Global GPS Anti-Jamming Market Size, Share, Growth Analysis Report - Forecast 2034

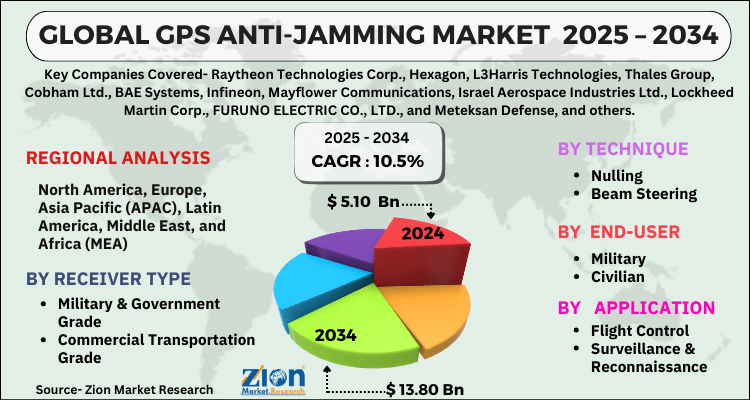

GPS Anti-Jamming Market By Receiver Type (Military & Government Grade and Commercial Transportation Grade), By Technique (Nulling, Beam Steering, and Civilian), End-User (Military and Civilian), Application (Flight Control, Surveillance & Reconnaissance, Position, Navigation & Timing, Targeting, Casualty Evacuation, and Others), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

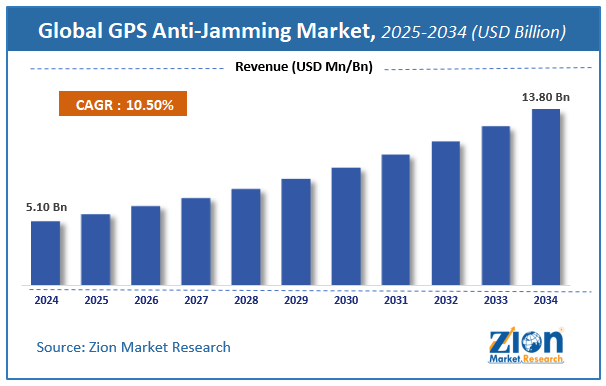

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.10 Billion | USD 13.80 Billion | 10.5% | 2024 |

GPS Anti-Jamming Market: Industry Perspective

The global GPS anti-jamming market size was worth around USD 5.10 Billion in 2024 and is predicted to grow to around USD 13.80 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 10.5% between 2025 and 2034. The report analyzes the global GPS anti-jamming market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the GPS anti-jamming industry.

GPS Anti-Jamming Market: Overview

The global positioning system is the most important utility supporting critical infrastructure across several industries. It is primarily developed to provide precision timing and navigation to the military sector. Society has developed a strong dependency on GPS information in many areas, including communications, transportation, and financial transactions. Jamming is the interference of signals with communications or surveillance systems which prevents it from receiving. GPS signals received on Earth are weak and susceptible to interference and intentional jamming.

Military GPS is capable of withstanding any vulnerability to protect it from spoofing and jamming attacks. Accessibility and utilization of low-cost GPS jamming equipment have resulted in an increasing threat of GPS signal disruption and growing the probability of future outages to systems that rely on GPS data. Hence, addressing the security of GPS signals and preventing denial of services has become a priority in several sectors.

PS Anti-Jamming shields GPS receivers against deliberate jamming and interference. The GPS signal is feeble by the time it reaches the Earth's surface, and it is vulnerable to being overpowered by higher-power Radio Frequency (RF) radiation. Even a tiny 10-watt jammer may interrupt an unprotected C/A Code receiver for up to 30 kilometers. GPS Anti-Jamming works by reducing the influence of interference and jamming on the GPS receiver so that it can continue to function properly.

With the help of GPS technologies, modern battle techniques have been transformed which is why many military groups rely on satellite technology for precise location, timing, and communications daily. However, GPS signals intercepted on Earth are vulnerable and weak to deliberate jamming and disruption.

Key Insights

- As per the analysis shared by our research analyst, the global GPS anti-jamming market is estimated to grow annually at a CAGR of around 10.5% over the forecast period (2025-2034).

- Regarding revenue, the global GPS anti-jamming market size was valued at around USD 5.10 Billion in 2024 and is projected to reach USD 13.80 Billion by 2034.

- The GPS anti-jamming market is projected to grow at a significant rate due to rising security concerns in military, defense, and commercial navigation systems, along with advancements in gps technologies.

- Based on Receiver Type, the Military & Government Grade segment is expected to lead the global market.

- On the basis of Technique, the Nulling segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User, the Military segment is projected to swipe the largest market share.

- By Application, the Flight Control segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Global GPS Anti-Jamming Market: Growth Drivers

The increasing adoption of GPS technology in military applications is projected to boost market growth.

Military forces throughout the world are always on the hunt for new, improved technologies to ensure precise navigation utilizing GPS technology. Mayflower Communications, for example, was given a USD 56 million deal for a GPS navigation antenna system in October 2020. The technology will be employed by the United States military and is expected to be completed in September 2024. Moreover, the Navigation Antenna (MAGNA) and Multi-Platform Anti-Jam Global Positioning System, which offers GPS protection, is the subject of this contract. Furthermore, Raytheon UK and the UK Ministry of Defense inked a deal in July 2020 to develop enhanced GNSS anti-jamming technology. Such initiatives are expected to fuel the global GPS anti-jamming market growth over the forecast period.

GPS/GNSS has become a critical component of today’s global information infrastructure. GPS technology has revolutionized modern warfare since several military organizations frequently depend on satellite technology for accurate timing, positioning, and communications. Increasing defense investment, escalating adoption of unmanned aerial vehicles for various defense operations, growing reliance on satellite communication for various military operations are some of the major factors driving the growth of the global anti-jamming market for GPS. Further, increasing intrusion and proliferation of low-cost jammers propel the global navigation satellite system (GNSS) anti-jamming systems market. However, competition from Precision Terrain Aided Navigation (PTAN), long approval period of new technologies for operational clearance, and software compatibility issues of GPS anti-jammers are some of the challenges faced by this industry.

GPS Anti-Jamming Market: Restraints

Technical hindrances such as the incompatibility of old-generation GPS systems with the latest technologies may hamper market growth

Old GPS receivers are incompatible with modern and highly effective GPS anti-jamming solutions, such as beamforming technology. Based on the direction of jamming signals, the beamforming recognizes, selects, and downlinks signals from four satellites and gives four anti-jam solutions in the form of algorithms. It cannot communicate with a typical GPS receiver that just has one input since it creates four outputs directed towards four chosen satellites from the GPS receiver. This is one of the major market restraints for GPS anti-jamming devices.

Global GPS Anti-Jamming Market: Opportunities

Rising demand for Unmanned aerial vehicles (UAVs) and unmanned systems are projected to offer healthy growth opportunities for market expansion.

According to an FAA drone estimate for 2020-2040, there will be 1.6 million drones in the air by 2024, with commercial drone sales alone expected to reach 1.2 million in the United States. Drones increasing commercial use may present a lucrative economic opportunity for GPS manufacturers. At the same time, they are susceptible to jamming and hence provide a substantial market potential for GPS anti-jamming technology.

GPS Anti-Jamming Market: Challenges

GPS spoofing is the major challenge for the expansion of the market.

A GPS spoofing attack is carried out by broadcasting erroneous signals that are meant to imitate a set of regular GPS signals in order to deceive a GPS receiver. It can also be done by rebroadcasting the original signals from a new location or at a different time. These signals can be altered to fool the receiver and allow for position monitoring.

For example, the GPS signals of 20 ships in the Black Sea were hacked on June 22, 2017, revealing that they were 32 kilometers inland near Gelendzhik Airport. Players in the GPS anti-jamming business are facing a challenge from such GPS spoofing assaults.

Global GPS Anti-Jamming Market: Segmentation

The global GPS anti-jamming market is segmented based on receiver type, technique, end-user, application, and region.

Based on receiver type, the market is bifurcated into commercial transportation grade and military & government grade. The Military & Government Grade segment dominates the GPS Anti-Jamming Market, driven by rising defense budgets, electronic warfare threats, and the need for secure military operations. However, the Commercial Transportation Grade segment is witnessing significant growth, fueled by the increasing dependence on GPS in aviation, maritime, and autonomous transportation.

On the basis of Technique, the global GPS anti-jamming market is bifurcated into Nulling, Beam Steering, and Civilian.

On the basis of end-users, the GPS anti-jamming market is bifurcated into military and civilian. The Military segment dominates the GPS Anti-Jamming Market, driven by rising electronic warfare threats, military modernization programs, and the increasing need for resilient GPS systems in defense operations. However, the Civilian segment is expanding rapidly, fueled by the growing reliance on GPS in commercial transportation, smart infrastructure, and autonomous systems.

In terms of Application, the global GPS anti-jamming market is categorized into Flight Control, Surveillance & Reconnaissance, Position, Navigation & Timing, Targeting, Casualty Evacuation, and Others.

GPS Anti-Jamming Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | GPS Anti-Jamming Market |

| Market Size in 2024 | USD 5.10 Billion |

| Market Forecast in 2034 | USD 13.80 Billion |

| Growth Rate | CAGR of 10.5% |

| Number of Pages | 185 |

| Key Companies Covered | Raytheon Technologies Corp., Hexagon, L3Harris Technologies, Thales Group, Cobham Ltd., BAE Systems, Infineon, Mayflower Communications, Israel Aerospace Industries Ltd., Lockheed Martin Corp., FURUNO ELECTRIC CO., LTD., and Meteksan Defense, and others. |

| Segments Covered | By Receiver Type, By Technique, By End-User, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

GPS Anti-Jamming Market: Regional Analysis

North America contributed the largest revenue during the forecast period

North America leads the global GPS anti-jamming market in terms of market share. This is due to escalating demand for weapon systems, the increasing existence of top players in the anti-jamming market, growing demands for miniaturization of GNSS-based anti-jamming devices, and growing dependence on satellite communication for numerous military operations in this region.

The Asia Pacific on the other side is predicted to be the fastest-growing GPS anti-jamming market. Key factors such as increased defense expenditure and expanding territorial disputes in this geography are contributing to the rapid adoption of advanced military systems and devices which is likely to boost the adoption of GPS anti-jamming systems and devices during the forecast period.

Recent Developments

- In July 2020, BAE Systems acquired Raytheon Technologies Corporation's Collins Aerospace Military Global Positioning System division bringing decades of knowledge, technological innovation, and a large installed base of equipment to the corporation.

- In July 2020, The UK Ministry of Defense granted Raytheon UK a contract to develop enhanced GNSS anti-jamming technology. Raytheon UK's Assured Positioning Navigation and Timing business will deliver a Technology Demonstrator Program with advanced multi-element Anti-Jam technology.

GPS Anti-Jamming Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the GPS anti-jamming market on a global and regional basis.

The global GPS anti-jamming market is dominated by players like:

- Raytheon Technologies Corp.

- Hexagon

- L3Harris Technologies

- Thales Group

- Cobham Ltd.

- BAE Systems

- Infineon

- Mayflower Communications

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corp.

- FURUNO ELECTRIC CO.

- LTD.

- and Meteksan Defense

The global GPS anti-jamming market is segmented as follows:

By Receiver Type

-

Military & Government Grade

- Commercial Transportation Grade

By Technique

- Nulling

- Beam Steering

- and Civilian

By End-User

- Military

- Civilian

By Application

- Flight Control

- Surveillance & Reconnaissance

- Position

- Navigation & Timing

- Targeting

- Casualty Evacuation

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed