Powertrain Machinery Market Size, Trend, Growth, Industry Analysis 2034

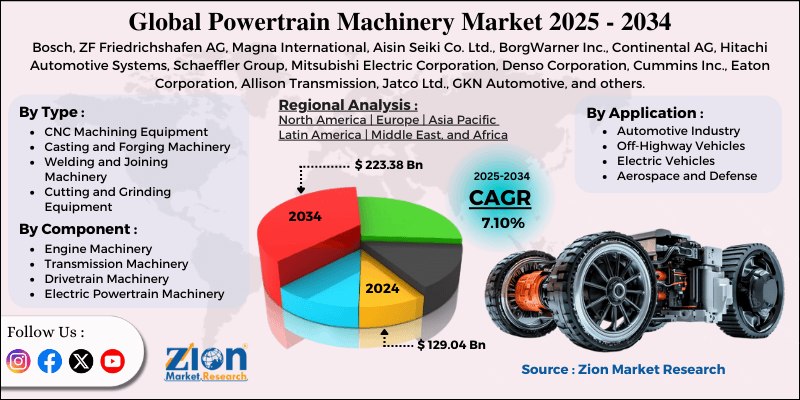

Powertrain Machinery Market By Type (CNC Machining Equipment, Casting and Forging Machinery, Welding and Joining Machinery, Cutting and Grinding Equipment), By Component (Engine Machinery, Transmission Machinery, Drivetrain Machinery, Electric Powertrain Machinery), By Application (Automotive Industry, Off-Highway Vehicles, Electric Vehicles, Aerospace and Defense), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

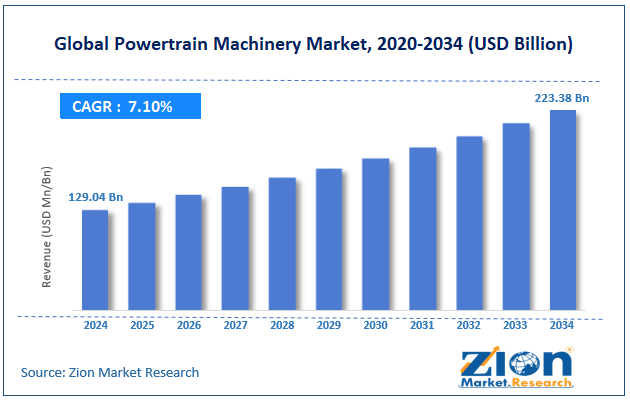

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 129.04 Billion | USD 223.38 Billion | 7.10% | 2024 |

Powertrain Machinery Industry Perspective:

The global powertrain machinery market size was approximately USD 129.04 billion in 2024 and is projected to reach around USD 223.38 billion by 2034, with a compound annual growth rate (CAGR) of approximately 7.10% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global powertrain machinery market is estimated to grow annually at a CAGR of around 7.10% over the forecast period (2025-2034)

- In terms of revenue, the global powertrain machinery market size was valued at around USD 129.04 billion in 2024 and is projected to reach USD 223.38 billion by 2034.

- The powertrain machinery market is projected to grow significantly due to the rising vehicle production in emerging economies, government incentives for clean energy transportation, and stringent global emission regulations.

- Based on type, the CNC machining equipment segment is expected to lead the market, while the casting and forging machinery segment is expected to grow considerably.

- Based on component, the engine machinery segment is the dominant segment, while the transmission machinery segment is projected to witness sizable revenue growth over the forecast period.

- Based on application, the automotive industry segment is expected to lead the market compared to the electric vehicles segment.

- Based on region, the Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Powertrain Machinery Market: Overview

Powertrain machinery relates to the components and systems that produce power and deliver it to the automobile's drivetrain for motion. It comprises transmissions, engines, axles, differentials, and drive shafts, which work jointly to optimize fuel efficiency, emissions, and performance. The global powertrain machinery market is expected to expand rapidly, driven by the growth in hybrid and electric vehicle production, increasing vehicle sales and production, as well as advancements in transmission technologies. The worldwide shift towards hybrid and electric vehicles is revolutionizing traditional powertrain designs.

Components like battery-integrated motors, e-axles, and regenerative braking systems are experiencing increased demand. This transition serves as a strong catalyst for industry expansion. Growing automotive sales in developing markets, such as Southeast Asia, Brazil, and India, are fueling powertrain demand. High production volumes promise constant requirements for transmissions, engines, and associated parts. This growth benefits both hybrid and ICE systems worldwide.

Moreover, modern transmission systems, such as dual-clutch and continuously variable transmissions, offer enhanced fuel efficiency and improved performance. These advancements are being broadly adopted in commercial and passenger vehicles. Their rising prominence supports overall growth in the powertrain industry.

Despite the growth, the global market is hindered by factors such as high manufacturing and development costs, as well as the complexity of powertrain integration. Producing and designing advanced powertrain systems, mainly for hybrids and EVs, requires massive investment. Small manufacturers face challenges in sustaining these costs, which restrict their adoption. This cost hindrance is a key limitation in price-sensitive regions.

Additionally, modern powertrains need accurate integration of electronic, mechanical, and software systems. This complexity raises engineering intricacies and demands expert labor. Any mistake in incorporation may negatively impact reliability and efficacy, increasing operational risks.

Nonetheless, the global powertrain machinery industry stands to gain from several key opportunities, including e-powertrain development, electrification, and the integration of IoT and AI-powered systems. The growth of electric vehicles presents significant opportunities for e-powertrain components, such as integrated drivetrains and electric motors. This segment is anticipated to progress at a double-digit rate. AI-based predictive maintenance and IoT-based diagnostics are revolutionizing powertrain performance. These innovative solutions reduce operational costs and enhance reliability for fleet operators. Companies emphasizing automation and connectivity are poised to gain a competitive advantage.

Powertrain Machinery Market: Growth Drivers

How does the integration of automation and smart manufacturing in powertrain production drive the powertrain machinery market growth?

The adoption of automation, AI-based processes, and robotics in powertrain manufacturing is a key driver of growth. Automobile manufacturers are adopting Industry 4.0 technologies to improve efficiency, enhance precision, and reduce production costs in component manufacturing. Recent developments include Hyundai Motor's investment of USD 1.6 billion in a fully automated powertrain plant in South Korea (Ulsan), which emphasizes hybrid and EV drivetrain production. These innovations enable real-time monitoring, faster production cycles, and predictive maintenance, making automation a vital enabler for competitive benefits in the global powertrain machinery market.

How do technological improvements in powertrain components spur the powertrain machinery market?

Advancements in powertrain technology, such as continuously variable transmissions (CVT), dual-clutch transmissions (DCT), and advanced torque converters, are fueling the demand for specialized machinery. These solutions enhance fuel performance and efficacy, meeting both regulatory and consumer needs. Recent developments include ZF Friedrichshafen AG introducing its 8-speed automatic transmission, which was improved for hybrid vehicles in 2023 and requires advanced assembly machinery. The integration of Industry 4.0 and digital twin technology in powertrain machinery is also gaining prominence, allowing enhanced manufacturing efficiency and predictive maintenance.

Powertrain Machinery Market: Restraints

Component shortages and supply chain disruptions unfavorably impact the market progress

The worldwide powertrain machinery sector is primarily reliant on a complex supply chain that comprises precision tools, specialized components, and electronic sensors. Recent disturbances, triggered by the pandemic, logistical barriers, and semiconductor shortages, have exposed the vulnerability of supply chains. In early 2024, Continental and Bosch reported extended lead times for electric vehicle powertrains, underscoring the current risks of supply chain shortages in the market.

Powertrain Machinery Market: Opportunities

How does the demand for lightweight and fuel-efficient powertrain components open lucrative opportunities for the powertrain machinery market development?

The global pressure for low emissions and improved fuel efficiency is driving demand for lightweight components and materials, such as magnesium housings, high-strength steel gears, and aluminum engine blocks. To support this trend, manufacturers need specialized machining and forming machinery. Toyota announced a collaboration with Nippon Steel to develop advanced, lightweight powertrain materials in 2024, fueling the need for upgraded manufacturing lines. This inclination offers opportunities for machinery providers that can deliver precision machining for lightweight composites and alloys, spurring the powertrain machinery industry.

Powertrain Machinery Market: Challenges

Will compliance with evolving environmental regulations restrict the powertrain machinery market growth?

As governments worldwide tighten emission regulations, powertrain machinery producers face increasing compliance requirements. Meeting new standards requires substantial investment in upgrading processes and equipment. For instance, the European Union's Euro 7 regulations are scheduled to take effect in 2025. Non-compliance may result in reputational risks and substantial penalties, making regulatory compliance a persistent challenge for market players.

Powertrain Machinery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Powertrain Machinery Market |

| Market Size in 2024 | USD 129.04 Billion |

| Market Forecast in 2034 | USD 223.38 Billion |

| Growth Rate | CAGR of 7.10% |

| Number of Pages | 215 |

| Key Companies Covered | Bosch, ZF Friedrichshafen AG, Magna International, Aisin Seiki Co. Ltd., BorgWarner Inc., Continental AG, Hitachi Automotive Systems, Schaeffler Group, Mitsubishi Electric Corporation, Denso Corporation, Cummins Inc., Eaton Corporation, Allison Transmission, Jatco Ltd., GKN Automotive, and others. |

| Segments Covered | By Type, By Component, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Powertrain Machinery Market: Segmentation

The global powertrain machinery market is segmented based on type, component, application, and region.

Based on type, the global powertrain machinery industry is divided into CNC machining equipment, casting and forging machinery, welding and joining machinery, and cutting and grinding equipment. The CNC machining equipment segment holds a leadership position in the market due to its impeccable efficiency and precision in manufacturing complex components. It is broadly used for engine blocks, shafts in both electric powertrain and ICE, and transmission housings. Integration with CAD/CAM and automation makes CNC machines suitable for both customized production and high-volume manufacturing. The rising shift towards lightweight materials and EVs further drives the demand for advanced CNC solutions across the globe.

Based on component, the global powertrain machinery market is segmented into engine machinery, transmission machinery, drivetrain machinery, and electric powertrain machinery. The engine machinery segment holds a substantial market share, as internal combustion engines are the dominant type worldwide. It comprises equipment for engine blocks, cylinder heads, crankshafts, and pistons, which are essential for commercial and passenger vehicles. Despite the EV transition, ICE engines still power the majority of cars, especially in emerging regions. Constant advancements to enhance fuel efficiency and meet emission standards strengthen the segmental dominance.

Based on application, the global market is segmented into the automotive industry, off-highway vehicles, electric vehicles, and aerospace and defense. The automotive industry held a dominating share of the market. It comprises manufacturing equipment for transmissions, engines, and drivetrains used in commercial and passenger vehicles. High vehicle production volumes, mainly in Europe and the Asia Pacific, fuel the segment's growth. The current technological advancements, such as fuel-efficient designs and lightweight powertrains, enhance the segment's prominence.

Powertrain Machinery Market: Regional Analysis

What enables the Asia Pacific to have a strong foothold in the global Powertrain Machinery Market?

Asia Pacific is anticipated to retain its leading role in the global powertrain machinery market as a result of being the most prominent automotive production hub, strong growth in EVs, and speedy urbanization and industrialization. The Asia Pacific region holds a leadership position in vehicle production, with economies such as Japan, India, and China contributing to more than 55% of the total automotive output. China alone produced over 30 million vehicles in 2023, generating huge demand for powertrain machinery. This high manufacturing volume promises the region's dominance in the industry. APAC is also a leader in EV adoption, accounting for more than 60% of global electric vehicle sales in 2023, according to the IEA.

Heavy investment in EV manufacturing fuels the demand for electric powertrain components, such as battery housings and e-axles. Government initiatives and infrastructure growth reinforce the region's prominence. The region's rapid urbanization and industrial development are driving up vehicle demand, primarily in India, China, and Southeast Asia. The growth in automotive sales creates significant demand for powertrain components and associated machinery. APAC's expanding infrastructure augments this growth route.

Europe ranks as the second-leading region in the global powertrain machinery industry as a result of dominance in hybrid and EV technologies, strict emission regulations fueling advancement, and a strong supply chain and skilled labor. Europe is a pioneer in the advancement of hybrid and electric powertrains, driven by stringent emission regulations and government incentives. The region accounts for nearly 25% of the total EV sales as of 2023, propelling demand for e-powertrain machinery. Leading automakers are expanding their EV production facilities, thereby boosting the segment.

Additionally, regulations such as the upcoming Euro 7 standards and Euro 6 impose stringent restrictions on emissions, forcing manufacturers to adopt advanced powertrain technologies. These policies need massive investment in lightweight materials, cleaner engines, and electrified systems. This regulatory pressure boosts industry growth for powertrain machinery in the region.

Additionally, the region boasts a well-established supply chain and a proficient labor pool, which supports high-quality manufacturing standards. Economies such as France, Germany, and Italy are leading hubs for the production of automotive components. This ecosystem assures the region's leading dominance in the market.

Powertrain Machinery Market: Competitive Analysis

The leading players in the global powertrain machinery market are:

- Bosch

- ZF Friedrichshafen AG

- Magna International

- Aisin Seiki Co. Ltd.

- BorgWarner Inc.

- Continental AG

- Hitachi Automotive Systems

- Schaeffler Group

- Mitsubishi Electric Corporation

- Denso Corporation

- Cummins Inc.

- Eaton Corporation

- Allison Transmission

- Jatco Ltd.

- GKN Automotive

Powertrain Machinery Market: Key Market Trends

Integration of Industry 4.0 and automation:

Advanced manufacturing solutions, including IoT, AI, and robotics, are being increasingly integrated into powertrain machinery. These solutions enable predictive maintenance, enhance production efficiency, and facilitate real-time monitoring and control. Smart factories deploying Industry 4.0 practices optimize quality and reduce downtime. This trend is crucial for achieving the high precision required in modern powertrain systems.

Demand for precision components and lightweight materials:

Strict emission regulations and fuel efficiency requirements are driving the use of lightweight materials, such as composites and aluminum, in powertrain parts. Machinery capable of managing advanced alloys and precision machining is experiencing a surge in demand. This trend impacts design changes in transmissions, engines, and EV drivetrains.

The global powertrain machinery market is segmented as follows:

By Type

- CNC Machining Equipment

- Casting and Forging Machinery

- Welding and Joining Machinery

- Cutting and Grinding Equipment

By Component

- Engine Machinery

- Transmission Machinery

- Drivetrain Machinery

- Electric Powertrain Machinery

By Application

- Automotive Industry

- Off-Highway Vehicles

- Electric Vehicles

- Aerospace and Defense

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Powertrain machinery relates to the components and systems that produce power and deliver it to the automobile's drivetrain for motion. It comprises transmissions, engines, axles, differentials, and drive shafts, which work jointly to optimize fuel efficiency, emissions, and performance.

The global powertrain machinery market is projected to grow due to the increasing adoption of hybrid and electric vehicles, advancements in powertrain technologies, and rising urbanization and mobility needs.

According to study, the global powertrain machinery market size was worth around USD 129.04 billion in 2024 and is predicted to grow to around USD 223.38 billion by 2034.

The CAGR value of the powertrain machinery market is expected to be approximately 7.10% from 2025 to 2034.

Macroeconomic factors, such as raw material price volatility, inflation, and global trade uncertainties, will slow short-term development but accelerate regional manufacturing localization and long-term innovation in the powertrain machinery market.

The value chain of the global powertrain machinery market comprises raw material sourcing → component manufacturing → machinery production → system integration → distribution → end-use application → aftermarket services.

Asia Pacific is expected to lead the global powertrain machinery market during the forecast period.

The powertrain machinery market is highly competitive, with global regional players and OEMs focusing on electrification, automation, and strategic collaborations to gain market share.

The key players profiled in the global powertrain machinery market include Bosch, ZF Friedrichshafen AG, Magna International, Aisin Seiki Co., Ltd., BorgWarner Inc., Continental AG, Hitachi Automotive Systems, Schaeffler Group, Mitsubishi Electric Corporation, Denso Corporation, Cummins Inc., Eaton Corporation, Allison Transmission, Jatco Ltd., and GKN Automotive.

The report examines key aspects of the powertrain machinery market, including a detailed analysis of existing growth factors and restraints, as well as an examination of future growth opportunities and challenges that will impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed