Insect Feed Market Size, Industry Analysis, Share, Forecast 2034

Insect Feed Market By Insect Type (Fly Larvae, Silkworms, Cicadas, and Other Insects), By Application (Aquaculture, Pig Nutrition, Poultry Nutrition, Dairy Nutrition, and Other Applications), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

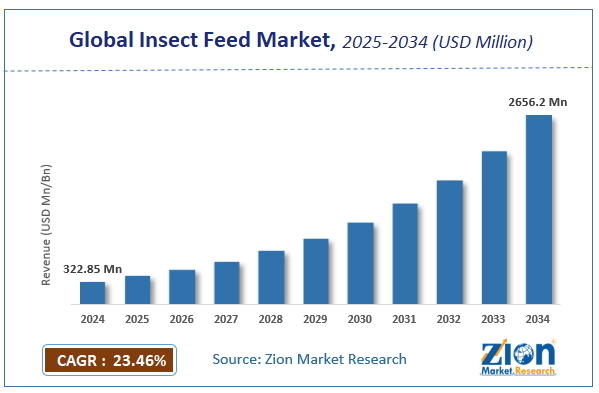

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 322.85 Million | USD 2656.2 Million | 23.46% | 2024 |

Insect Feed Market: Industry Perspective

The global insect feed market size was worth around USD 322.85 million in 2024 and is predicted to grow to around USD 2656.2 million by 2034 with a compound annual growth rate (CAGR) of roughly 23.46% between 2025 and 2034. The report analyzes the global insect feed market's drivers, restraints/challenges, and the effect they have on the demand during the projection period. In addition, the report explores emerging opportunities in the insect feed industry.

Insect Feed Market: Overview

Meals that have been heavily protein-enhanced and produced from various additives and unprocessed components are known as insect feeds. These concoctions are made specifically with aquafeed in mind, considering the requirements of the intended animal. They are made by feed compounders such as crumbles, pellets, or different types of meals. Insect feed is becoming more well-liked as a sustainable source of protein for livestock, companion animals, and people. Insect feed is a helpful product with many applications because it is available in various formats. Insect feed can completely replace or enhance conventional feed sources. Additionally, it's becoming more and more common to eat insects as food.

The market for insect feed has remained dormant for far too long. However, customers are paying attention now that a new batch of insect feed products is available. The market for edible insects used as animal feed is seeing a lot of innovation. As the population expands, so does the demand for food. To fulfill the growing worldwide need for food, meat production has increased. Animals must be fed properly to improve the quality of the meat they produce. The feed business has created a market for edible insects for animal feed. Insects provide high protein levels, which are essential for enhancing animal growth. Farmers are looking for alternative sources of protein to meet the rising demand.

Key Insights

- According to the analysis provided by our research analyst, the global insect feed market is projected to grow at a compound annual growth rate (CAGR) of approximately 23.46% annually over the forecast period (2025-2034).

- Regarding revenue, the global insect feed market size was valued at around USD 322.85 million in 2024 and is projected to reach USD 2656.2 million by 2034.

- The insect feed market is projected to grow at a significant rate due to rising demand for sustainable protein sources, increasing aquaculture and livestock production, environmental benefits, and cost-effectiveness compared to traditional feed.

- Based on Insect type, the mealworms segment is expected to lead the global market.

- On the basis of application, the aquaculture segment is growing at a high rate and will continue to dominate the global market.

- Based on region, Asia Pacific is predicted to dominate the global market during the forecast period.

Insect Feed Market: Growth Drivers

The growing use of insect feed due to animals natural dietary patterns to driving market growth

Numerous animals, including birds, poultry, fish, and other species, naturally consume insects as part of their diet. The use of insect proteins in commercial feed is predicted to increase because these animals are natively adapted to eating insect feed. Additionally, insects have bioactive components that enhance gut health, making them highly sought after by animal husbandry businesses. Additionally, the demand for food products derived from animals has grown as a result of the expanding population and changing dietary preferences.

An extra supply of protein-based feed from environmentally friendly sources is needed to meet market demand. The Food and Agriculture Organization predicts that by 2050, there will be a 465 million tons increase in the demand for livestock products worldwide. In the upcoming years, these factors are anticipated to favor the growth of the global insect feed market.

Insect Feed Market: Restraints

Stringent rules and regulations act as a barrier to market expansion

In the upcoming years, market growth is expected to be constrained by the strict laws and regulations related to introducing new insect feed. For instance, the Bovine Spongiform Encephalopathy (BSE) problem, which poses a serious threat to consumer health and safety, significantly impacts the European approach to using insects as feed. Additionally, one of the main roadblocks to the industrialization of insect feed in many areas is the lack of clear laws and standards governing the use of insects as food.

Global Insect Feed Market: Opportunities

Emerging insect protein applications offer growth opportunities for market

Protein sources have been the subject of much research lately. The nutritional value and essential amino acids of novel protein sources must be maintained while the flavor and price are improved. The use of insect protein is becoming increasingly widespread as the industry grows. Insect-based protein components are typically derived from the insects' muscles, body fat, and outer coats.

These come in both water-soluble and water-insoluble forms in their natural state. Worldwide sales of insect feed have increased as a result of this. Livestock receive nutrition from insect feed, which promotes healthy growth. Farmers will look to insects as an alternative source of protein in the future, creating significant growth potential for the global insect feed market.

Insect Feed Market: Challenges

Scaling production poses a challenge to the growth of the market.

Start-ups must discover dependable, consistent methods of production scaling to take advantage of economies of scale, maximize returns, and compete with other suppliers of animal feed supplies. Currently, the manufacturing capacity of insect feed is dwarfed by the size of the current feedstock sector. Even extremely high-quality insect meal won't make a difference for a feedstock factory that routinely processes millions of tonnes through highly industrialized methods. Some of the difficulties are securing enough breeding stock, generating money to support infrastructure investments, and risk management in a sector without a spot market or secondary supply source.

Insect Feed Market: Segmentation Analysis

The global insect feed market is segregated based on insect type, application, and region.

Based on insect type, the market is divided into fly larvae, silkworms, cicadas, and other insects. Mealworms are expected to account for a sizeable portion of the global insect feed market since they contain significant amounts of copper, potassium, iron, zinc, selenium, and vitamins. For instance, mealworms often contain more vitamins than beef, except for vitamin B12. The abundance of fly larvae is also anticipated to increase their use in insect food production.

On the basis of application, the market is divided into aquaculture, pig nutrition, poultry nutrition, dairy nutrition, and other applications. Aquaculture is anticipated to significantly dominate the market for insect feed. Both fish production and consumption have increased significantly during the last few decades. Due to the success of the aquaculture sector, which now provides almost half of the world's fish, the need for insect feed from the aquaculture industry is anticipated to rise.

Recent Development

- In October 2021, the Aspire Food Group revealed plans to build a brand-new, fully automated cricket processing plant in London, Ontario, Canada. With this investment, the company may generate 10,000 tonnes of items made from crickets annually. As a result, Aspire Food Group would be able to meet the rising demand from the animal feed sector.

- In September 2021, Insect announced a partnership with Pure Simple True LLC to launch its first product in the United States. The product is vital in dog food because it is a high-quality, sustainable protein. The company expanded and provided its products across the United States thanks to its introduction. The product introduction was also a crucial milestone for the business's further expansion in the US market.

- InnovaFeed and Cargill collaborated to use insect oil for pig feed in May 2021, expanding their alliance beyond aquaculture nutrition. By 2026, this expanded relationship should help more than 20 million piglets and give the business a strategic opportunity to contribute to the improvement of the world's food system.

- Beta Hatch declared its intention to grow its activities in December 2020. It received new funding of USD 9.3 million. This action assisted the business in erecting one of North America's biggest mealworm facilities.

Insect Feed Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insect Feed Market |

| Market Size in 2024 | USD 322.85 Million |

| Market Forecast in 2034 | USD 2656.2 Million |

| Growth Rate | CAGR of 23.46% |

| Number of Pages | 200 |

| Key Companies Covered | Nextprotein, Buhler AG, Hexafly, Entofood, Diptera Nutrition, Enviroflight, Coppens, Agriprotein, and others. |

| Segments Covered | By Insect Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Insect Feed Market: Regional Analysis

Increasing demand for a protein-rich diet is likely to help Asia Pacific dominate the global market

Asia Pacific region has long dominated the global insect feed market. The market share of alternative protein sources, such as insects, has increased by 38% in recent years because of the rising demand for diets high in protein. The popularity of bug feed for cattle has increased as a result. Since insect meal is a significant source of income in rural areas, the decline in the rural market increases the income shares of the remaining rural population, driving up the market for insect feed across the country.

Approximately 33.0 % of the global market for edible insects for animal feed was accounted for by North America in 2021. The bug species with the fastest growth rate in the region's market for edible insects used as animal feed are mealworms, black soldier flies, and orthoptera.

The Middle East and Africa have a higher need for edible insects for animal feed than Latin America. However, it is predicted that the market in Latin America will expand more quickly throughout the forecast period than in the Middle East and Africa.

Insect Feed Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the insect feed market on a global and regional basis.

The global insect feed market is dominated by players like:

- Nextprotein

- Buhler AG

- Hexafly

- Entofood

- Diptera Nutrition

- Enviroflight

- Coppens

- Agriprotein

The global insect feed market is segmented as follows;

By Insect Type

- Fly Larvae

- Silkworms

- Cicadas

- Other Insects

By Application

- Aquaculture

- Pig Nutrition

- Poultry Nutrition

- Diary Nutrition

- Other Applications

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Meals that have been heavily protein-enhanced and produced from various additives and unprocessed components are known as insect feeds. These concoctions are made specifically with aquafeed in mind, considering the requirements of the intended animal.

The global insect feed market is expected to grow due to rising demand for sustainable and alternative protein sources for animal feed, due to increasing environmental concerns, limitations of traditional feed ingredients, and the nutritional benefits of insect-based feed.

According to a study, the global insect feed market size was worth around USD 322.85 Million in 2024 and is expected to reach USD 2656.2 Million by 2034.

The global insect feed market is expected to grow at a CAGR of 23.46% during the forecast period.

Asia Pacific is expected to dominate the insect feed market over the forecast period.

Leading players in the global insect feed market include Nextprotein, Buhler AG, Hexafly, Entofood, Diptera Nutrition, Enviroflight, Coppens, Agriprotein, among others.

The report explores crucial aspects of the insect feed market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed