Digital Payment In Healthcare Market Size, Share, Trends, Growth and Forecast 2034

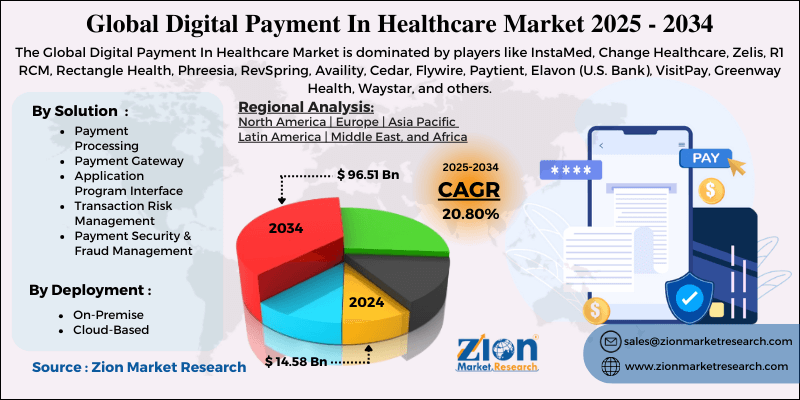

Digital Payment In Healthcare Market By Solution (Payment Processing, Payment Gateway, Application Program Interface, Transaction Risk Management, Payment Security & Fraud Management, and Others), By Deployment (On-Premise and Cloud-Based), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

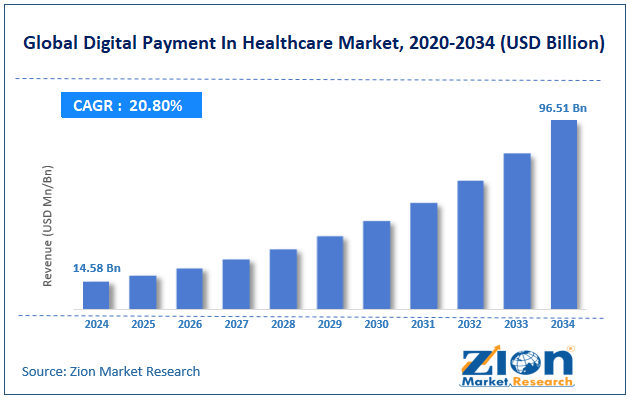

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 14.58 Billion | USD 96.51 Billion | 20.80% | 2024 |

Digital Payment In Healthcare Industry Perspective:

The global digital payment in healthcare market size was worth around USD 14.58 billion in 2024 and is predicted to grow to around USD 96.51 billion by 2034, with a compound annual growth rate (CAGR) of roughly 20.80% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global digital payment in healthcare market is estimated to grow annually at a CAGR of around 20.80% over the forecast period (2025-2034)

- In terms of revenue, the global digital payment in healthcare market size was valued at around USD 14.58 billion in 2024 and is projected to reach USD 96.51 billion by 2034.

- The digital payment in healthcare market is projected to grow at a significant rate due to the rising use of contactless payment methods among businesses and the general public.

- Based on the solution, the payment gateway segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the deployment, the cloud-based segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Digital Payment In Healthcare Market: Overview

Digital payment in healthcare refers to the use of electronic means of payment in the healthcare industry. The payments may be transacted between hospitals and patients, hospitals and vendors, hospitals and employees, and healthcare facilities and third-party service providers. Digital payments in healthcare include automated billing and payment processes at clinical facilities. Healthcare providers may leverage card payments, mobile wallets, online banking, and other digital modes of payment in place of traditional methods of cash payments. According to industry research, digital payment methods are more convenient and offer greater transparency in terms of financial transactions. Additionally, human error risk is greatly reduced when electronic means of payment are integrated in a healthcare facility.

During the projection period, investments in digital payment solutions for the healthcare industry will continue to garner higher revenue due to the rising adoption of the tools across major hospitals and other clinical facilities. Moreover, increasing use of blockchain technology and other methods of securing online payment tools will encourage improved growth rates during the forecast period. However, the industry is projected to be affected by the high cost of initial investment as well as growing cases of online payment fraud.

Digital Payment In Healthcare Market: Growth Drivers

Rising use of contactless payment methods among businesses and the general public is expected to fuel the market demand rate

The global digital payment in healthcare market is expected to be led by the growing use of contactless payment methods. Businesses and the general population worldwide are increasingly adopting mobile payment methods to make financial transactions, including both low-cost and high-value payments. Contactless payment methods gained more momentum during COVID-19 as patients and healthcare facilities sought ways to reduce the risk of infection.

Since then, a growing number of hospitals worldwide have been facilitating mobile payment methods, as they offer greater safety, payment transparency, and convenience not only to patients but also to healthcare providers. The surge in the number of smartphone users equipped with a wide range of mobile payment applications will help the industry thrive in the coming years. Additionally, growing public digital literacy will play a crucial role in the market’s final growth rate by the end of the forecast duration.

Will the growing expansion of telemedicine and remote healthcare promote revenue in the digital payment in healthcare market?

In the last few years, the global healthcare sector has witnessed the emergence and rapid expansion of telemedicine. It is a form of remote healthcare that allows disease diagnosis and treatment using novel telecommunication technologies. Remote medical care will enable patients to secure advanced treatments without being physically present at hospital premises.

According to industry analysis, telemedicine is highly effective in ensuring access to quality care in remote areas of the world, especially regions that have limited healthcare infrastructure. The growing demand for more advancements in remote medical care setups will fuel revenue in the global digital payment in healthcare market. These technologies will facilitate the remote transfer of financial payments according to the patient’s convenience.

Digital Payment In Healthcare Market: Restraints

Does the high cost of infrastructure setup restrict the digital payment in healthcare market expansion?

The global digital payment in healthcare industry is expected to be restricted by the high cost of infrastructure set up for seamless integration of advanced technologies enabling electronic payment gateways. According to market research, the average cost of setting up a digital payment architecture in a small clinic ranges from USD 15,000 to USD 50,000. The cost increases further in case of applications in larger settings. Furthermore, expenses related to employee training and a lack of compatibility with legacy systems may also impede market expansion during the projection duration.

Digital Payment In Healthcare Market: Opportunities

How does the integration of cutting-edge technologies in payment gateways generate growth opportunities for digital payment in healthcare industry?

The global digital payment in healthcare market is expected to generate growth opportunities due to the growing integration of sophisticated solutions such as Artificial Intelligence (AI) and blockchain in the electronic payment channels. These cutting-edge engineering solutions allow enhanced performance of the digital payment tools while also promoting safety features.

Furthermore, the industry can benefit from intensifying regulatory strictness concerning the use of digital payment models. Regional regulatory authorities are encouraging the adoption of new-age payment solutions that offer higher security and transparency.

Surge in government initiatives favoring the industry will push return on investment (ROI)

Regional governments are increasingly launching favorable initiatives encouraging the adoption of electronic payment methods in hospitals and clinics. These government-backed initiatives are aimed at enhancing patient care. For instance, in April 2025, the Kerala state government of India announced the launch of a new digital payment system in hospitals run by the government. In the first phase, around 313 hospitals in the state will offer electronic payment solutions using debit cards, credit cards, and United Payments Interface (UPI). The remaining hospitals will be brought under the scheme in the coming years.

Similarly, other regional governments are working on improving patient experience in healthcare settings. Moreover, digital payment gateways are also beneficial to the healthcare providers since the tools assist in streamlining financial operations.

Digital Payment In Healthcare Market: Challenges

Growing cases of digital fraud and the risk of cybercrime challenge market expansion

The global digital payment in healthcare industry is expected to be challenged by the rising cases of digital fraud reported worldwide. According to market analysis, more than 149 million US citizens were victims of credit card fraud in 2024. Similar statistics were in other parts of the world as well.

Moreover, digital payment gateways are vulnerable to cybercrimes, including data theft. The US Federal Bureau of Investigation (FBI) reported more than 333,981 cases of cyber-related complaints in 2024. Such incidents will affect the greater adoption of digital payment solutions in clinics and healthcare facilities.

Digital Payment In Healthcare Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Digital Payment In Healthcare Market |

| Market Size in 2024 | USD 14.58 Billion |

| Market Forecast in 2034 | USD 96.51 Billion |

| Growth Rate | CAGR of 20.80% |

| Number of Pages | 214 |

| Key Companies Covered | InstaMed, Change Healthcare, Zelis, R1 RCM, Rectangle Health, Phreesia, RevSpring, Availity, Cedar, Flywire, Paytient, Elavon (U.S. Bank), VisitPay, Greenway Health, Waystar, and others. |

| Segments Covered | By Solution, By Deployment, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Digital Payment In Healthcare Market: Segmentation

The global digital payment in healthcare market is segmented based on solution, deployment, and region.

Based on the solution, the global market divisions are payment processing, payment gateway, application program interface, transaction risk management, payment security & fraud management, and others. In 2024, the highest growth was listed in the payment gateway segment. It is expected to generate a CAGR of more than 23%. These solutions ensure seamless and secure financial transactions concerning different stakeholders associated with a healthcare facility. Payment gateways are essential for authorizing transactions and ensuring privacy compliance.

Based on the deployment, the global market divisions are on-premise and cloud-based. In 2024, over 53.05% of the total revenue was generated by the cloud-based deployment of payment gateways and other digital solutions. The rising expansion of cloud solutions worldwide is fueling segmental revenue. Moreover, cloud-based deployment of digital payment tools delivers higher scalability, flexibility, and relatively reduced investment volume. The growing advancements in cloud-based technologies will promote higher growth in the segment during the forecast period.

Digital Payment In Healthcare Market: Regional Analysis

What factors will aid North America in continuing to lead the digital payment in healthcare market during the forecast period?

The global digital payment in healthcare market will be led by North America during the forecast period. In 2024, around 40.05% of the total revenue was generated by North America, with the US and Canada playing crucial roles in the regional economy. Growth in North America is a result of the broader acceptance of technological solutions in the healthcare sector, along with the growing emphasis on electronic transformation.

Moreover, higher digital literacy among North American citizens further helps the region thrive. The regional industry further benefits from growing proactive strategies adopted by healthcare providers to enhance patient experience.

Asia-Pacific is another prominent region in the digital payment in healthcare industry with exceptional growth potential. Around 23.7% of the global revenue in 2024 was listed in Asian countries, including India, China, and others. The growing demand for digital payment methods across healthcare facilities in the Asia-Pacific, along with favorable government initiatives, will promote regional expansion. On the other hand, the growing burden on the region’s healthcare infrastructure and greater need to streamline healthcare operations will facilitate the adoption of digital payment tools in the coming years.

Digital Payment In Healthcare Market: Competitive Analysis

The global digital payment in healthcare market is led by players like:

- InstaMed

- Change Healthcare

- Zelis

- R1 RCM

- Rectangle Health

- Phreesia

- RevSpring

- Availity

- Cedar

- Flywire

- Paytient

- Elavon (U.S. Bank)

- VisitPay

- Greenway Health

- Waystar

The global digital payment in healthcare market is segmented as follows:

By Solution

- Payment Processing

- Payment Gateway

- Application Program Interface

- Transaction Risk Management

- Payment Security & Fraud Management

- Others

By Deployment

- On-Premise

- Cloud-Based

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Digital payment in healthcare refers to the use of electronic means of payment in the healthcare industry.

The global digital payment in healthcare market is expected to be led by the growing use of contactless payment methods.

According to study, the global digital payment in healthcare market size was worth around USD 14.58 billion in 2024 and is predicted to grow to around USD 96.51 billion by 2034.

The CAGR value of digital payment in healthcare market is expected to be around 20.80% during 2025-2034.

The global digital payment in healthcare market will be led by North America during the forecast period.

The global digital payment in healthcare market is led by players like InstaMed, Change Healthcare, Zelis, R1 RCM, Rectangle Health, Phreesia, RevSpring, Availity, Cedar, Flywire, Paytient, Elavon (U.S. Bank), VisitPay, Greenway Health, and Waystar.

The report explores crucial aspects of the digital payment in healthcare market, including a detailed discussion of existing growth factors and restraints, while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed