Payment Security Software Market Size, Share, Growth, Trends, and Forecast, 2032

Payment Security Software Market - By Mode of Payment (Online Payment Security Software, Mobile Payment Security Software, And Security & Point-Of-Sale (Pos) Systems), By The Solution ( Services And Software), By End-Use (Bfsi, Retail, Healthcare, And The Government Divisions), And By Region - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts 2024 - 2032

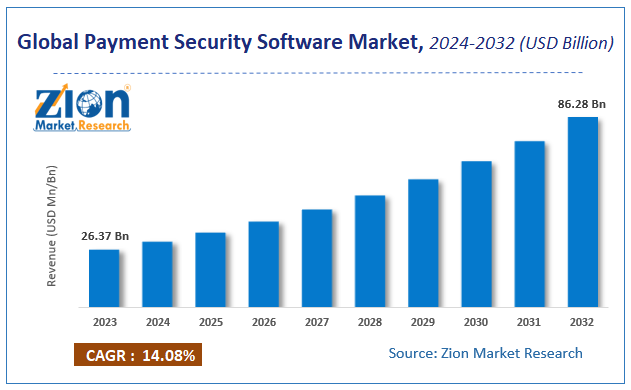

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 26.37 Billion | USD 86.28 Billion | 14.08% | 2023 |

Description

Payment Security Software Market Insights

According to the report published by Zion Market Research, the global Payment Security Software Market size was valued at USD 26.37 Billion in 2023 and is predicted to reach USD 86.28 Billion by the end of 2032. The market is expected to grow with a CAGR of 14.08% during the forecast period. The report analyzes the global Payment Security Software Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the payment security software industry.

Global Payment Security Software Market: Overview

Online payment helps in the cheap and fast medium of online transfer and online transaction. Currently, the acceptance of payment security software particularly in economic services division has gained traction. Banking division is ready to explore several prospects and opportunities which can make the banking payment transactions easier and simpler to process. Growth in penetration of digital technology in sectors like banking has resulted in the expansion of easy and simple to use online application and online platforms.

Global Payment Security Software Market: Growth Factors

The global payment security software market is projected to witness a momentous growth in the coming years, due to the growing inclination towards digitization. With the increasing penetration of smartphones, there is an increase in the number of mobile payments. As a result, it has augmented the concerns and problems over the security and data protection of these payment methods all over the world, which is propelling greatly the growth of the global payment security software market. The continuing shift towards cashless financial system is another factor that drives the development of global payment security software market considerably, as several non-banking players are accepting a range of cashless transaction, for instance, mobile money, digital wallets, and virtual currencies. On the whole, the prospect of the global payment security software market is projected to be remarkable in the coming years.

Global Payment Security Software Market: Segmentation

The global payment security software market is majorly classified into three fronts: Mode of payment, the solution, and the end user.

Based on Solution - In terms of solution, services and software are regarded as the most important divisions of this market. Firewalls, (SIEM) security information and event management, anti-virus/anti-malware, (IDS/IPS) intrusion detection and prevention, multi-factor authentication, data encryption, data loss prevention (DLP) and tokenization, are the most important payment security software accessible across the world.

Based on the Mode of Payment, the market is categorized into online payment security software, mobile payment security software, and security & point-of-sale (PoS) systems. As mobile payments are broadly used for transactions, this division is anticipated to dominate the market in the coming future.

Based on End Users - The BFSI, retail, healthcare, and the government divisions have emerged as the major end users of the payment security software.

Payment Security Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Payment Security Software Market |

| Market Size in 2023 | USD 26.37 Billion |

| Market Forecast in 2032 | USD 86.28 Billion |

| Growth Rate | CAGR of 14.08% |

| Number of Pages | 204 |

| Key Companies Covered | Intel Corporation, Thales e-Security., Symantec Corporation, CA, Inc., Cisco Systems Inc., Gemalto, Trend Micro, HCL Technologies, TNS Inc., and VASCO Data Security International, Inc., among others |

| Segments Covered | By mode of payment, By the solution, By the end user and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Payment Security Software Market: Regional Analysis

Geographically, the global payment security software market is classified into Europe, North America, the Middle East & Africa (MEA), Asia Pacific, and South America. North America is anticipated to show its dominance in the payment security software market in the coming years. North America is followed by Asia Pacific. South America and the Middle East & Africa are likely to be in the beginning phases of implementation of the technology. The projected development of banking division in Africa is anticipated to support the payment security software market expansion in the coming future.

Global Payment Security Software Market: Competitive Players

Some of the most important market players in the global payment security software market are

- Intel Corporation

- Thales e-Security.

- Symantec Corporation

- CA. Inc.

- Cisco Systems Inc.

- Gemalto

- Trend Micro

- HCL Technologies

- TNS Inc.

- VASCO Data Security International. Inc.

- Among Others.

This report segments the global payment security software market as follows:

By Mode of Payment

- Online Payment Security Software

- Mobile Payment Security Software

- Security & Point-Of-Sale (Pos) Systems

By Solution

- Services And Software

By End-Use

- Bfsi

- Retail

- Healthcare

- The Government Divisions

Global Payment Security Software Market: Regional Segment Analysis

- North America

- The U.S.

- Europe

- The UK

- France

- Germany

- The Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- The Middle East and Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

Payment security software safeguards financial data during online transactions. Encrypting data, identifying and avoiding fraud, and complying with PCI DSS assures payment data security. This program protects credit card numbers, personal data, and other financial information from cyberattacks, ensuring secure payments for businesses and consumers.

The global payment security software market is projected to witness a momentous growth in the coming years, due to the growing inclination towards digitization. With the increasing penetration of smartphones, there is an increase in the number of mobile payments.

According to the report, the global payment security software size was worth around USD 26.37 Billion in 2023 and is predicted to grow to around USD 86.28 Billion by 2032.

The global payment security software market is expected to grow at a CAGR of 14.08% during the forecast period.

North America is anticipated to show its dominance in the payment security software market in the coming years.

Some of the most important market players in the global payment security software market are Intel Corporation, Thales e-Security., Symantec Corporation, CA, Inc., Cisco Systems Inc., Gemalto, Trend Micro, HCL Technologies, TNS Inc., and VASCO Data Security International, Inc., among others.

The global payment security software market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed