Agriculture Technology-as-a-Service (Agri-TaaS) Market Size Report 2034

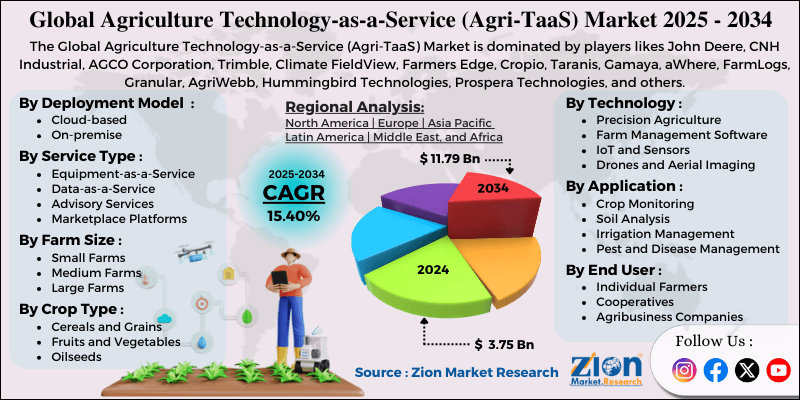

Agriculture Technology-as-a-Service (Agri-TaaS) Market By Service Type (Equipment-as-a-Service, Data-as-a-Service, Advisory Services, and Marketplace Platforms), By Technology (Precision Agriculture, Farm Management Software, IoT and Sensors, Drones and Aerial Imaging, AI and Machine Learning, and Robotics and Automation), By Application (Crop Monitoring, Soil Analysis, Irrigation Management, Pest and Disease Management, Yield Prediction, Livestock Monitoring, and Supply Chain Management), By Deployment Model (Cloud-based and On-premise), By Farm Size (Small Farms, Medium Farms, and Large Farms), By Crop Type (Cereals and Grains, Fruits and Vegetables, Oilseeds, and Others), By End-User (Individual Farmers, Cooperatives, Commercial Farming Enterprises, and Agribusiness Companies), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

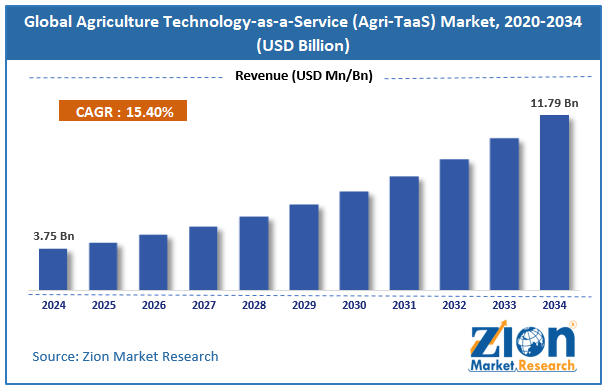

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 3.75 Billion | USD 11.79 Billion | 15.40% | 2024 |

Agriculture Technology-as-a-Service Industry Perspective:

The global agriculture technology-as-a-service market size was worth approximately USD 3.75 billion in 2024 and is projected to grow to around USD 11.79 billion by 2034, with a compound annual growth rate (CAGR) of roughly 15.40% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global agriculture technology-as-a-service market is estimated to grow annually at a CAGR of around 15.40% over the forecast period (2025-2034).

- In terms of revenue, the global agriculture technology-as-a-service market size was valued at approximately USD 3.75 billion in 2024 and is projected to reach USD 11.79 billion by 2034.

- The agriculture technology-as-a-service market is projected to grow significantly due to increasing demand for precision farming, rising adoption of digital agriculture, growing need for farm productivity improvement, expanding internet connectivity in rural areas, and increasing focus on sustainable agricultural practices.

- Based on service type, the equipment-as-a-service segment is expected to lead the agriculture technology-as-a-service market. In contrast, the data-as-a-service segment is anticipated to experience significant growth.

- Based on technology, the precision agriculture segment is expected to lead the market, while the AI and machine learning segment is anticipated to witness notable growth.

- Based on application, the crop monitoring segment is the dominating segment, while the yield prediction segment is projected to witness sizeable revenue over the forecast period.

- Based on the deployment model, the cloud-based segment is expected to lead the market compared to the on-premise segment.

- Based on farm size, the medium farms segment is expected to lead the market during the forecast period.

- Based on crop type, the cereals and grains segment is expected to lead compared to the fruits and vegetables segment.

- Based on end-user, the individual farmers segment is expected to lead the market.

- Based on region, North America is projected to dominate the global agriculture technology-as-a-service market during the estimated period, followed by Europe.

Agriculture Technology-as-a-Service Market: Overview

Agriculture technology-as-a-service is a model in which farmers use advanced farming tools, data services, and expert support through subscriptions or pay-per-use systems instead of buying expensive equipment. This approach makes technologies such as drones, sensors, automated machines, and software accessible to small and medium farmers who cannot afford large upfront investments. Service providers handle maintenance, upgrades, and daily operation while farmers pay only for the period or amount of use. Farmers can rent tractors, harvesters, and other machinery during the seasons they need them, without managing repairs, storage, or depreciation. Data platforms collect information from satellites, sensors, and weather systems to give simple insights about soil, crops, pests, and optimal planting times. Advisory services connect farmers to experts who translate data into clear recommendations that improve yields and reduce costs. Marketplace platforms help farmers reach buyers directly, which increases their earnings. The subscription model spreads costs across monthly or seasonal payments, making modern technology affordable. Farmers also gain access to the latest tools as providers continually upgrade their equipment.

The increasing need for sustainable farming practices, combined with the rising adoption of digital agriculture, is expected to drive substantial growth in the agriculture technology-as-a-service market throughout the forecast period.

Agriculture Technology-as-a-Service Market Dynamics

Growth Drivers

Precision farming and key adoption drivers

The agriculture technology-as-a-service market is expanding rapidly as farmers worldwide recognize the benefits of precision methods, which improve crop yields while reducing input costs and environmental impact. Traditional farming practices apply fertilizers, water, and pesticides across entire fields, wasting resources in some zones while missing needs in others. Precision farming uses GPS, sensors, and data analytics to create field maps showing soil quality, moisture levels, and nutrient content across different areas. Farmers apply inputs at variable rates, giving each zone the correct amount for healthy growth. This targeted method cuts fertilizer use by 20 to 30 percent while increasing yields through stronger crop health and reduced stress.

Water savings reach similar levels through precision irrigation, which delivers water only where and when it is required based on soil readings. Automated guidance systems reduce overlap during planting and spraying, saving fuel and inputs. Drone imagery highlights pest issues and diseases early, when treatment remains easier and less costly.

How are growing internet connectivity and smartphone adoption in rural areas driving the global agriculture technology-as-a-service market?

The global agriculture technology-as-a-service market is growing as internet access reaches remote farming regions and smartphone use becomes increasingly common across developing countries. Mobile networks provide enough bandwidth for sending sensor data, receiving weather updates, and using farm management platforms. Smartphones give farmers easy tools for monitoring fields, controlling irrigation, receiving alerts, and speaking with advisors from any location. Mobile apps turn complex technologies into simple interfaces that require very little training for daily use.

Video guides and online courses help farmers learn new skills at a comfortable pace. Digital payment systems built into service platforms make transactions simple and create clear financial records, which are useful for credit access. Social media connects farmers in shared communities where they exchange ideas and solutions. Cloud computing removes the need for servers or software installation, lowering the technical barriers to adoption. Internet access allows remote equipment monitoring, allowing providers to predict maintenance needs before failures occur. Real-time sensor data provides insights that are impossible to obtain through manual observation. Weather updates and market prices support better timing for planting and selling.

Restraints

Limited digital literacy and technology adoption barriers

The agriculture technology-as-a-service industry faces major challenges because many farmers, especially older generations and those in developing regions, have limited digital experience and feel uneasy adopting unfamiliar practices. Traditional knowledge passed through families creates resistance toward data-based methods that appear different from long-trusted routines. Lower education levels in rural areas make it hard to understand dashboards, read analytics, and solve technical problems. Language differences create confusion when platforms and support teams use major languages instead of local dialects spoken in farming communities.

Poor interface design often requires digital skills that many farmers do not have, which increases frustration. Weak training and limited support during onboarding leave farmers unsure about proper usage, which often results in discontinued adoption. Concerns about data privacy create hesitation because farmers worry about sharing operational information with technology companies. Fear of data being misused for competition or land issues adds to this reluctance. Many farmers wait for visible results from neighbors before trying new services.

Opportunities

How is the expansion into emerging markets and smallholder farmer segments creating opportunities in the agriculture technology-as-a-service market?

The agriculture technology-as-a-service market is presenting significant opportunities as providers develop affordable solutions tailored for smallholder farmers across Asia, Africa, and Latin America, who manage a substantial portion of the global farmland. These regions include millions of small family farms that grow only a few acres yet support food supplies for huge populations. Improving productivity on these small farms has a stronger effect on food security and rural income compared with gains on large commercial operations. Service providers are building simple platforms with basic tools that work on feature phones and need very little data usage.

Micro-subscription plans cost only a few dollars monthly, making services accessible for subsistence farmers. Shared access systems allow cooperatives to purchase services used collectively by members, thereby spreading the overall costs. Mobile money payment options remove banking requirements and increase convenience. Local content in regional languages with familiar designs improves adoption among diverse communities. Partnerships with government programs, NGOs, and farmer groups create trusted channels for introducing new digital tools. Weather-indexed insurance bundled with technology services protects farmers from climate risks while offering new revenue options.

Challenges

How are fragmented farming systems and standardization issues affecting the agriculture technology-as-a-service market?

The agriculture technology-as-a-service market faces major challenges because farming practices, crop types, regional conditions, and farm sizes vary so widely that creating uniform solutions becomes very difficult. Agricultural systems differ greatly between rice fields in Asia, wheat farms in North America, coffee plantations in South America, and vegetable operations in Europe. Each crop requires specific methods, equipment, inputs, and knowledge that generic platforms cannot fully support. Soil conditions, climate patterns, pest pressures, and water availability vary significantly between regions, making advice applicable in one area ineffective in another.

Farm sizes range from tiny half-acre plots to huge operations covering thousands of acres, which demand different technologies and business models. Equipment designed for large farms cannot function well on small, scattered plots with irregular shapes. Seasonal cycles create demand surges when many farmers need equipment at the same time, and low usage during other months. Ownership structures, ranging from single farmers to cooperatives and corporations, require different service approaches. Local rules involving land use, water access, chemical applications, and data handling differ across countries and provinces. Technology integration remains limited because vendors use proprietary systems and incompatible data formats.

Agriculture Technology-as-a-Service (Agri-TaaS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Agriculture Technology-as-a-Service (Agri-TaaS) Market |

| Market Size in 2024 | USD 3.75 Billion |

| Market Forecast in 2034 | USD 11.79 Billion |

| Growth Rate | CAGR of 15.40% |

| Number of Pages | 216 |

| Key Companies Covered | John Deere, CNH Industrial, AGCO Corporation, Trimble, Climate FieldView, Farmers Edge, Cropio, Taranis, Gamaya, aWhere, FarmLogs, Granular, AgriWebb, Hummingbird Technologies, Prospera Technologies, and others. |

| Segments Covered | By Service Type, By Technology, By Application, By Deployment Model, By Farm Size, By Crop Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Agriculture Technology-as-a-Service Market: Segmentation

The global agriculture technology-as-a-service market is segmented based on service type, technology, application, deployment model, farm size, crop type, end-user, and region.

Based on service type, the global agriculture technology-as-a-service industry is segmented into equipment-as-a-service, data-as-a-service, advisory services, and marketplace platforms. Equipment-as-a-service leads the market due to high equipment costs, which make rental models attractive to farmers and the flexibility to access specialized machinery only when needed, without the maintenance burdens.

Based on technology, the industry is segregated into precision agriculture, farm management software, IoT and sensors, drones and aerial imaging, AI and machine learning, and robotics and automation. Precision agriculture leads the market due to its proven ability to reduce input costs while increasing yields through variable rate application and site-specific management.

Based on application, the global agriculture technology-as-a-service market is divided into crop monitoring, soil analysis, irrigation management, pest and disease management, yield prediction, livestock monitoring, and supply chain management. Crop monitoring is expected to lead the market during the forecast period due to its fundamental importance for identifying problems early and making timely interventions that protect yields.

Based on the deployment model, the global market is classified into cloud-based and on-premise. Cloud-based holds the largest market share due to lower upfront costs, automatic updates, accessibility from any location, and the elimination of local IT infrastructure requirements.

Based on farm size, the global agriculture technology-as-a-service market is segmented into small farms, medium farms, and large farms. Medium farms hold the largest market share due to their sufficient scale to justify technology investments while still benefiting significantly from efficiency improvements that technology-as-a-service provides.

Based on crop type, the global market is categorized into cereals and grains, fruits and vegetables, oilseeds, and others. Cereals and grains hold the largest market share due to their dominance in global agricultural production and the suitability of precision farming techniques for these commodity crops.

Based on end-user, the global market is segmented into individual farmers, cooperatives, commercial farming enterprises, and agribusiness companies. Individual farmers hold the largest market share due to their sheer numbers globally and the increasing recognition that access to technology is essential for remaining competitive.

Agriculture Technology-as-a-Service Market: Regional Analysis

How does advanced infrastructure and strong technology adoption position North America as the leading region in the agriculture technology-as-a-service market?

North America holds a strong position in the agriculture technology-as-a-service market due to its well-developed digital infrastructure, high levels of farmer education, large commercial farms, and active venture capital investment in agricultural technology. The United States and Canada have broad rural broadband coverage that supports data-heavy precision agriculture tools across major crop regions. Farmers in this region use smartphones and computers frequently, which lowers barriers to adopting digital services and learning new systems. Large farms covering hundreds or thousands of acres create powerful incentives for efficiency gains delivered through modern technologies. Commercial operations approach farming as a business and welcome innovations offering cost reductions or yield improvements.

Agricultural universities and research centers work closely with technology companies to create practical tools suited for real farm conditions. Government programs encourage adoption through financial support and technical guidance for precision farming practices. Local equipment dealers provide reliable sales channels and service networks for new technologies. Strong intellectual property rules motivate companies to continue investing in advanced solutions. Supportive regulations allow quick deployment of tools, including drones and autonomous machines, across fields. Climate variability and water shortages in key production zones increase the demand for precision irrigation and weather-based decision systems.

Europe's steady growth in the market

Europe is experiencing steady growth in the agriculture technology-as-a-service market because environmental rules encourage farmers to use sustainable methods and precision tools that lower chemical use and reduce environmental harm. The European Union’s Common Agricultural Policy links subsidies to environmental performance, which creates financial motivation for farmers to adopt precision techniques that improve efficiency. Strict limits on pesticides and fertilizers push farmers toward technologies that control application rates and prevent unnecessary waste across fields. Worries about soil health and water quality make variable rate tools important for meeting compliance requirements.

Small and medium farms dominate European agriculture, making equipment-as-a-service models appealing because farmers can access costly machines without buying them. Strong cooperative systems help farmers share technology and lower expenses through collective use. High labor costs increase interest in automation and robotics, which reduces manual work. Organic farming groups value precision tools for managing crops without the use of synthetic chemicals. Consumer interest in sustainable food creates premiums that support investment in better technologies. Government programs provide research grants and adoption support for agricultural innovation. National and EU digital initiatives strengthen rural connectivity and improve data systems.

Recent Market Developments:

- In May 2025, John Deere expanded its equipment-as-a-service program across European markets, allowing farmers to access precision planting and spraying equipment through flexible subscription models.

- In August 2025, Bayer Digital Farming announced partnerships with regional cooperatives in India and Brazil to provide smallholder farmers with affordable access to satellite-based crop monitoring services.

Agriculture Technology-as-a-Service Market: Competitive Analysis

The leading players in the global agriculture technology-as-a-service market are:

- John Deere

- CNH Industrial

- AGCO Corporation

- Trimble

- Climate FieldView

- Farmers Edge

- Cropio

- Taranis

- Gamaya

- aWhere

- FarmLogs

- Granular

- AgriWebb

- Hummingbird Technologies

- Prospera Technologies

The global agriculture technology-as-a-service market is segmented as follows:

By Service Type

- Equipment-as-a-Service

- Data-as-a-Service

- Advisory Services

- Marketplace Platforms

By Technology

- Precision Agriculture

- Farm Management Software

- IoT and Sensors

- Drones and Aerial Imaging

- AI and Machine Learning

- Robotics and Automation

By Application

- Crop Monitoring

- Soil Analysis

- Irrigation Management

- Pest and Disease Management

- Yield Prediction

- Livestock Monitoring

- Supply Chain Management

By Deployment Model

- Cloud-based

- On-premise

By Farm Size

- Small Farms

- Medium Farms

- Large Farms

By Crop Type

- Cereals and Grains

- Fruits and Vegetables

- Oilseeds

- Others

By End User

- Individual Farmers

- Cooperatives

- Commercial Farming Enterprises

- Agribusiness Companies

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

List of Contents

Agriculture Technology-as-a-ServiceIndustry Perspective:Key Insights:Agriculture Technology-as-a-Service OverviewAgriculture Technology-as-a-Service Market DynamicsReport ScopeAgriculture Technology-as-a-Service SegmentationAgriculture Technology-as-a-Service Regional AnalysisRecent Market Developments:Agriculture Technology-as-a-Service Competitive AnalysisThe global agriculture technology-as-a-service market is segmented as follows:HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed