Poultry Vitamin Market Size, Share, Growth, Opportunities 2034

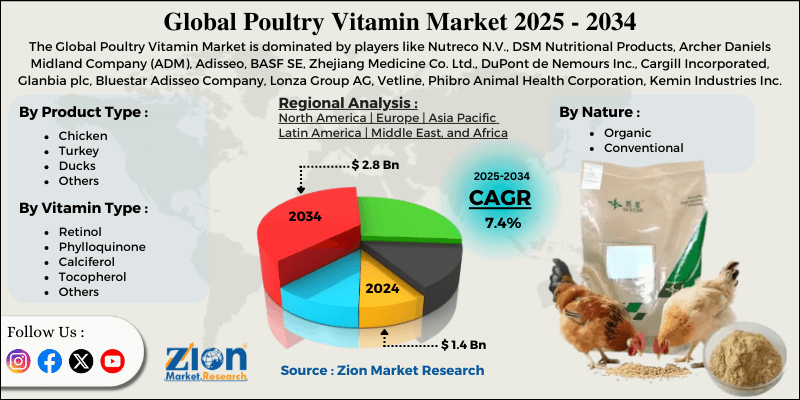

Poultry Vitamin Market By Product Type (Chicken, Turkey, Ducks, and Others), By Nature (Organic and Conventional), By Vitamin Type (Retinol, Phylloquinone, Calciferol, Tocopherol, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.4 Billion | USD 2.8 Billion | 7.4% | 2024 |

Poultry Vitamin Industry Perspective:

What will be the size of the global poultry vitamin market during the forecast period?

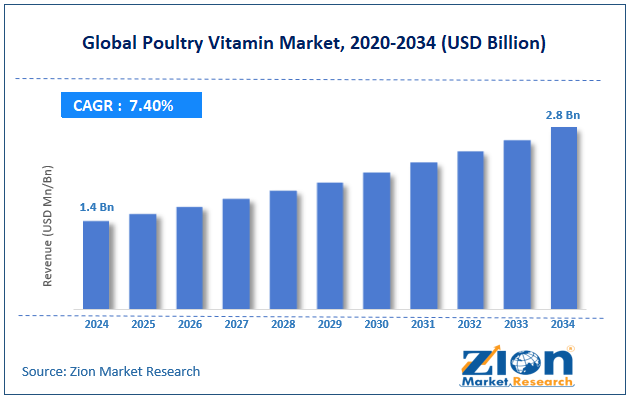

The global poultry vitamin market size was worth around USD 1.4 billion in 2024 and is predicted to grow to around USD 2.8 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.4% between 2025 and 2034.

Key Insights

- As per the analysis shared by our research analyst, the global poultry vitamin market is estimated to grow annually at a CAGR of around 7.4% over the forecast period (2025-2034).

- In terms of revenue, the global poultry vitamin market size was valued at around USD 1.4 billion in 2024 and is projected to reach USD 2.8 billion by 2034.

- Growth of commercial poultry operations & vertical integration is expected to drive the poultry vitamin market.

- Based on the product type, in 2024, the chicken segment dominates the market.

- Based on the nature, the conventional segment is expected to dominate the market over the projected period.

- Based on the vitamin type, the retinol segment held the largest revenue share in 2024 and is expected to continue the same pattern during the projected period.

- Based on region, North America is expected to lead the poultry vitamin market over the projected period.

Poultry Vitamin Market: Overview

Poultry vitamins are important micronutrients added to the feed or water of birds, such as broilers, layers, and breeders, to support their growth, health, digestion, immunity, and reproduction. These vitamins are important for bone growth, egg production, disease resistance, stress tolerance, and feed efficiency. They are fat-soluble (A, D, E, and K) and water-soluble (B-complex and vitamin C). Poultry vitamins are available in several forms, including premixes, concentrates, powders, and liquids. They are made to fit the bird's age, stage of production, and the environment. They are a key part of modern poultry nutrition, especially in intensive and commercial farming systems where the vitamins in the feed may not be enough. The poultry vitamin industry is largely driven by people worldwide eating more chicken meat and eggs. This is because populations and cities are growing, and people in developing countries want cheap animal protein. As the number of chickens raised increases, farmers and integrators increasingly rely on vitamin supplements to improve feed conversion rates, growth rates, egg output, and overall flock productivity.

On the other hand, the poultry vitamin sector faces several challenges that could slow its growth, even as chicken production is rising worldwide. One of the biggest problems is that raw material prices can fluctuate significantly. This is because many vitamins are produced through energy-intensive chemical processes, so production costs may change when energy, petrochemicals, and supplies are unavailable. Also, strict, often-changing rules on feed additives, safety standards, and labeling make compliance more expensive and may delay product approvals, especially for smaller or regional companies.

Poultry Vitamin Market: Dynamics

Growth Drivers

How does the rising demand for poultry meat & eggs propel the development of the poultry vitamin market?

The poultry vitamin market is growing because more people want chicken meat and eggs. This leads to more poultry being raised and to more intensive, commercial farming methods being used. To meet expanding demand, producers focus on growth rates, feed efficiency, egg production, and overall flock performance. This means that diets need to be nutritionally balanced and include vital vitamins. As production increases, birds are maintained in larger groups and under more controlled conditions. This underscores the importance of providing them with vitamins to strengthen their immune systems, reduce mortality rates, and address their nutritional and environmental stressors.

Also, producers are more likely to use vitamins as natural performance and health boosters, as customers increasingly seek high-quality, safe, antibiotic-free poultry products. All of these things together create a long-term demand for chicken vitamins, which helps the poultry nutrition and feed additives sector grow and modernize.

For instance, according to the FAO, world egg production has increased by 150 percent over the last three decades.

Restraints

Raw-material price volatility is hampering the industry's growth

Unstable raw-material costs slow the sector's expansion by reducing profit margins and creating uncertainty for poultry vitamin and feed manufacturers. Volatile energy and petrochemical feedstock prices make it difficult to set stable pricing, leading to long-term supply contracts breaking and forcing manufacturers to raise prices. This leads cost-conscious poultry farmers to buy less. As a result, unpredictable costs disrupt production planning and inventory management, dampening investment, innovation, and overall poultry vitamin market growth.

Opportunities

How does increasing product innovation offer opportunities for expansion of the poultry vitamin market?

New products give the poultry vitamin industry more opportunities to improve its businesses. It helps them go beyond basic items and offer superior, performance-based solutions. Micro-encapsulated vitamins that are stable at high temperatures maintain nutrients in feed during processing and storage. This makes it easier and more reliable for farmers to add vitamins to their animals' diets. Providers can meet the needs of modern poultry systems by making custom blends and formulations for different conditions, such as starter, grower, layer, and breeder. These can help the immune system, digestive health, or lower stress levels. Innovation supports clean-label, antibiotic-free nourishment that meets customer needs and follows the rules. These improvements set brands apart and make higher prices reasonable. They also encourage commercial farms to adopt them and open new markets for chickens in both established and emerging countries.

For instance, in December 2025, at Poultry India 2025 in Hyderabad, Orffa, a global supplier of specialized feed additives, unveiled its own line of amino acids and vitamins. This greatly increased the company's nutritional options for the South Asian feed and livestock market. The new line of products has a comprehensive range of vital amino acids and vitamins that dissolve in fat and water. These vitamins and amino acids are commonly used in poultry, aquaculture, and animal production.

Challenges

Why do substitution and technological shifts pose a major threat to the poultry vitamin industry's growth?

Farmers are less reliant on traditional poultry vitamin products due to market constraints, such as substitution and technological advances. They are switching to other, more integrated nutritional solutions. Probiotics, prebiotics, enzymes, phytogenics, organic acids, and improved amino acid formulations are now used in chicken feed to enhance nutrition. In some cases, these can do the same things as vitamins. They are especially effective for gut health, immunity, and growth. At the same time, precision feeding technology and data-driven nutrition models make it easier to deliver nutrients to the right place.

As a result, people may not need to take as many vitamin pills on their own. Chicken farmers now want more multifunctional feed additives or integrated premix solutions. This trend may reduce the need for basic, undifferentiated vitamin supplies. Producers will need to develop new ideas and find better ways to use vitamins in larger, more valuable nutritional systems. Thus, the aforementioned factor acts as a major threat to the poultry vitamin market.

Poultry Vitamin Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Poultry Vitamin Market |

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2034 | USD 2.8 Billion |

| Growth Rate | CAGR of 7.4% |

| Number of Pages | 213 |

| Key Companies Covered | Nutreco N.V., DSM Nutritional Products, Archer Daniels Midland Company (ADM), Adisseo, BASF SE, Zhejiang Medicine Co. Ltd., DuPont de Nemours Inc., Cargill Incorporated, Glanbia plc, Bluestar Adisseo Company, Lonza Group AG, Vetline, Phibro Animal Health Corporation, Kemin Industries Inc., Alltech, and others. |

| Segments Covered | By Product Type, By Nature, By Vitamin Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Poultry Vitamin Market: Segmentation

Product Type Insights

In 2024, the chicken segment dominates the market. The fast rise in chicken meat and egg consumption is driving revenue growth in this field. Chicken is still the cheapest and most widely accepted animal protein in both developed and emerging countries. To meet this need, chicken farmers are expanding their operations, which in turn increases the demand for vitamin-rich feed to accelerate growth, improve feed conversion efficiency, increase egg yield, and make the flock more uniform.

Nature Insights

The conventional segment is expected to dominate the market over the projected period. The rise is due to its widespread use, affordability, and demonstrated effectiveness in commercial chicken production. Conventional poultry vitamins are widely used by large-scale feed mills and integrators because they are easy to obtain, well standardized, and compatible with the feed formulations and manufacturing procedures already in use. Compared to organic or specialized vitamins, regular vitamins are cheaper and provide nutrients more consistently, which is important for poultry farmers on a tight budget. Their ability to support rapid development, efficient feed conversion, high egg production, and disease resistance—especially in intensive broiler and layer operations—helps sustain high demand.

Vitamin Type Insights

The retinol segment held the largest revenue share in 2024 and is expected to maintain this pattern during the projected period. This is because it helps chickens and other birds grow, stay healthy, see better, and reproduce. Retinol is an important component of chicken feed because it helps maintain epithelial tissue health. It makes birds more resistant to disease, helps embryos develop, and supports egg production. Intensive chicken farming limits access to natural vitamin A, so birds rely on fortified feed. This is driving revenue growth.

Regional Insights

What factors drive the growth of the poultry vitamin market in North America?

North America is expected to lead the poultry vitamin market over the projected period. There is a lot of industrialized poultry production in the area, and people want high-quality, antibiotic-free poultry meat and eggs, which is driving growth in the region's poultry business. Because of this, large poultry corporations in the US and Canada that own and operate their own farms need feed formulas that are exact and consistent across all farms. Because of this necessity, vitamin premixes are very important for keeping birds healthy, productive, and consistent on a large scale.

Also, strict standards and food safety laws make it more likely that people will use vitamin supplements made by professionals. These ensure that people follow the rules and reduce the risk of getting sick without using antibiotic growth boosters. Customers are now more interested in clean-label, traceable, animal-friendly chicken products. Because of this need, producers are more likely to employ vitamins as a natural way to improve performance and immune function.

Poultry Vitamin Market: Competitive Analysis

The global poultry vitamin market is dominated by players like:

- Nutreco N.V.

- DSM Nutritional Products

- Archer Daniels Midland Company (ADM)

- Adisseo

- BASF SE

- Zhejiang Medicine Co. Ltd.

- DuPont de Nemours Inc.

- Cargill Incorporated

- Glanbia plc

- Bluestar Adisseo Company

- Lonza Group AG

- Vetline

- Phibro Animal Health Corporation

- Kemin Industries Inc.

- Alltech

The global poultry vitamin market is segmented as follows:

By Product Type

- Chicken

- Turkey

- Ducks

- Others

By Nature

- Organic

- Conventional

By Vitamin Type

- Retinol

- Phylloquinone

- Calciferol

- Tocopherol

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed