EMV Card Market Size, Share, Trends, Growth and Forecast 2034

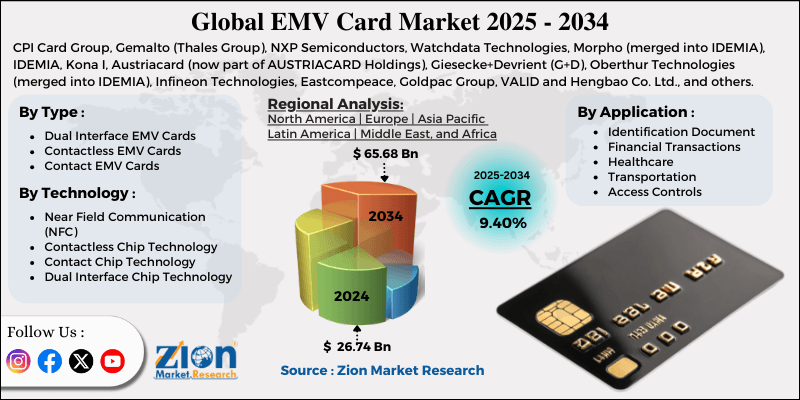

EMV Card Market By Type (Dual Interface EMV Cards, Contactless EMV Cards, and Contact EMV Cards), By Technology (Near Field Communication (NFC), Contactless Chip Technology, Contact Chip Technology, Dual Interface Chip Technology, and Others), By Application (Identification Document, Financial Transactions, Healthcare, Transportation, and Access Controls), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

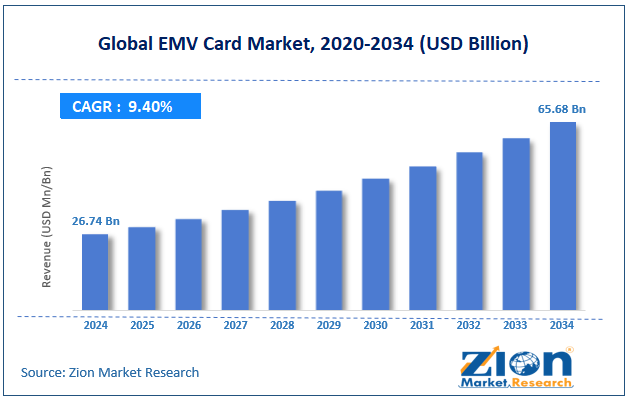

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.74 Billion | USD 65.68 Billion | 9.40% | 2024 |

EMV Card Industry Perspective:

The global EMV card market size was worth around USD 26.74 billion in 2024 and is predicted to grow to around USD 65.68 billion by 2034 with a compound annual growth rate (CAGR) of roughly 9.40% between 2025 and 2034.

Key Insights:

- As per the analysis shared by our research analyst, the global EMV card market is estimated to grow annually at a CAGR of around 9.40% over the forecast period (2025-2034)

- In terms of revenue, the global EMV card market size was valued at around USD 26.74 billion in 2024 and is projected to reach USD 65.68 billion, by 2034.

- The market is projected to grow at a significant rate due to the changing consumer lifestyle and growing awareness.

- Based on the type, the contact EMV cards segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the financial transactions segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

EMV Card Market: Overview

An EMV (Europay, Visa, and Mastercard) card is a payment-facilitating card that uses powerful and compact embedded chips for secure transactions. Europay, Visa, and Mastercard are the original companies that first started using chip technology to improve security features in modern methods of cashless payments. Since its development in 19902, EMV cards have set new benchmarks for secure card payments worldwide. EMV cards are different from cashless cards that have a magnetic stripe known as magstripe at the back. EMV cards are more secure as compared to cards with magstripe and hence register higher adoption among users.

Currently, the industry is led by two types of EMV cards that are chip-and-pin and chip-and-signature. The former requires EMV card users to create a PIN number which must be used for authenticating all transactions. EMC cards refrain from sharing real card numbers during transactions. The cards generate a unique code for each purchase thus safeguarding confidential card information from being shared with other parties.

During the forecast period, demand for EMV cards is expected to continue growing primarily driven by rising consumer awareness and increasing demand for more secure tools during cashless transactions. However, the industry for EMV cards has also registered growing cases of fraud which may limit the market’s expansion trends in the future.

EMV Card Market: Growth Drivers

Changing consumer lifestyle and growing awareness to propel market demand

The global EMV card market is expected to be driven by the changing consumer lifestyle observed worldwide. Modern consumers are increasingly preferring cashless methods of payment for all types of purchases. In recent times, credit and debit card ownership has improved at a steady pace across developed and developing nations. According to a recent market analysis, more than 50% of Americans have at least two credit card accounts.

Moreover, emerging economies such as India, China, and others are also generating higher adoption of cashless methods of payments including cards. As of 2024, India registered more than 974 million active debit card users across the country. Card-based payments offer greater flexibility and security to the users. For instance, card users for payment do not have to worry about carrying cash which is not only inconvenient but also highly perilous.

Growing demand for secure payment solutions to push market revenue in the coming years

The increasing rate of digitalization in payment methods has also influenced higher demand for more secure solutions. EMV cards offer higher payment security as compared to other methods of cashless payment. The security feature of EMV cards is a result of the use of encryption technology since the cards generate unique codes per transaction. This feature prevents any fraudsters from obtaining the user’s card information for further use in case of a security breach. The growing cases of payment card-related cyber crimes worldwide will directly influence demand in the global EMV card market in the coming years.

EMV Card Market: Restraints

High cost of infrastructure implementation will limit market expansion in the future

The global EMV card industry is projected to be restricted due to the high cost associated with the implementation of the required infrastructure. EMV cards. The chip technology for payments requires merchants to install EMV-compatible point-of-sale (POS) terminals in addition to the associated payment network. Furthermore, additional technical procedures such as ensuring timely compliance with updates from bank host systems may discourage increased adoption of EMV cards in the coming years.

EMV Card Market: Opportunities

Expansion of EMV card application and technological growth in the industry to generate growth opportunities

The global EMV card market is projected to generate growth opportunities as end-user industries continue to seek ways in which the application of EMV cards can be expanded. Industry players are working on improving the overall functionality of EMV cards including applications in transport systems and as an access control document. Furthermore, technological advancements in EMV cards will generate higher confidence among potential end-users in the coming years.

In October 2024, Fime, a leading testing, certification, and consulting specialist with expertise in payment and smart mobility solutions, announced the launch of the industry’s first EMV C-8 Contactless Kernel Specification. The novel approach is directed toward streamlining the production, testing, and launch of new contactless payment terminals for solution providers, merchants, and vendors

. In April 2024, NMI, a global provider of solutions for embedded payments, launched the ID TECH VP3350 mobile card reader. The tool connects directly to tablets and smartphones. It is designed to provide cost-effective, seamless, and quick mobile payment acceptance, especially for mid and small-sized companies. The technology is certified to be used with Android and iOS systems.

EMV Card Market: Challenges

Growing cases of EMV card frauds and other forms of contactless payments to challenge market expansion

The global EMV card industry is projected to be challenged by the rising fraud cases related to chip-based cards. According to UK Finance, an increase of 12% in financial fraud cases was recorded in the UK in 2024. Moreover, a growing development of alternate methods of contactless payment offering higher security may fragment consumer groups leading to limited revenue. Some of the most popular competing technologies include smartphone payments, digital wallets, wearable payments, and biometric payment systems.

EMV Card Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | EMV Card Market |

| Market Size in 2024 | USD 26.74 Billion |

| Market Forecast in 2034 | USD 65.68 Billion |

| Growth Rate | CAGR of 9.40% |

| Number of Pages | 220 |

| Key Companies Covered | CPI Card Group, Gemalto (Thales Group), NXP Semiconductors, Watchdata Technologies, Morpho (merged into IDEMIA), IDEMIA, Kona I, Austriacard (now part of AUSTRIACARD Holdings), Giesecke+Devrient (G+D), Oberthur Technologies (merged into IDEMIA), Infineon Technologies, Eastcompeace, Goldpac Group, VALID and Hengbao Co. Ltd., and others. |

| Segments Covered | By Type, By Technology, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

EMV Card Market: Segmentation

The global EMV card market is segmented based on type, technology, application, and region.

Based on the type, the global market divisions are dual interface EMV cards, contactless EMV cards, and contact EMV cards. In 2024, the highest growth was listed in the contact EMV cards segment accounting for nearly 60.01% of the total revenue. Contact EMV cards can be used in conventionally used payment systems such as POS terminals. During the forecast period, contactless EMV cards are projected to grow at a higher CAGR due to improved convenience and positive user feedback in the last few years.

Based on technology, the global EMV card industry is divided into near-field communication (NFC), contactless chip technology, contact chip technology, dual interface chip technology, and others.

Based on the application, the global market divisions are identification documents, financial transactions, healthcare, transportation, and access controls. In 2024, the highest revenue was listed in the financial transactions segment dominating around 46% of the total sales. In the forecast period, the segment is expected to deliver a CAGR of more than 10.01%. The rising incorporation of EMV cards of payments for all types of purchases is propelling segmental revenue. The segment will continue to dominate the market in the coming years.

EMV Card Market: Regional Analysis

Asia-Pacific to dominate the industry during the forecast period

The global EMV card market is expected to be led by Asia-Pacific during the forecast period. China is one of the largest contributors to the regional market driven by the presence of a massive number of EMV card users in the country. Additionally, India and Japan are anticipated to emerge as the second and third-highest revenue generators respectively during the forecast period.

The growing presence of consumer groups across Asia-Pacific, changing lifestyles, and increasing digitalization in payment solutions will encourage higher market adoption. Europe is a significant revenue generator and will continue to play a crucial role in driving the global industry growth rate.

European countries were one of the first nations to be introduced to EMV card technology and hence the industry enjoys the presence of a mature market. Rising integration of EMV cards and other digital payment mediums such as e-wallets will fuel regional expansion during the forecast period.

North America is projected to register a higher CAGR in the coming years. The increasing demand for secure cashless transactions and the presence of supporting government initiatives will encourage regional expansion in the coming years. Furthermore, North America is home to a large number of high-net-worth individuals creating demand for personalized EVM cards with higher security features.

EMV Card Market: Competitive Analysis

The global EMV card market is led by players like:

- WowGo

- Meepo

- Evolve Skateboards

- Teamgee

- Halo Board

- Verreal

- Backfire

- Boosted Boards

- Lectec

- Ownboard

- Skatebolt

- Raldey

- Exway

- Onewheel

- Maxfind

The global EMV card market is segmented as follows:

By Type

- Dual Interface EMV Cards

- Contactless EMV Cards

- Contact EMV Cards

By Technology

- Near Field Communication (NFC)

- Contactless Chip Technology

- Contact Chip Technology

- Dual Interface Chip Technology

- Others

By Application

- Identification Document

- Financial Transactions

- Healthcare

- Transportation

- Access Controls

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

An EMV (Europay, Visa, and Mastercard) card is a payment-facilitating card that uses powerful and compact embedded chips for secure transactions.

The global EMV card market is expected to be driven by the changing consumer lifestyle observed worldwide.

According to study, the global EMV card market size was worth around USD 26.74 billion in 2024 and is predicted to grow to around USD 65.68 billion by 2034.

The CAGR value of the EMV card market is expected to be around 9.40% during 2025-2034.

The global EMV card market is expected to be led by Asia-Pacific during the forecast period.

The global EMV card market is led by players like CPI Card Group, Gemalto (Thales Group), NXP Semiconductors, Watchdata Technologies, Morpho (merged into IDEMIA), IDEMIA, Kona I, Austriacard (now part of AUSTRIACARD Holdings), Giesecke+Devrient (G+D), Oberthur Technologies (merged into IDEMIA), Infineon Technologies, Eastcompeace, Goldpac Group, VALID and Hengbao Co., Ltd.

The report explores crucial aspects of the EMV card market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed