Payment Bank Solutions Market Size, Share, Trends and Forecast, 2032

Payment Bank Solutions Market By Type (Software And Hardware), and By Region: Global Industry Analysis, Size, Share, Growth, Trends, Value, and Forecast, 2024-2032

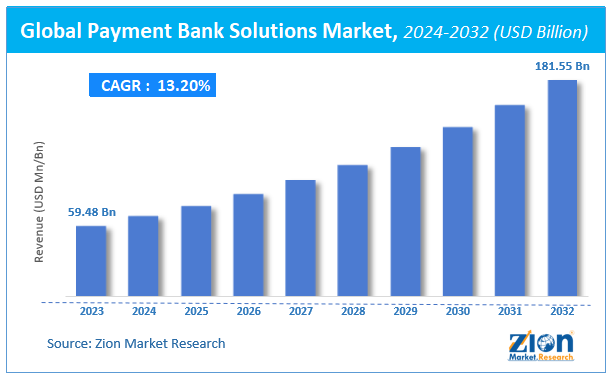

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 59.48 Billion | USD 181.55 Billion | 13.2% | 2023 |

Description

Payment Bank Solutions Market Insights

According to the report published by Zion Market Research, the global Payment Bank Solutions Market size was valued at USD 59.48 Billion in 2023 and is predicted to reach USD 181.55 Billion by the end of 2032. The market is expected to grow with a CAGR of 13.2% during the forecast period. The report analyzes the global Payment Bank Solutions Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the rising opportunities in the Payment Bank Solutions industry.

Payment Bank Solutions Market: Overview

In recent years, there has been an increasing demand for online transactions and the increasing integration of digitization has made the banks offer several options for banking payments. These payment banks have modernized banking solutions by providing unique payment solutions to the users. The payment bank solution is growing rapidly owing to the greater adoption of mobile technology.

Global Payment Bank Solutions Market: Facts

In Global Payment Bank Solutions Market Report, A payment bank solution was launched by Infosys Finacle which was named Finacle Payments Bank and in the Indian market, it was named Finacle Small Finance Bank Solutions. The solutions were specifically tailored for the organizations that were seeking small finance bank licenses from the Reserve Bank of India.

Payment Bank Solutions Market: Segmentation

The payment bank solutions market is fragmented into its type and region.

Based on the type, the payment bank solutions market is segregated into software and hardware. The software segment is sub-segregated into mobile apps and platforms. The hardware segment of the payment bank solutions market is sub-categorized into debit cards, ATM cards, and forex cards. The geographical diversification of the payment bank solutions market includes regions such as Asia Pacific, the Middle East and Africa, Latin America, North America, Western Europe, and Eastern Europe.

Payment Bank Solutions Market: Growth Factors

The main factor that is driving the payment bank solutions market is the increased utilization of mobile technology by consumers. This trend is prevalent highly in the younger population. Due to the availability of the high-speed internet services, most of the population prefer online transactions. The majority of the individuals are adopting mobile technology and prefer online banking services, online shopping, and other e-commerce transactions.

The payment bank solutions are not complex in nature and thus they are easily adopted which propels the growth of the payment bank solutions market. The factors that are limiting the growth of the market are the lack of awareness among the people and the fact that this concept is still at a developing stage.

Payment Bank Solutions Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Payment Bank Solutions Market |

| Market Size in 2023 | USD 59.48 Billion |

| Market Forecast in 2032 | USD 181.55 Billion |

| Growth Rate | CAGR of 13.2% |

| Number of Pages | 214 |

| Key Companies Covered | MasterCard, Infosys Finacle, Mahindra Conviva among others |

| Segments Covered | By Type and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Payment Bank Solutions Market: Regional Analysis

The region that is having the major share in the payment bank solutions market is Asia Pacific region. In the Asia Pacific region, the emerging nation India has the major share in the payment bank solutions market owing to the increased adoption of net banking applications and mobile banking applications among consumers. Owing to this adoption several enterprises have enhanced their payment services and they have the benefit of real-time financial assistance. In the other regions, the payment bank solution market will grow rapidly in the future years owing to the increased adoption of the cloud-based applications and the rise in the number of the solution providers.

Payment Bank Solutions Market: Competitive Players

The key market players that are involved in the payment bank solutions market include;

- MasterCard

- Infosys Finacle

- Mahindra Conviva

The global payment bank solutions market is segmented as follows;

By Type

- Software

- Mobile Apps

- Platforms

- Hardware

- Debit Cards

- ATM Cards

- Forex Cards

By Region

- North America

- U.S.

- Europe

- UK

- France

- Germany

- Asia Pacific

- China

- Japan

- India

- Latin America

- Brazil

- Middle East and Africa

What Reports Provide

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, ongoing, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

Payment bank solutions are the technological platforms and services that enable payment banks to operate efficiently. These solutions provide the core infrastructure for managing customer accounts, processing transactions, and delivering financial services.

According to a study, the global payment bank solutions market size was worth around USD 59.48 billion in 2023 and is expected to reach USD 181.55 billion by 2032.

The global payment bank solutions market is expected to grow at a CAGR of 13.2% during the forecast period.

Asia Pacific is expected to dominate the payment bank solutions market over the forecast period.

Leading players in the global payment bank solutions market include MasterCard, Infosys Finacle, Mahindra Conviva among others, among others.

The payment bank solutions market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed