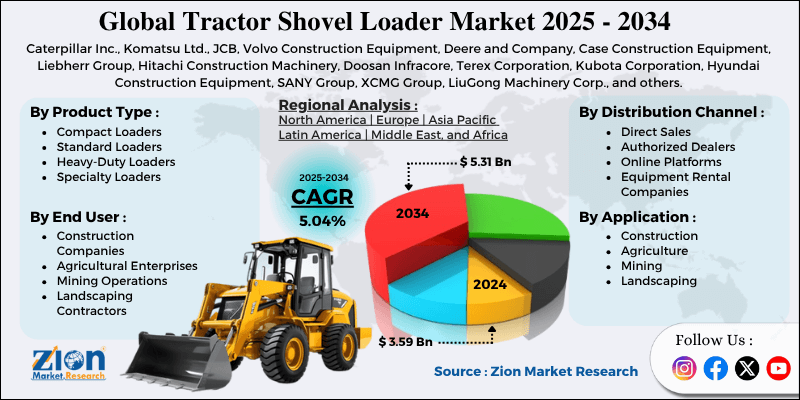

Tractor Shovel Loader Market By Product Type (Compact Loaders, Standard Loaders, Heavy-Duty Loaders, and Specialty Loaders), By Application (Construction, Agriculture, Mining, and Landscaping), By Distribution Channel (Direct Sales, Authorized Dealers, Online Platforms, and Equipment Rental Companies), By End User (Construction Companies, Agricultural Enterprises, Mining Operations, and Landscaping Contractors), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

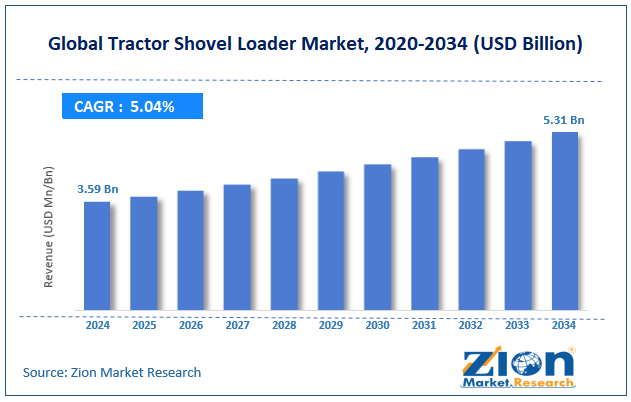

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.59 Billion | USD 5.31 Billion | 5.04% | 2024 |

Tractor Shovel Loader Industry Perspective:

The global tractor shovel loader market was valued at approximately USD 3.59 billion in 2024 and is expected to reach around USD 5.31 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 5.04% between 2025 and 2034.

Tractor Shovel Loader Market: Overview

Tractor shovel loader is a multi-purpose heavy equipment that combines the functionality of a tractor and a front-end loader to handle various material handling and earth-moving tasks across multiple industries. These machines feature a front-mounted bucket or shovel attachment that allows for efficient and precise digging, lifting, and transporting of soil, gravel, sand, and debris. The tractor shovel loader market covers a wide range of equipment sizes and configurations, from compact units suitable for small-scale operations to heavy-duty models for large-scale construction and mining projects.

Modern tractor shovel loaders have advanced hydraulic systems, ergonomic operator cabins, and sophisticated controls to increase productivity and operator comfort. The market includes new equipment sales and aftermarket services with a growing emphasis on equipment efficiency, fuel efficiency, and environmental compliance.

The expanding mining operations are expected to drive substantial growth in the tractor shovel loader market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global tractor shovel loader market is estimated to grow annually at a CAGR of around 5.04% over the forecast period (2025-2034)

- In terms of revenue, the global tractor shovel loader market size was valued at around USD 3.59 billion in 2024 and is projected to reach USD 5.31 billion by 2034.

- The tractor shovel loader market is projected to grow significantly due to the increasing infrastructure development projects and growing mechanization in the construction and agricultural sectors.

- Based on product type, standard loaders lead the segment and will continue to dominate the global market.

- Based on the application, construction is expected to lead the market.

- Based on the distribution channel, authorized dealers are anticipated to command the largest market share.

- Based on end-users, construction companies are expected to lead the market during the forecast period.

- Based on region, Asia Pacific is projected to lead the global market during the forecast period.

Tractor Shovel Loader Market: Growth Drivers

Rapid infrastructure development and urbanization trends

The tractor shovel loader market is growing quickly because of large-scale infrastructure projects and fast urban development around the world. Governments are working to improve transportation systems by building roads, bridges, and airports, which increases the need for flexible earth-moving machines like tractor shovel loaders.

As cities expand with new housing areas, shopping centers, and factories, there is a strong need for machines that can move materials efficiently in tight spaces while keeping up with high work demands. The push for smart cities and eco-friendly infrastructure is increasing interest in advanced tractor shovel loaders that use less fuel and cause less pollution. Since these machines can perform many tasks, contractors prefer using them to get the most value and efficiency from their investment.

Technological advancement and automation in construction equipment

The tractor shovel loader industry is growing because of new technologies that improve machine performance, safety, and work efficiency. Modern machines now have better hydraulic systems, electronic controls, and GPS systems that help operators work more accurately and with less tiredness during extended hours.

New technologies like telematics and internet-connected sensors help track machine performance, schedule repairs in advance, and manage entire fleets better, which lowers downtime and saves money. Automatic features such as bucket leveling, load detection, and programmed work cycles help boost productivity and make it easier to use the equipment without needing highly skilled workers.

Tractor Shovel Loader Market: Restraints

High initial investment costs and financing challenges

Despite their operational benefits, the tractor shovel loader market faces significant market challenges from high initial purchase costs and financing difficulties that limit access for smaller contractors and emerging market participants. These machines are built with strong parts and advanced technology, which makes them expensive and out of budget for small and medium-sized construction companies.

In many developing countries, there are insufficient loan or lease options, so buyers cannot obtain the necessary funding. Equipment also loses value over time, and because construction projects are sometimes uncertain, it is challenging for companies to take the risk of incurring large expenditures without a steady income.

Tractor Shovel Loader Market: Opportunities

Growing demand for rental and leasing services

The tractor shovel loader industry offers significant growth opportunities through expanding rental and leasing services, which provide flexible access to equipment without requiring large capital investments. Rental services are gaining popularity among contractors who seek flexible access to machines without the associated costs and risks of ownership.

Many construction jobs are short-term, so renting equipment as needed helps contractors manage their budgets better. Leasing with flexible payment plans and service packages also helps customers plan their costs and avoid maintenance worries. In countries where loans are hard to get, renting is a great option that gives access to machines without needing ownership.

Tractor Shovel Loader Market: Challenges

Skilled operator shortage and training requirements

The tractor shovel loader market faces ongoing challenges from skilled operator shortages and the increasing training requirements needed to operate modern, sophisticated equipment effectively. Modern tractor shovel loaders are more complex, with modern hydraulic systems, electronics, and safety tools.

Using them effectively requires specialized training and certifications that many workers lack. Older workers who know how to use this equipment are retiring, and younger workers are not very interested in these jobs, which creates a gap in skills. Training new operators takes time and money, adding to the cost for contractors and rental firms.

Tractor Shovel Loader Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Tractor Shovel Loader Market |

| Market Size in 2024 | USD 3.59 Billion |

| Market Forecast in 2034 | USD 5.31 Billion |

| Growth Rate | CAGR of 5.04% |

| Number of Pages | 212 |

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd., JCB, Volvo Construction Equipment, Deere and Company, Case Construction Equipment, Liebherr Group, Hitachi Construction Machinery, Doosan Infracore, Terex Corporation, Kubota Corporation, Hyundai Construction Equipment, SANY Group, XCMG Group, LiuGong Machinery Corp., and others. |

| Segments Covered | By Product Type, By Application, By Distribution Channel, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Tractor Shovel Loader Market: Segmentation

The global tractor shovel loader market is segmented into product type, application, distribution channel, end-user, and region.

Based on product type, the market is segregated into compact loaders, standard loaders, heavy-duty loaders, and specialty loaders. Standard loaders lead the market due to their versatility in handling various construction and agricultural tasks, balanced performance characteristics, and cost-effectiveness for general-purpose applications.

Based on application, the tractor shovel loader industry is classified into construction, agriculture, mining, and landscaping. Construction holds the largest market share due to increasing infrastructure development projects, urban construction activities, and the need for efficient material handling equipment in building and road construction projects.

Based on the distribution channel, the tractor shovel loader market is divided into direct sales, authorized dealers, online platforms, and equipment rental companies. Authorized dealers are expected to lead the market during the forecast period due to their established customer relationships, technical support services, and ability to provide financing and maintenance solutions.

Based on the end-user, the market is segmented into construction companies, agricultural enterprises, mining operations, and landscaping contractors. Construction companies lead the market share due to growing infrastructure development activities, urban construction projects, and increasing mechanization in construction operations.

Tractor Shovel Loader Market: Regional Analysis

Asia Pacific to lead the market

Asia Pacific leads the tractor shovel loader market due to massive infrastructure development initiatives, rapid urbanization, and strong government investment in construction and transportation projects. The region accounts for approximately 50% of the global market, with China being the largest consumer and producer of tractor shovel loaders across all product categories. Government infrastructure programs, including Belt and Road initiatives, smart city developments, and transportation network expansions, are driving substantial demand for construction equipment.

The region benefits from growing construction industries, expanding agricultural mechanization, and increasing mining activities that require efficient material handling equipment. Manufacturing facilities in Asia Pacific are expanding production capacity to meet domestic demand and serve international markets with cost-effective equipment solutions.

North America is expected to demonstrate strong growth.

North America is experiencing steady growth in the tractor shovel loader market, as the region focuses on infrastructure modernization, replacement of aging equipment, and adoption of advanced construction technologies. The market focuses on efficient machines, strict safety rules, and environmental standards, which support the use of advanced tractor shovel loaders with smart control systems. The region has a strong construction industry and high-quality expectations, creating demand for top-performing equipment.

Major manufacturers in North America are spending on research and development to make new machines that meet local needs and follow regulations. Government spending on infrastructure and private building projects is helping the market grow and increasing the need for equipment. Growing interest in green technologies and a desire to reduce pollution are also driving the adoption of hybrid and electric models in the region.

Recent Market Developments:

- In June 2025, Caterpillar Inc. launched a new series of electric tractor shovel loaders designed for urban construction projects, featuring zero-emission operation and reduced noise levels for sensitive work environments.

- In April 2025, Komatsu Ltd. announced the development of autonomous tractor shovel loaders with AI-powered navigation systems, targeting increased productivity and safety in large-scale construction and mining operations.

Tractor Shovel Loader Market: Competitive Analysis

The global tractor shovel loader market is led by players like:

- Caterpillar Inc.

- Komatsu Ltd.

- JCB

- Volvo Construction Equipment

- Deere and Company

- Case Construction Equipment

- Liebherr Group

- Hitachi Construction Machinery

- Doosan Infracore

- Terex Corporation

- Kubota Corporation

- Hyundai Construction Equipment

- SANY Group

- XCMG Group

- LiuGong Machinery Corp.

The global tractor shovel loader market is segmented as follows:

By Product Type

- Compact Loaders

- Standard Loaders

- Heavy-Duty Loaders

- Specialty Loaders

By Application

- Construction

- Agriculture

- Mining

- Landscaping

By Distribution Channel

- Direct Sales

- Authorized Dealers

- Online Platforms

- Equipment Rental Companies

By End User

- Construction Companies

- Agricultural Enterprises

- Mining Operations

- Landscaping Contractors

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A tractor shovel loader is a multi-purpose heavy equipment that combines the functionality of a tractor and a front-end loader to handle various material handling and earth-moving tasks across multiple industries.

The tractor shovel loader market is expected to be driven by increasing infrastructure development projects, growing mechanization in the construction and agricultural sectors, technological advancements in equipment automation, expanding mining operations, and rising demand for efficient material handling solutions.

According to our study, the global tractor shovel loader market was worth around USD 3.59 billion in 2024 and is predicted to grow to around USD 5.31 billion by 2034.

The CAGR value of the tractor shovel loader market is expected to be around 5.04% during 2025-2034.

The global tractor shovel loader market will register the highest revenue contribution from Asia Pacific during the forecast period.

Key players in the tractor shovel loader market include Caterpillar Inc., Komatsu Ltd., JCB, Volvo Construction Equipment, Deere and Company, Case Construction Equipment, Liebherr Group, Hitachi Construction Machinery, Doosan Infracore, Terex Corporation, Kubota Corporation, Hyundai Construction Equipment, SANY Group, XCMG Group, and LiuGong Machinery Corp.

The report provides a comprehensive analysis of the tractor shovel loader market, including an in-depth examination of market drivers, restraints, emerging trends, regional dynamics, and future growth prospects. It also examines the competitive dynamics, product innovations, distribution strategies, and technological advancements that shape the modern construction equipment and machinery ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed