Thiochemicals Market Size, Share, Trends, Growth & Forecast 2034

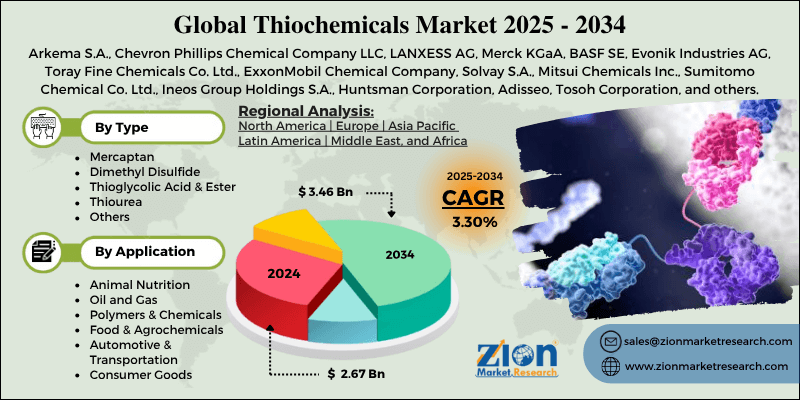

Thiochemicals Market By Type (Mercaptan, Dimethyl Disulfide, Thioglycolic Acid and Ester, Thiourea, and Others), By Application (Animal Nutrition, Oil and Gas, Polymers and Chemicals, Food and Agrochemicals, Automotive and Transportation, Consumer Goods, Plastics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

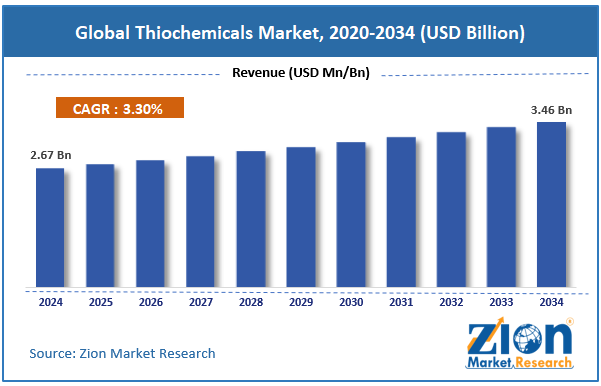

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2.67 Billion | USD 3.46 Billion | 3.30% | 2024 |

Thiochemicals Industry Perspective:

The global thiochemicals market size was approximately USD 2.67 billion in 2024 and is projected to reach around USD 3.46 billion by 2034, with a compound annual growth rate (CAGR) of approximately 3.30% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global thiochemicals market is estimated to grow annually at a CAGR of around 3.30% over the forecast period (2025-2034)

- In terms of revenue, the global thiochemicals market size was valued at around USD 2.67 billion in 2024 and is projected to reach USD 3.46 billion by 2034.

- The thiochemicals market is projected to grow significantly due to the increasing use in oil and gas refining processes, growing demand in agrochemical formulations, and expanding applications in wastewater treatment.

- Based on type, the mercaptan segment is expected to lead the market, while the dimethyl disulfide segment is expected to grow considerably.

- Based on application, the oil and gas segment is the largest, while the animal nutrition segment is projected to experience substantial revenue growth over the forecast period.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Thiochemicals Market: Overview

Thiochemicals are sulfur-containing chemical compounds that are extensively used in various applications due to their versatility and unique reactivity. They play a vital role in industries such as animal nutrition, oil and gas for desulfurization and odor control, and agrochemicals as intermediates in fertilizers and pesticides. The global thiochemicals market is expected to expand rapidly, driven by the growing animal feed industry, increasing demand in rubber and polymer applications, and rising use in agrochemicals. Methyl mercaptan is a vital precursor in the production of methionine, a key amino acid for livestock nutrition.

The flourishing aquaculture and poultry industries are fueling the use of thiochemicals. The FAO anticipates a 14% surge in livestock protein demand by 2030, reinforcing industry growth. Thiochemicals serve as vulcanizing and cross-linking agents in the production of polymers. The expanding construction and automotive industries, which demand high-performing elastomers, drive the use of thiochemicals. As global demand for synthetic rubber increases, thiochemicals are gaining popularity in manufacturing processes.

Furthermore, sulfur-based intermediates are paramount to fertilizer and pesticide formulations, improving crop yield and disease resistance. Growing global food demand and precision agriculture trends augment the consumption of thiochemicals. The industry benefits from advancements in agriculture in the developing nations.

Despite the growth, the global market is hindered by factors such as price volatility of raw materials, high production and operational costs, as well as health and safety concerns. Thiochemical production relies heavily on sulfur, which is obtained from the refining of petroleum. Variations in crude oil supply and refinery output disturb availability and pricing. This volatility impacts planning for manufacturers and their profit margins. Similarly, complex manufacturing processes need specialized equipment and safety systems. The need for corrosion-resistant infrastructure and odor control increases capital investment. Small producers often struggle to remain competitive amid rising operational expenses. Several thiochemicals release odors and are hazardous if not handled properly. Worker safety requirements and storage regulations raise compliance efforts. Accidental exposure risks may hamper adoption in less-regulated markets.

Nonetheless, the global thiochemicals industry stands to benefit from several key opportunities, including the growth of the renewable energy sector and advancements in green thiochemistry. As renewable fuels gain traction, thiochemicals can help in refining bio-based feedstocks. Their role in odorization and desulfurization creates a fresh sustainability niche. Associations in green refining processes offer lucrative opportunities. Moreover, companies that invest in a circular sulfur economy gain a competitive advantage.

Thiochemicals Market Dynamics

Growth Drivers

How is increasing adoption in gas and biogas treatment driving the thiochemicals market?

Thiochemicals are vital in odor management and gas treatment applications, especially tert-butyl mercaptan (TBM), which is used as an odorant in natural gas. The ongoing expansion of renewable natural gas (RNG) and biogas infrastructure worldwide has created new opportunities for the use of thiochemicals.

According to the reports, there was a 19% rise in worldwide RNG plant installations, with odorization being identified as a vital safety requirement. Economies such as India, Germany, and the United States are investing in gas odorization systems, driving demand for thiochemicals. For example, in 2024, Arkema introduced a novel eco-efficient TBM line to support renewable gas infrastructure in Europe.

How are sustainable chemistry initiatives and technological improvements notably fueling the thiochemicals market?

The thiochemicals market is experiencing technological advancements emphasizing green synthesis and circular economy principles. Manufacturers are investing in low-emission production technologies, such as waste sulfur recovery and catalytic oxidation. Recent news from 2025 in the industry reveals investments in carbon-neutral thiochemical plants powered by renewable energy sources.

Additionally, the global market for green thiochemicals is expected to grow at a CAGR of 6.8% by 2032, driven by regulatory pressure for environmental compliance. These improvements not only reduce carbon footprints but also increase the versatility of applications in electronics, pharmaceuticals, and specialty chemicals.

Restraints

Occupational health and safety concerns hamper the market progress

Thiochemicals are inherently risky, with many compounds being corrosive, toxic, and odorous, offering severe occupational risks. Exposure may result in dermatological and respiratory issues. Demanding stringent adherence to ILO and OSHA safety guidelines. Implementing advanced ventilation, continuous monitoring systems, and PPE adds substantial operational costs. Recent accidents in sulfur plants in India and China have prompted the implementation of stringent inspection guidelines, resulting in temporary production halts at many facilities.

Opportunities

How is the thiochemicals market opportune for the adoption of advanced materials and specialty polymers?

Thiochemicals are primarily applied in specialty polymers, rubber vulcanization, and adhesives, mainly for industrial products and EV tires. According to the studies, a 4.2% rise in worldwide rubber consumption was reported, fueling the demand for thiazole and thiuram accelerators. Advancements in eco-friendly vulcanization processes offer differentiation for manufacturers. Companies like Lanxess and BASF are actively marketing green thiochemical accelerators. This trend opens opportunities in high-value, performance-based markets. This has a significant impact on the growth of the thiochemicals industry.

Challenges

Competitive pressure and market fragmentation restrict the market growth

The global market is highly fragmented, with large multinational companies competing against numerous regional players. Intense price differentiation and competition complications restrict profitability. According to ICIS (2025), consolidation in Europe and APAC is growing as companies prefer economies of scale. Emerging players experience obstacles due to capital-intensive setups and regulatory compliance costs. Maintaining a competitive advantage needs continuous advancement, market-specific product adaptation, and strategic partnerships.

Thiochemicals Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Thiochemicals Market |

| Market Size in 2024 | USD 2.67 Billion |

| Market Forecast in 2034 | USD 3.46 Billion |

| Growth Rate | CAGR of 3.30% |

| Number of Pages | 216 |

| Key Companies Covered | Arkema S.A., Chevron Phillips Chemical Company LLC, LANXESS AG, Merck KGaA, BASF SE, Evonik Industries AG, Toray Fine Chemicals Co. Ltd., ExxonMobil Chemical Company, Solvay S.A., Mitsui Chemicals Inc., Sumitomo Chemical Co. Ltd., Ineos Group Holdings S.A., Huntsman Corporation, Adisseo, Tosoh Corporation, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Thiochemicals Market: Segmentation

The global thiochemicals market is segmented based on type, application, and region.

Based on type, the global thiochemicals industry is divided into mercaptan, dimethyl disulfide, thioglycolic acid and ester, thiourea, and others. The mercaptan segment holds a leading market share due to its wide range of applications in animal feed, odor control, and polymer production. Its robust adoption in the oil & gas sector is fueled by the strict safety regulations that require odorants in natural gas pipelines. Moreover, its versatility as a precursor in synthesizing different energy infrastructure and livestock nutrition, mercaptan continues to lead the worldwide thiochemical consumption.

On the other hand, the dimethyl disulfide segment holds a second-leading share, mainly due to its rising use as a sulfiding agent in hydrodesulfurization (HDS) and as a soil fumigant in agriculture. Its high sulfur content and efficiency in catalyst activation make it essential in refining operations. In agriculture, DMDS serves as an eco-friendlier substitute for conventional fumigants, supporting green farming initiatives. As the demand for sustainable practices continues to grow, the global demand for DMDS is expected to remain strong.

Based on application, the global thiochemicals market is segmented into animal nutrition, oil and gas, polymers and chemicals, food and agrochemicals, automotive and transportation, consumer goods, plastics, and others. The oil and gas segment holds a dominating share in the market, fueled by its use in desulfurization, gas odorization, and refinery processes. Thiochemicals, such as DMDS and mercaptans, are vital for ensuring safety compliance and catalyst activation in hydrocarbon processing. Growing worldwide energy demand and the growth of natural gas networks further propel the consumption of thiochemicals. Moreover, strict safety and environmental regulations make thiochemicals crucial for oil & gas operations across the globe.

Conversely, the animal nutrition segment holds a second position, mainly due to the use of thiochemicals in methionine production, a vital amino acid for poultry and livestock feed. With the rising consumption of dairy and meat worldwide, the demand for high-quality feed supplements is increasing. Thiochemicals support livestock growth, productivity, and health, increasing their importance in the feed market. The expansion of the poultry and aquaculture sectors in developing economies boosts segmental growth.

Thiochemicals Market: Regional Analysis

Why is Asia Pacific outperforming other regions in the global Thiochemicals Market?

The Asia Pacific is expected to maintain its leading position in the global thiochemicals market, driven by rapid industrialization, the expansion of the oil & gas sector, and the growing animal feed industry. The APAC region, particularly India and China, is experiencing rapid industrial growth in the oil & gas, polymer, and chemicals sectors. This industrial progress fuels substantial demand for thiochemicals used in polymer production, refining, and industrial intermediates.

According to the latest reports, the APAC region accounts for over 40% of the worldwide thiochemical consumption, underscoring its industrial significance. The region's natural gas production and refinery capacities are increasing gradually, mainly in India, China, and Australia. Thiochemicals, such as DMDS and mercaptans, are vital for hydrodesulfurization and odor control, thereby increasing regional dominance.

The Asia Pacific oil & gas industry is anticipated to progress at a CAGR of 5-6%, impacting the thiochemical demand. Growing populations and increasing protein consumption are driving the expansion of the aquaculture and livestock industries in the Asia Pacific. Thiochemicals, such as methyl mercaptan, are major precursors for methionine, supporting growth in animal nutrition. The APAC feedstock industry is anticipated to exceed $250 billion by 2030, strengthening the region's thiochemical consumption.

Europe ranks as the second-largest region in the global thiochemicals industry, thanks to its sophisticated oil & gas infrastructure, a strong animal feed and livestock industry, and strict environmental and safety regulations. Europe has a well-developed oil refining and natural gas infrastructure, particularly in economies such as the Netherlands, the UK, and Germany. Thiochemicals, comprising DMDS and mercaptans, are widely used for hydrodesulfurization and odor control.

The European refining industry produced more than 700 million tons of crude oil in 2023, facilitating significant thiochemical demand. The European dairy, poultry, and aquaculture industries fuel the demand for thiochemical-derived methionine in animal feed. The growing emphasis on high-quality nutrition and productivity drives steady use and consumption. Europe's animal feed industry was estimated to be worth nearly $60 billion in 2023, underscoring the importance of thiochemicals in this segment.

Additionally, Europe enforces stringent safety and emission standards, mainly for the chemical and natural gas industries. Thiochemicals play a crucial role in sulfur removal and gas odorization, enabling compliance with regulatory requirements. These strict regulations promise industrial demand despite overall industry development.

Thiochemicals Market: Competitive Analysis

The leading players in the global thiochemicals market are:

- Arkema S.A.

- Chevron Phillips Chemical Company LLC

- LANXESS AG

- Merck KGaA

- BASF SE

- Evonik Industries AG

- Toray Fine Chemicals Co. Ltd.

- ExxonMobil Chemical Company

- Solvay S.A.

- Mitsui Chemicals Inc.

- Sumitomo Chemical Co. Ltd.

- Ineos Group Holdings S.A.

- Huntsman Corporation

- Adisseo

- Tosoh Corporation

Thiochemicals Market: Key Market Trends

Rising demand in animal nutrition and agrochemicals:

Thiochemicals are experiencing increased use in methionine production for animal feed, as well as serving as intermediates in the production of fertilizers and pesticides. With the worldwide boom in protein consumption and the rise of precision agriculture, this trend reinforces the adoption of thiochemicals. Europe and the Asia Pacific are the dominating regions for these applications.

Focus on high-value and specialty thiochemicals:

There is a growing trend towards specialty thiochemicals for pharmaceuticals, polymers, and catalysts, rather than bulk commodity products. Companies are actively investing in high-margin, customized solutions to meet the niche industrial needs of specific markets. This trend supports higher profitability and long-term industry growth.

The global thiochemicals market is segmented as follows:

By Type

- Mercaptan

- Dimethyl Disulfide

- Thioglycolic Acid and Ester

- Thiourea

- Others

By Application

- Animal Nutrition

- Oil and Gas

- Polymers and Chemicals

- Food and Agrochemicals

- Automotive and Transportation

- Consumer Goods

- Plastics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Thiochemicals are sulfur-containing chemical compounds that are extensively used in various applications due to their versatility and unique reactivity. They play a vital role in industries such as animal nutrition, oil and gas for desulfurization and odor control, and agrochemicals as intermediates in fertilizers and pesticides.

The global thiochemicals market is projected to grow due to surging demand for animal nutrition additives, the rise of polymer and plastics production, and advancements in sulfur chemistry.

According to study, the global thiochemicals market size was worth around USD 2.67 billion in 2024 and is predicted to grow to around USD 3.46 billion by 2034.

The CAGR value of the thiochemicals market is expected to be approximately 3.30% from 2025 to 2034.

Significant opportunities driving the thiochemicals market include the expansion of the oil & gas and agrochemical sectors, rising demand in animal nutrition, the adoption of sustainable production processes, growth in specialty chemicals, and emerging markets in the Asia Pacific.

Animal nutrition is expected to offer the most significant growth opportunities because thiochemicals are essential for generating methionine, supporting livestock growth amid expanding animal feed markets and rising global protein demand.

Asia Pacific is expected to lead the global thiochemicals market during the forecast period.

The key players profiled in the global thiochemicals market include Arkema S.A., Chevron Phillips Chemical Company LLC, LANXESS AG, Merck KGaA, BASF SE, Evonik Industries AG, Toray Fine Chemicals Co., Ltd., ExxonMobil Chemical Company, Solvay S.A., Mitsui Chemicals, Inc., Sumitomo Chemical Co., Ltd., Ineos Group Holdings S.A., Huntsman Corporation, Adisseo, and Tosoh Corporation.

Leading players are adopting strategies such as partnerships, mergers and acquisitions, regional expansions, and product innovations to strengthen their market presence.

The report examines key aspects of the thiochemicals market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed